Please don't spread hearsay la guys. There's already enough misinformation about EPF.

EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Oct 14 2024, 08:25 AM Oct 14 2024, 08:25 AM

Return to original view | Post

#161

|

Senior Member

3,834 posts Joined: Oct 2011 |

Please don't spread hearsay la guys. There's already enough misinformation about EPF. Barricade, HolyCooler, and 1 other liked this post

|

|

|

|

|

|

Oct 14 2024, 02:24 PM Oct 14 2024, 02:24 PM

Return to original view | Post

#162

|

Senior Member

3,834 posts Joined: Oct 2011 |

|

|

|

Oct 17 2024, 07:59 AM Oct 17 2024, 07:59 AM

Return to original view | Post

#163

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(ronnie @ Oct 16 2024, 10:06 PM) Is it possible to take out EPF Account 2 for paying 90% of the house purchase price ? Yes. About a week. How long is the process ? What documents do we need ?  https://www.kwsp.gov.my/en/member/house-withdrawal/buy-house |

|

|

Oct 17 2024, 08:16 AM Oct 17 2024, 08:16 AM

Return to original view | Post

#164

|

Senior Member

3,834 posts Joined: Oct 2011 |

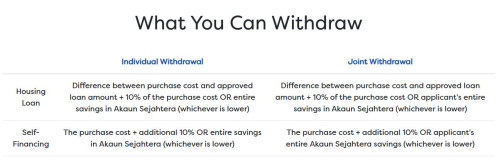

QUOTE(ronnie @ Oct 17 2024, 08:09 AM) it mention this part I think it means you pay 20% first, and then you can withdraw 100%+10% of purchase cost or entire saving from Acc 2 (whichever lower). But please confirm with EPF about this first."Bukti bayaran tidak kurang 20% daripada harga rumah" Does this mean i need to fork out 20% for the house and 80% from EPF account 2 can be withdrawn to finance the house purchase (no financing option) ? |

|

|

Oct 17 2024, 09:23 AM Oct 17 2024, 09:23 AM

Return to original view | Post

#165

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(Rinth @ Oct 17 2024, 09:22 AM) tell your lawyer you want to withdraw EPF acc2 and they'll CTC all the necessary documents. Did you take loan? His question was self-financing without loan.For proving the "20% bukti bayaran", i didnt encounter this at all, in fact i just bring my Bank letter offer only. actually many ppl misunderstood only can withdraw the SPA price 10%, in fact actually is "the amount you've paid for downpayment + additional 10% of the purchase cost" Example RM 500k property, you paid 10% down RM 50k, loan RM 450k. so you can take out actually RM 50k (the downpayment u paid) + RM 50k (Additional 10% of purchase cost) = RM 100k, or the whole acc2 if doesnt reached RM 100k. This post has been edited by poweredbydiscuz: Oct 17 2024, 09:24 AM |

|

|

Oct 17 2024, 09:28 AM Oct 17 2024, 09:28 AM

Return to original view | Post

#166

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(Rinth @ Oct 17 2024, 09:26 AM) Yes. If got take loan, I think most people know about it. My situation is exactly the same as i illustrated. only the figures was different abit. Fun fact, sometimes your MRTA & Legal fee will funded together in your loan right? EPF doesnt count those, they'll still take the nett 10% that you fork out for your withdrawal. Example RM 500k property paid 10% loan RM 450k + MRTA & Legal fee became RM 480k loan, EPF still allow you to withdrawal RM 50k + RM 50k = RM 100k, despite your loan was RM 480k. His question was about the 20% payment receipt requirement which is specifically for self-financing option, not loan. |

|

|

|

|

|

Oct 29 2024, 12:22 PM Oct 29 2024, 12:22 PM

Return to original view | Post

#167

|

Senior Member

3,834 posts Joined: Oct 2011 |

|

|

|

Nov 1 2024, 10:51 AM Nov 1 2024, 10:51 AM

Return to original view | Post

#168

|

Senior Member

3,834 posts Joined: Oct 2011 |

Don't discuss here la. Cool story like this belongs to kopitam and there's a thread about this already.

