yup, coz when it rebound, sure

buying now & it drops lower won't be tat bad gua

so dun sai lang all, go in batch by batch. the indexes is ur guide along with usa dog jones

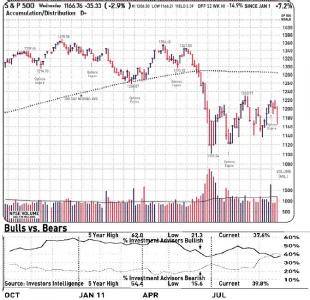

1300 and below wil be a wet dream

we'll look at it again, if it ever goes there

QUOTE(yok70 @ Sep 22 2011, 05:30 PM)

i agree with your advice of "it's now too late to cut loss".

so i guess all i can do now is to save more additional capital and take out my shopping cart waiting at 1300 or below.

I also waiting for klse thread sifus feedback

QUOTE(NewB-MX @ Sep 22 2011, 05:18 PM)

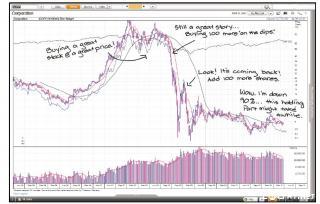

Im very new to the market and was too naive to think that the first 2 weeks of Jan 2011 were how the market normally is

So after making some "easy" coffee money I went in deeper and now am drowning with huge paper loss. Guess im paying some tuition fees for not doing enough homework.

So I would greatly appreciate any suggestions from the sifus here regarding my portfolio - whether to cut loss now or to hold for rebound. javascript:emoticon(':help:')

Im tempted to nibble on or add some "solid" counters which are at attractive prices now (e.g. KPJ, DLady, Panamy, Utdplt and Carlsberg). But would need to take out some FDs to do that, unless I cut loss on some of my present counters and use the leftover.

My portfolio :-

1. AMedia @ 0.315

2. DRBHCOM @ 2.12

3. DUTALND @ 0.61

4. GSB @ 0.105 (average)

5. Jotech @ 0.155

6. KUB @ 0.755

7. MBSB @ 1.42

8. MNC @ 0.13

9. Mulpha (MIB) @ 0.64

10. NCB @ 4.15

11. OMedia @ 0.09

12. PCHEM @ 6.98

13. Perdana @ 1.07 (average)

14. Perisai @ 0.855

15. Plenitude @ 2.13

16. PMCap @ 0.12 & 0.10

17. Poh Kong @ 0.50

18. Theta @ 0.815

19. Timecom @ 0.59

20. Axiata @ 4.39 & 4.48

Thanks in advance!

Sep 22 2011, 03:08 PM

Sep 22 2011, 03:08 PM

Quote

Quote

0.0248sec

0.0248sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled