Outline ·

[ Standard ] ·

Linear+

Fund Investment Corner v3, Funds101

|

MUM

|

Sep 30 2021, 09:23 PM Sep 30 2021, 09:23 PM

|

|

QUOTE(RigerZ @ Sep 30 2021, 08:37 PM) Question: What are the important points to look for in a unit trust annual/interim report and how should they be interpreted? So far I can only find this blog https://limkimtong.wordpress.com/2007/02/28...nancial-tip-35/ which gives a fairly decent explanation. Is there anything else that was left out? maybe can seek these out for added compilation to the list of things.... Unit trusts: Making sense of fund documents and reports https://www.moneysense.gov.sg/articles/2018...nts-and-reportsask for the latest annual or interim report. Among the things you should look for are: ............ https://www.manulifeinvestment.com.my/Produ...t-In-Unit-TrustHow to read A Mutual Fund shareholder report https://www.sec.gov/files/ib_readmfreport.pdf |

|

|

|

|

|

MUM

|

Dec 3 2021, 02:05 PM Dec 3 2021, 02:05 PM

|

|

QUOTE(imbibug @ Dec 3 2021, 01:21 PM) I was shown this UOB PRUValue Gain endowment plan and asked for advice. I know that this type of insurance endowment plans are typically not recommended. I haven't been keeping up with local investment plans/unit trusts so I'd like to ask for advice on any investment funds which will be better than this. https://www.uob.com.my/personal/insure/sing...value-gain.pageSince the product is an insurance product, Maybe you should ask in insurance thread? |

|

|

|

|

|

MUM

|

Dec 3 2021, 03:53 PM Dec 3 2021, 03:53 PM

|

|

QUOTE(imbibug @ Dec 3 2021, 03:01 PM) I should've stated clearly, not interested in an insurance product. Want recommendations on investment products instead. for recommendations on investment products.... hope you can narrow down the products that suits your risk, expected ROI and preferences. for a start, maybe you can try read this... singapore context,...but basically it will the the same for application to malaysia too. Get started on your investment journey. Learn about different investment products and how to invest according to your goals, risk profile and circumstances. https://www.moneysense.gov.sg/investments |

|

|

|

|

|

MUM

|

Dec 22 2021, 10:24 PM Dec 22 2021, 10:24 PM

|

|

QUOTE(rebeka @ Dec 22 2021, 03:11 PM) ** They have few type of fund ,the above applies to type of fund with minimum investment of USD 100k , Not applicable to type of fund with minimum investment of USD25k & 10k  good info, mind sharing the list of funds that does not requires to be an accredited investors (“AI”) and their minimum investments amount and preferably their related charges?  |

|

|

|

|

|

MUM

|

Dec 23 2021, 09:36 AM Dec 23 2021, 09:36 AM

|

|

QUOTE(rebeka @ Dec 23 2021, 09:21 AM) There are 2 type of funds with minimum investment of USD 10k & 25k ,subscription fee is 1% & redemption fee is 0.5% . If you need more details, kindly pm me ... wow, so secretive one,...need to PM if wanted more details... anyway thanks for the same posted details....   too bad those that wanted to know more about its years of inception, mandate, performance, risk factors etc etc,...will just have to forgo it or PM for it |

|

|

|

|

|

MUM

|

Dec 23 2021, 09:49 AM Dec 23 2021, 09:49 AM

|

|

QUOTE(Avicted @ Dec 23 2021, 06:48 AM) RHB Big Cap investment fund now not good?yes, now not good if compared it to past July 2019 till Feb 2021 period compared to it all time ATH in Feb 2021 No, now is good if buy now compared to Feb 2021 (or any buy since July 2020) compare to 10 yrs ago,...it is still way up from 100 to 250 (per indicator in the chart) just don't sailang all in ....if your portfolio construction requires it, then perhaps under supplementary or "commando/striker" section of a diversified port Attached thumbnail(s)

|

|

|

|

|

|

MUM

|

Dec 23 2021, 01:28 PM Dec 23 2021, 01:28 PM

|

|

QUOTE(Avicted @ Dec 23 2021, 01:26 PM) Should i sell it ? Or waiting until new year to see the trend? how many % of it is in your portfolio? any similar mandated fund in your port? how many % of losses are you having on this particular fund? does this losses impacted you in any way? do you needed that money (from selling it) for something in less than 3 yrs down the road? This post has been edited by MUM: Dec 23 2021, 01:30 PM |

|

|

|

|

|

MUM

|

Dec 23 2021, 05:49 PM Dec 23 2021, 05:49 PM

|

|

QUOTE(Avicted @ Dec 23 2021, 05:03 PM) 1. 29% from overall 2. Not really. 3. Around 27% 4. & 5. : Nope At 27% still hv "nope" for 4 & 5,... Then it would make the decision as to whether to sell or continue to hold easier... 👍👍 |

|

|

|

|

|

MUM

|

Jan 11 2022, 09:15 PM Jan 11 2022, 09:15 PM

|

|

QUOTE(onepunch369 @ Jan 11 2022, 09:08 PM) Hi everyone new to this forum! I've been using both unit trusts and robos for a few years. Any reason why most OGs still opt for unit trusts rather than roboadvisors? sorry if noob question Does Robo advisors allows you to select your own countries or regions or sectors & the % of allocation to each of them at the choice you preferred like unit trust funds does in the composition of your DIY portfolio? This post has been edited by MUM: Jan 11 2022, 09:41 PM |

|

|

|

|

|

MUM

|

Jan 23 2022, 07:09 AM Jan 23 2022, 07:09 AM

|

|

QUOTE(rebeka @ Jan 22 2022, 08:15 PM) Mind to share which SA portfolio maintained at 40++% ? TQ while waiting for his response,.... unknown of his investment period or if he did made any additional big top up at the "right" time (ex: in 2020) my wild guessed based on mentioned annualised returns, invested since inception and no top up since then....looks likely from the 30 & 36% SRI https://www.stashaway.my/how-we-invest#performance Attached thumbnail(s)

|

|

|

|

|

|

MUM

|

Jan 23 2022, 12:04 PM Jan 23 2022, 12:04 PM

|

|

QUOTE(rebeka @ Jan 23 2022, 11:55 AM) Thanks for your feedback ... u mean it’s the return since inception ? Reading his posting, I think he meant 40+% since he invested in SA 3 yrs ago |

|

|

|

|

|

MUM

|

Jan 23 2022, 06:43 PM Jan 23 2022, 06:43 PM

|

|

QUOTE(senyii @ Jan 23 2022, 05:20 PM) Hi I am fairly new in investment, only invest in unit trust before but didn't really know much. Now i am thinking to invest in another unit trust. I have some general question: 1. I see generally unit trust return around 5-10% ? what is the minimum year investment lock for? Unit trust investments are subject to investment risks, including the possible loss of the principal amount invested.

Past performance is not indicative of future performance.

The value of the unit trusts and the income from them may fall as well as rise.

Thus there is no guaranteed that it can be 5~10% every year.....at times it can go into BIG negatives too (like 50% off from your purchased NAV price)2. Previously my unit trust were paid monthly a X amount, is all unit trust has these option or must be 1 lump sum investment? YES, there are monthly dividend distributing unit trust funds.

NO, not all unit trust has this monthly dividend distributing option.

Some only do it once a year and some also did not distribute dividend

btw, in unit trust investing, the dividend distribution does not make the $$ value you have inside it to be more. There is no variance of the $$ you have BEFORE or AFTER dividend distribution process.

For, When a unit split/distribution is declared, the NAV per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV.

there is a minimum amount of money you need to buy initially (lumpsum of that initial amount)

3. I'm told by my friend stashway is also good to consider, anyone can share more thoughts against other unittrust? There is a Stashaway thread in LYN...you can try follow/read/explore from there...

StashAway Malaysia, Multi-Region ETF at your fingertips!https://forum.lowyat.net/topic/4750563Lastly love to have some suggestion which unit trust to consider, I'm looking at no more than 5years investment. or if there is any other investment you would suggest, looking for low to medium risk and doesn't require extensive monitoring. i would suggest you think of it this way,......which unit trust funds you would consider that allows you to accept possible XX% pa of losses and when this losses happens; it will not have impact your emotional well being, impact your work/family life. and you will not quit/sell off? (in short, what amount of % of losses you will accepts before calling it quits?)

How many % of ROI will you want to try to make at the end of that 5 years? |

|

|

|

|

|

MUM

|

Jan 25 2022, 07:24 PM Jan 25 2022, 07:24 PM

|

|

QUOTE(senyii @ Jan 25 2022, 07:16 PM) Thanks for the reply… what are some of the unit trust that are doing fairly good currently? On the loss honestly off course prefer no lost at least breakeven..not a gambler hence wont go for those high risk one…i prolly will hold for a max a yr for it to go back up? Unit trust investing will be subjected to risk of losses even for Fixed income funds,...unless you select those money market funds or extremely low risk type of Fixed income funds

For stashaway the thread mostly talk about stashaway alone not comparing with other.. i want to know how it is different with other unit trust? Stashaway is investing in ETFs while Unit trust is investing in Stocks

Stashaway is like FSM managed portfolio....both is whre you let them do the managing, selections or changing of the portfolio composition....you got no say in what or how much you want to allocateFor the monthly question was not about dividen but the payment for the investment in unit trust is there type when u can pay monthly and accumulate or it has to pay one lumpsum type? there are Regular Saving Plan (RSP) in FSM

check out the FAQs on Regular Savings Plan - RSPhttps://www.fsmone.com.my/support/frequentl...routeFaqId=7075 |

|

|

|

|

|

MUM

|

Feb 20 2022, 10:04 AM Feb 20 2022, 10:04 AM

|

|

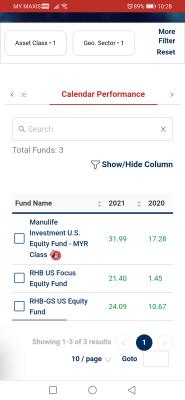

QUOTE(zhitou @ Feb 20 2022, 09:48 AM) Akru's highest risk portfolio beat 90% of locally managed global unit trust funds in 2021. See www.akrunow.com/articles/perfromance-report-december-2021 and Julian Ng's latest Facebook page post at m.facebook.com/story.php?story_fbid=10158532442872671&id=534737670 Start now with Akrunow.com. Please use the PASSIVE20 promo code so that Akru can give you a RM20 top up as a token of appreciation. What are the geographical allocation of this Akru's highest portfolio? Does it has a heavy allocation (like more than 50%) to a certain country/sector/segment mkts? What is the current year YTD performance of this highest risk portfolio? Some don't like the biased n heavy allocation to a certain country/sector/segment even though it can managed to beat 90% of locally managed global unit trust funds in 2021. Btw, I think alot of unit trust funds that focused heavily in US mkt would do well in 2021 also. What is the 2021 returns of that Akru's highest risk portfolio? This post has been edited by MUM: Feb 20 2022, 10:44 AM Attached thumbnail(s)

|

|

|

|

|

|

MUM

|

Feb 20 2022, 11:08 AM Feb 20 2022, 11:08 AM

|

|

QUOTE(zhitou @ Feb 20 2022, 11:03 AM) The portfolio mix is as follows: S&P500 57% Ex-US Equity 40% US & International Bond 3% Per Akru Performance Report www.akrunow.com/articles/perfromance-report-december-2021, it was 22.8% in 2021 for P10 (highest risk portfolio) At 57% us... 2021 MYR performance is 22.8%? Global ut funds had broken that ROI for 2021. Btw, any idea for the current 2022 YTD returns for akru portfolio 10?.. Global UT funds are bad YTD, just hope portfolio 10 can be different |

|

|

|

|

|

MUM

|

Feb 20 2022, 12:39 PM Feb 20 2022, 12:39 PM

|

|

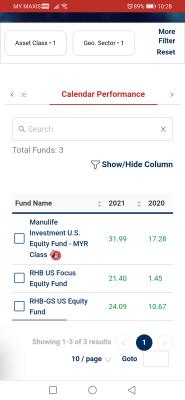

QUOTE(zhitou @ Feb 20 2022, 12:15 PM) In Jan 2022, Akru P10 down ~3.8% (vs S&P500 -5.2%). How do the Global UT funds do in 2021 and Jan 2022? Global UT funds BAD as i mentioned earlier on those listed earlier Attached thumbnail(s)

|

|

|

|

|

|

MUM

|

May 1 2022, 09:40 AM May 1 2022, 09:40 AM

|

|

QUOTE(Tyeway0on @ May 1 2022, 08:27 AM) Hi, may I know if you joined this investment thingy? If yes, is it leggit or a scam? If you meant this.... CP Global Asset Management,... According to their website,.... Registered Fund Management Company ("RFMC") and Exempt Financial Adviser regulated by the Monetary Authority of Singapore ("MAS") https://cpglobal.com.sg/new-our-firm |

|

|

|

|

|

MUM

|

May 13 2022, 09:12 PM May 13 2022, 09:12 PM

|

|

QUOTE(SpringBreak2012 @ May 13 2022, 08:49 PM) Hi, would like to ask for sifus opinion. A family member would like to apply for a long-term savings and investment plan (it's legit, 12m x 5y w/ 20 year maturity) in my name with payments fully made by them. It's a nice gesture, but since it's being made in my name I would like to know what is the worst case scenario that could happen? e.g. 1) Payment is not made on time - any impact on my CCRIS? 2) Payment is not made on time - will I be hounded by payment reminders? 3) And anything else that could happen? my wild guess while waiting for value added responses,... saving plan is NOT a loan,.....thus will has no bearing to your CCRIS report. if this saving plan is like those of "insurance saving plan,.... then my guess is that the money inside will greatly reduced if in the event that there is a discontinuation of the plan midway .... and yes, they will sent you payment reminder if can tell them to put inside your EPF a/c This post has been edited by MUM: May 13 2022, 09:13 PM |

|

|

|

|

|

MUM

|

May 14 2022, 10:31 PM May 14 2022, 10:31 PM

|

|

QUOTE(SpringBreak2012 @ May 14 2022, 10:13 PM) Okays that sounds reasonable to me. Will take note on your advice on maintaining continuous payment. Just a note, Many had mentioned, the returns of "saving plan" is just a bit better or same as Fd,... As most of the supposed returns had been used to pay premium used to provide the insurance coverage through out the entire duration.... |

|

|

|

|

|

MUM

|

May 30 2022, 12:12 PM May 30 2022, 12:12 PM

|

|

QUOTE(xDjWanNabex @ May 30 2022, 11:10 AM) Have a friend who introduced me to the MCIS titan fund. Anyone have any experience/knowledge about it? It seems its performing quite well, with returns from 14-20% yearly. I Googled and got this from,... https://www.mcis.my/Media-Centre/Investor-R...t-Linked-Funds# Attached thumbnail(s)

|

|

|

|

|

Sep 30 2021, 09:23 PM

Sep 30 2021, 09:23 PM

Quote

Quote

0.0723sec

0.0723sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled