QUOTE(kh8188 @ Mar 18 2012, 03:40 PM)

I mean in a shape of a thin foil in Ø60mm x 0.1mm.Gold investment corner v4, Will gold price achieve USD2000 by 2012?

Gold investment corner v4, Will gold price achieve USD2000 by 2012?

|

|

Mar 18 2012, 04:00 PM Mar 18 2012, 04:00 PM

|

All Stars

26,528 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 18 2012, 06:37 PM Mar 18 2012, 06:37 PM

|

Senior Member

503 posts Joined: Jun 2008 |

|

|

|

Mar 19 2012, 11:08 AM Mar 19 2012, 11:08 AM

|

Senior Member

546 posts Joined: Nov 2011 |

is the economy going to get worst? if yes, gold is good. if no, good luck to gold holders  gold price tak boleh achieve USD2000 by 2012 market has factor in obama losing election, dog jones going to 14k and economic boom time cycle cuming gold now trapped sideways, sucking in sheeps and izit killing them slowly my pov onli, no need get so upset gold lovers

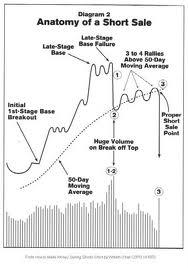

sector rotation by momo seems over for gold, they are at the bottom of the heap http://www.barchart.com/stocks/sectors/cha...age=ytd&_dtp1=2 look at those companies producing gold & etc. going longkang liao lo http://www.barchart.com/stocks/sectors/-MIGL remember, momo buy/ sell shares. anticipating in advance wats happening few months down the road http://www.investopedia.com/terms/s/sector...p#axzz1pWopnsil look at the this 3 samples. sooner or later, can short them, waiting for support line to pecah Randgold Resources Limited, together with its subsidiaries, engages in the exploration and mining of gold mines

Royal Gold, Inc., together with its subsidiaries, engages in the acquisition and management of precious metal royalties

Newmont Mining Corporation, together with its subsidiaries, engages in the acquisition, exploration, and production of gold and copper properties

» Click to show Spoiler - click again to hide... «

|

|

|

Mar 19 2012, 12:05 PM Mar 19 2012, 12:05 PM

|

Senior Member

1,175 posts Joined: Mar 2011 |

learn2earn8 :good graph, thanks for sharing .

i dont think there will be huge increment for gold this year . |

|

|

Mar 19 2012, 01:11 PM Mar 19 2012, 01:11 PM

|

Senior Member

546 posts Joined: Nov 2011 |

wait till the usa economies start picking up

then sooner or later, can short gld (ie. etf for gold) i also dont think there will be huge increment for gold this year not sure about those holding physical book or bought it via passbook, awaiting their advise for those pro-gold camp QUOTE(thunderaj @ Mar 19 2012, 12:05 PM) |

|

|

Mar 19 2012, 01:21 PM Mar 19 2012, 01:21 PM

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(learn2earn8 @ Mar 19 2012, 01:11 PM) wait till the usa economies start picking up You are so sure of yerself, why the need for advise?then sooner or later, can short gld (ie. etf for gold) i also dont think there will be huge increment for gold this year not sure about those holding physical book or bought it via passbook, awaiting their advise for those pro-gold camp Short gold now.............. Shew yer money where yer mouth is........ |

|

|

|

|

|

Mar 19 2012, 01:49 PM Mar 19 2012, 01:49 PM

|

Senior Member

546 posts Joined: Nov 2011 |

AIYO RELAX LA anyway, hav to wait for the time to short, not just main hentam onli alwiz pro-gold only, very boring. in bolehland, erection also cuming. so u pro or anti? tat is y must be balance la  QUOTE(prophetjul @ Mar 19 2012, 01:21 PM) You are so sure of yerself, why the need for advise? Short gold now.............. Shew yer money where yer mouth is........ » Click to show Spoiler - click again to hide... «

|

|

|

Mar 19 2012, 04:02 PM Mar 19 2012, 04:02 PM

|

Senior Member

1,175 posts Joined: Mar 2011 |

Gold MYR 162.43 per gram..

|

|

|

Mar 19 2012, 04:19 PM Mar 19 2012, 04:19 PM

|

Senior Member

503 posts Joined: Jun 2008 |

QUOTE(learn2earn8 @ Mar 19 2012, 01:49 PM) AIYO RELAX LA I wouldn't rely solely on technical analysis.anyway, hav to wait for the time to short, not just main hentam onli alwiz pro-gold only, very boring. in bolehland, erection also cuming. so u pro or anti? tat is y must be balance la Nonetheless, you may be right but my money is on an israel-iran conflict within the year. Word's out that benny boy has been suppressing crude and gold to make the economy look better too but who knows. This post has been edited by iceypain: Mar 19 2012, 04:20 PM |

|

|

Mar 19 2012, 04:25 PM Mar 19 2012, 04:25 PM

|

Senior Member

1,175 posts Joined: Mar 2011 |

QUOTE(iceypain @ Mar 19 2012, 04:19 PM) I wouldn't rely solely on technical analysis. yes i agreed with you on the israel and iran conflict . How is severe the war will be is another question...Nonetheless, you may be right but my money is on an israel-iran conflict within the year. Word's out that benny boy has been suppressing crude and gold to make the economy look better too but who knows. From previous trend , if US goes war in the middle east the gold price will increase accordingly. correct me if i wrong. |

|

|

Mar 19 2012, 04:27 PM Mar 19 2012, 04:27 PM

|

Senior Member

546 posts Joined: Nov 2011 |

of coz, TA & FA goes hand in hand together

I do agree tat the economy stil sucks but how can we fight with the obama propaganda mesin? well then, we're all here to make money. there's got to be winners & losers in tis game within the year, we'll know the answer & cheers to whomever wins, HUAT AH! QUOTE(iceypain @ Mar 19 2012, 04:19 PM) |

|

|

Mar 19 2012, 04:53 PM Mar 19 2012, 04:53 PM

|

Junior Member

476 posts Joined: Jul 2009 |

QUOTE(iceypain @ Mar 19 2012, 04:19 PM) I wouldn't rely solely on technical analysis. +1, same here, i see this coming/happening..Nonetheless, you may be right but my money is on an israel-iran conflict within the year. Word's out that benny boy has been suppressing crude and gold to make the economy look better too but who knows. |

|

|

Mar 20 2012, 09:37 AM Mar 20 2012, 09:37 AM

|

Junior Member

18 posts Joined: Nov 2010 From: Kuala Lumpur |

I would't trust technical analysis either, it seems like the world economy (interest rates, currencies, stock market, commodities etc) is being manipulated somehow. Anyway, lets hope the current gold price can make a clean break through above the 1662 resistance level towards the next the next level at 1674.

QUOTE(vincentwmh @ Mar 19 2012, 04:53 PM) |

|

|

|

|

|

Mar 20 2012, 10:04 AM Mar 20 2012, 10:04 AM

|

Senior Member

879 posts Joined: Jan 2011 From: iWill.com.my |

|

|

|

Mar 20 2012, 10:09 AM Mar 20 2012, 10:09 AM

|

Senior Member

1,175 posts Joined: Mar 2011 |

rumours are high that election is in June ..Parliment will be dissolve after the sultan kedah ceremony as agong this april..

|

|

|

Mar 20 2012, 01:55 PM Mar 20 2012, 01:55 PM

|

Senior Member

3,725 posts Joined: Jul 2005 From: In /hardware/ |

Gold continues to drop even more...

|

|

|

Mar 20 2012, 08:39 PM Mar 20 2012, 08:39 PM

|

Senior Member

546 posts Joined: Nov 2011 |

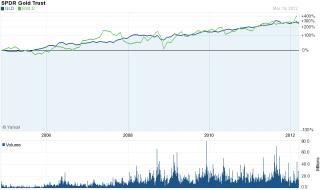

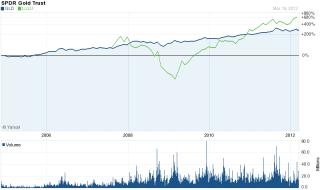

I take up your challenge until usa election in nov2012. we dun consider aapl, as it alredi ROCK-IT

but its not fair to use indices either, coz its a weightage average, the losers drag down the winners it seems u awaiting the gap up for exiting. for shares, I await their earnings sux and exit it before goes to longkang here r 5 stock selections to challenge ur gold (via. etf gld) no problemo rite? coz ur gold so terer via ur sophisticated analisis http://forum.lowyat.net/topic/2027841/+680 Post #685 selection 1, ur gold is winning by a whopping 90% who knows? earnings season could be lousy & economi outlook deteriorate. then ur gold can recontinue uptrend, all the best to both of us look futures r down for shares & dog jones could dip below 13k to scare weakholders. but nonetheless, I m hanging tight my position http://finance.yahoo.com/q/ta?t=my&s=GLD&l...z=l&q=l&c=disca

http://finance.yahoo.com/q/ta?t=my&s=GLD&l=on&z=l&q=l&c=bwld

http://finance.yahoo.com/q/ta?t=my&s=GLD&l=on&z=l&q=l&c=sxci

http://finance.yahoo.com/q/ta?t=my&s=GLD&l=on&z=l&q=l&c=lulu

http://finance.yahoo.com/q/ta?s=GLD&t=my&l...=l&p=&a=&c=dltr

QUOTE(prophetjul @ Mar 12 2012, 07:52 AM) If you bought it EARLIER than 1979, why did you SELL when it ROCK-IT? No get out strategy? 117% in two months should have told ya something. Added on March 12, 2012, 7:57 am Easier said than done..........many people thought the US mkt would be better in last 10 years..... lost to gold HANDSDOWN There arent many assets which beat gold in the last 10 years......so? Maybe someone can educate us what were the assets which beat gold apart from obvious commodities? Let me know an asset which will in the next 5 years which will..........thanks Added on March 12, 2012, 8:49 amGold Bulls Strengthen as Wagers Hit $131 Billion Gold traders are the most bullish in four months after investors accumulated more metal than ever and hedge funds raised bets on gains to a five-month high. Sixteen of 23 analysts surveyed by Bloomberg expect prices to gain next week and one was neutral, the highest proportion since Nov. 11. Investors increased their holdings in exchange- traded products backed by bullion for seven consecutive weeks and now hold 2,407 metric tons valued at $131 billion, data compiled by Bloomberg show. March 7 (Bloomberg) -- Joseph Cusick, senior market analyst at OptionsXpress Holdings Inc., Jason Schenker, president of Prestige Economics LLC, and Bloomberg's William Maloney talk about the outlook for gold prices and their trading strategies. They speak with Trish Regan on Bloomberg Television's "Street Smart." (Source: Bloomberg) Demand for gold is strengthening as European leaders seek to contain the region’s debt crisis and governments from the U.S. to the U.K. keep interest rates at all-time lows to shore up growth. The Federal Reserve and Bank of England have bought debt and the European Central Bank offered unlimited three-year loans to the region’s lenders, actions that spurred some investors to buy gold as protection against inflation. “Record-high ETP holdings show both institutional demand and hedge-fund demand is robust,” said Mark O’Byrne, the executive director of Dublin-based GoldCore Ltd., a brokerage that sells and stores everything from quarter-ounce British Sovereigns to 400-ounce bars. “People are concerned about inflationary implications of quantitative easing, zero-percent interest rates policy and global currency debasement.” Bank of America Gold rose 9.3 percent to $1,711.90 an ounce this year on the Comex in New York, heading for a 12th annual advance. That compares with a 9.5 percent jump in the Standard & Poor’s GSCI gauge of 24 commodities and a 10 percent appreciation in the MSCI All-Country World Index (MXWD) of equities. Treasuries fell 0.5 percent, a Bank of America Corp. index (MXWD) shows. Hedge funds and other money managers increased bets on higher prices by 10 percent to 197,552 futures and options in the week ended Feb. 28, the highest level since Sept. 6, Commodity Futures Trading Commission data show. The CFTC will publish the latest data later today. The most-traded options on March 7 were call options giving owners the right to buy gold at $1,900 and $1,850 an ounce by April 25, data from the Comex show. The most widely held contract confers the right to buy at $2,200 by July 26. The economy of the 17-nation euro region may shrink 0.1 percent in 2012, compared with a previous forecast for 0.3 percent growth, ECB President Mario Draghi said yesterday. Inflation will probably breach the bank’s 2 percent limit this year, he said in Frankfurt. Chinese Premier Wen Jiabao lowered the country’s annual growth target to 7.5 percent, the lowest since 2004, in a state-of-the-nation speech on March 5. Benchmark Rate The ECB left interest rates at a record 1 percent yesterday and the Bank of England also held its benchmark rate at an all- time low of 0.5 percent. In January, the Fed extended its pledge to keep its benchmark rate for overnight loan between banks at almost zero at least through late 2014. Gold futures tumbled 4.3 percent on Feb. 29 after Fed Chairman Ben S. Bernanke failed to signal in testimony to Congress that the central bank will take new steps to boost liquidity. The metal dropped below its 200-day moving average on March 6 for the first time since mid-January. That’s a sign for some investors who study charts of trading patterns and prices to predict trends that a rout has further to go. “Gold is going to struggle a bit in the next couple of weeks,” said Walter de Wet, the head of commodities research at Standard Bank Plc in London. “If gold goes to $1,720 and higher, we’ll start to see physical appetite waning. Gold is also going to find it difficult to rally just yet from an investment perspective, with all the talk around no more quantitative easing from the Fed.” Warren Buffett Warren Buffett, the third-richest person in the Bloomberg Billionaires Index, said last month in his annual letter to shareholders that investors should avoid gold because its uses are limited and it doesn’t have the potential of farmland or companies to produce new wealth. Supply is “very tight and tightening” and mine costs are rising, Randgold Resources Ltd. Chief Executive Officer Mark Bristow said in an interview in Toronto on March 7. Price swings will likely increase this year, with gold trading from $1,500 to $2,000, said the executive, whose company mines gold in Africa. The futures reached a record $1,923.70 in September. Fifteen of 27 traders and analysts surveyed by Bloomberg expect copper to advance next week. The metal for delivery in three months, the London Metal Exchange’s benchmark contract, rose 12 percent to $8,500 a ton this year after declining 21 percent last year. Raw Sugar Thirteen of 17 people surveyed expect raw sugar to fall next week. The commodity gained 1.4 percent this year to 23.63 cents a pound on ICE Futures U.S. in New York. Twelve of 26 people surveyed anticipate lower corn prices next week, while 14 of 26 said soybeans will drop. Corn fell 0.6 percent to $6.425 a bushel this year as soybeans gained 11 percent to $13.355 a bushel. “There are a lot of risks out there,” Jason Schenker, the president of Prestige Economics LLC in Austin, Texas, said in a Bloomberg Television interview March 7. “Gold is an inflation hedge, it’s a risk hedge. Think of it as one of the major reserve currencies, but it’s not subject to a default.” Gold survey results: Bullish: 16 Bearish: 6 Hold: 1 Copper survey results: Bullish: 15 Bearish: 7 Hold: 5 Corn survey results: Bullish: 8 Bearish: 12 Hold: 6 Soybean survey results: Bullish: 7 Bearish: 14 Hold: 5 Raw sugar survey results: Bullish: 2 Bearish: 13 Hold: 2 White sugar survey results: Bullish: 2 Bearish: 12 Hold: 3 White sugar premium results: Widen: 6 Narrow: 4 Neutral: 7 To contact the reporters on this story: Maria Kolesnikova in London at mkolesnikova@bloomberg.net; Nicholas Larkin in London at nlarkin1@bloomberg.net To contact the editor responsible for this story: Claudia Carpenter at ccarpenter2@bloomberg.net http://www.bloomberg.com/news/2012-0...mmodities.html |

|

|

Mar 21 2012, 10:41 AM Mar 21 2012, 10:41 AM

|

Senior Member

1,175 posts Joined: Mar 2011 |

gold hovering between myr 162 to 163 rm per gram..

|

|

|

Mar 21 2012, 12:23 PM Mar 21 2012, 12:23 PM

|

Senior Member

603 posts Joined: Nov 2010 |

|

|

|

Mar 21 2012, 12:26 PM Mar 21 2012, 12:26 PM

|

Senior Member

1,175 posts Joined: Mar 2011 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0390sec 0.0390sec

0.58 0.58

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 12:54 AM |