QUOTE(nexona88 @ Mar 12 2023, 05:01 PM)

Maybe things have change but I have seen people still able to open Maybank and CIMB account with no issue.Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Mar 12 2023, 05:03 PM Mar 12 2023, 05:03 PM

Return to original view | IPv6 | Post

#921

|

All Stars

24,421 posts Joined: Feb 2011 |

|

|

|

|

|

|

Mar 12 2023, 10:20 PM Mar 12 2023, 10:20 PM

Return to original view | IPv6 | Post

#922

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(MUM @ Mar 12 2023, 05:19 PM) It's true Maybank and comb Sg is under MAS jurisdiction and not under BNM. So as long as MAS continue to allow Malaysian to open account via Maybank and CIMB from Malaysia side, no issue. Only if MAS said no then both banks have to comply.This post has been edited by Ramjade: Mar 12 2023, 10:28 PM nexona88 liked this post

|

|

|

Mar 21 2023, 11:12 PM Mar 21 2023, 11:12 PM

Return to original view | IPv6 | Post

#923

|

All Stars

24,421 posts Joined: Feb 2011 |

|

|

|

Mar 21 2023, 11:24 PM Mar 21 2023, 11:24 PM

Return to original view | IPv6 | Post

#924

|

All Stars

24,421 posts Joined: Feb 2011 |

|

|

|

Mar 22 2023, 12:02 AM Mar 22 2023, 12:02 AM

Return to original view | IPv6 | Post

#925

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(Nutbeater69 @ Mar 21 2023, 11:26 PM) Haiz. I thought you manage to open. I read it as you managed to open. This guide maybe outdated.1. Get ready min SGD 3k cash 2. Travel to singapore (you can't do without being physical there) 3. Go early. Best to reach there around 8-9am 4. Go to Marina Bay Financial Center (their HQ, you cannot do it in normal branch). You can go there via their MRT 5. Bring your IC, passport, Malaysia bank statement, bill statement (original, and photocopy), income tax receipt 6. Once there tell them you want to open DBS Multiplier account, DBS vickers and CDP. (yes you need to open all 3 account). You cannot choose one. There is no other way 7. Just keep pushing to open the account. Say you want to invest. 8. If they say cannot, tell them you want to speak to manager. (this is very important). You need to be persistent. 9. Be prepared to wait like 4h to open the account. Be patient. Don't show angry face or be keep pushing like why so slow? 11. Once ready, deposit your SGD3k 12. Good luck. That's how I open my account at the height of 1mdb scandal. Not sure if things have change. |

|

|

Mar 22 2023, 12:07 AM Mar 22 2023, 12:07 AM

Return to original view | IPv6 | Post

#926

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(nexona88 @ Mar 21 2023, 11:41 PM) DBS way superior to CIMB. Cimb only good thing is rates to bring money back to Malaysia.QUOTE(Nutbeater69 @ Mar 22 2023, 12:01 AM) Collected CIMB SG already Try moomoo cash plus or tiger cash vault or moneyowl saversI'm looking to park money in SG FD, CIMB SG 4% Promo FD just ended https://blog.seedly.sg/cash-management-accounts-singapore/ You get the interest of FD without the need to lock up your money. |

|

|

|

|

|

Mar 22 2023, 12:14 AM Mar 22 2023, 12:14 AM

Return to original view | IPv6 | Post

#927

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(Nutbeater69 @ Mar 22 2023, 12:07 AM) Your call. Once you have that account, you have access to a multicurrency account that you can accept/send USD, GBP, AUD, etc.This post has been edited by Ramjade: Mar 22 2023, 12:15 AM ceo684 liked this post

|

|

|

Mar 22 2023, 12:27 AM Mar 22 2023, 12:27 AM

Return to original view | IPv6 | Post

#928

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(Nutbeater69 @ Mar 22 2023, 12:20 AM) Yes. Wise is restricted by Malaysian law that you cannot have more than RM20k inside. You got no such restriction with DBS account as Malaysian restriction does not apply to Singapore banks In terms of exchange rate, I think wise wins no doubt. Nutbeater69 and ceo684 liked this post

|

|

|

Mar 22 2023, 12:57 AM Mar 22 2023, 12:57 AM

Return to original view | IPv6 | Post

#929

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(Nutbeater69 @ Mar 22 2023, 12:29 AM) wow nice. not sure if I have extra 4 hours to open an account or not Just make a trip one day without her. For me it's worth it as I can get USD cashback from shopping online in US to be deposited into my multicurreny account and then transfer USD into Interactive broker at no cost.I think my gf will kill me if I slot this into the trip.. hopefully DBS have some sort of online account opening in future Got. All sg banks have online application for people who have singpass (working/studying/staying there). QUOTE(TOS @ Mar 22 2023, 12:34 AM) Please don't rub it in to people who got no pass. Be considerate. We know you got pass and able to open account easily. Some of us not so lucky. TOS liked this post

|

|

|

Mar 22 2023, 01:13 PM Mar 22 2023, 01:13 PM

Return to original view | IPv6 | Post

#930

|

All Stars

24,421 posts Joined: Feb 2011 |

TOS that's why you see I post stuff so that ordinary Malaysian without priority banking access/working or studying in Singapore can have access to overseas stuff.

