Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

Ramjade

|

Jun 21 2023, 12:46 PM Jun 21 2023, 12:46 PM

|

|

QUOTE(ccschua @ Jun 21 2023, 12:29 PM) other than fix instrument like FD or EPF, i will not consider as this is the retirement funds. I know a lot of funds can outperform the CPF/EPF. but just cant guarantee the rate. https://thesmartinvestor.com.sg/4-singapore...of-4-9-or-more/Fullerton SGD cash fund invest in FDs basically. |

|

|

|

|

|

Ramjade

|

Jul 9 2023, 11:06 AM Jul 9 2023, 11:06 AM

|

|

QUOTE(Mr Gray @ Jul 9 2023, 07:07 AM) Sorry. I 've searched both your posts and this thread. Couldn't find it U mentioned that u are not SG PR or working/studying in SG, yet u have OCBC SG, so I wonder how did u do that. Because as far as I know, ocbc sg needs work permit. I already have maybank SG and cimb sg If you got huge money, no issue. They will turn you away. If you are peasant like me, yes no hope. |

|

|

|

|

|

Ramjade

|

Jul 9 2023, 05:49 PM Jul 9 2023, 05:49 PM

|

|

QUOTE(Mr Gray @ Jul 9 2023, 03:18 PM) https://www.ocbc.com/group/media/release/20...foreigners.pageSeems like we can. My passport has less than 6 month maturity though, got an error message when trying to do that. The apps says need passport more than 6 month validity. You may try. It should work I think. Need to renew my passport then try again DBS > OCBC. OCBC got no good multicurrency acocunt. If got also need to lock up sgd3k. |

|

|

|

|

|

Ramjade

|

Jul 11 2023, 11:36 PM Jul 11 2023, 11:36 PM

|

|

QUOTE(clon12 @ Jul 11 2023, 09:05 PM) Hi all, I am interested to open a SG bank account and after reading the recent posts, I am leaning towards opening the CIMB SG account despite the lengthy process. However, I still have some questions before proceeding. 1. Is the rate (SGD to MYR) really better on CIMB than Maybank? I couldn't find the forex rate on Maybank SG site to compare, though I read on this forum that most suggests CIMB SG has better rate. 2. What is the max amount per transaction for CIMB SG to CIMB MY and Maybank SG to Maybank MY? 3. Can I use the CIMB SG account to pay bills (e.g. insurance) via CIMB Clicks? Thanks in advance. 1. CIMB SG offer the best rate Vs other banks unless you can get access to fintech like singx. 2. Don't know. 3. Please do not use your sg money to pay your Malaysian bills. Kindly do not put money into Singapore if you keep wanting to bring back money or use the money every month. Money in Singapore is meant to be long term/one way ticket which you can only assess say after 5-10 years. By you keep bringing the money back, the only person to benefit is cimb. |

|

|

|

|

|

Ramjade

|

Jul 12 2023, 12:15 AM Jul 12 2023, 12:15 AM

|

|

QUOTE(clon12 @ Jul 12 2023, 12:12 AM) Thanks for your reply, for my question #3 actually I meant paying for bills in SG. The reason I am opening a SG account is to pay the Singlife insurance as they do not accept Wise payment directly. Of course. Just use FAST transfer. Singlife accept FAST transfer. I have asked them. |

|

|

|

|

|

Ramjade

|

Jul 17 2023, 12:19 PM Jul 17 2023, 12:19 PM

|

|

QUOTE(hksgmy @ Jul 17 2023, 06:22 AM) After reading through most of the comments here, I'm now quite keen to open an CIMB SG account (I'm based in Singapore) - and after that, try to open up one in Malaysia. If you are based in sg, just go with DBS My acocunt. It have multicurrency acocunt vs CIMB. Only downside is the rate not as great as Cimb. Otherwise multicurrency acocunt which let you send or received foreign currency without the need for conversion, no min lockup amount. |

|

|

|

|

|

Ramjade

|

Jul 17 2023, 01:23 PM Jul 17 2023, 01:23 PM

|

|

QUOTE(ccschua @ Jul 17 2023, 12:43 PM) if u open CIMB bank account, it has dual linkages. u need to link the Malyasia side, once approved, and link the singapore side. for msia side, to transfer RM into SGD. for Spore side, to transfer SGD to RM. Never ever use cimb Malaysia to transfer RM to SGD. It's expensive. You get less SGD per ringgit by using cimb Malaysia. This post has been edited by Ramjade: Jul 18 2023, 06:41 PM |

|

|

|

|

|

Ramjade

|

Jul 18 2023, 08:41 PM Jul 18 2023, 08:41 PM

|

|

QUOTE(MasBoleh! @ Jul 18 2023, 08:37 PM) What is the most economical way to convert RM to SGD then transfer to my SG bank account for now? Thank you Sunway money. No one come close. |

|

|

|

|

|

Ramjade

|

Jul 18 2023, 09:03 PM Jul 18 2023, 09:03 PM

|

|

QUOTE(MasBoleh! @ Jul 18 2023, 08:44 PM) Because the 1 post above mine was comparing CIMB MY to SG , and is better to use Wise. And if HSBC MY to Sunway Money then to HSBC SG, I think got extra processing fees charges Only pay RM1.00 You can check yourself. I have checked myself using maybank, cimb, Hong leong, UOB, standard chartered, instarem, moneymatch, TransferWise. All cannot even match Sunway money. I don't have HSBC bank account to check. This post has been edited by Ramjade: Jul 18 2023, 09:05 PM |

|

|

|

|

|

Ramjade

|

Jul 19 2023, 01:01 AM Jul 19 2023, 01:01 AM

|

|

QUOTE(Medufsaid @ Jul 19 2023, 12:36 AM) anyone compared bigpay vs Sunway Money MYRSGD rates? Yes. Sunway money still wins. Don't ask me why. |

|

|

|

|

|

Ramjade

|

Jul 19 2023, 10:20 AM Jul 19 2023, 10:20 AM

|

|

QUOTE(Medufsaid @ Jul 19 2023, 08:17 AM) after going down the rabbit hole, i can only recommend that you do your own research as the rates of each remittance service updates at different times, so e.g., competitor no. 2 will be cheaper than no. 1 at your preferred time signup for (this is my preference order) 1) wise 2) money match 3) bigpay and this below is less competitive but u might still wanna signup 4) sunway money 5) instarem and finally, if u happen to go Midvalley money changers, and afterwards be in singapore to deposit paper money at banks, the theoretical (doable but very impractical) best is 0) midvalley money changers I have sign up for all. Last time always did comparison. Still sunway money always win. Nowadays don't bother doing comparison cause if I do comparisons, sunway money is still the cheapest. Lol. |

|

|

|

|

|

Ramjade

|

Jul 19 2023, 10:51 AM Jul 19 2023, 10:51 AM

|

|

QUOTE(Medufsaid @ Jul 19 2023, 10:45 AM) problem is i've just signed up for them all and your findings don't tally with mine. so let's agree to disagree. and i can provide screenshots of the quotes i get from bigpay or money match, which can easily beat sunway money Did you do during office hour? If you do during weekends and after hour then yeahmn Glad to know. That means the other competitors are getting competitive again. Le met check for my next month transfer and will update here. Can money match send to own account? Last I check, they block people from sending to their own account? |

|

|

|

|

|

Ramjade

|

Jul 19 2023, 11:09 AM Jul 19 2023, 11:09 AM

|

|

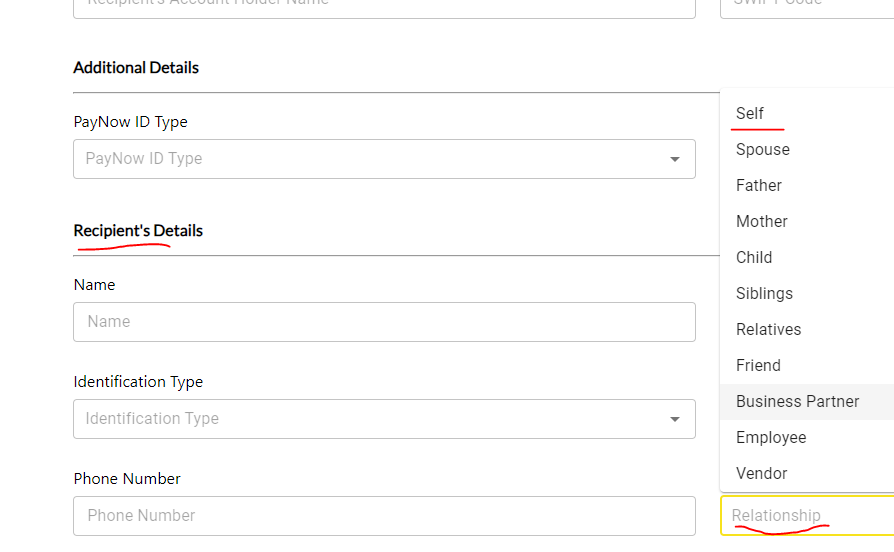

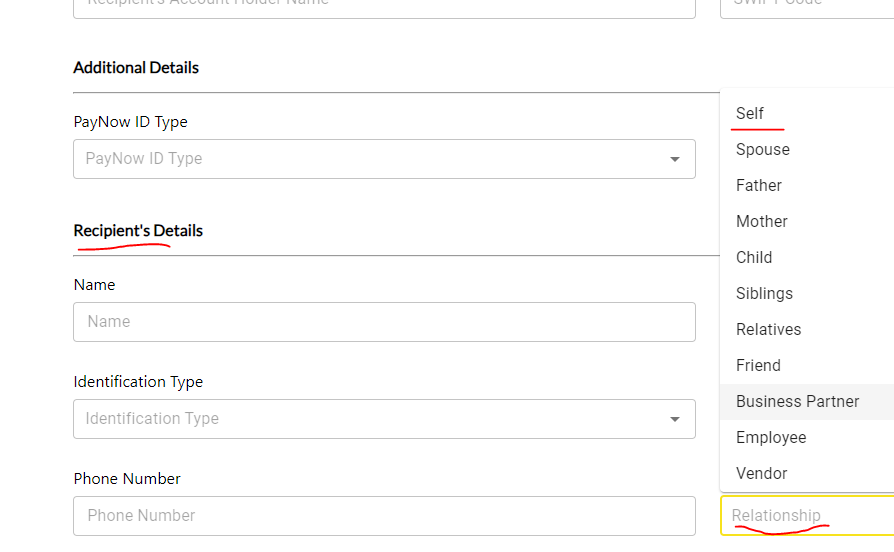

QUOTE(Medufsaid @ Jul 19 2023, 11:05 AM) i manage to add my SG bank account as recipient in moneymatch. can select "self", and my name in CIMB sg & money match is the same  haven't proceed any further though. but if later @ checkout can't remit out, wow will be a buggy flow You can add. What when you try send money, money is return to you. It cannot go though. Something about their license does not let them send money to oneself. Lol Not sure if their license have been updated. This was 7 years ago history. That's why I never used them at all already and as mentioned they have lost rates. |

|

|

|

|

|

Ramjade

|

Jul 20 2023, 06:34 PM Jul 20 2023, 06:34 PM

|

|

QUOTE(Medufsaid @ Jul 20 2023, 11:43 AM) aah they called me today, asked them and they assured that i can remit to myself. so i'll attempt moneymatch remit and see how it goes Any update? Did the transaction go through? Is the money in your account already? Are the rates better than Sunway money? |

|

|

|

|

|

Ramjade

|

Jul 22 2023, 05:44 PM Jul 22 2023, 05:44 PM

|

|

QUOTE(Medufsaid @ Jul 22 2023, 04:50 PM) remitted last night 10-11pm, just got email @ 4pm saying successfully arrived in SG acct. verified. last night, mymoneymaster rates were 3.432/3.42, and i got mine converted at roughly 3.44 Good to know that now they can transfer to own account. Let me check the rates once I send money next month and see if moneymarch rates are competitive. |

|

|

|

|

|

Ramjade

|

Jul 22 2023, 06:03 PM Jul 22 2023, 06:03 PM

|

|

QUOTE(ShinG3e @ Jul 22 2023, 05:49 PM) Once I reach rm10k, I move my money to Singapore. I can reach rm10k if I grind, if not it's just rm5k like that. |

|

|

|

|

|

Ramjade

|

Jul 22 2023, 06:17 PM Jul 22 2023, 06:17 PM

|

|

QUOTE(joeblow @ Jul 22 2023, 06:07 PM) So currently for MYR to transfer to SGD to Singapore bank, which is the best platform for less than rm30k? Sunway Money? If you move frequently, do you get audited or fund freeze by either Malaysia or Singapore side? I think once ringgit strengthens (ie if they strengthen at all) back to around 1 to 3.3, I may start move my ringgit to overseas. A bit fed up to keep ringgit to be honest... When you go overseas you feel the pain converting Ringgit. I kena audited both my Singapore and Malaysia side. For me, so far, Sunway money have always give me the best rate. Years already. Not sure why Medufsaid said moneymatch better. I will do comparison on Monday (just key in and see amount) and do real transfer next month and see who have the best rate. Audited from sunway money and cimb SG. They want my bank statement to see where my money is coming from. No fund freezes. Just give them the statement via email, answer their call (sg side and you are good). I have been transferring ringgit since 1mdb started. I transferred regardless of ringgit price cause long term ringgit can only go down. What is expensive today is actually cheap in future. This post has been edited by Ramjade: Jul 22 2023, 06:21 PM |

|

|

|

|

|

Ramjade

|

Jul 22 2023, 06:35 PM Jul 22 2023, 06:35 PM

|

|

QUOTE(joeblow @ Jul 22 2023, 06:28 PM) Thanks for the info. So the audit is done by Sunway and CIMB SG, not BNM or LHDN right? Actually I don't know what Sunway can do since a bank statement doesn't tell anything much. I fear more from BNM or LHDN, though I have been audited by LHDN twice. Just want to avoid the trouble. Yes ringgit is on downtrend. But so is vietnam dong, thai baht, indo rupiah 10 or 20 years ago. All recovered to perform better than Malaysia. Let's keep the faith eventually Ringgit will go back up... But my plan eventually is to move fund out from 75% Malaysia 25% to overseas to more 50% 50%. Sunway money and CIMB sg. The bank statement will tell them where the money is coming from. None by lhdn. For me I declare everything to lhdn. As mentioned in another place if you declared everything to lhdn and keep all records, they cannot do anything to you. |

|

|

|

|

|

Ramjade

|

Jul 28 2023, 08:45 PM Jul 28 2023, 08:45 PM

|

|

QUOTE(yjy @ Jul 28 2023, 06:43 PM) haha I'm the same... I want to throw my phone out the window. Why is the tech so badly executed, so many other apps like trading and crypto apps have no problems verifying ID. Did you find a scenario that worked best? Bright room? Dark background? Sg is rather old fashion and old school despite them portraying themselves as modern. Last time I went, they do not have thumbprint verification for banks. I was like omg. Haha |

|

|

|

|

|

Ramjade

|

Jul 29 2023, 05:55 PM Jul 29 2023, 05:55 PM

|

|

QUOTE(ShinG3e @ Jul 29 2023, 05:37 PM) SG maybank kim eng reset password means they’ll mail you a physical letter with a new code. Worse, the mail usually takes 2-3 weeks to reach you and the code valid only for 30 days, so u only have 1 week to reset password. It’s 2023 and no password reset email. 🙄 That's why next trip I am going down, closing all my maybank stuff. Not needed since I have Moomoo, FSM. |

|

|

|

|

Jun 21 2023, 12:46 PM

Jun 21 2023, 12:46 PM

Quote

Quote

0.1684sec

0.1684sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled