I take up your challenge until usa election in nov2012. we dun consider aapl, as it alredi ROCK-IT

but its not fair to use indices either, coz its a weightage average, the losers drag down the winners

it seems u awaiting the gap up for exiting. for shares, I await their earnings sux and exit it before goes to longkang

here r 5 stock selections to challenge ur gold (via. etf gld)

who knows? earnings season could be lousy & economi outlook deteriorate. then ur gold can recontinue uptrend, all the best to both of us

look futures r down for shares & dog jones could dip below 13k to scare weakholders. but nonetheless, I m hanging tight my position

If you bought it EARLIER than 1979, why did you SELL when it ROCK-IT?

No get out strategy?

117% in two months should have told ya something.

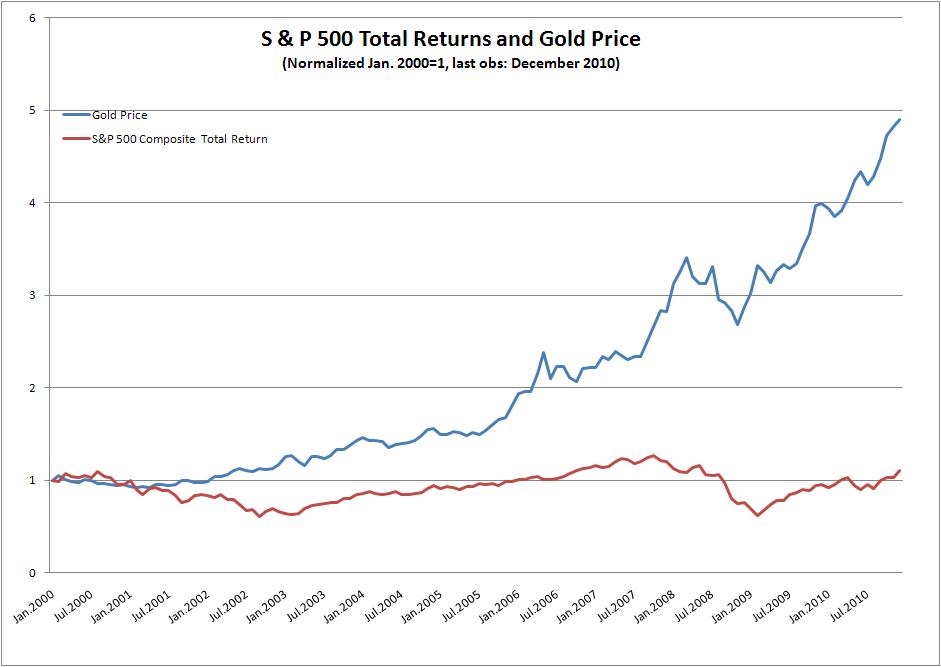

Added on March 12, 2012, 7:57 amEasier said than done..........many people thought the US mkt would be better in last 10 years.....

lost to gold HANDSDOWN

There arent many assets which beat gold in the last 10 years......so?

Maybe someone can educate us what were the assets which beat gold apart from obvious commodities?

Let me know an asset which will in the next 5 years which will..........thanks

Added on March 12, 2012, 8:49 amGold Bulls Strengthen as Wagers Hit $131 Billion

Gold traders are the most bullish in four months after investors accumulated more metal than ever and hedge funds raised bets on gains to a five-month high.

Sixteen of 23 analysts surveyed by Bloomberg expect prices to gain next week and one was neutral, the highest proportion since Nov. 11. Investors increased their holdings in exchange- traded products backed by bullion for seven consecutive weeks and now hold 2,407 metric tons valued at $131 billion, data compiled by Bloomberg show.

March 7 (Bloomberg) -- Joseph Cusick, senior market analyst at OptionsXpress Holdings Inc., Jason Schenker, president of Prestige Economics LLC, and Bloomberg's William Maloney talk about the outlook for gold prices and their trading strategies. They speak with Trish Regan on Bloomberg Television's "Street Smart." (Source: Bloomberg)

Demand for gold is strengthening as European leaders seek to contain the region’s debt crisis and governments from the U.S. to the U.K. keep interest rates at all-time lows to shore up growth. The Federal Reserve and Bank of England have bought debt and the European Central Bank offered unlimited three-year loans to the region’s lenders, actions that spurred some investors to buy gold as protection against inflation.

“Record-high ETP holdings show both institutional demand and hedge-fund demand is robust,” said Mark O’Byrne, the executive director of Dublin-based GoldCore Ltd., a brokerage that sells and stores everything from quarter-ounce British Sovereigns to 400-ounce bars. “People are concerned about inflationary implications of quantitative easing, zero-percent interest rates policy and global currency debasement.”

Bank of America

Gold rose 9.3 percent to $1,711.90 an ounce this year on the Comex in New York, heading for a 12th annual advance. That compares with a 9.5 percent jump in the Standard & Poor’s GSCI gauge of 24 commodities and a 10 percent appreciation in the MSCI All-Country World Index (MXWD) of equities. Treasuries fell 0.5 percent, a Bank of America Corp. index (MXWD) shows.

Hedge funds and other money managers increased bets on higher prices by 10 percent to 197,552 futures and options in the week ended Feb. 28, the highest level since Sept. 6, Commodity Futures Trading Commission data show. The CFTC will publish the latest data later today.

The most-traded options on March 7 were call options giving owners the right to buy gold at $1,900 and $1,850 an ounce by April 25, data from the Comex show. The most widely held contract confers the right to buy at $2,200 by July 26.

The economy of the 17-nation euro region may shrink 0.1 percent in 2012, compared with a previous forecast for 0.3 percent growth, ECB President Mario Draghi said yesterday. Inflation will probably breach the bank’s 2 percent limit this year, he said in Frankfurt. Chinese Premier Wen Jiabao lowered the country’s annual growth target to 7.5 percent, the lowest since 2004, in a state-of-the-nation speech on March 5.

Benchmark Rate

The ECB left interest rates at a record 1 percent yesterday and the Bank of England also held its benchmark rate at an all- time low of 0.5 percent. In January, the Fed extended its pledge to keep its benchmark rate for overnight loan between banks at almost zero at least through late 2014.

Gold futures tumbled 4.3 percent on Feb. 29 after Fed Chairman Ben S. Bernanke failed to signal in testimony to Congress that the central bank will take new steps to boost liquidity. The metal dropped below its 200-day moving average on March 6 for the first time since mid-January. That’s a sign for some investors who study charts of trading patterns and prices to predict trends that a rout has further to go.

“Gold is going to struggle a bit in the next couple of weeks,” said Walter de Wet, the head of commodities research at Standard Bank Plc in London. “If gold goes to $1,720 and higher, we’ll start to see physical appetite waning. Gold is also going to find it difficult to rally just yet from an investment perspective, with all the talk around no more quantitative easing from the Fed.”

Warren Buffett

Warren Buffett, the third-richest person in the Bloomberg Billionaires Index, said last month in his annual letter to shareholders that investors should avoid gold because its uses are limited and it doesn’t have the potential of farmland or companies to produce new wealth.

Supply is “very tight and tightening” and mine costs are rising, Randgold Resources Ltd. Chief Executive Officer Mark Bristow said in an interview in Toronto on March 7. Price swings will likely increase this year, with gold trading from $1,500 to $2,000, said the executive, whose company mines gold in Africa. The futures reached a record $1,923.70 in September.

Fifteen of 27 traders and analysts surveyed by Bloomberg expect copper to advance next week. The metal for delivery in three months, the London Metal Exchange’s benchmark contract, rose 12 percent to $8,500 a ton this year after declining 21 percent last year.

Raw Sugar

Thirteen of 17 people surveyed expect raw sugar to fall next week. The commodity gained 1.4 percent this year to 23.63 cents a pound on ICE Futures U.S. in New York.

Twelve of 26 people surveyed anticipate lower corn prices next week, while 14 of 26 said soybeans will drop. Corn fell 0.6 percent to $6.425 a bushel this year as soybeans gained 11 percent to $13.355 a bushel.

“There are a lot of risks out there,” Jason Schenker, the president of Prestige Economics LLC in Austin, Texas, said in a Bloomberg Television interview March 7. “Gold is an inflation hedge, it’s a risk hedge. Think of it as one of the major reserve currencies, but it’s not subject to a default.”

Gold survey results: Bullish: 16 Bearish: 6 Hold: 1

Copper survey results: Bullish: 15 Bearish: 7 Hold: 5

Corn survey results: Bullish: 8 Bearish: 12 Hold: 6

Soybean survey results: Bullish: 7 Bearish: 14 Hold: 5

Raw sugar survey results: Bullish: 2 Bearish: 13 Hold: 2

White sugar survey results: Bullish: 2 Bearish: 12 Hold: 3

White sugar premium results: Widen: 6 Narrow: 4 Neutral: 7

To contact the reporters on this story: Maria Kolesnikova in London at mkolesnikova@bloomberg.net; Nicholas Larkin in London at nlarkin1@bloomberg.net

To contact the editor responsible for this story: Claudia Carpenter at ccarpenter2@bloomberg.net

http://www.bloomberg.com/news/2012-0...mmodities.html

Mar 19 2012, 11:08 AM

Mar 19 2012, 11:08 AM

Quote

Quote

0.0709sec

0.0709sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled