recently found out the uob eaccount actually only give 3.6% for the balance starting from 50k and not for the balance of the first 50k

Anyone can confirm this?

Savings Account in Malaysia

Savings Account in Malaysia

|

|

Dec 26 2018, 05:16 PM Dec 26 2018, 05:16 PM

|

Senior Member

833 posts Joined: Sep 2012 From: Earth |

recently found out the uob eaccount actually only give 3.6% for the balance starting from 50k and not for the balance of the first 50k

Anyone can confirm this? |

|

|

|

|

|

Jan 14 2019, 09:46 AM Jan 14 2019, 09:46 AM

|

Junior Member

426 posts Joined: Aug 2011 |

QUOTE(55665566 @ Dec 26 2018, 10:16 AM) recently found out the uob eaccount actually only give 3.6% for the balance starting from 50k and not for the balance of the first 50k Hi, I have yet to open a UOB eAccount but feel that 3.5% p.a. interests on entire balance above RM 50k sounds too good to be true. I wonder if they pay lower interest for the first RM 50k, and only 3.5% for balance beyond RM 50k.Anyone can confirm this? Let me know once confirmed? |

|

|

Jan 14 2019, 09:58 AM Jan 14 2019, 09:58 AM

|

All Stars

14,866 posts Joined: Mar 2015 |

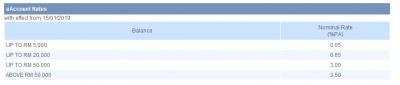

QUOTE(jerantut2011 @ Jan 14 2019, 09:46 AM) Hi, I have yet to open a UOB eAccount but feel that 3.5% p.a. interests on entire balance above RM 50k sounds too good to be true. I wonder if they pay lower interest for the first RM 50k, and only 3.5% for balance beyond RM 50k. googled and found this....Let me know once confirmed? https://www1.uob.com.my/personal/useful/fees/e-account.page https://uniservices1.uob.com.my/jsp/finance/fin_sav.jsp Attached thumbnail(s)

|

|

|

Jan 14 2019, 06:33 PM Jan 14 2019, 06:33 PM

|

Junior Member

83 posts Joined: Jan 2018 |

QUOTE(jerantut2011 @ Jan 14 2019, 09:46 AM) Hi, I have yet to open a UOB eAccount but feel that 3.5% p.a. interests on entire balance above RM 50k sounds too good to be true. I wonder if they pay lower interest for the first RM 50k, and only 3.5% for balance beyond RM 50k. I opened eaccount recently. Can confirm that for the RM20k+ I put in there got full 3.13% (was 3.13 in Dec, recently lowered) and not 0.6% on the first 20k that sort of thing.Let me know once confirmed? I would assume same for 50k+. You can see how it's worded for the One account, where the interest is by bracket. They also show the effective interest rate: https://www1.uob.com.my/personal/save/savin...ne-account.page |

|

|

Jan 15 2019, 09:29 AM Jan 15 2019, 09:29 AM

|

Senior Member

1,616 posts Joined: Jul 2016 |

|

|

|

Jan 15 2019, 09:37 AM Jan 15 2019, 09:37 AM

|

Senior Member

833 posts Joined: Sep 2012 From: Earth |

QUOTE(Cookie101 @ Jan 15 2019, 09:29 AM) as if, my account got rm50000 for entire year, i get 50000*0.035 = 1750 every year?are you sure? https://uniservices1.uob.com.my/jsp/finance/fin_sav.jsp

not sure any misunderstanding or not. |

|

|

|

|

|

Jan 15 2019, 09:55 AM Jan 15 2019, 09:55 AM

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(55665566 @ Jan 15 2019, 09:37 AM) as if, my account got rm50000 for entire year, i get 50000*0.035 = 1750 every year? Yes. are you sure? https://uniservices1.uob.com.my/jsp/finance/fin_sav.jsp

not sure any misunderstanding or not. been getting around 100/monthly for bal of 35k~. |

|

|

Jan 15 2019, 09:56 AM Jan 15 2019, 09:56 AM

|

Senior Member

833 posts Joined: Sep 2012 From: Earth |

|

|

|

Jan 15 2019, 04:03 PM Jan 15 2019, 04:03 PM

|

Junior Member

83 posts Joined: Jan 2018 |

Yeah the UOB eaccount interest rate is higher than most FD rates (those online facilities) and its computed daily. With average minimum balance > 10k they waive the GIRO ATM withdrawal fee also. I keep only this ATM card with me nowadays, confirm the most ATMs haha. Better get it while it lasts!

|

|

|

Jan 22 2019, 07:32 AM Jan 22 2019, 07:32 AM

|

All Stars

65,286 posts Joined: Jan 2003 |

|

|

|

Jan 22 2019, 12:06 PM Jan 22 2019, 12:06 PM

Show posts by this member only | IPv6 | Post

#511

|

Senior Member

7,616 posts Joined: Mar 2009 |

Does anyone know what is the minimum amount needs to be kept in SA for Hong leong, CIMB, and maybank to remain active?

|

|

|

Jan 22 2019, 12:08 PM Jan 22 2019, 12:08 PM

|

All Stars

65,286 posts Joined: Jan 2003 |

QUOTE(annoymous1234 @ Jan 22 2019, 12:06 PM) Does anyone know what is the minimum amount needs to be kept in SA for Hong leong, CIMB, and maybank to remain active? no such thing.rm20 min balance for for BSA but if no activity for 1 year, it will turn dormant. info from maybank >> https://www.maybank2u.com.my/WebBank/DormantAccount-FAQ.pdf |

|

|

Jan 22 2019, 12:40 PM Jan 22 2019, 12:40 PM

Show posts by this member only | IPv6 | Post

#513

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jan 22 2019, 11:42 PM Jan 22 2019, 11:42 PM

|

Junior Member

233 posts Joined: Mar 2007 |

QUOTE(55665566 @ Jan 15 2019, 09:37 AM) as if, my account got rm50000 for entire year, i get 50000*0.035 = 1750 every year? Confirmed with UOB's lenglui staff, if:are you sure? 1. Ur saving - 20,001 to 49,999, you get 3% p.a. for whole balance 2. Ur saving - above 50,000, you get 3.5% p.a. (was 3.6%) for whole balance, no max limit for now So if ur acc got rm1,000,000, u get rm35,000 per year. |

|

|

Jan 23 2019, 09:14 AM Jan 23 2019, 09:14 AM

|

Senior Member

833 posts Joined: Sep 2012 From: Earth |

QUOTE(shuin1986 @ Jan 22 2019, 11:42 PM) Confirmed with UOB's lenglui staff, if: Good to hear, not bad eh!1. Ur saving - 20,001 to 49,999, you get 3% p.a. for whole balance 2. Ur saving - above 50,000, you get 3.5% p.a. (was 3.6%) for whole balance, no max limit for now So if ur acc got rm1,000,000, u get rm35,000 per year. yea, not sure why they adjust the -0.1% |

|

|

Feb 12 2019, 06:35 PM Feb 12 2019, 06:35 PM

|

Junior Member

366 posts Joined: Mar 2006 |

How about Hong Leong Bank?

|

|

|

Apr 3 2019, 03:24 PM Apr 3 2019, 03:24 PM

|

Junior Member

31 posts Joined: Mar 2007 |

what document(s) needed for senior housewife to open a senior bank account? thanks.

|

|

|

May 25 2019, 11:53 AM May 25 2019, 11:53 AM

Show posts by this member only | IPv6 | Post

#518

|

All Stars

26,524 posts Joined: Jan 2003 |

My CASA with UOB is going to be 12 months without any physical transaction. To avoid dormant fee, is cash deposit through CDM counts or it must be over the counter? Thanks

|

|

|

May 26 2019, 07:39 PM May 26 2019, 07:39 PM

Show posts by this member only | IPv6 | Post

#519

|

Junior Member

54 posts Joined: Aug 2015 |

Hi guys,

Not sure is this the right thread to post this. Planning to open RHB bonus savers account, however I cant find much details on the website. To confirm, monthly deposits of rm500 and can withdraw on the 13th month right? How are the charges? Any annual fees etc? I think I’ve read that there is a debit card issuance of rm8, can i request for it to be a free savings account? (Since the purpose of this account is for savings and no need for withdrawals, I can also transfer to my active accounts) Also what’s the minimum balance for this account after the 1st year? Thanks in advance! |

|

|

May 26 2019, 07:49 PM May 26 2019, 07:49 PM

|

All Stars

65,286 posts Joined: Jan 2003 |

QUOTE(hamjipeng @ May 26 2019, 07:39 PM) Hi guys, info here >> https://www.rhbgroup.com/personal/personal-saving/index.htmlNot sure is this the right thread to post this. Planning to open RHB bonus savers account, however I cant find much details on the website. To confirm, monthly deposits of rm500 and can withdraw on the 13th month right? How are the charges? Any annual fees etc? I think I’ve read that there is a debit card issuance of rm8, can i request for it to be a free savings account? (Since the purpose of this account is for savings and no need for withdrawals, I can also transfer to my active accounts) Also what’s the minimum balance for this account after the 1st year? Thanks in advance! can you search in this topic >> https://forum.lowyat.net/index.php?showtopic=4439367 |

| Change to: |  0.0180sec 0.0180sec

0.22 0.22

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 05:39 PM |