QUOTE(ic no 851025071234 @ Jul 27 2015, 09:29 AM)

Ya I read the post then I understand the bank earn higher interest in terms of % based on the later balance due to lower amount and flat interest.

But if calculate based on total ringgit value it earn higher by just put bank. I do a calculation on loan street with flat interest 100k 2.5% for 5 yrs end up

need to pay rm112500 total.

If fd compound interest same scenario but interest rate 3.5% I will end up having rm118768.

My scenario is based on not touching the fd money and I pay the loan based on extra income 1k a month or whatever the loan requires. Like that better right?

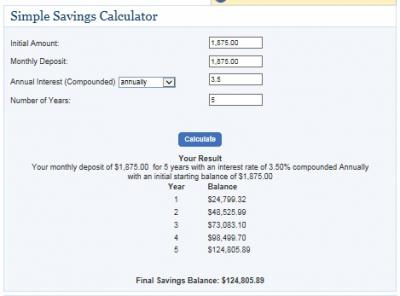

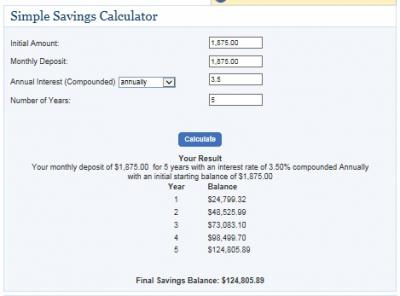

assuming need to pay RM 112500 / 60mths (5yrs) = RM1875 per month

if this RM1875 are not used to pay the bank loan but are used to put into the bank a/c that earns 3.5%pa

in the end of 5 years you get...RM124 800

which are more than the RM100k+ int you deposited into the FD (RM118768) and more than your total loan amount (RM112500)

so do you still think that it is still a "gain" to take a RM100k car loan and pay the monthly installment with money from the other source of income and keep the existing RM 100k available money in FD to earn interest?

I used a calculator online

http://www.bankrate.com/calculators/saving...lator.aspx?MSA=This post has been edited by T231H: Jul 27 2015, 10:28 AM Attached thumbnail(s)

Jul 20 2015, 12:52 PM

Jul 20 2015, 12:52 PM

Quote

Quote

0.0242sec

0.0242sec

0.16

0.16

7 queries

7 queries

GZIP Disabled

GZIP Disabled