QUOTE(Junrave @ May 28 2015, 08:39 AM)

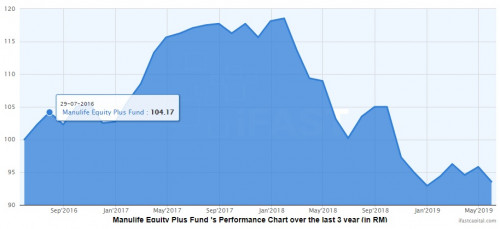

The attached link only shows the concept of compounding interest, but it did not exhibit how investing unit trust can be benefited from it. Since the value of unit trust fund is primarily affected by fluctuation of price and unit held for the fund. Lets put it this way, if i bought at rm1.00 per share for RM1000, and the price increase to rm1.20 at next year (earning become RM1200), and drop to rm0.90 at the third year, then the value of fund at the third year will be (price x unit held = RM900. (Correct me if I am wrong). Therefore, I am experiencing loss in this scenario.

But if I got consistent annual return of 10% for example, then it increase NAV yearly and compound interest shall apply in this case, however, since the performance data which figure % pa shown is annualized (fund price could experience 1 year high and 1 year low), then the application of compounding will be ambiguous.

Need sifus to clarify this for me. thanks

IF, (fund price could experience 1 year high and 1 year low), then the application of compounding will be ambiguous....

same logic...if the fund continued to be in RED for 3 years...then there is not benefits.

it shows the concept, but this concept cannot be compared to the investment that had fixed results (ex. FD (assuming rate no change)).

in this case of FD....the compounding interest affect can be seen as the interest earned can be added into the calculation of next year interest rate.

but for investment like UTs that has no guarantee of returns.....what ever you earned can be wiped out too.....

but if one were to keep investing ...in the longer terms......the effect could be seen....

This post has been edited by yklooi: May 28 2015, 09:12 AM

May 27 2015, 06:50 PM

May 27 2015, 06:50 PM

Quote

Quote

0.0670sec

0.0670sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled