Isn't it quite clear from our previous posts here?

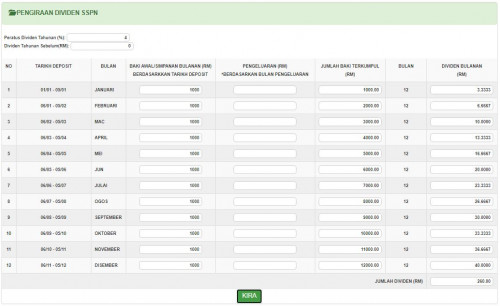

Take any period from 5th of month X to 4th of month X+1.

Calculate lowest balance in that period. Per-month dividend given for that lowest balance.

A few examples according to my understanding. Assume account starts with 8k inside before Jan 5th

Example 1

Jan 7 - deposit 8k

Feb 3 - withdraw 12k

Dividend given on lowest balance which is 4k. So you effectively earned NO interest on the 12k you withdrew.

Example 2

Jan 7 - withdraw 7k

Feb 3 - deposit 20k

Dividend given on lowest balance which is 1k. No interest on the 20k deposit (but if you leave it there till the NEXT 4th then you get interest).

Example 3

Jan 7 - deposit 20k

Jan 20 - deposit 10k

Feb 1 - withdraw 5k

Dividend given on lowest balance which is 8k. So all that 15k increase balance won't earn interest.

If the above is correct (which I think it is) then the 'best' way is to keep track of your balance starting the 5th of each month. If you're playing the in/out game, and you deposit large, may as well withdraw it quickly (earns no interest for that month).

But towards end of the month (coming up to 4th of the next month) then it may be worth to leave the sum in. Assuming that the next month you're not going to withdraw.

Put another way, if you know that for example on end Dec you will withdraw 25k, you may as well withdraw on the 5th since you won't be earning interest on that withdrawn sum for the whole 5-31 anyway.

Mar 8 2021, 12:42 PM

Mar 8 2021, 12:42 PM

Quote

Quote

0.0444sec

0.0444sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled