Gloom news now:

Stocks slump on gloomy Fed, China PMI

UPDATED @ 02:57:00 PM 22-09-2011

September 22, 2011

Traders gather on the floor of the New York Stock Exchange, July 16, 2009. — Reuters pic

SINGAPORE, Sept 22 — Stocks tumbled and the dollar surged today after a warning from the Federal Reserve that the United States faced a grim economic outlook with “significant downside risks” and further evidence of a slowdown in China.

European stock index futures fell more than 2.5 per cent after a slump of more than four per cent on Asian exchanges, while commodities and emerging market currencies dived in a broad sell-off of riskier assets.

Global miners and Asia’s big exporters were hit hard, with Rio Tinto falling 6.2 per cent and Honda Motor shedding 3.9 per cent.

“It is hard to ignore the macroeconomic picture,” said Tony Nunan, a risk manager with Tokyo-based Mitsubishi Corp.

The dollar jumped to a seven-month high on the prospect of higher short-term interest rates after the Fed said it would sell US$400 billion (RM1.2 trillion) of short-term Treasury bonds to buy longer-dated debt.

The widely predicted Fed move, known as “Operation Twist”, aims to stimulate the economy by forcing down long-term borrowing costs.

But it was the central bank’s bleak assessment of the world’s biggest economy that preoccupied markets, with some investors also disappointed that there were no bolder stimulus moves, given the extent of the Fed’s pessimism.

“The dollar’s strength and the risk aversion that we have seen in recent weeks have picked up steam after the Fed, as investors came to terms with the fact they can’t pin their hopes on the bank to help the economy,” said Tohru Sasaki, head of Japan rates and FX research at JPMorgan Chase.

Euro STOXX 50 index futures fell 2.7 per cent. Futures for Germany’s DAX and France’s CAC-40 were down more than 2.5 per cent, while financial spreadbetters in London called the FTSE 100 to open down as much as 2.7 per cent.

Japan’s Nikkei fell 2.1 per cent and MSCI’s broadest index of Asia Pacific shares outside Japan slumped 4.3 per cent, near the intraday low.

Earlier it touched a 14-month trough as capital outflows hammered emerging market strongholds such as Hong Kong and Indonesia .

Selling accelerated on Asian stock markets after HSBC’s China Flash PMI showed the factory sector shrank for a third consecutive month in September, pointing to a slowdown in the world’s second-largest economy.

The data suggested that China, the engine room of global growth in recent years, may not be able to provide much of a counterweight to flagging US and European growth.

The twin fears of US recession and a banking crisis brought on by Europe’s sovereign debt woes have haunted equity markets, fuelling a sharp sell-off in early August and renewed weakness this month.

Emerging Asian equities have underperformed US stocks since the August falls, with the MSCI Asia ex-Japan index now nearly 25 per cent below its 2011 high in April and Wall Street’s S&P 500 down 15 per cent from its peak in May.

“Operation Twist” is the latest in a series of steps aimed at reviving an economy that has struggled to rebound from the 2008 financial crisis.

But investors worry that the Fed’s latest plan will have little effect on lending in an economy that appears to be stagnating, which the Fed also noted.

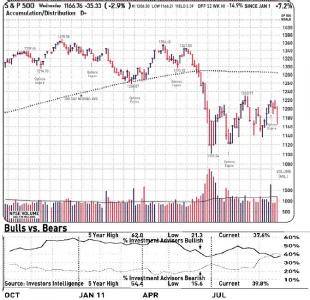

US stocks suffered their worst one-day drop in a month after the central bank wrapped up its two-day policy meeting yesterday, with the S&P 500 falling nearly three per cent.

S&P index futures traded in Asia fell 0.4 per cent, suggesting further weakness when trading resumes.

The dollar rose broadly, with the dollar index, which measures the greenback against a basket of major currencies, gaining as much as 0.9 per cent to hit a seven-month high.

As investors sought safety in the highly liquid dollar, currencies of emerging economies such as the Brazilian real and the South African rand made their biggest daily losses since the 2008 crisis.

Offshore dollar/yuan forwards rose, with the active three-month contract implying the Chinese currency would depreciate in three months, in a reversal of one of the core bets that foreign exchange markets have held all year.

The euro eased to US$1.3565, heading back towards a seven-month low of US$1.3495 struck last week, and hit a 10-year trough versus the yen — another benefactor of dampened risk sentiment — at 103.67 before recovering to around 104.10.

US Treasuries extended gains made after the Fed’s announcement, with the 10-year Treasury yield falling to a new 60-year low at 1.82 per cent.

The Fed’s plan to tilt its portfolio towards longer maturities brought the 30-year yield down sharply to 2.94 per cent, a fall of six basis points today after a whopping 22 basis points drop yesterday.

Japanese government bond yields also fell, with the benchmark 10-year sliding as much as two basis points to 0.965 per cent, its lowest since November.

The Australian dollar , sensitive to expected demand for commodities — especially from China — dipped below parity with the US dollar for the first time since August 9.

Oil and industrial metals, led by copper, slipped further amid worries of slowing Chinese demand.

“It is another blow after the Fed’s language about downside risks on the economy really hurt sentiment,” said David Thurtell, a Citigroup Inc. analyst based in Singapore. “China is the commodity world’s only remaining crutch.”

Brent crude was down 1.4 per cent at US$108.83 a barrel and US crude lost 1.6 per cent to US$84.54. Copper fell more than three per cent to US$8,045 a tonne, its lowest level since November. — Reuters

STOCK MARKET DISCUSSION V98, Celebrating KLCI breach 13xx point

Sep 22 2011, 04:23 PM

Sep 22 2011, 04:23 PM

Quote

Quote

0.0179sec

0.0179sec

0.64

0.64

6 queries

6 queries

GZIP Disabled

GZIP Disabled