Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

TheEquatorian

|

Dec 9 2021, 09:36 PM Dec 9 2021, 09:36 PM

|

|

QUOTE(TOS @ Dec 8 2021, 09:08 AM) The Edge seems to have an agenda. Why save for retirement even, it’s better to have nothing and take from those that have saved. That logic has been working well for Malaysia thus far. Capital/investment flight anyone.. 🙄 |

|

|

|

|

|

TheEquatorian

|

Dec 11 2021, 05:15 AM Dec 11 2021, 05:15 AM

|

|

QUOTE(backspace66 @ Dec 10 2021, 05:22 PM) Owh really, please enlighten me then? Are you implying it is ok to redistribute dividend this way in asb and not in epf. Or is it about ASB for bumi and EPF is all Malaysian. Or is it about asb being an optional secure investment for bumi and epf being mandatory. Remember they are trying to imply that 1 million is the cutoff, but we all know these guys can withdraw all the amount that exceeded 1 million. Even if the cutoff is 500k, still wont matter since as i mentioned there are other way to withdraw some amount to reduce the impact or invest using MIS. Why would anyone want to use MIS with the outrageous fees - I prefer removing it from EPF and placing in an ETF tracking S&P500. But that choice won’t be there since the funds below 1m will be stuck in EPF subsidizing others. |

|

|

|

|

|

TheEquatorian

|

Dec 15 2021, 01:09 AM Dec 15 2021, 01:09 AM

|

|

https://www.malaymail.com/news/malaysia/202...wals-fr/2028459” “It is very clear that there is an urgent need for far-reaching solutions covering an effective social safety net programmes, robust labour market policies, sustainable economic growth, reskilling and upskilling of the labour force, as well as policies to encourage automation and digitalisation to help increase productivity and make the economic cake bigger so that employees have better chance to earn more, thereby increasing their contributions to the EPF,” he added. — Bernama” Finally someone that makes more sense than all this communistic tiered dividend talk.

|

|

|

|

|

|

TheEquatorian

|

Dec 20 2021, 12:21 AM Dec 20 2021, 12:21 AM

|

|

|

|

|

|

|

|

TheEquatorian

|

Dec 20 2021, 02:23 PM Dec 20 2021, 02:23 PM

|

|

QUOTE(prophetjul @ Dec 20 2021, 11:26 AM) Indeed, why is EPF funding what the government should be handling. The fin min seems to think that EPF is his piggy bank. |

|

|

|

|

|

TheEquatorian

|

Dec 20 2021, 02:28 PM Dec 20 2021, 02:28 PM

|

|

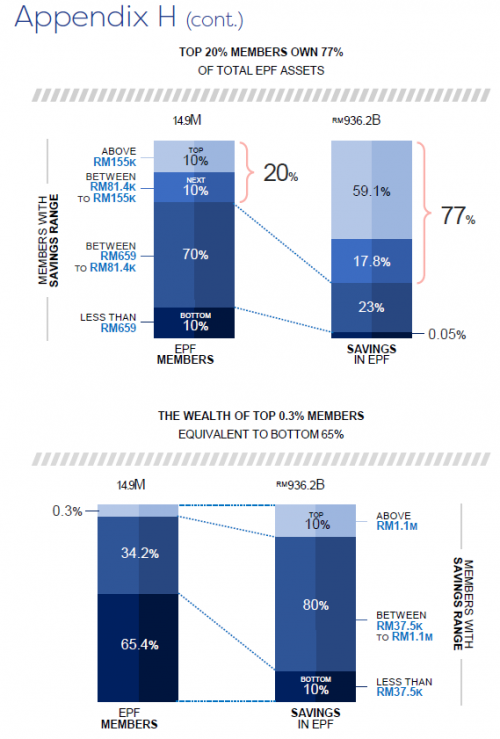

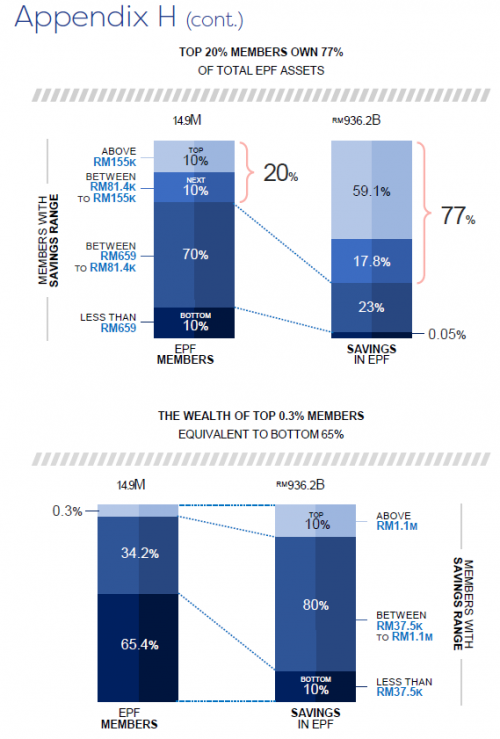

Yes, I think there is an understanding that the structural problem is from low wages. The Star article refers a discussion of a social system for those that are poor - which makes more sense than meddling with EPF - so it’s more if the govt can afford to implement it with all it’s current liabilities. But structural changes need to come, like converting civil service pension to EPF and rationalizing staff there. [quote=plc255,Dec 20 2021, 11:41 AM] Finally found the source of info - from EPF SOCIAL PROTECTION INSIGHT VOL 5 2021 - Appendix HSource: https://www.kwsp.gov.my/documents/20126/dda...bb-f85b1b3eddbfMore fun fact :  A lot of discussion on the high value account inside this document under the section THE NUANCES OF INEQUALITY IN SOCIAL SECURITYBelow is a selective highlight of my biased reading :- [/spoiler] All quotes from EPF SOCIAL PROTECTION INSIGHT VOL 5 2021 - THE NUANCES OF INEQUALITY IN SOCIAL SECURITYSource: https://www.kwsp.gov.my/documents/20126/dda...bb-f85b1b3eddbf[/quote] Well, this is coming from EPF official publication and their comment about high value account... however there is no mention of tier dividend. Thank you for your link which led me to the EPF article / document indirectly. [/quote] This post has been edited by TheEquatorian: Dec 20 2021, 02:29 PM |

