Thanks for the replies. I'll check with another bank and see. :S

Latest Car Loan Rate 2012-2021| 2021

Latest Car Loan Rate 2012-2021| 2021

|

|

May 31 2023, 06:39 PM May 31 2023, 06:39 PM

Show posts by this member only | IPv6 | Post

#3461

|

Junior Member

413 posts Joined: Jul 2008 |

Thanks for the replies. I'll check with another bank and see. :S

|

|

|

|

|

|

May 31 2023, 10:08 PM May 31 2023, 10:08 PM

|

Junior Member

643 posts Joined: Feb 2014 |

QUOTE(shaniandras2787 @ May 31 2023, 05:44 PM) a Myvi costs RM60,000.00 and a Yaris costs RM83,000.00, assuming each car suffers a depreciate value of 10% p.a. then at the end of the first year, the Mvyi will be at RM54,000.00 and the Yaris is at RM74,700.00 but given Toyota's track record and market reputation, the Yaris could suffer less depreciation. Assuming again that the loan interest rate for both cars is at 3% p.a. and is on a 5 year loan tenure, this generates the total loan amount payable of RM62,100.00 for the Myvi and RM85,905.00 for the Yaris 10% down payment. At the end of the first year, the outstanding loan for the Myvi should be at RM49,680.00 and the Yaris at RM57,519.00. with this simple minded calculation, the difference between the marketable value and the outstanding loan amount payable for the Myvi is too close for comfort to the financier and because of this, the financier has to rake up the interest to "recover the risks" first. i remember many years back when i bought my F10 and opted for BMW Credit as the financier because the interest rate is much lower compared to all other financiers, asked the SA why and she said it's because BMW Malaysia actually "subsidized" some of the difference in the interest rate to make purchasing their cars more attractive since everyone knows continental cars depreciates like crazy and maintenance costs are high, second hand value for these are almost non-existence. So the credit scoring goes back to buyer demography |

|

|

Jun 1 2023, 09:53 AM Jun 1 2023, 09:53 AM

Show posts by this member only | IPv6 | Post

#3463

|

Senior Member

2,309 posts Joined: Apr 2011 |

QUOTE(OrangeGrove @ May 31 2023, 10:08 PM) Nah... VW Ford Peugeot are even worse product, worse depreciation.. but these new cars can get 2.4% interest rate.. i don't think so you can still get VW / Ford at 2.4% now, visited the showroom last month and was offered a rate between 2.8% - 3.0% (depending on the tenure), tcken's friend was offered 3.48% for a Myvi. So the credit scoring goes back to buyer demography furthermore, the entry price for a new VW/Ford is relatively high compared to local brands and this makes buying a used/second-hand much more viable and for vast majority, unless desperate, will get a brand new one. |

|

|

Jun 1 2023, 11:04 AM Jun 1 2023, 11:04 AM

|

Junior Member

643 posts Joined: Feb 2014 |

QUOTE(shaniandras2787 @ Jun 1 2023, 09:53 AM) i don't think so you can still get VW / Ford at 2.4% now, visited the showroom last month and was offered a rate between 2.8% - 3.0% (depending on the tenure), tcken's friend was offered 3.48% for a Myvi. that rate was before the OPR was raised.. but the point is foreign car brand interest rate is lower than local ones in general.. it has nothing to do with car depreciation as you mentioned earlier..furthermore, the entry price for a new VW/Ford is relatively high compared to local brands and this makes buying a used/second-hand much more viable and for vast majority, unless desperate, will get a brand new one. So.. because these cars likely to be bought by group of buyers with higher purchasing power, thus the risk is lesser on them.. If you are saying that interest rate has to do with car depreciation so that point dont hold water because VW suffer more deprecation rate than MyVi. Moreover, MyVi is easier to flip in used market than VW. (I had a VW and I know how shitty the depreciation is) So why VW gets a lower rate and perceived as lower risk? Because their buyers are generally more capable to repay and lower default rate. So it is the buyer group. You get what I mean.. This post has been edited by OrangeGrove: Jun 1 2023, 11:06 AM |

|

|

Jun 1 2023, 08:17 PM Jun 1 2023, 08:17 PM

Show posts by this member only | IPv6 | Post

#3465

|

Senior Member

5,750 posts Joined: Jan 2003 From: Sri Kembangan |

QUOTE(-Panadol- @ May 19 2023, 08:22 AM) May I know are there Reducing Balance car loans in Malaysia? If so, what are the typical interest rates? Depends on your credit rating, local or foreign car, number of loan year.I think the interest should be slightly higher compared to regular fixed rate car loans? Local car Maybank five year if good credit rating can get 3.3% kua If early settlement can get intesrt discount. This post has been edited by g5sim: Jun 1 2023, 08:18 PM |

|

|

Jun 5 2023, 09:06 PM Jun 5 2023, 09:06 PM

|

Senior Member

2,006 posts Joined: May 2011 |

will e-CCRIS show the record after banks approve my car loan application?

Let say I apply 2 banks and both also approve the loan, before I accept any offer, will e-CCRIS show 2 application records? |

|

|

|

|

|

Jun 5 2023, 11:28 PM Jun 5 2023, 11:28 PM

|

Senior Member

4,928 posts Joined: Feb 2008 From: /K/opitiam Pak Hang Status: Permaban |

|

|

|

Jun 12 2023, 11:32 AM Jun 12 2023, 11:32 AM

|

Junior Member

74 posts Joined: Nov 2016 |

QUOTE(tcken @ May 30 2023, 11:14 PM) Hi. My friend is getting a Myvi H. my brother getting myvi AV, maybank offer him 3.62% on 42k loan. also this is his first car.The loan is approved by Affin bank 42K 3.48% Is this considered normal or high? why so hai one the interest rate? salesman said cause opr increased and will increase 3 more times this year. suddenly became bnm officer. is this true? |

|

|

Jun 13 2023, 06:05 PM Jun 13 2023, 06:05 PM

Show posts by this member only | IPv6 | Post

#3469

|

Junior Member

33 posts Joined: Oct 2022 |

4MBank

City E RM 70K 2.84% 9 yrs halimao 70k 2.69% 9yrs why the rate i get so high ah? only 1 house loan (still under construction) |

|

|

Jun 20 2023, 06:59 PM Jun 20 2023, 06:59 PM

Show posts by this member only | IPv6 | Post

#3470

|

Junior Member

148 posts Joined: May 2010 |

Myvi,20K, 6y,

3.73%, PBB. 3.45%,BSN This post has been edited by sin2010: Jun 22 2023, 08:05 PM |

|

|

Jun 20 2023, 09:05 PM Jun 20 2023, 09:05 PM

Show posts by this member only | IPv6 | Post

#3471

|

Senior Member

3,508 posts Joined: Apr 2009 |

Mazda CX-30

110k 7 yrs Ambank bagi 2.56% Public Bank bagi 2.46% This post has been edited by General_Nic: Jun 22 2023, 08:31 PM |

|

|

Jun 22 2023, 06:06 PM Jun 22 2023, 06:06 PM

Show posts by this member only | IPv6 | Post

#3472

|

Junior Member

413 posts Joined: Jul 2008 |

QUOTE(as77 @ Jun 12 2023, 11:32 AM) my brother getting myvi AV, maybank offer him 3.62% on 42k loan. also this is his first car. Yes. The agent says my rate is the cheapest compared to others. I could outsource if I don't believe it. = =why so hai one the interest rate? salesman said cause opr increased and will increase 3 more times this year. suddenly became bnm officer. is this true? |

|

|

Jun 23 2023, 09:40 AM Jun 23 2023, 09:40 AM

|

Junior Member

502 posts Joined: Apr 2015 From: Kuala Lumpur |

QUOTE(propusers @ Jun 5 2023, 09:06 PM) will e-CCRIS show the record after banks approve my car loan application? It will show on your CCRIS until you request for cancellation. I applied to 4 banks and had to call the 3 other banks to cancel my applications as they were still showing on my CCRIS after almost 3 months. I thought they will auto-cancel after 1 month non-acceptance.Let say I apply 2 banks and both also approve the loan, before I accept any offer, will e-CCRIS show 2 application records? General_Nic liked this post

|

|

|

|

|

|

Jul 25 2023, 11:16 AM Jul 25 2023, 11:16 AM

Show posts by this member only | IPv6 | Post

#3474

|

Junior Member

265 posts Joined: Sep 2014 |

320i

Maybank 240k 9years 2.61% I feel this is rather high. Nego’ed till 2.57% This post has been edited by Musikl: Aug 22 2023, 05:58 PM |

|

|

Jul 25 2023, 11:20 AM Jul 25 2023, 11:20 AM

|

Senior Member

1,226 posts Joined: Nov 2017 |

Anyone got Tesla loan info?

|

|

|

Jul 29 2023, 06:01 PM Jul 29 2023, 06:01 PM

|

Junior Member

98 posts Joined: Dec 2020 |

Hi wanna ask

MBB City, 80k, 9yrs, 2.67% is this consider ok? This post has been edited by bing0212: Jul 29 2023, 06:01 PM |

|

|

Jul 29 2023, 11:38 PM Jul 29 2023, 11:38 PM

|

Senior Member

2,207 posts Joined: Jan 2003 From: stankonia |

i think a lot of banks have increased the interest rate. 2.5~2.6 seems to be the benchmark now and hard to get lower unless good records.

|

|

|

Jul 30 2023, 02:40 PM Jul 30 2023, 02:40 PM

|

Newbie

2 posts Joined: Jun 2016 |

Honda HYBRID car

100k 9 years Variable rate : Base rate + 0.10% (now BR is 3.75%) equivalent to Fixed rate 2.06% RHB This post has been edited by lpinggy89: Sep 14 2023, 02:30 AM |

|

|

Jul 31 2023, 04:29 PM Jul 31 2023, 04:29 PM

Show posts by this member only | IPv6 | Post

#3479

|

Junior Member

6 posts Joined: Jun 2010 |

Proton saga

42k 9years 3.75,% |

|

|

Aug 17 2023, 08:33 AM Aug 17 2023, 08:33 AM

|

Newbie

1 posts Joined: Jul 2009 |

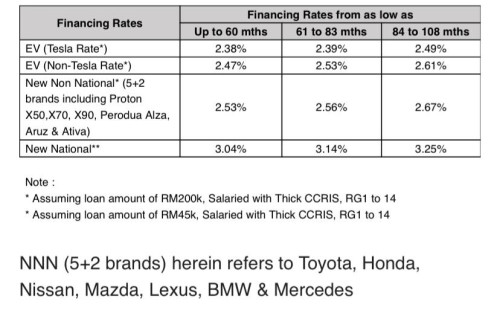

For Maybank. The reply I got: The 1.98% for Tesla is not fixed in nature. The rate will step up after certain number of years. The officer in charge said they don’t have the rate schedule/memo yet 2) For fixed rate, it is 2.31% (5 yrs), 2.37% (7 yrs), 2.5% (9 yrs) for Tesla or any EV marques. In general, these are 10bp cheaper vs conventional auto loans Pic is from AMbank  overfloe liked this post

|

| Change to: |  0.0273sec 0.0273sec

0.25 0.25

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 02:14 AM |