I know many investors who are value investors would look at PE. I do. PE is the simplest benchmark to evaluate how attractive a company can be. But we cannot use them all the time. In fact, we can only use them only as a guide. Let me give some examples for this article. You may think of many more...

Value investing in Stocks is about investing into great business

The easiest way into any investment is about your comfort level. When investing into certain companies, as I noticed, some people have commented that they buy because so and so company gives good dividends and has low PE ratio. Are you sure? Can they last?

Let's look at it this way. A company may provide good dividends but are those dividends sustainable. An example, Masterskill gave 7 sen dividend / share in September 2010 and 7.9 sen dividend per share in May 2011. During that time, the price seemed to be cheap - based on dividend yield that is. However, those numbers were not sustainable. Look at what happened now. This is because its business is risky. It did not have fundamentals. It was relying too much on government's loans to those students who did not know the options that they had. Getting education at the end of the day is about getting jobs from the qualifications that they obtained. Many of the nurses that Masterskill trained could not get jobs as the demand was not as much as the number of trained nurses they produced yearly. What happened then? These students could not get the jobs they were looking for, hence their loans from the government are not paid. PTPTN, the lending party hence came up with tougher rules.

Compare that to a company that I have liked. Oldtown. Originally, I have gone on the unconventional to say that Oldtown was an attractive IPO. Most IPOs during the last few years underperformed. Oldtown underperformed actually for the first few months. However, for one you can easily noticed this business that the owners built is there to stay. Customers frequent. Its location are fantastic. (Ever wonder why McDonalds prefers to have outlets along the highways than in a mall? - make themselves noticeable - they go on eyeballs per dollar invested!) Oldtown is not Starbucks or McDonalds but it is a company which gave some goosebumps until rumours that Vincent Tan who owns franchises for the two offered Oldtown's owner for the business. I wouldn't be surprise actually.

Why? Sentiments may say that Oldtown is facing a very competitive challenge in a very competitive space. Yes again! Remember PCs. Were PC business competitive? Most competitors failed. Lesser and lesser survived. And those who survived did very well at least for a period - Dell, Compaq, HP, Acer, IBM. Starbucks has that similar competition. It is now a USD38billion company - still with tonnes of competition. Well. this is because the business makes sense. That's why there are tonnes of competition. But only few survived and those who have proven to do so will most probably thrive. Starbucks thrives.

Business is about collection

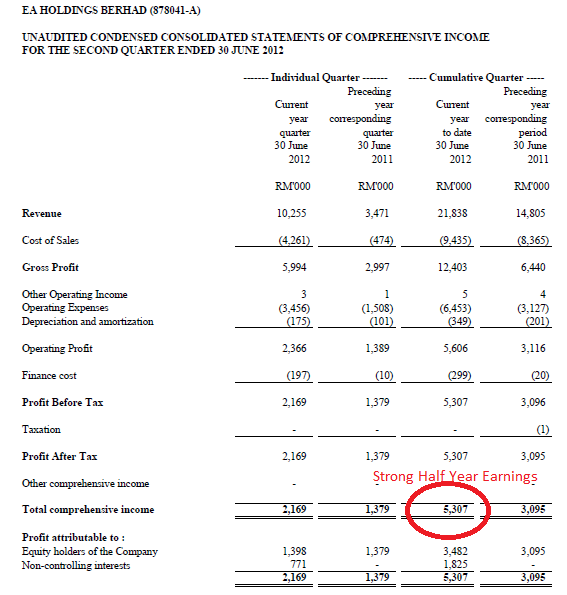

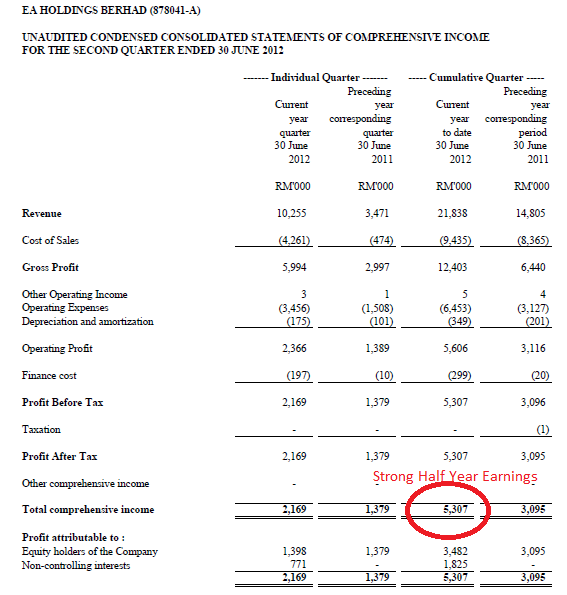

Simple logic. Why else would you do business for. List them? But to face tough collections problems. See below. EA Holdings trades at about 4x PE. How low can it go some more? But its (yet to be collected) collection is about 1 year its revenue. Collectible you may wonder, I don't know actually - I have doubts.

Big business is easier actually

Listed in Malaysia, there are some franchises - but not many. Most are small companies. Nestle is a franchise for its cocoa drinks - Milo, Nescafe. Oldtown and Airasia are successful franchises which are built amazingly over a short period. Other franchises - CIMB, Public Bank, KFC, Amway etc. To run these businesses are much easier than most SMEs CEOs. These large companies CEOs may not agree with me, but at least they do not worry over money, paying salaries, survival. They mostly worry over their own survival first, then only the company. Try to be in position of SMEs - some of them are listed. If you look at the balance sheet of these smaller companies, they have no budget. Each and every action needs to be thought of properly as they have limited funds. Raising funds is tough as convincing people - such as investors, bankers. Now you know, that Tony Fernandez has said it many times - where were the banks when he needed funds. Now he can have it, It was tough though when he started. Believe that.

Because of this - would you pay a higher PE for larger companies which already has a franchise - be it in its process or brand? If you do not believe me, try looking for some of the smaller companies which has low PEs - invest in them. Chances are for them to survive they have to be consistently successful not once, but many instances - much tougher. Because of that, they are unable to build a solid franchise name.

Hence, in future when invest in value, try thinking all of these. It can be easy. And do not think complicatedly.

Link :

http://www.intellecpoint.com/2012/09/value...w-pe-alone.html

Sep 4 2012, 04:13 PM

Sep 4 2012, 04:13 PM

Quote

Quote

0.0345sec

0.0345sec

0.83

0.83

6 queries

6 queries

GZIP Disabled

GZIP Disabled