|

|

|

|

|

TheEquatorian

|

Dec 26 2021, 06:23 AM Dec 26 2021, 06:23 AM

|

|

Is EPF considered a GLIC - hope they are not treating it as their money. ” “The GLICs and GLCs which contributed included Petronas; Yayasan Petronas, Khazanah Nasional and Yayasan Hasanah; Yayasan Sime Darby, CIMB, Celcom, Telekom Malaysia, Yayasan UEM and Employee Provident Fund (EPF). With the Government’s grant of RM25 million, the total fund to deal with flood impact and post-flood recovery has risen to RM75.8 million, ”he said.” https://m.malaysiakini.com/announcement/603955 |

|

|

|

|

|

TheEquatorian

|

Dec 27 2021, 11:13 AM Dec 27 2021, 11:13 AM

|

|

https://m.malaysiakini.com/news/604662Here we go again. Politicise it more and wonder why the balances are so low..

|

|

|

|

|

|

TheEquatorian

|

Dec 27 2021, 04:32 PM Dec 27 2021, 04:32 PM

|

|

|

|

|

|

|

|

TheEquatorian

|

Dec 28 2021, 03:07 PM Dec 28 2021, 03:07 PM

|

|

https://www.theborneopost.com/2021/12/27/fo...ood-relief/?ampQUOTE(TheEquatorian @ Dec 20 2021, 02:23 PM) Indeed, why is EPF funding what the government should be handling. The fin min seems to think that EPF is his piggy bank.

|

|

|

|

|

|

TheEquatorian

|

Dec 28 2021, 04:30 PM Dec 28 2021, 04:30 PM

|

|

Exactly, the cause is not so much the issue as the precedent this sets. Who’s to say what they will choose to ”support” with EPF funds in the future. It’s very odd that MPs are so quiet about this, my take is because of the cause and the opposite side politicising any questions. Sigh, the institutional integrity is not very impressive here. QUOTE(shamino_00 @ Dec 28 2021, 03:55 PM) There's a sitting EPF board members. Maybe the right question can be directed at them too. While the amount is small compare to overall EPF fund. But right process must be followed, contributors reasonable to ask. We are not saying EPF should not help flood relief, but it's a statutory body on a different mandate. We don't want precedent the MOF can willy nilly take funds out of EPF to do whatever it likes. https://www.kwsp.gov.my/about-epf/corporate...re#boardMembersEmployee's representative - Catherine Jikunan, Dato Haji Adnan Mat, Law Kiat Min |

|

|

|

|

|

TheEquatorian

|

Dec 29 2021, 09:56 AM Dec 29 2021, 09:56 AM

|

|

Moreover, it is impossible to safeguard the currency when underlying issues are never dealt with. Tbh EPF needs to have a strategy on rationalising staff (as does civil service, restructure their pensions as well) with digitalistion I see that they have disposed many prime office locations, what will the people behind the counter be doing. Upskilling is such a big issues here. Instead there is this idea that we can reallocate dividends to continue to sustain an unsustainable structure in our interdependent globalised economy. You can’t prop up a currency forever if no one believes in the economy. Rant done. ✔️ QUOTE(prophetjul @ Dec 29 2021, 08:52 AM) That is living in a dream world. The government is not here to safeguard the currency. They are here to safeguard their reign. Why do you think the ringgit has been sliding for the past 30 years, especially against the SGD? |

|

|

|

|

|

TheEquatorian

|

Jan 5 2022, 09:49 AM Jan 5 2022, 09:49 AM

|

|

|

|

|

|

|

|

TheEquatorian

|

Jan 5 2022, 11:39 AM Jan 5 2022, 11:39 AM

|

|

|

|

|

|

|

|

TheEquatorian

|

Jan 6 2022, 04:07 AM Jan 6 2022, 04:07 AM

|

|

|

|

|

|

|

|

TheEquatorian

|

Jan 8 2022, 10:28 AM Jan 8 2022, 10:28 AM

|

|

QUOTE(prophetjul @ Jan 8 2022, 10:10 AM) And its true. If you estimate by the performance of EPF for 2021 thus far, it has out performed 2020 by a long stretch. It can easily dish out 6% taking into account Rm100 billion principal has been withdrawn in the year. But politically, they won't. Because they will want to keep some for rainy day and it cannot be too much more than ASB. However, it its election year, they may give you a few points more. I think 6% is possible with election year and also to motivate people to maintain their balance. |

|

|

|

|

|

TheEquatorian

|

Jan 11 2022, 12:56 PM Jan 11 2022, 12:56 PM

|

|

|

|

|

|

|

|

TheEquatorian

|

Jan 11 2022, 08:56 PM Jan 11 2022, 08:56 PM

|

|

|

|

|

|

|

|

TheEquatorian

|

Jan 11 2022, 08:57 PM Jan 11 2022, 08:57 PM

|

|

|

|

|

|

|

|

TheEquatorian

|

Jan 15 2022, 07:05 PM Jan 15 2022, 07:05 PM

|

|

|

|

|

|

|

Dec 9 2021, 09:36 PM

Dec 9 2021, 09:36 PM

Quote

Quote

1.3937sec

1.3937sec

0.74

0.74

7 queries

7 queries

GZIP Disabled

GZIP Disabled