No more Instant Transfer fee for e-payments below RM5,000 from July 1, 2018http://www.thesundaily.my/news/2017/12/08/...000-july-1-2018KUALA LUMPUR: In a bid to facilitate migration to the e-payment space,

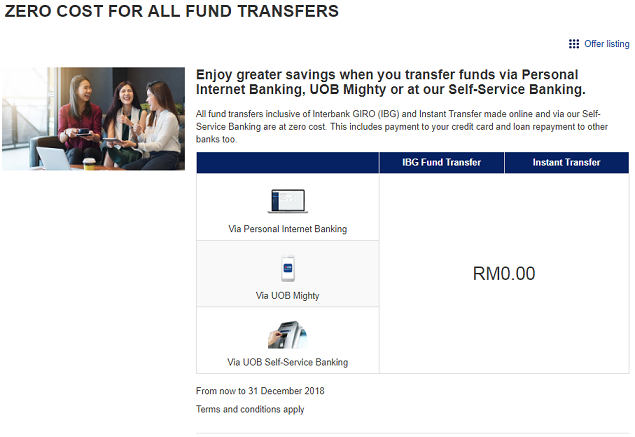

Bank Negara Malaysia (BNM) has announced that the Instant Transfer fee of 50 sen for transactions below RM5,000 made by individuals and small and medium enterprises (SMEs) will be waived, effective July 1, 2018.

"To drive the migration to e-payments during the transition period, the Instant Transfer fee of 50 sen will be waived for transactions up to RM5,000 per transaction made by individuals and SMEs effective July 1, 2018," BNM governor Tan Sri Muhammad Ibrahim said in his keynote address at the 2017 Payments Forum & Exhibition held earlier today.

He noted that cheques are a costly payment option compared with e-payment, given its processing cost of RM4, in contrary to Interbank GIRO and Instant Transfer which would only cost around 30 sen per transaction.

The usage of some 120 million cheques in 2017 has translated into an enormous cost of RM484 million, which Muhammad deemed as a sheer wastage to the economy.

However, the usage of cheques has declined 42% since 2011 from 205 million to 120 million in 2017.

In view of the high processing cost for cheques as well as to hasten migration to the e-payment space, Muhammad said cheque fee will be hiked from 50 sen to RM1 from Jan 2, 2021 and "gradually thereafter to reflect the actual cost of cheque processing".

Meanwhile, the central bank has issued an exposure draft on its website, in which it had outlined the proposed requirements for the Interoperable Credit Transfer Framework (ICTF).

"To encourage Quick Response (QR) code payment, avoid market fragmentation and broaden financial inclusion, BNM has issued the ICTF for consultation. The ICTF aims to connect both banks and eligible non-bank e-money issuers to ensure reachability of bank accounts and e-money accounts," Muhammad said.

"For the first time in our history, customers of both banks and non-banks will soon be able to transfer funds across the network seamlessly by just referencing the mobile number and IC numbers of the recipients or scanning the QR code of the recipients," he added.

The platform to facilitate the shared infrastructure payment service, known as Real-Retail Payments Platform (RPP) is currently being developed by Payments Network Malaysia (PayNet) and is slated for completion in June 2018.

PayNet which is the merged entity between MEPS and MyClear will be the operator of the shared payment infrastructure.

May 7 2017, 08:29 AM

May 7 2017, 08:29 AM

Quote

Quote

0.0273sec

0.0273sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled