Outline ·

[ Standard ] ·

Linear+

Credit Card v11

|

zenquix

|

Aug 18 2010, 11:50 PM Aug 18 2010, 11:50 PM

|

|

QUOTE(David83 @ Aug 18 2010, 11:48 PM) How does that work by the way? @ronnie: I changed to ?? Someone in V10 mentioned it was 1% as communicated by CS. But by comparison i think it is much higher... Edit: found the post http://forum.lowyat.net/index.php?act=findpost&pid=35583782» Click to show Spoiler - click again to hide... « QUOTE(hebe87) QUOTE

Dear Sir

Thank you for your email enquiring on the charges for foreign currency transactions and cross border fee.

Please be informed that Foreign currency transaction are first converted to US Dollar through Visa International or MasterCard International before the US Dollars are subsequently converted to Ringgit Malaysia on the date the transaction is posted into card member’s Visa/MasterCard Payment Card account. The rate of exchange on the date of such posting may therefore differ from the rate of exchange on the date of the transaction. Further, the Bank will also impose a fee of 1% being administration charges for such transactions.

We trust the above matter is clarified.

Should you require further assistance, please email us at info@alliancebg.com.my or call our Contact Centre at 03-5516 9988.

Alliance Bank Contact Centre

Tel :03-5516 9988

Fax:03-5621 5624

Email reply from Alliance Bank

So in conclusion, there is 1% administration charges for foreign currency transaction, not 0% T.T |

|

|

|

|

|

zenquix

|

Aug 18 2010, 11:59 PM Aug 18 2010, 11:59 PM

|

|

Seems like the new price war is on cashback rebates....

|

|

|

|

|

|

zenquix

|

Aug 19 2010, 08:09 PM Aug 19 2010, 08:09 PM

|

|

QUOTE(PJusa @ Aug 19 2010, 07:50 PM) hmmm... i just checked this months US$ transactions on my alliance bank CC and i dont see a 1% handling fee. transaction date is 1.8.2010 and the exchange rate applied when converting RM to US$ via http://corporate.visa.com/pd/consumer_serv..._ex_results.jsp with 0% bank fee is 3.1755 which is the exact rate i get from my statement when i divide the amount in RM by the amount charged in US$. maybe i need to check - or do they treat the cards differently. card in question is a priority banking plat card. Are u using transaction date or posting date? will compare on my end |

|

|

|

|

|

zenquix

|

Aug 19 2010, 08:36 PM Aug 19 2010, 08:36 PM

|

|

QUOTE(PJusa @ Aug 19 2010, 08:18 PM) zenquix, transaction date. hm.. wouldn't the correct date to use be the posting date? |

|

|

|

|

|

zenquix

|

Aug 20 2010, 12:22 AM Aug 20 2010, 12:22 AM

|

|

Petrol transactions should count as well....

|

|

|

|

|

|

zenquix

|

Aug 20 2010, 03:54 AM Aug 20 2010, 03:54 AM

|

|

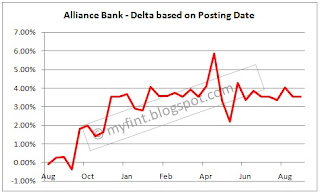

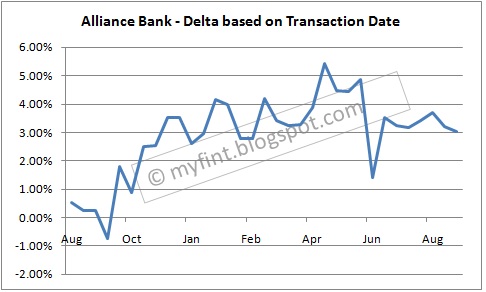

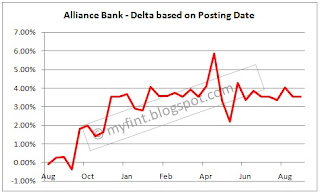

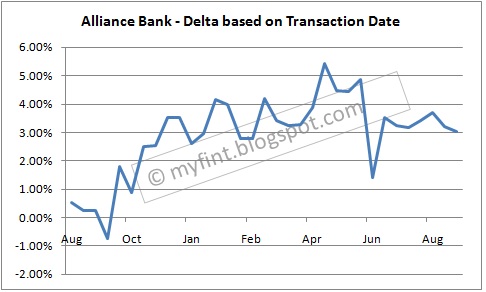

QUOTE(PJusa @ Aug 19 2010, 07:50 PM) hmmm... i just checked this months US$ transactions on my alliance bank CC and i dont see a 1% handling fee. transaction date is 1.8.2010 and the exchange rate applied when converting RM to US$ via http://corporate.visa.com/pd/consumer_serv..._ex_results.jsp with 0% bank fee is 3.1755 which is the exact rate i get from my statement when i divide the amount in RM by the amount charged in US$. maybe i need to check - or do they treat the cards differently. card in question is a priority banking plat card. Thanks to PJusa, I was able to make some comparisons of the rate Bank Alliance charges vs. the Card Issuer. Details is in the blog but in a nutshell: Alliance Bank is no longer a 0% admin charge bank. Maybe 0% is now reserved for their priority banking customers. Hope PJusa can share more data on his other transactions. » Click to show Spoiler - click again to hide... «   It was low in Aug'09 - Sept'09 but started climbing up from Oct '09 onwards to the level it is today. |

|

|

|

|

|

zenquix

|

Aug 20 2010, 08:52 AM Aug 20 2010, 08:52 AM

|

|

QUOTE(PJusa @ Aug 20 2010, 08:31 AM) zenquix, interesting indeed. i only have one, tops two US$ transactions on my alliance card per month so i cant really plot too much. but i did check the rates for transaction dates for the last 2 months (well only 4 transactions so not representative) but they all reflect the rate posted by visa with 0% charge. i also called CC customer service to double check and they did confirm that my card (and they claim all plat cards do) dont have any admin fee from the bank imposed. did you compare only US$ transactions or did you also look into other currency purchases? Combination of USD and GBP. I gather you are using the normal Platinum or is it a Business Platinum? Think I will complain via email. This post has been edited by zenquix: Aug 20 2010, 09:04 AM |

|

|

|

|

|

zenquix

|

Aug 20 2010, 11:21 AM Aug 20 2010, 11:21 AM

|

|

QUOTE(PJusa @ Aug 20 2010, 09:17 AM) zenquix, this is a normal plat card i got when the account was converted to prio status a couple of years ago. the contract signed did also state 0% charge. maybe this has changed in the meantime and they only honour old contracts?

Added on August 20, 2010, 9:24 amyes it does seem their conditons have changed. cardmember agreement clause 13.3 now reads: 13.3 Foreign currency transactions are first converted to US Dollars through Visa International or MasterCard International before the US Dollars are subsequently converted to Ringgit Malaysia on the date the transaction is posted into Cardmember’s VISA/MASTERCARD CARD Account. The rate of exchange on the date of such posting may therefore differ from the rate of exchange on the date of the transaction. The Bank will also impose a fee of 1% being administration charges for such transactions. my cardmember agreement reads 0% instead and i never got a new one from them either or any sort of notification that this has changed. so it might be possible that a) they honour their old agreement or b) i calculate wrongly  Thanks for the info. I am holding a plat as well (my card is more than a year old) so this case of double standards is another nail in the coffin. I guess I am not alone in the case of high charges since it has been reported by winner several times. The fact that it is higher than Amex  |

|

|

|

|

|

zenquix

|

Aug 20 2010, 12:09 PM Aug 20 2010, 12:09 PM

|

|

QUOTE(PJusa @ Aug 20 2010, 11:34 AM) zenquix, i sometimes dont understand them. as the smallest bank they should always try harder. my card is 5 or 6 years old though. i used to be very content when i was with section 13 branch but since that closed and i was moved to SS2 i cant say i am still as happy. that resulted in them lossing already most of my investments. there are banks that know better then them and drop charges if i ask for it  but the cashback on the alliance card seems to be the best in the market (despite the silly cap). I know what you mean. Oh well, if i get the OCBC Titanium card, might just cancel this. |

|

|

|

|

|

zenquix

|

Aug 20 2010, 11:18 PM Aug 20 2010, 11:18 PM

|

|

QUOTE(Gen-X @ Aug 20 2010, 10:34 PM) No. in terms of merchants/outlets discount and overseas spending (other cards offer 2X reward points). No if you spend more than RM1K month as rebate capped at RM50/month comes next year. See my comments on Alliance Plat above. In my opinion, this card is good as a primary card and once hit the maximum capped amount, start swipping with another card. Don't forget that the OCBC Titanium offers 5% cash back for Dining. This option is unique compared to the other cards. The utilities cash back also does not seem to infer that direct debit is required so quite easy to get rebates from those electricity and water bills.... challenge is where to pay... ^@%# merchant code |

|

|

|

|

|

zenquix

|

Aug 21 2010, 12:52 PM Aug 21 2010, 12:52 PM

|

|

QUOTE(ck_tonny @ Aug 21 2010, 12:32 PM) And cash rebate for dining is worldwide, not only Malaysia, I can't find any other cards can offer this. Yeah agree. MCC is controlled by Visa & Mastercard so likely it can be applied worldwide. |

|

|

|

|

|

zenquix

|

Aug 23 2010, 03:17 PM Aug 23 2010, 03:17 PM

|

|

got my ocbc titanium  |

|

|

|

|

|

zenquix

|

Aug 23 2010, 04:36 PM Aug 23 2010, 04:36 PM

|

|

last wednesday. I asked to collect at branch so will be faster.

|

|

|

|

|

|

zenquix

|

Aug 23 2010, 10:29 PM Aug 23 2010, 10:29 PM

|

|

Alliance Bank just won some brownie points with me. Their access to the KLIA plaza premium lounge is now without quota  |

|

|

|

|

|

zenquix

|

Aug 25 2010, 10:33 PM Aug 25 2010, 10:33 PM

|

|

QUOTE(hebe87 @ Aug 25 2010, 10:17 PM) not sure whether this question has been brought up before.. I have 10k CL, my current balance is RM0, I go and pay RM10k, so now my current balance is -RM10k Can I swipe a transaction of RM12k? yes as long as it is not an Easy payment. |

|

|

|

|

|

zenquix

|

Aug 26 2010, 01:01 AM Aug 26 2010, 01:01 AM

|

|

QUOTE(themattock @ Aug 25 2010, 11:33 PM) so if easy payment. got credit limit rm10,000. can swipe rm10,000? n qualified for easy payment such as ipayplan cimb? Most easy payment scheme will lock up your normal credit limit and u cannot use it until the easy payment clears. So if you deposit extra RM10k, you can do a normal swipe of up to RM20k but easy payment is still RM10k limit. QUOTE(waiwaisan @ Aug 26 2010, 12:00 AM) Just want to ask about the finance charge Standard financial charge (interest rate) Tier 1 > 13.5% p.a. Tier 2 > 16% p.a. Tier 3 > 17.5% p.a. May I know how to calculate the finance charge? if one year total I use total RM5000, will charge me the interest 13.5%?? This is only applicable only if you don't settle in full every month and keep outstanding balances |

|

|

|

|

|

zenquix

|

Aug 26 2010, 04:13 AM Aug 26 2010, 04:13 AM

|

|

QUOTE(Shinichi @ Aug 26 2010, 02:13 AM) Hmmm, but the agent that called me to fax my application to 03-27111098... I wonder if this number belong to OCBC... Gonna call 1300 tomorrow to verify my application... QUOTE(Shinichi @ Aug 26 2010, 02:15 AM) I'm now starting to worry I might be conned for my application form... I don't think it is a problem as the agent I dealt with also had the same fax number. Although eventually i emailed my application to the agent instead of faxing (and it was to a gmail account). My guess is this is actually an outsource arrangement by OCBC. Info goes to agents who would get contact the customers and get apps + supporting documents to be forwarded to OCBC processing. This post has been edited by zenquix: Aug 26 2010, 05:08 AM |

|

|

|

|

|

zenquix

|

Aug 26 2010, 05:28 AM Aug 26 2010, 05:28 AM

|

|

QUOTE(jack2 @ Aug 26 2010, 05:10 AM) OCBC is really efficient. My application was e-mailed to the agent on Monday noon and the application is already in processing status while checking through 1300885000.

Added on August 26, 2010, 5:13 amThe agent who served me is from OCBC in which his e-mail account is ocbc.com Interesting. Although i submitted my application thru the website www.ocbccards.com.my, the agent that eventually contacted me for documents seemed like a 3rd party. What was the steps you took to eventually have the OCBC agent contact you? At least mine seems legit as I have already gotten the card and using it. |

|

|

|

|

|

zenquix

|

Aug 26 2010, 01:53 PM Aug 26 2010, 01:53 PM

|

|

QUOTE(jack2 @ Aug 26 2010, 07:53 AM) OCBC application can be submitted through website? I thought website one, you just fill up and print it out? I filled and submitted the contact us in OCBC website and then someone contacted me lo.. Great, you are very fast and I think the first person here to have it and started use it...  Hahah i meant the contact us form in the website as well  Didn't know I am the first. But so far no problems with the card. However according to CS, the rebate is based on statement month, so we only get a RM120 cap from Aug X to Sept X, not RM120 for Aug and RM120 for Sept. |

|

|

|

|

|

zenquix

|

Aug 26 2010, 02:15 PM Aug 26 2010, 02:15 PM

|

|

QUOTE(chemistry @ Aug 26 2010, 01:45 PM) What? 0.3% cash rebate nia? [attachmentid=1748281] Did you find some old site? Try www.ocbccards.com.my |

|

|

|

|

Aug 18 2010, 11:50 PM

Aug 18 2010, 11:50 PM

Quote

Quote

0.0220sec

0.0220sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled