QUOTE(garfield007 @ May 16 2013, 07:44 AM)

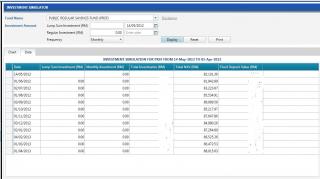

I'm planning to invest using my epf. Is this Public Islamic Select Treasures Fund 6.98% 1.41% 2.81% 4.77% 7.42% 7.44% fund good? What is the important thing to take note to compare which fund should invest? And how to know which is equity fund? Thank you.

you may go to fund review and get the latest 1Q Fun Review.

From there, you can see which one is more equity based on their %.

This is an example of balanced fund.

For equity, its should be more % on equity, >70%.

You may choose your fund by comparing total asset in different country, top holding and the annualized return. All already inside the fund review.

PISTF is 100% Malaysia holding, quite large % of money market (which I don't really like, but its make it a stable fund). Commence on 2009 but only had annualized return of 8%.

Apr 5 2013, 11:56 AM

Apr 5 2013, 11:56 AM

Quote

Quote

0.0576sec

0.0576sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled