QUOTE(sgh @ Dec 16 2021, 01:59 AM)

You know Msia very big correct? Depend where you are not all shops etc high tech they still only accept cold hard cash. The place I go is small town with kampong kind not those taman and high rise places. So must go town bank atm press monies take out. My spouse former Msian so I know abit of inside culture etc. Also I say for emergencies as usually inside relatives got MYR to change with me.

I find you tend to fire off without asking each poster for more info. I wonder in workplace your working style is like in this forum?

Bro. Take a look at the atm withdrawal fees. All can withdraw cash from ATM machine. Do not give free money to banks. If you ATM fees only charge say sgd1.00 why bother with bank account?

Come I spoon-feed you.

Revolut zero ATM fee for sgd350/month withdrawal for free account

Youtrip sgd5.00 up to max sgd5000

Bigpay free for first withdrawal up SGD2500/day

Wise free sgd350 withdrawal then sgd1.50

https://www.asiaone.com/money/digital-multi...e-vs-revolut-vsThe atm fees you pay can be cheaper than what what the bank charge in exchange rate provided you do lump sum withdraw. And there's ATM everywhere. If you withdraw small amount each time, then better to go with banks.

So if I am in your shoes, I will just grab any if the cards I mentioned and forget about bank account. Unless you regularly visit Malaysia then yes bank account might be useful.

QUOTE(chupapi_munyayo @ Dec 16 2021, 10:34 AM)

Where can I open a SG bank account here in Malaysia?

I hear CIMB can but I have many bank account already including Maybank,

Public Bank, HL Bank, UOB

which one of them can?

Or shall I open or opt for foreign currency account?

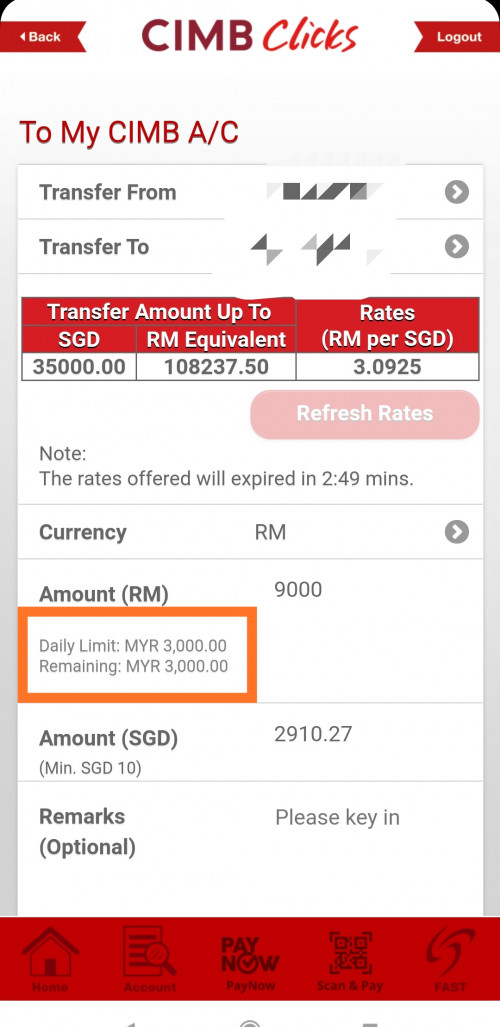

You want online, only cimb sg.

If you willing to visit branch, Maybank sg (visit maybank Malaysia, certain branches).

If you don't want to lock up sgd500-1000, then cimb sg.

If you don't mind locking up sgd500-1000 then Maybank sg. Lockup here means no interest for money that must be kept inside the bank to prevent getting charged fall below fees.

Public bank, Hong Leong does not have sg based account. UOB needs to be priority customer or they won't even entertain you.

This post has been edited by Ramjade: Dec 16 2021, 11:59 PM

Nov 22 2021, 01:47 AM

Nov 22 2021, 01:47 AM

Quote

Quote

0.1911sec

0.1911sec

0.95

0.95

7 queries

7 queries

GZIP Disabled

GZIP Disabled