Just because someone is rich and have priority access they can open account easily. Normal people like me don't stand a chance if we don't have priority banking. That's why you don't see me promote anything priority banking way. My way are for normal working folks in Malaysia who just want to invest overseas. This post has been edited by Ramjade: May 23 2023, 10:14 PM |

|

|

Mar 22 2023, 02:06 PM Mar 22 2023, 02:06 PM

Return to original view | IPv6 | Post

#931

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(TOS @ Mar 22 2023, 01:33 PM) Ya you have a point. I do notice a few priority HSBC and Stand. Chart. clients here though. SG worse place to honeymoon/holiday. I went there and not going back. Nothing to see and do in Singapore unless you like to see people put tissue on the table during lunch time. But based on observations here thus far, no one after you have reported success with opening DBS bank account in SG without buying UTs or have SG pass (unless I missed out some posts earlier). Again, recent trials to knock on DBS' doors from members can be found in this post: https://forum.lowyat.net/index.php?showtopi...ost&p=106627194 I remember some others mentioned successful trials with UOB (also no pass/not willing to buy UTs), but they went missing when pressed for further info. -------------------------- One must also not lose sight of the fact that too often, people go to SG to honeymoon with girlfriend/wife or travel with family... not specifically to open DBS SG account. This post has been edited by Ramjade: Mar 22 2023, 02:07 PM CommodoreAmiga and nexona88 liked this post

|

|

|

Apr 29 2023, 10:45 PM Apr 29 2023, 10:45 PM

Return to original view | Post

#932

|

All Stars

24,421 posts Joined: Feb 2011 |

|

|

|

Apr 30 2023, 10:44 PM Apr 30 2023, 10:44 PM

Return to original view | IPv6 | Post

#933

|

All Stars

24,421 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jun 6 2023, 08:36 AM Jun 6 2023, 08:36 AM

Return to original view | IPv6 | Post

#934

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(TOS @ Jun 5 2023, 11:11 PM) Just to inform Maybank SG users to check if there are any fraudulent/unauthorized transactions with your debit cards. I never activate any of my sg cards. I noticed someone stole hundreds of SGD from my account via unauthorized debit card transactions with merchant names like MyPerfectResume.com and BLS*MYHeritageLtd. Have to call Maybank SG Customer Rep. to deactivate my debit card and now need to submit a dispute resolution form to claim back my money... If the "stolen" amount is small (e.g. 5 SGD), no email notification will be sent, but if the amount is large, e.g. hundreds of SGDs in one go, then that will trigger an email to your account. So, it's best to login and check your account often. |

|

|

Jun 6 2023, 11:58 AM Jun 6 2023, 11:58 AM

Return to original view | IPv6 | Post

#935

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(TOS @ Jun 6 2023, 10:48 AM) I will be closing my Maybank SG account in light of this recent event. Getting tied 500 SGD there plus risking such issues just doesn't make any business sense. All cards get hacked regardless of banks or provider I kena on bigpay before USD10/transaction multiple times for Facebook marketplace.Oh DBS "Platinum" card also never activate? True also lah if you stay in MY often not travelling to SG then not activating the card makes sense from security point of view. I have also closed my HK Hang Seng Bank account and locked my Mox bank card all the time. Now with only one HK bank account, easier to monitor things. I never activate any of my sg bank cards. TOS liked this post

|

|

|

Jun 16 2023, 09:45 PM Jun 16 2023, 09:45 PM

Return to original view | IPv6 | Post

#936

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(GretZeit @ Jun 16 2023, 08:54 PM) Hi Bros wanna open a CDP in Sg for the SG Reits. Saw on SGX and some comments here to open a CDP in Sg need either a Work permit or a Student Pass right? If old student pass Fin can use anot? from what i know the Fin is stuck to you for life since i went back sg for short course also got the same Fin No few years ago. Don't bother with CDP unless you have sg address. If you got no singapore address you can't participate in rights or placement even with CDP acocunt.got a acc with account with posb bank that still valid tho no much money think that okay. can just dump some money in if needed also wanna ask seeing ppl say FMS Sg.... google only show FMSone only. same thing??? To participate in rights or placement use custodian broker like fsm or Moomoo. Btw keep in mind investing in Singapore reits will and shall make you the atm every once in awhile. So yeah prepare for that. If you are not prepared to be ATM, don't invest in reits. For me I already sold all my reits as I don't want to be an atm to my reits. I want my companies to be my ATM and not the other way around. If you broaden your horizon, you will know there are lots of companies paying REIT like yiled with only payout of day 40-50% Vs reits at 90%. If a company with dividend payout of 50% and paying 5%p.a, Vs a REIT with payout of 90% and paying 5%p.a the company is superior to the REIT in every way. This post has been edited by Ramjade: Jun 16 2023, 09:48 PM MasBoleh! liked this post

