Outline ·

[ Standard ] ·

Linear+

Private Retirement Fund, What the hell is that??

|

familyfirst

|

Mar 25 2021, 08:43 AM Mar 25 2021, 08:43 AM

|

|

QUOTE(Ramjade @ Mar 24 2021, 09:34 PM) Depend on yourself. It's cheaper than it is if compare beginning of the year. But it's not cheap enough for me. Then again market can just go higher from here. Some people will just want to buy and be done with it. For me it's not worth because there's no discount. I buy when market red. Always. And this have help boost my prs return. I still have until end of this year to buy. So no hurry for me. The name should tell you. If not open up the fundfactsheet. Boss, I biasa just top up via PRS portal around Nov/early Dec - ok ka macam ini? No idea if market is red or blue or green at that time. What do you think I should do better? BTW, my investment is usually 3k saja. |

|

|

|

|

|

familyfirst

|

Mar 25 2021, 10:41 AM Mar 25 2021, 10:41 AM

|

|

QUOTE(MUM @ Mar 25 2021, 10:04 AM) a quick analysis... for this PRS fund... 7 out of 8 years,...there was untung if you buy in January....(pssst,..you can view it as Dec too  ) i did not "compute" for other month of entry....you can try if you want.... This is good enough for me. Thanks. |

|

|

|

|

|

familyfirst

|

Mar 31 2021, 09:07 AM Mar 31 2021, 09:07 AM

|

|

How many of you contribute more than the 3k annually? Am thinking since markets are improving and the funds are generally doing pretty good, it can only get better when situations across are opening up more? Safe to dump in more than the 3k (if close to retirement and can wait till then for withdrawal)?

|

|

|

|

|

|

familyfirst

|

Apr 2 2021, 02:26 PM Apr 2 2021, 02:26 PM

|

|

So i received some money (interest) in my bank account and its from CIMB Commerce Trust but I cant recall any investment in CIMB other than the PRS fund I bought previously (now known as Principal Asset something .... ) . Does the dividend from PRS go into our bank account (I thot it goes back into our PRS account). Help  |

|

|

|

|

|

familyfirst

|

Apr 2 2021, 03:15 PM Apr 2 2021, 03:15 PM

|

|

QUOTE(MUM @ Apr 2 2021, 02:54 PM) i think you need to check the prospectus of your PRS fund.... i think i read....inside them,... DISTRIBUTION OF THE FUNDS The Funds are not expected to make any distributions. All income earned by you will automatically be reinvested into the Fund. and also it mentioned Scheme Trustee : Deutsche Trustees Malaysia Berhad not sure if they are the same criteria for your PRS fund Then its not from PRS then, will have to dig with other funds. Thanks. |

|

|

|

|

|

familyfirst

|

Apr 4 2021, 09:34 PM Apr 4 2021, 09:34 PM

|

|

QUOTE(Takudan @ Apr 2 2021, 10:23 PM) Thanks for the link, I parsed the PDF into gsheet for filtering/sorting again  Also built macros for them so I'll be able to do this regularly. If anyone wants to do their own sorting/filtering, can make your own copy: https://docs.google.com/spreadsheets/d/1hLn...gKPkv8HOwA/editCorrect me if I am wrong but the longer I keep the funds, the lower the annualised return? Im not sure how to read the data. Appreciate your learnings thanks. |

|

|

|

|

|

familyfirst

|

Apr 7 2021, 09:17 AM Apr 7 2021, 09:17 AM

|

|

QUOTE(PPZ @ Apr 7 2021, 12:27 AM) Thanks guys. I wonder which one you select because there are too many. Lol Haiyo 3k only a year,so 1 year choose a new one. Keep to max 3 or 4 funds and repeat the following years. Dont think too much. This is long term investment. |

|

|

|

|

|

familyfirst

|

Apr 11 2021, 01:48 PM Apr 11 2021, 01:48 PM

|

|

QUOTE(cklimm @ Apr 9 2021, 08:17 PM) Above is the best way. But in case you have missed the boat(s), just buy the top losers during the promotion, then you will have promo in both world. When market is down, do you guys still buy via PRS or buy from the fund directly? |

|

|

|

|

|

familyfirst

|

Apr 21 2021, 02:47 PM Apr 21 2021, 02:47 PM

|

|

QUOTE(MUM @ Apr 21 2021, 12:06 PM) try check this out to see if it his is what you wanted? as per 31 Mar 2021 https://www.ppa.my/wp-content/uploads/2021/...ll-Mar_2021.pdfIve asked before but I still cant understand. Help me out again please. My question is the longer we hold, the lower the returns? How lah ini macam? |

|

|

|

|

|

familyfirst

|

Jul 7 2021, 02:40 PM Jul 7 2021, 02:40 PM

|

|

QUOTE(snicker @ Jul 7 2021, 01:58 PM) Invested principal PRS Plus Asia Pac Ex Jpn since year 2013, total investment 3k x 8years, now the total balance 36k. Earlier time invest thru cimb Bank directly with promotion sale charge, few years back start to invest thru FSM with 0% sales charge. If you look thru the morningstar report, only this PRS fund manage to achieve double digit return with 7 years return. People always tell you past record can't take as reference for future return, but 9 years should good enough to show you the capability of the fund manager... I find that the longer we keep the fund (above 10 yrs) the return is lower per annum. How ah? To keep or withdraw after around 7-8 yrs? |

|

|

|

|

|

familyfirst

|

Aug 13 2021, 03:23 PM Aug 13 2021, 03:23 PM

|

|

QUOTE(cklimm @ Aug 13 2021, 02:07 PM) Cant believe it has been 10 years, and is still going strong. Time flies. Just like that already 10 yrs done. But then still not much interest in PRS other than tax benefits. |

|

|

|

|

|

familyfirst

|

Oct 6 2021, 05:11 PM Oct 6 2021, 05:11 PM

|

|

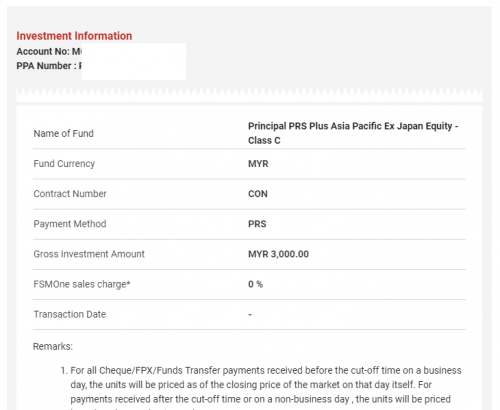

QUOTE(cklimm @ Oct 6 2021, 08:47 AM) So, for my 1st time, I have bought 3k with the fabled Principal APAC ex Japan PRS, Reason: seeing it dropped for more than 4% in 3 months, should be a decent entry point. Method: just tap and swipe with the FSM app, but signing with finger feels awkward, hope they accept the slightly warped fingnature  Ok followed you, topped up today  |

|

|

|

|

Mar 25 2021, 08:43 AM

Mar 25 2021, 08:43 AM

Quote

Quote

0.0312sec

0.0312sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled