Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v2

|

ronnie

|

Apr 23 2013, 07:48 AM Apr 23 2013, 07:48 AM

|

|

QUOTE(rickyfan8888 @ Apr 23 2013, 07:46 AM) Hey guys, first timer here and would like to ask that when I want to pay income tax through cimb clicks and I came across with this No Ansuran, seems like the default value is set at 99 at LHDN there. Just wondering what is this and where can I find the correct value to put in? Thanks If you are NOT paying Income Tax under Installment, then just put 99 (it's written on your physical form and M2U also defaults to 99) |

|

|

|

|

|

ronnie

|

Apr 25 2013, 08:34 AM Apr 25 2013, 08:34 AM

|

|

QUOTE(deity01 @ Apr 25 2013, 07:06 AM) need help here... does anyone know how's the child deduction works? I hv a child, new born baby, so I can claim 1 under 18 child 100% tax relief? or both me n my wife can claim 100%? or 50% each? or either 1 of me or my wife can claim 100% only? Either 50% - 50% OR One parent selects 100% Best option: Put 100% Child Tax Relief to the person who get TAXED higher |

|

|

|

|

|

ronnie

|

Apr 25 2013, 10:13 PM Apr 25 2013, 10:13 PM

|

|

QUOTE(mletee @ Apr 25 2013, 10:12 PM) hi guys, do u know when is the deadline to PAY the outstanding taxes? I already submitted BE form. Pay by 30 April 2013 |

|

|

|

|

|

ronnie

|

Apr 25 2013, 11:04 PM Apr 25 2013, 11:04 PM

|

|

Now e-Lejar is down  |

|

|

|

|

|

ronnie

|

Apr 29 2013, 09:37 AM Apr 29 2013, 09:37 AM

|

|

QUOTE(johnnywzm @ Apr 29 2013, 09:16 AM) wanna ask about the personal relief for personal computer. I bought a pc for rm2892 last year but when i filed i key in the wrong price RM2899. would there be any problem with that? Officially : of course a problem of over-declaring tax relief Un-officially : don't worry too much |

|

|

|

|

|

ronnie

|

Apr 29 2013, 09:48 AM Apr 29 2013, 09:48 AM

|

|

QUOTE(Moonlight86 @ Apr 29 2013, 09:44 AM) Which payment code and installment number I shall fill in to pay the excess amount after filling up the efilling? 084 Bayaran Ansuran Cukai - Individu or 095 Bayaran Cukai Pendapatan (tidak termasuk skim ansuran) Thanks Select 095 Bayaran Cukai Pendapatan (tidak termasuk skim ansuran) |

|

|

|

|

|

ronnie

|

Apr 29 2013, 03:31 PM Apr 29 2013, 03:31 PM

|

|

QUOTE(endau02 @ Apr 29 2013, 03:27 PM) hey there, anyone tried paying tax using maybank2u? looks like mine take forever to finish Pay early to avoid such problems... as M2U actually connects to IRB server to pick up some details. |

|

|

|

|

|

ronnie

|

May 8 2013, 08:16 AM May 8 2013, 08:16 AM

|

|

QUOTE(angeline2my @ May 7 2013, 11:07 PM) hi there i need some help here i'm a car sales agent, i do have my EA form provided by the company. however my income is not as much as it declare in my EA form as most of the income (commission) has been discounted to my client. which colume should i declare for my discount to the client? by the way since i'm earning basic and commision, i should go for the e-be or e-b? thanks Well, I believe you CANNOT "deduct" your "given-away commission".... Your company should prepare the correct EA form on the actual take home commission (NOT gross commission). Discuss with your company. Definitely e-BE for you as you have EA form. |

|

|

|

|

|

ronnie

|

May 8 2013, 11:27 AM May 8 2013, 11:27 AM

|

|

QUOTE(matmoto5125 @ May 8 2013, 11:09 AM) Guys, if buy Ogawa massage chair (requested by parents costs MYR10k), can use to claim income tax under medication to parents or not? Of course not.... Ogawa Massage Chair (or OSIM/Gintell/..) is not medical device also.   |

|

|

|

|

|

ronnie

|

May 8 2013, 11:44 AM May 8 2013, 11:44 AM

|

|

QUOTE(matmoto5125 @ May 8 2013, 11:29 AM) Haha.. Someone told me it can be claimed under that portion.  Thanks by the way.  Sales people will say anything to sell you something.... |

|

|

|

|

|

ronnie

|

May 8 2013, 03:19 PM May 8 2013, 03:19 PM

|

|

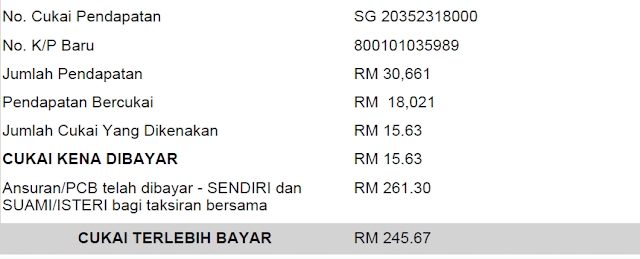

QUOTE(jayro_88 @ May 8 2013, 02:56 PM) » Click to show Spoiler - click again to hide... « Hi guys. Want to ask. Take the image as an example. How much do I have to pay? I dont know anything about this because this is my first time doing it.   You overpaid.... so just do nothing and wait for REFUND |

|

|

|

|

|

ronnie

|

May 20 2013, 09:39 AM May 20 2013, 09:39 AM

|

|

QUOTE(frontierzone @ May 20 2013, 09:16 AM) Anyone noticed the dodgy elejar system from Hasil is down again? Was alright a week ago or so , and now it's down again.. Before that it was down too. Off and On it will go down... latest statement updated until 15 April 2013 only.... |

|

|

|

|

|

ronnie

|

May 29 2013, 12:24 AM May 29 2013, 12:24 AM

|

|

E-Lejar is available currently... Account Updates up to 30-April-2013 URL: https://elejar.hasil.gov.my/login.htmlThis post has been edited by ronnie: May 29 2013, 12:25 AM |

|

|

|

|

|

ronnie

|

May 31 2013, 04:42 PM May 31 2013, 04:42 PM

|

|

QUOTE(cursebreaker @ May 31 2013, 10:54 AM) Hi, I have still not yet receive my tax return. I submitted my tax on the 1st of may through e filling. is this normal? when i check my summary online, it shows that they have over taxed me. so should i contact them or wait a little longer? That means you have to pay more tax ? |

|

|

|

|

|

ronnie

|

Jun 30 2013, 12:44 AM Jun 30 2013, 12:44 AM

|

|

QUOTE(lightwerker @ Jun 30 2013, 12:43 AM) i heard business efiling extended to july right? For Form B submission via e-Filling is until 15 July 2013 |

|

|

|

|

|

ronnie

|

Jul 26 2013, 02:54 PM Jul 26 2013, 02:54 PM

|

|

QUOTE(ragk @ Jul 26 2013, 02:33 PM) my salary is 3700, but my employee tax charged is 291+ per month, is this normal? my sis salary is much higher thn me but also dint charge as higher as me Did you submit Form TP1 to "estimate" your Tax Relief ? |

|

|

|

|

|

ronnie

|

Jul 28 2013, 11:53 PM Jul 28 2013, 11:53 PM

|

|

QUOTE(Feinberg1 @ Jul 28 2013, 07:47 PM) is it june 30 the deadline for filing income tax for sole proprietor ? property consultant. July 15th if you use E-Filling. It's now (28-July) too late to ask    |

|

|

|

|

|

ronnie

|

Jul 30 2013, 10:23 AM Jul 30 2013, 10:23 AM

|

|

QUOTE(moon yuen @ Jul 30 2013, 10:01 AM) In order to claim for tax purpose, we need to kept OFFICIAL RECEIPT for many years.But, many of the RECEIPT I kept a few months ago, the INK already faded out, not able to see the words clearly... So, what is the purpose of keeping ? Or I should photostat all of my receipts ?? Not economical or environment friendly lo... Have you heard of scanning a digital copy ? Even with the digital copy, you still need to keep the original faded copy |

|

|

|

|

|

ronnie

|

Jul 30 2013, 12:27 PM Jul 30 2013, 12:27 PM

|

|

QUOTE(moon yuen @ Jul 30 2013, 10:46 AM) SO, I need to scan every receipt ?? So, scan one , its acceptable ? Quite troublesome to me... Or I can tell the tax officer, document ink faded... Not my problem  Thanks  You MUST SHOW the receipt with faded ink as supporting (even with scan copy). It's to counter-check. |

|

|

|

|

Apr 23 2013, 07:48 AM

Apr 23 2013, 07:48 AM

Quote

Quote

0.0242sec

0.0242sec

0.22

0.22

7 queries

7 queries

GZIP Disabled

GZIP Disabled