Those with projected DPU increase are..

CCT

CRCT

FCT

SPH

Acendas

MIT

Viva

Keppel DC

This post has been edited by gark: Mar 29 2017, 02:36 PM

Singapore REITS, S-REITS

|

|

Mar 29 2017, 02:32 PM Mar 29 2017, 02:32 PM

Return to original view | Post

#261

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

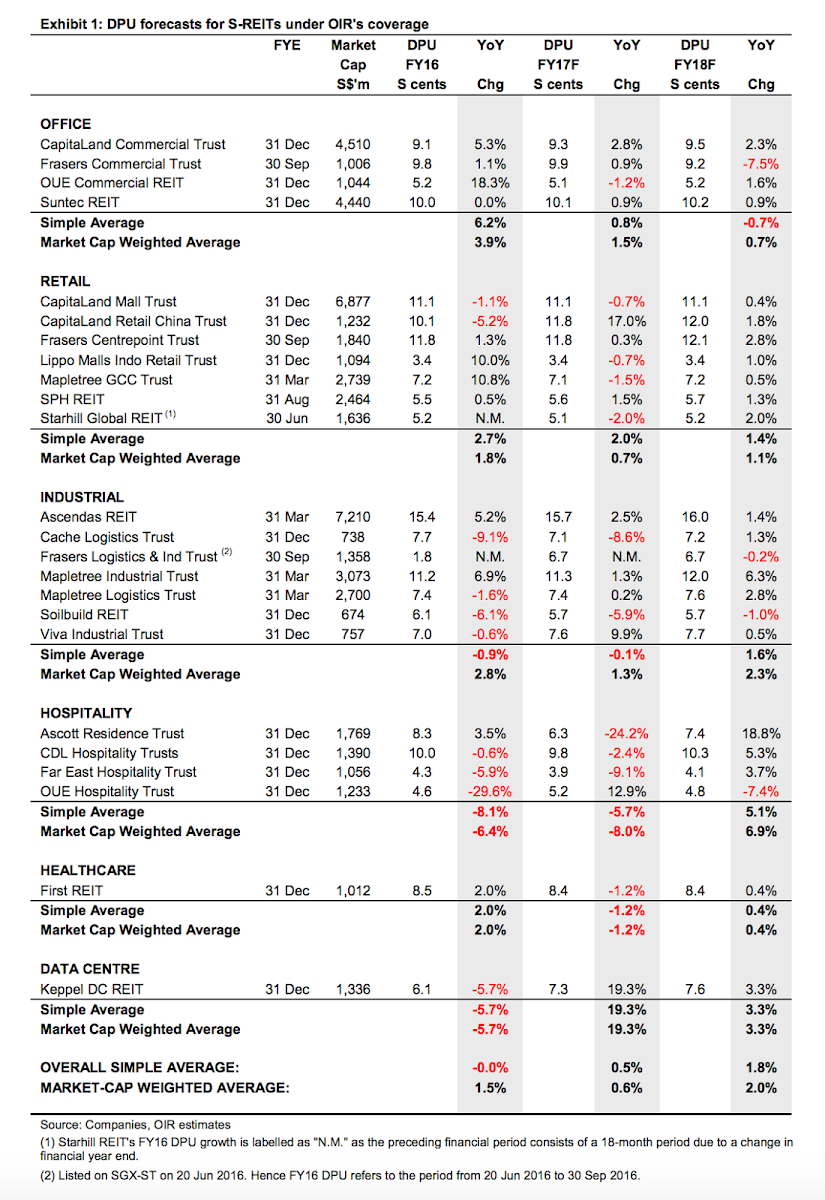

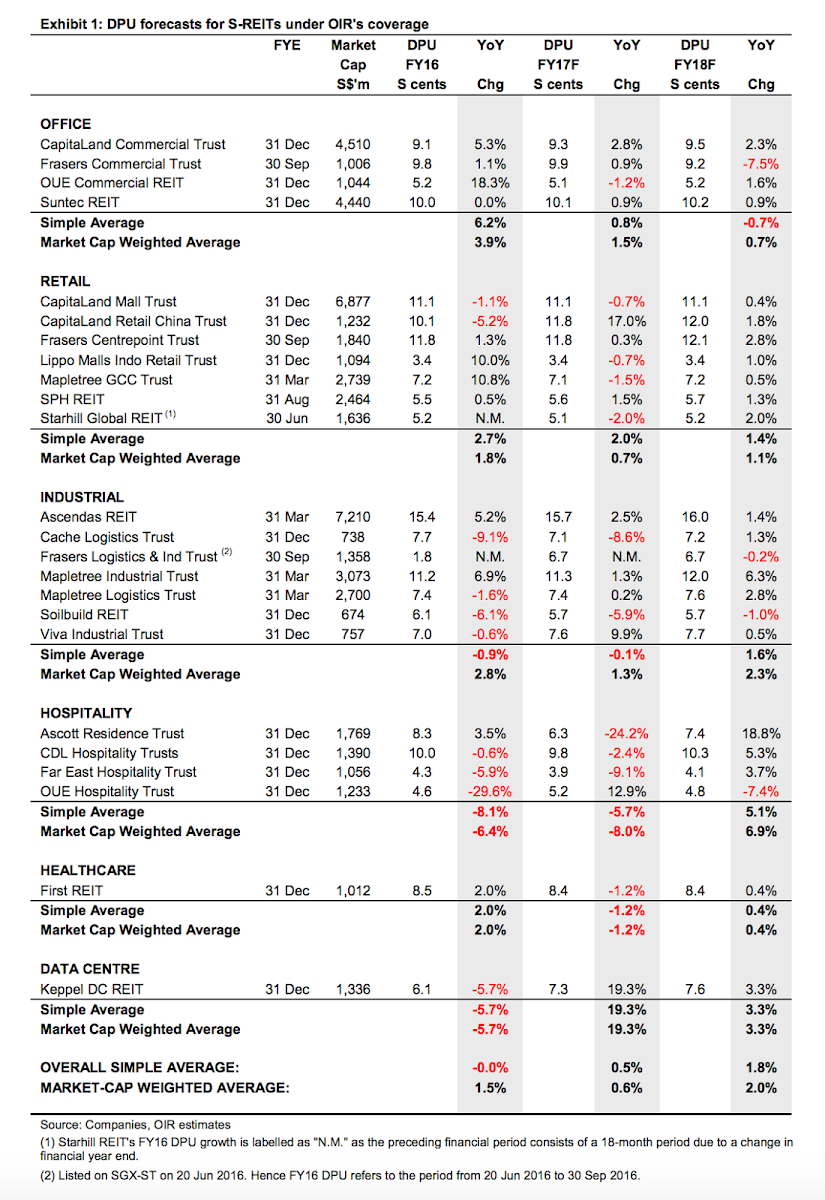

OCBC REIT DPU forecast..report 23rd March

Those with projected DPU increase are.. CCT CRCT FCT SPH Acendas MIT Viva Keppel DC This post has been edited by gark: Mar 29 2017, 02:36 PM |

|

|

|

|

|

Mar 29 2017, 04:25 PM Mar 29 2017, 04:25 PM

Return to original view | Post

#262

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(elea88 @ Mar 29 2017, 03:52 PM) hence the daily increase in share price... I think its simple.. as long as the yields still make sense to you then can buy lar...Buy or not? All still waiting correction.. like weeks already no sign of any correction? But if not, then better hold off... I am planning to selectively buy some if i see value from time to time.. We will never know when market crash again, maybe in 1 month, 1 year , 2 years or longer... |

|

|

Mar 30 2017, 06:43 PM Mar 30 2017, 06:43 PM

Return to original view | Post

#263

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(bearbear @ Mar 30 2017, 04:21 PM) drop cause some will move the fund else where but I doubt will drop too far. I decide to buy some now cause I am worry the market bull too much. we are still 1-2 months away from divvy and by then I dont know how much it will go up. Just up a bit.. already panic buy meh? if really fall and still confident just average down ba |

|

|

Mar 30 2017, 10:56 PM Mar 30 2017, 10:56 PM

Return to original view | Post

#264

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Mar 30 2017, 11:02 PM Mar 30 2017, 11:02 PM

Return to original view | Post

#265

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Ramjade @ Mar 30 2017, 11:00 PM) (i) This is business trust or reit? Cause I saw the gearing at about 45% and still ok. No rights Yes it is trust, not reit. Trust got no gearing limit...(ii) How come my order not furfilled? I queue it at 0.89 price drop to 0.89. At least fulfilled partially la I think 0.87 also hard to get. Got more ppl q at 89... Belum reach ur turn yet lo... This post has been edited by gark: Mar 30 2017, 11:02 PM |

|

|

Mar 30 2017, 11:06 PM Mar 30 2017, 11:06 PM

Return to original view | Post

#266

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

|

|

|

Mar 30 2017, 11:17 PM Mar 30 2017, 11:17 PM

Return to original view | Post

#267

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Mar 31 2017, 12:19 PM Mar 31 2017, 12:19 PM

Return to original view | Post

#268

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Ramjade @ Mar 31 2017, 12:13 PM) They are not reits, so they don't need to bother with gearing. Which means they can take in loan to buy assets. They don't need to do a right issue. Even though they are not reit.. and have no cap, but they cannot over leverage as well, otherwise they get into big trouble. They must practice financial responsibility.If they don't do a right issue, the price won't drop... Unless they do right every year |

|

|

Apr 1 2017, 01:31 PM Apr 1 2017, 01:31 PM

Return to original view | Post

#269

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Apr 1 2017, 01:11 PM) Bro,... just a theory,.. careful,.. Most REITs want to acquire a lot of asset because they can monetize their sponsor's asset and also get higher management and transaction fees.If they don't acquire new properties/assets, then they would not need to issue placements or rights,.. they will stay status quo. But then, if this happens, the income available for distribution will also stay constant, assuming all property expenses do not increase due to whatever reasons. But,..they can also do placements or rights offering for asset enhancement activities and for working capital though... ...either way, they will need more money to have a chance of increasing our dpu. They can't take loans from Japan anymore due to capping of the loan packages that have met the capped level. There is one more way by which the dpu can increase, ie after one year[SIZE=7], if there is a positive rental reversion clause or condition set inside the lease agreement. Other than this, I don't see any other way by which they can increase our dpu,... they could only 'defend' the dpu payout amt,... I stand open to corrections in the above,... in case I missed out on anything ! This Croesus has just internalized their manager, so there might be not so much incentive to add more assets to raise fees.. because there are no more fees (only more work for manager, without additional reward). The manager now works solely for the shareholders. This REIT is no longer the same REIT compared to previously.. This post has been edited by gark: Apr 1 2017, 01:33 PM |

|

|

Apr 1 2017, 03:52 PM Apr 1 2017, 03:52 PM

Return to original view | Post

#270

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Apr 1 2017, 03:51 PM) Tq bro,... if the manager also holds units of Croesus, that would be the incentive to increase the dpu amount too, right ? The manager was internalized late last year. The last rights issue is used to buy out the manager. So now the manager only receive salary and no ownership.But, yes, without the additional incentives of earning more performance fees, this mgr may not push for asset size increase so hard anymore. When was the manager internalized ? This time if shareholder dont like the manager's performance can really fire the manager because he is now just an employee. This post has been edited by gark: Apr 1 2017, 03:55 PM |

|

|

Apr 1 2017, 05:08 PM Apr 1 2017, 05:08 PM

Return to original view | Post

#271

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Apr 1 2017, 04:50 PM) The manager may not be increasing the asset size anymore after this, hence, no possibility for dpu increase from here on,...sure, unit holders could perhaps do something, but it may be messy,... looking at what's happening to Sabana now. They are independent since IPO.. they have no sponsor. They have done quite a good job so far IMHO.But one hope for us is the sponsor may want to continue monetizing their assets. However, what sort of asset pipeline does this sponsor have ? Who's the sponsor of Croesus anyway ? I am happy if they just continue to keep delivering the same DPU forever.. The majority shareholder is Tong Jinquan. This post has been edited by gark: Apr 1 2017, 05:10 PM |

|

|

Apr 3 2017, 02:36 PM Apr 3 2017, 02:36 PM

Return to original view | Post

#272

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Apr 3 2017, 02:31 PM) And finally,.. I believed the writer did not attend FCT's AGM last year, prior to FCT starting the big AEI works for Northpoint ! I asked a question in the AGM : how is FCT going to maintain the DPU for us unitholders when a number of lots could not be rented out due to works being done from March 2016 till September 2017 ? The mgmt replied me, and heard by all unitholders in the hall at the industrial complex : We will take more of our fees and incentives in units rather than in cash, hence, we will free up more cash to give out to unitholders. ... careful of what we read in these SG blogs,.. |

|

|

Apr 3 2017, 05:24 PM Apr 3 2017, 05:24 PM

Return to original view | Post

#273

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

|

|

|

Apr 3 2017, 06:14 PM Apr 3 2017, 06:14 PM

Return to original view | Post

#274

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Apr 4 2017, 02:57 PM Apr 4 2017, 02:57 PM

Return to original view | Post

#275

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Apr 4 2017, 03:13 PM Apr 4 2017, 03:13 PM

Return to original view | Post

#276

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Ramjade @ Apr 4 2017, 03:08 PM) Want to buy also think twice. If you buy stock $1, divvy 5 sens.. now the stock price is $1.10, you have equivalent of 2 years worth of divvy in gains. What does this mean "holdings sure gained equivalent a few years of divvy already"? Er you mean IDR right or you indian rupee? Now waiting for frasers commercial to exceed my buying price then sell it at profit. Then wait for them to confirm that they will lose HP as tenant then buy back again Btw, does singtel at 3.90 seems ok to you? INR = Indian Rupee The HP thingy, already reflected in price, everybody know already, even if they announce, I see no impact. |

|

|

Apr 4 2017, 03:15 PM Apr 4 2017, 03:15 PM

Return to original view | Post

#277

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(prophetjul @ Apr 4 2017, 03:10 PM) Dunno why... suddenly everybody loves INR.. http://www.xe.com/currencycharts/?from=SGD&to=INR&view=1Y » Click to show Spoiler - click again to hide... «

|

|

|

Apr 4 2017, 04:43 PM Apr 4 2017, 04:43 PM

Return to original view | Post

#278

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Apr 4 2017, 05:11 PM Apr 4 2017, 05:11 PM

Return to original view | Post

#279

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(elea88 @ Apr 4 2017, 05:06 PM) People here in forum must panic first and start selling.. then only the Sreit can become red... As long as everyone still saying miss the boat etc and faster chase.. it will not likely go down. This post has been edited by gark: Apr 4 2017, 05:12 PM |

|

|

Apr 4 2017, 05:19 PM Apr 4 2017, 05:19 PM

Return to original view | Post

#280

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

| Change to: |  0.5347sec 0.5347sec

0.49 0.49

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 02:53 PM |