|

|

|

Jun 17 2023, 12:22 AM Jun 17 2023, 12:22 AM

Return to original view | IPv6 | Post

#937

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(GretZeit @ Jun 16 2023, 10:54 PM) but thats interesting you mean the Reits will take money from you? how the heck does that works? Sorry still new and most of my knowledge are from online. Eg like wilmar. I think payout only 30%+ and paying 4%+ and growing dividend by around 10%p.a. That's means if you don't add any money, your current dividend next year will automatically increase by 10%p.a. Reits increase their dividends by 1-3%p.a if you are lucky.personally i was considering between reits and gov bonds or similar but tot reits seems more long term? saw some sgs bond with payout but have a time period 5 to 10 years or so I might have misunderstood tho. what i wanted to do was just put a certain amt in reits and just let it stew till kingdom come if that made sense. did consider company but have to study more into it It's a better buy Vs reits. Look at the news recently. Lots of reits did placement in the past 1 month. That's how they ask money from you. If you don't participate, your dividend will decrease (diluted). This post has been edited by Ramjade: Jun 17 2023, 12:23 AM Mattrock liked this post

|

|

|

Jun 18 2023, 03:09 PM Jun 18 2023, 03:09 PM

Return to original view | IPv6 | Post

#938

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(TOS @ Jun 17 2023, 11:53 PM) Going to SG in Late July. Will close my Maybank SG account. Neither. Cause both also got fall below fees. Go for trust bank (digital bank) which I have no fees.I am thinking of opening either OCBC or UOB account as a backup local SG account in case DBS system went down. Any comments on OCBC vs UOB? (Leaning towards OCBC as there's a branch on NTU's campus. DBS keeps spamming my cousin's SG address mailbox will T-bill notification letter every 2 weeks. I feel sorry for him. OCBC and UOB don't send physical notification letters, an advantage, opportunity cost is 1k SGD tied-up inside OCBC/UOB account. Just don't know whether to choose OCBC or UOB? Past users can share experience? Or sifu Ramjade ikanbilis? I am not sifu as I do t have uob or OCBC. Even if I can open I won't want to open so many. QUOTE(lyyera96 @ Jun 18 2023, 10:48 AM) Maybe cause never use?QUOTE(Medufsaid @ Jun 18 2023, 12:12 PM) Maybank SG account might require minimum account balance. I closed my traditional DBS acct (minimum S$500 balance) and opened a CIMB sg one bcos of that (DBS eMySavings requires S$0 balance but i decide to use CIMB to link to CIMB MY) DBS my account is better than cimb as it's a multicurrency acocunt and no fall below fees. I keep only SGD0.10 inside. TOS liked this post

|

|

|

Jun 21 2023, 11:01 AM Jun 21 2023, 11:01 AM

Return to original view | IPv6 | Post

#939

|

All Stars

24,421 posts Joined: Feb 2011 |

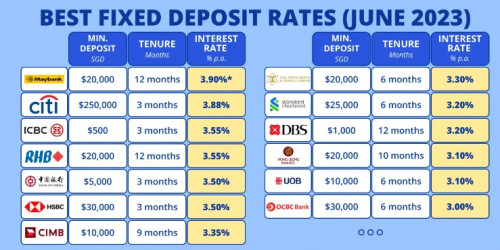

QUOTE(ccschua @ Jun 21 2023, 10:43 AM)  Maybank sg FD is the best currently. I close my mabank sg acc before COVID. I do not have singapass nor am I a PR/work permit. can I open Maybank sg acc at any of the Malaysia branches, is it still work ? MasBoleh! liked this post

|

|

|

Jun 21 2023, 11:46 AM Jun 21 2023, 11:46 AM

Return to original view | IPv6 | Post

#940

|

All Stars

24,421 posts Joined: Feb 2011 |

QUOTE(ccschua @ Jun 21 2023, 11:23 AM) Moomoo is an online brokerage. Mmf is money market fund. https://growbeansprout.com/cash-management-...singapore-guide |

| Change to: |  0.1710sec 0.1710sec

0.36 0.36

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 10:32 AM |