https://forum.lowyat.net/index.php?showtopic=5488221 |

|

|

Nov 15 2024, 02:05 PM Nov 15 2024, 02:05 PM

Return to original view | Post

#169

|

Senior Member

3,834 posts Joined: Oct 2011 |

|

|

|

Nov 21 2024, 10:06 AM Nov 21 2024, 10:06 AM

Return to original view | Post

#170

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(nexona88 @ Nov 21 2024, 09:02 AM) Seriously wonder when EPF can have options in i-akaun to transfer account 3 $$$ into account 1 & 2.. Because it's pointless, for now.Current one is kinda hassle... Need to fill form each time & summit to counter for approval... It's just one off for that amount... Not automatically later month... |

|

|

Nov 21 2024, 10:28 AM Nov 21 2024, 10:28 AM

Return to original view | Post

#171

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(silence94 @ Nov 21 2024, 10:08 AM) Hi guys, i have some questions regarding Akaun 2 withdrawal for house purchase. It will be pro-rated until the day of withdrawal, doesn't matter dec 24 or jan 25.I have bought a house and the SPA signed on 31st May 2022. If following the criteria of withdrawal, the SPA sign date cannot be more than 3 years. Questions: 1. If i withdraw account 2 for house purchase by let's say January'25, will I still be entitled for the full whole year dividend for 2024 year? 2. Or if I withdraw by December,'24 will the dividend pro-rated? After the dividen announced around Mar-April'25. Appreciate any sifu advice on this, thanks! |

|

|

Nov 21 2024, 12:42 PM Nov 21 2024, 12:42 PM

Return to original view | Post

#172

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(alexei @ Nov 21 2024, 10:49 AM) got 2 types, lump sum vs monthly He's referring to the buy house withdrawal (house price - loan amount + 10%) as he mentioned SPA not more than 3 years. if lump sum, follow the cut off date for entitlement if monthly loan paymant, then the amount you withdrawn, will be put under a separate section in EPF, the amount leftover will continue to enjoy dividend The monthly installment withdrawal can apply anytime as long as still got outstanding loan. |

|

|

Nov 26 2024, 10:22 AM Nov 26 2024, 10:22 AM

Return to original view | Post

#173

|

Senior Member

3,834 posts Joined: Oct 2011 |

|

|

|

|

|

|

Nov 26 2024, 11:13 AM Nov 26 2024, 11:13 AM

Return to original view | Post

#174

|

Senior Member

3,834 posts Joined: Oct 2011 |

|

|

|

Nov 27 2024, 09:38 AM Nov 27 2024, 09:38 AM

Return to original view | Post

#175

|

Senior Member

3,834 posts Joined: Oct 2011 |

Under maintenance now. EDIT: It's up and running now. Just done top up. This post has been edited by poweredbydiscuz: Nov 27 2024, 10:28 AM nexona88 liked this post

|

|

|

Nov 27 2024, 12:44 PM Nov 27 2024, 12:44 PM

Return to original view | Post

#176

|

Senior Member

3,834 posts Joined: Oct 2011 |

|

|

|

Nov 27 2024, 04:39 PM Nov 27 2024, 04:39 PM

Return to original view | Post

#177

|

Senior Member

3,834 posts Joined: Oct 2011 |

|

|

|

Nov 29 2024, 10:42 AM Nov 29 2024, 10:42 AM

Return to original view | Post

#178

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(chinkw1 @ Nov 29 2024, 10:32 AM) My aunty went to Maybank counter, seems that if want to deposit voluntary into EPF, got 2 types of froms, either Form S or M. Is ur aunt employed? Anyone knows which form to use? Form S - self-contribution (employed) Form M - i-saraan/i-suri This post has been edited by poweredbydiscuz: Nov 29 2024, 10:42 AM |

|

|

Dec 3 2024, 02:05 PM Dec 3 2024, 02:05 PM

Return to original view | Post

#179

|

Senior Member

3,834 posts Joined: Oct 2011 |

|

|

|

Dec 3 2024, 02:15 PM Dec 3 2024, 02:15 PM

Return to original view | Post

#180

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(mamamia @ Dec 3 2024, 02:07 PM) Eg if you contribute 1k to epf on 10th June 2024, this 1k will earn 6 months (Jul-Dec) + 1 day (for Jun) of dividend for year 2024. No matter which day you contribute in June, it will only get 1 day dividend for June. You can see the official example by EPF here: QUOTE(poweredbydiscuz @ Nov 29 2024, 01:28 PM) mamamia liked this post

|

| Change to: |  0.0524sec 0.0524sec

0.62 0.62

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 07:13 AM |