QUOTE(Wong Kit yew @ Apr 14 2020, 01:22 PM)

Have you bought before?Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Apr 14 2020, 01:41 PM Apr 14 2020, 01:41 PM

Return to original view | IPv6 | Post

#21

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 14 2020, 01:44 PM Apr 14 2020, 01:44 PM

Return to original view | IPv6 | Post

#22

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Wong Kit yew @ Apr 14 2020, 01:43 PM) So you want to have access to PPA website right?https://www.ppa.my/about-ppa/ppa-faq/first-...gin-procedures/ This post has been edited by GrumpyNooby: Apr 14 2020, 01:48 PM |

|

|

Apr 14 2020, 04:30 PM Apr 14 2020, 04:30 PM

Return to original view | IPv6 | Post

#23

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 14 2020, 07:14 PM Apr 14 2020, 07:14 PM

Return to original view | IPv6 | Post

#24

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 14 2020, 07:17 PM Apr 14 2020, 07:17 PM

Return to original view | IPv6 | Post

#25

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 14 2020, 07:40 PM Apr 14 2020, 07:40 PM

Return to original view | IPv6 | Post

#26

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Wong Kit yew @ Apr 14 2020, 07:39 PM)  They should grant credential for online account right? https://www.aminvest.com/eng/Pages/home.aspx |

|

|

|

|

|

Apr 29 2020, 04:31 PM Apr 29 2020, 04:31 PM

Return to original view | IPv6 | Post

#27

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 29 2020, 06:26 PM Apr 29 2020, 06:26 PM

Return to original view | IPv6 | Post

#28

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(saintmikal @ Apr 29 2020, 06:19 PM) It will be interesting to see how many will still contribute to PRS post 2020 (I believe it is the last year for relief, barring any extensions, or corrections - in case I am mistaken). The tax relief is up to 2021 which is next year. I for one, will not as the main purpose is to gain from tax savings. The moment this no longer exists, there will be no significant incentive to even consider this medium. Their returns (in my case) have been super pathetic and I have tried all permutations - aggressive, moderate, conservative. All super koyak - putting the money in FD even at 3% per year is better. And I have been investing since 2012. However, I will take advantage of the RM 1,500 and then retop up another RM 1,500 for the final time this year. Similarly to SSPN tax relief, I'm seeing this tax relief will get an extension. |

|

|

Apr 29 2020, 07:51 PM Apr 29 2020, 07:51 PM

Return to original view | IPv6 | Post

#29

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(victorian @ Apr 29 2020, 07:44 PM) Can I top up 3k into PRS, and then withdraw all from account B during the same year? Am I still entitled for the tax relief of 3k? Isn't there answer few posts above if you did scroll up?QUOTE(leanman @ Apr 29 2020, 11:36 AM) I just called up PPA minutes ago, the CS agent confirmed with me that withdrawal has no effect on your contribution for tax purposes. Meaning even you withdraw RM1500, provided in this year you contribute, you can still claim the tax deduction based on your current year's contribution. my contribution was solely to benefit on the tax deduction as some said. my current scenario; PRS A (acct B) RM 2000 PRS B (acct B) RM 800+(new, from August 2019) Planning to top up RM2400, to make up to RM1500 in PRS B so that i can withdraw comes August 2020 Withdraw from PRS A comes May Top up RM600 by year ends to make up my total contribution of RM3000 for tax purposes for YA20 QUOTE(!@#$%^ @ Apr 29 2020, 11:50 AM) just so you may want to consider. does it mean 1 year from last topup or 1 year from 1st topup? Note: One of the prevailing terms and conditions for pre-retirement withdrawal from sub-account B is still applicable, whereby such withdrawals may only be made from a PRS fund one year after enrolment. https://www.ppa.my/wp-content/uploads/2020/...Penalty-new.pdf QUOTE(leanman @ Apr 29 2020, 11:58 AM) This post has been edited by GrumpyNooby: Apr 29 2020, 07:51 PM |

|

|

Apr 29 2020, 08:23 PM Apr 29 2020, 08:23 PM

Return to original view | IPv6 | Post

#30

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(victorian @ Apr 29 2020, 08:19 PM) I see, I have one existing PRS fund with FSM. One of the prevailing terms and conditions for pre-retirement withdrawal from sub-account B is still applicable, whereby such withdrawals may only be made from a PRS fund one year after enrolment.So I should top up to that fund right? If I top up to new fund I won’t Be able to withdraw this year. The prevailing requirement is very clearly stated. If you're aiming for withdrawal, you should top up existing funds. It looks like PPA is managing this per PRS provider (FM) basis. This post has been edited by GrumpyNooby: Apr 29 2020, 08:24 PM |

|

|

Apr 29 2020, 08:49 PM Apr 29 2020, 08:49 PM

Return to original view | IPv6 | Post

#31

|

All Stars

12,387 posts Joined: Feb 2020 |

I hate the paperworks!

Why can't PPA come out with an app like EPF and embrace digitalization like EPF iInvest? |

|

|

Apr 30 2020, 09:30 AM Apr 30 2020, 09:30 AM

Return to original view | IPv6 | Post

#32

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 30 2020, 06:28 PM Apr 30 2020, 06:28 PM

Return to original view | IPv6 | Post

#33

|

All Stars

12,387 posts Joined: Feb 2020 |

Easier for Principal PRS members to withdraw cash

KUALA LUMPUR: Private Retirement Scheme (PRS) members under the Principal PRS Plus and Principal Islamic PRS Plus schemes may apply to withdraw a maximum of RM1,500 from their Account B starting from Thursday, says Principal Asset Management Bhd (Principal). Principal said that in light of the Movement Control Order, members may submit their application via email, followed by a call to its customer service to verify their application. "If the call-back is successful, the request will be processed and payment will be made within 10 working days after receiving the necessary paperwork, ” it said. https://www.thestar.com.my/business/busines...o-withdraw-cash This should be the way! Salute to Principal! |

|

|

|

|

|

Apr 30 2020, 08:01 PM Apr 30 2020, 08:01 PM

Return to original view | IPv6 | Post

#34

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ Apr 30 2020, 07:57 PM) this is only for those who buy directly from them right? if buy via fsm or eunittrust, got to go through them As I said PRS you bought from FSM/eUT is not using their nominee account, it is under your name and NRIC. I believe the PRS provider should have records of your holdings even though you bought from FSM/eUT. PRS provider demanded original handwritten copy of forms in black to be returned to them even though you bought from FSM/eUT. This post has been edited by GrumpyNooby: Apr 30 2020, 08:04 PM |

|

|

Apr 30 2020, 08:06 PM Apr 30 2020, 08:06 PM

Return to original view | IPv6 | Post

#35

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ Apr 30 2020, 08:04 PM) yup, for affin hwang when i emailed them few weeks back they ask me to go through the platform where i bought the fund - unfortunately got to send it hard copy. If PRS fund declares distribution, FSM doesn't send tax voucher to you. maybe i shall shoot principal an email. It is sent out by PRS provider. |

|

|

May 1 2020, 07:25 PM May 1 2020, 07:25 PM

Return to original view | IPv6 | Post

#36

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(MiKE7LIM @ May 1 2020, 07:24 PM) FAQ on PRS Pre-Retirement Withdrawals that are Exempted from Tax Penalty Yes.6. Can I request to withdraw all the amount in sub-account B from one or more PRS Providers? Yes, members may request to withdraw all amounts from sub-account B of more than one PRS Provider. However, for withdrawals above RM1500, the balance will attract an 8% tax penalty That mean withdraw below RM1500 is zero tax penalty right? then can withdraw and throw back again this year …? |

|

|

May 6 2020, 04:43 PM May 6 2020, 04:43 PM

Return to original view | Post

#37

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 6 2020, 05:30 PM May 6 2020, 05:30 PM

Return to original view | IPv6 | Post

#38

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 6 2020, 05:53 PM May 6 2020, 05:53 PM

Return to original view | IPv6 | Post

#39

|

All Stars

12,387 posts Joined: Feb 2020 |

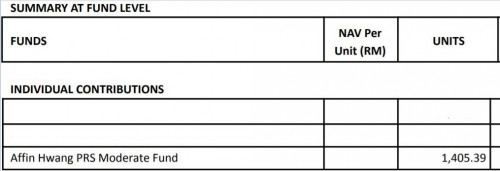

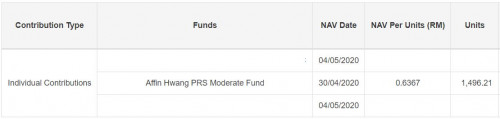

QUOTE(!@#$%^ @ May 6 2020, 05:37 PM) seriously? but my total amount of units at the end of 2019 based on the pdf affin hwang sent is still the same as now. Not sure why people in the section like to challenge? From PPA website: 2019 PPA annual statement:  2020 PPA Account Summary:  The last round Affin Hwang PRS Moderate declared distribution before April 2020 is October 2019. This post has been edited by GrumpyNooby: May 6 2020, 05:55 PM |

|

|

May 6 2020, 06:11 PM May 6 2020, 06:11 PM

Return to original view | IPv6 | Post

#40

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ May 6 2020, 06:03 PM) you are right, i checked from ppa website after u showed me that. but not reflected yet in FSM where i bought my PRS. should be soon then. Not sure why but FSM doesn't track PRS funds.There's no logo beside the fund name.  Based on the last distribution, it'll take > 1 month. |

| Change to: |  0.0219sec 0.0219sec

0.59 0.59

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 03:49 PM |