QUOTE(Pink Spider @ Aug 11 2012, 01:17 PM)

Definitely not RM 1k.Fundsupermart - Invest Globally and Profitably, Discussion on investment through FSM

Fundsupermart - Invest Globally and Profitably, Discussion on investment through FSM

|

|

Aug 11 2012, 01:18 PM Aug 11 2012, 01:18 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

|

|

|

Aug 11 2012, 01:20 PM Aug 11 2012, 01:20 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(Pink Spider @ Aug 11 2012, 02:09 PM) The transferring in of funds into fundsupermart lo.. Got many small small things which is hard to ask and put down in writing la. So face to face will be best for clarification..Added on August 11, 2012, 1:23 pm QUOTE(David83 @ Aug 11 2012, 02:18 PM) Haha.. So confident show hand ka.. I dare not lump sum la for this fund.. This post has been edited by Kaka23: Aug 11 2012, 01:23 PM |

|

|

Aug 11 2012, 01:23 PM Aug 11 2012, 01:23 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(David83 @ Aug 11 2012, 01:18 PM) Wow u really put a lot of faith in that fund... My current equity portion breakdown: 25% EM equities 12.5% Asian REITs 12.5% Malaysian+Asian equities ("reserved" portion, timing my entry 25% global dividend equities 25% global large cap/leader equities If I buy more than 1K, my allocations will go wrong |

|

|

Aug 11 2012, 01:25 PM Aug 11 2012, 01:25 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(Kaka23 @ Aug 11 2012, 01:20 PM) The transferring in of funds into fundsupermart lo.. Got many small small things which is hard to ask and put down in writing la. So face to face will be best for clarification.. Added on August 11, 2012, 1:23 pm Haha.. So confident show hand ka.. I dare not lump sum la for this fund.. QUOTE(Pink Spider @ Aug 11 2012, 01:23 PM) Wow u really put a lot of faith in that fund... The amount in three funds in FSM are same which is not much as you guys think. Let's me disclose and not playing any guessing here.My current equity portion breakdown: 25% EM equities 12.5% Asian REITs 12.5% Malaysian+Asian equities ("reserved" portion, timing my entry 25% global dividend equities 25% global large cap/leader equities If I buy more than 1K, my allocations will go wrong It's RM 2k in AMD, OSK EMB and AMAP REIT. |

|

|

Aug 11 2012, 01:31 PM Aug 11 2012, 01:31 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(David83 @ Aug 11 2012, 01:25 PM) The amount in three funds in FSM are same which is not much as you guys think. Let's me disclose and not playing any guessing here. large or not is always relative to one's portfolio size...like in your case, it's 11% of your portfolio, which I consider to be quite significant. So, u don't plan to top up on this fund in the short term? It's RM 2k in AMD, OSK EMB and AMAP REIT. Your approach...your returns very much depend on u timing your entry right |

|

|

Aug 11 2012, 01:31 PM Aug 11 2012, 01:31 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

|

|

|

Aug 11 2012, 01:34 PM Aug 11 2012, 01:34 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(Pink Spider @ Aug 11 2012, 01:31 PM) large or not is always relative to one's portfolio size...like in your case, it's 11% of your portfolio, which I consider to be quite significant. So, u don't plan to top up on this fund in the short term? Because my total amount invested in UT is not big as you and RM 2k in one fund makes the allocation big. Your approach...your returns very much depend on u timing your entry right I may top up if price is attractive. I wanted to top up in AMD but it was closed. QUOTE(Kaka23 @ Aug 11 2012, 01:31 PM) I also consider to that too but depends on its performance. Will keep on monitoring it. |

|

|

Aug 11 2012, 01:38 PM Aug 11 2012, 01:38 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

Seriously, for a REIT fund to go up 20%+ in one year, it does feel somewhat "too much, soo soon". But I also don't wanna end up regretting missing the boat should it continue to go up and up and up. Buy in minimum and then topping up monthly/quarterly is the way to go for me in this case.

|

|

|

Aug 11 2012, 01:38 PM Aug 11 2012, 01:38 PM

|

|

Elite

5,784 posts Joined: Jan 2003 From: Shah Alam |

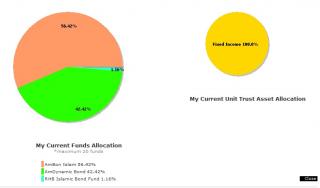

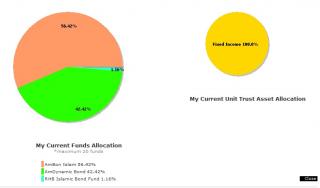

On the contrary, here's my ultra conservative portfolios.

- holding some other bonds @ PM and some stocks AM REITS is good, may consider bulleting in. Honestly, i'm surprised it's performing this well. Heck even beat some of the Local REITS (stock markets)

This post has been edited by kucingfight: Aug 11 2012, 01:40 PM |

|

|

Aug 11 2012, 01:40 PM Aug 11 2012, 01:40 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

The reason that I'm buying lump sum for both OSK EMF and AMAP REIT is because of the 1% SC.

OSK EMF under promot and will end soon. AMAP REIT is utilizing a token from referral. |

|

|

Aug 11 2012, 01:41 PM Aug 11 2012, 01:41 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(kucingfight @ Aug 11 2012, 01:38 PM) On the contrary, here's my ultra conservative portfolios. Why that 1%++ in RHB? - holding some other bonds @ PM and some stocks AM REITS is good, may consider bulleting in. Honestly, i'm surprised it's performing this well. Heck even beat some of the Local REITS (stock markets)

|

|

|

Aug 11 2012, 01:43 PM Aug 11 2012, 01:43 PM

|

|

Elite

5,784 posts Joined: Jan 2003 From: Shah Alam |

ya the dumb exit fee of 1% before 365days, no choice but to hold it on till then n sell it off

|

|

|

Aug 11 2012, 01:46 PM Aug 11 2012, 01:46 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

kucing, can share the annualised return of your ultraconservative portfolio?

Added on August 11, 2012, 1:53 pmA topic for discussion: Being not-so-professional investor ourselves, how do u decide how much % to allocate to the various regions/markets/sectors? Equity/Bond split is fairly straightforward...e.g. conservative would be 20/80, balanced 40/60 to 60/40, aggressive would be 80/20... But how much for EM, how much for Asia, how much for Malaysia, how much for small caps, how much for US/Europe, how to decide? Purely guesswork/subjective juggling, no? This post has been edited by Pink Spider: Aug 11 2012, 01:54 PM |

|

|

|

|

|

Aug 11 2012, 04:19 PM Aug 11 2012, 04:19 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(Pink Spider @ Aug 11 2012, 01:46 PM) kucing, can share the annualised return of your ultraconservative portfolio? No need to be so sophisticated like FSM. Added on August 11, 2012, 1:53 pmA topic for discussion: Being not-so-professional investor ourselves, how do u decide how much % to allocate to the various regions/markets/sectors? Equity/Bond split is fairly straightforward...e.g. conservative would be 20/80, balanced 40/60 to 60/40, aggressive would be 80/20... But how much for EM, how much for Asia, how much for Malaysia, how much for small caps, how much for US/Europe, how to decide? Purely guesswork/subjective juggling, no? First is just to divide your portfolio into bond/fixed income, balanced/mixed and equity funds. Second, is just to divide them into local and offshore. |

|

|

Aug 11 2012, 04:21 PM Aug 11 2012, 04:21 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Aug 11 2012, 04:24 PM Aug 11 2012, 04:24 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(Pink Spider @ Aug 11 2012, 04:21 PM) My current portfolio has only 28% local. Maybe will try to rebalance it to 30 to 35% local with your HSOF (IIRC). Previously before switching into PSMALLCAP, it was 100% offshore. This post has been edited by David83: Aug 11 2012, 04:27 PM |

|

|

Aug 11 2012, 04:42 PM Aug 11 2012, 04:42 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Aug 11 2012, 04:43 PM Aug 11 2012, 04:43 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Aug 11 2012, 04:46 PM Aug 11 2012, 04:46 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(David83 @ Aug 11 2012, 04:43 PM) Haven't since I'm shying away from Malaysian equity because KLCI has reached all time high. Maybe after GE13. Yeah me too, after I studied my portfolio closely, realised that I actually have about 6% exposure to local equities...mainly dividend stocks and banking stocks, enough for now. |

|

|

Aug 11 2012, 04:54 PM Aug 11 2012, 04:54 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(Pink Spider @ Aug 11 2012, 04:46 PM) Yeah me too, after I studied my portfolio closely, realised that I actually have about 6% exposure to local equities...mainly dividend stocks and banking stocks, enough for now. HSOF has mixed country allcoation even though it said that Malaysia focus.As of 30 June 2012, it invested in HK and some ASEAN countries with Malaysia constitutes to 42.4% |

|

Topic ClosedOptions

|

| Change to: |  0.0175sec 0.0175sec

0.50 0.50

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 01:59 PM |