2.5 million is our goal if we want to retire comfortable now

i use to focus on 1.5M but after knowing that medical cost is so expensive i think 2.5M is needed

even with insurance it wont help especially when you old you need to take supplement, you need physiotherapy, you need domestic helper

i start to plan all this as now i am at 52 this year and why 1.25M per person as i need to cover for my wife so i need to have 2.5M for 2

future cost in 10 years - hopefully this number maintains!

domestic helper - RM3.5k per month

physiotherapy for 2 - RM1k per month

insurance for 2 - RM1.2k per month

tnb - RM500 per month

water bill - RM50 per month

supplement for 2 - RM500 (milk powder, omega, vitamins, ect)

medicine for 2 - RM500 (depend on your sickness - just assume u have heart problem, cholesterol problem, diabetic problem, high bp)

phone bill for 2 - RM100

unifi - RM150

other misc - RM1000 (clinic visit, travel cost)

makan for 3 - RM3000 (me, my wife, domestic helper)

Total 11.5k

» Click to show Spoiler - click again to hide... «

Estimate i think on the safe side just make sure put 15k per month for expenses

2.5M x 5.5% = RM137,500 per year dividend

137500 / 12 = RM11458 per month so need to take out additional 3.5k per month to top it up until RM15k per month

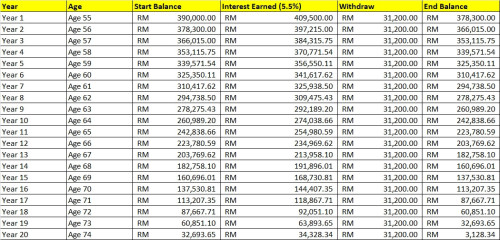

chatgpt projected as long as i have 2.5M and i consistently withdraw RM15k per month and with dividend of 5.5% after 20 years i should still have 900k left...

if you think the above number is not realistic i really welcome you to comment so i can adjust and plan accordingly

i have 8 more years till retirement but if i continue to work for the next 8 years and do not withdraw any money from EPF and continue to slowly pump like RM10k per year i might hit it base on my calculation

Nicely put.

Many of those points are valid. However, many can be managed and prevented or lessen.

For example, health issues. You still have time to reverse your heart issues, pre diabetes by adjusting your lifestyle NOW.

You don't need a domestic helper is you are active. Housework is exercise! But not adequate.

You also need some funds for leisure travelling and daily travels. Car maintenance, etc.

Aug 1 2025, 10:07 AM

Aug 1 2025, 10:07 AM

Quote

Quote

0.0517sec

0.0517sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled