Let's say you have 120k in cash and would like to buy a new car. What is the best strategy financially?

- To buy the car with cash?

- To pay only minimum amount required?

In the latter scenario, would it be better to stretch the number of year to maximum (9 years) or make it shortest (1-2 year)?

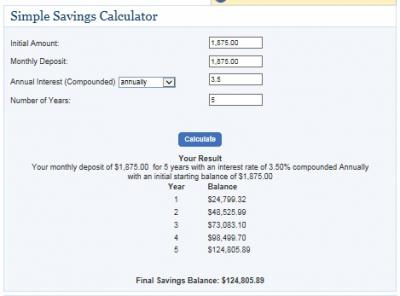

My calculation model shows that paying the minimum amount required and stretch the loan to maximum number of years is the most profitable. But advices that I get from the Internet is to put as much downpayment as possible.

I am confused. Please enlighten me.

Thanks!!

Sep 17 2011, 02:26 AM, updated 15y ago

Sep 17 2011, 02:26 AM, updated 15y ago

Quote

Quote

0.0836sec

0.0836sec

1.01

1.01

6 queries

6 queries

GZIP Disabled

GZIP Disabled