QUOTE(roarus @ Sep 8 2021, 12:01 PM)

I thought Basic Savings Account falls under no questions asked category, as long as you go to the branch near where your IC address is?

CIMB Malaysia memang troublesome to open account.Opening a Bank Account in Singapore

|

|

Sep 8 2021, 12:02 PM Sep 8 2021, 12:02 PM

Return to original view | IPv6 | Post

#721

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(roarus @ Sep 8 2021, 12:01 PM) I thought Basic Savings Account falls under no questions asked category, as long as you go to the branch near where your IC address is? CIMB Malaysia memang troublesome to open account. |

|

|

|

|

|

Sep 8 2021, 03:49 PM Sep 8 2021, 03:49 PM

Return to original view | IPv6 | Post

#722

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(TOS @ Sep 8 2021, 03:32 PM) I got my Maybank SG smoothly, just print forms, fill it and tell them honestly "do investment", then it got approved. (Notice the different with "CIMB MY", you say "investment" with student status it is an immediate "no", at least from the "first branch" of CIMB, not sure how things are with CIMB SG yet). No need wait. It's all online. Just make sure you have sgd1k inside Maybank to make your life opening CIMB sg easier.Maybank MY opened while I study at college, so I was on solid grounds back then, with offer letter from college, scholarships etc. Yes still studying, but this time in HK uni. Offer letters are of no help, so as Student ID since they are all evidences/proofs based in HK. The only "rather stupid" reason I can think out of my mind yesterday was "facilitate transfer of funds between HK and MY" and to further convince/persuade them, gave some terrible excuses like "fx rates are good...". I also added my father has account at CIMB so "service is nice"... I don't like to cheat, not really considered cheating anyway since the funds from HK will some day come back here, though that is not the main purpose. I will wait for some time first before going on with CIMB SG, still busy with air tickets and quarantine hotel bookings. |

|

|

Sep 8 2021, 04:41 PM Sep 8 2021, 04:41 PM

Return to original view | IPv6 | Post

#723

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(TOS @ Sep 8 2021, 03:56 PM) |

|

|

Sep 8 2021, 08:20 PM Sep 8 2021, 08:20 PM

Return to original view | IPv6 | Post

#724

|

All Stars

24,429 posts Joined: Feb 2011 |

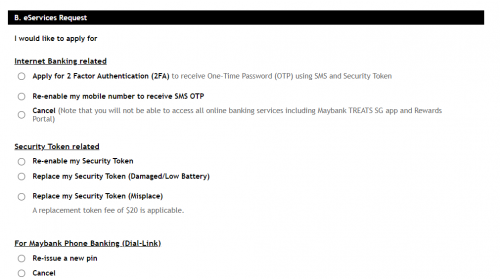

QUOTE(Ramjade @ Sep 8 2021, 04:41 PM) I use excuse for investing last time for CIMB sg as well. Maybank sg 2fa support SMS authentication. QUOTE(TOS @ Sep 8 2021, 04:43 PM) What sort of excuse? Maybank SG to add new payee they only give me option to use the security token. But for some access, I can choose between token and SMS. Excuse for opening cimb sg.Not sure if this helps.  No need to to services. Just pay new payee. Alternatively just call them and ask for new security device. Faster than email. |

|

|

Sep 8 2021, 08:37 PM Sep 8 2021, 08:37 PM

Return to original view | IPv6 | Post

#725

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(cklimm @ Sep 8 2021, 02:48 PM) What are you doing now wiith your SGD? Hope you don't mind asking. Hopefully you don't answer me with SG FD. This post has been edited by Ramjade: Sep 8 2021, 08:37 PM TOS liked this post

|

|

|

Sep 9 2021, 12:52 AM Sep 9 2021, 12:52 AM

Return to original view | IPv6 | Post

#726

|

All Stars

24,429 posts Joined: Feb 2011 |

|

|

|

|

|

|

Sep 10 2021, 07:00 AM Sep 10 2021, 07:00 AM

Return to original view | IPv6 | Post

#727

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(coolguy99 @ Sep 10 2021, 06:55 AM) No he is saying Maybank sg app have build in 2fa authenticator. Hence if your physical token is lock or damaged or no battery, can still use digital token. TOS liked this post

|

|

|

Sep 10 2021, 11:33 PM Sep 10 2021, 11:33 PM

Return to original view | IPv6 | Post

#728

|

All Stars

24,429 posts Joined: Feb 2011 |

|

|

|

Sep 11 2021, 08:29 PM Sep 11 2021, 08:29 PM

Return to original view | IPv6 | Post

#729

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(cklimm @ Sep 11 2021, 09:41 AM) Of all thing Sia. :XQUOTE(coolguy99 @ Sep 11 2021, 11:16 AM) I have sg broker account but didn’t invest yet. My sgd is still mainly in StashAway. Do you think it’s better to invest in the stock market? Thing is I don’t have much time to monitor the sg market hence I opted for StashAway instead You don't need to monitor if you buy the right company. Take it from me. My investment are all buy and hold and I have left it on auto pilot for 7 years+ (no monitoring)This post has been edited by Ramjade: Sep 11 2021, 08:30 PM |

|

|

Sep 12 2021, 02:29 AM Sep 12 2021, 02:29 AM

Return to original view | Post

#730

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(hft @ Sep 11 2021, 10:02 PM) Forget about investing in sg market. You want slow growth, low risk, go buy apple, microsoft, Costco, Lockheed Martin and home depot in us market.If you die die must buy sg stocks, mapletree commercial trust, mapletree logistics trust, frasers logistics trust, elite commercial trust. esyap liked this post

|

|

|

Sep 12 2021, 07:36 PM Sep 12 2021, 07:36 PM

Return to original view | IPv6 | Post

#731

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(cklimm @ Sep 12 2021, 09:40 AM) Throw away sembcrop. Lousy. Better choices available exist such as CKI HK, CLP HK, JLEN Plc, TRIG Plc, HICL, plc (note all 3 plc are debt free and giving around 5%p.a dividend)., Brookfield renewable, Brookfield infrastructure, Fortis, Algonquin are way better anytime anyday compare to sembcorp. Have your pick.Throw away SATS also. Reason is even with monopoly in sg, before pandemic have very weak pricing power. Better alternative like Shenzhen international. I thought sats was good company but one Singaporean showed me they are actually lousy despite having monopoly. QUOTE(cklimm @ Sep 12 2021, 09:41 AM) No way to avoid. Bite the bullet. One way I am doing to get around the 30% tax is buy 100 shares of the company. Then sell weekly covered calls on it. When you sell a covered call, you get paid for the contract. Premiums you get paid are tax free as it's counted as capital gain tax. There's no capital gain tax on foreigner from US side and there's no dividend or capital gain tax for stocks from Malaysian side.Give you one eg. I owned 100 visa shares. Yes the visa card company. I do covered calls on it and getting paid USD 50-70/week tax free. In one year time, that's is USD2600-3640. Assuming one visa share price now is USD224.91 and you need 100 shares to do what I am doing, cost would be USD22491. USD2600-3640/USD22491 x100% = 11-16%p.a tax free. Yes you get to keep the whole 11-16%p.a and US govt is not taking a cut from it. More than any dividend you get paid. Best part is if your share don't get sold away (assuming the current market price is below the strike price of your contract), you can rinse and repeat in weekly basis. That's why I don't bother doing dividend investing anymore. With dividend investing, I was limited by 1) companies I can buy - die die must buy dividend paying companies last time. Not anymore. 2) geography - I can now i vest in US companies and don't get tax 30% 3) slow growth - I can now have both high capital gains and high DIY tax free dividends You can do it on any company like Microsoft, Apple, Google, SEA ltd (owner of shopee). Keep in mind tiger and moomoo are not ideal platform to do the above. If you really want to do what I am doing, go open interactive broker, TD, or first trade. Interactive broker Can use your sg bank account and deposit SGD Spot exchange rate (real time without any markup) -better than what any priority Banking with banks/money changer can give you. Very cheap cost for buying shares at USD0.35/transaction. Multiple markets (US, Canada, UK, Europe,HK, SG, AU) One free withdrawal a month Expensive commision for options - around USD1.00-1.50 Lousy interface No free live data. Need to pay for it. TD Nice interface Cheap comission for options at USD0.70 Free live data if you have USD500 or more with them Unable to deposit SGD unless you have DBS SG Higher markup for currency conversion Vs interactive broker q Only have US market. Long waiting time to open acocunt around 3 months. USD25/withdrawal. No free withdrawal. Banned by Malaysian govt as they deem it as illegal platform. First trade Everything is free (zero commision on stocks, options) Free live data US based which means you will lose money when you transfer money to them or from them (as you can only use banks) US35/withdrawal. US market only. 2. Buy Ireland domiciled etf from London stock exchange and get taxed 15% Vs 30%. 3. Buy stocks in tax free country like SG, HK, UK. Accept 15% tax cut and buy stocks from country like Canada, Germany, France. Hope the above help you. This post has been edited by Ramjade: Sep 12 2021, 08:02 PM |

|

|

Sep 12 2021, 11:14 PM Sep 12 2021, 11:14 PM

Return to original view | Post

#732

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(asimov82 @ Sep 12 2021, 09:36 PM) Trading212. But IB is the best for UK ETF. Trading212 uses IB as backbone.QUOTE(lawrencesha @ Sep 12 2021, 09:39 PM) Lots of value trap in sg market (GLC) and subpar companies.This post has been edited by Ramjade: Sep 12 2021, 11:26 PM |

|

|

Sep 13 2021, 12:46 AM Sep 13 2021, 12:46 AM

Return to original view | IPv6 | Post

#733

|

All Stars

24,429 posts Joined: Feb 2011 |

|

|

|

|

|

|

Sep 17 2021, 01:04 PM Sep 17 2021, 01:04 PM

Return to original view | IPv6 | Post

#734

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(TaiGoh @ Sep 16 2021, 06:04 PM) Thanks for the guide! Super useful. Do t bother with CIMB sg if you are moving to sg. It's only good if you are want to bring money back to Malaysia. Then again, if you are in sg lots of fintech can match or have better rated than CIMB sg.Wondering is there any annual fee for CIMB SG account? Moving to SG soon, planning to open a temporary account first and apply a permanent one once I reach there. One of them is singx.(highly recommended if you are in sg)..Others are world remit, revolut. Go with dbs my account. You don't have fall below fees. You can use to to received foreign currency Plenty of ATM Island wide. I have dbs my account and I only keep SGD0.10 inside. Lol QUOTE(polarzbearz @ Sep 17 2021, 12:29 PM) Windows XP style is already complementing them Quite surprised that their website so outdated Vs CIMB MY site. polarzbearz, TaiGoh, and 1 other liked this post

|

|

|

Sep 18 2021, 05:54 PM Sep 18 2021, 05:54 PM

Return to original view | IPv6 | Post

#735

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(Duxia999 @ Sep 18 2021, 12:12 PM) It's been a week since I depo 1sgd from my cimb my and then transfer 999 from my dbs... Still no call from sg cimb.. Last the no call. The will just send you everything via mail. Need to wait around 1 month for it everything to arrived. Keep in mind to check your email. They will send you an email.That's was during my time. |

|

|

Sep 26 2021, 10:17 PM Sep 26 2021, 10:17 PM

Return to original view | IPv6 | Post

#736

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(homosapien8888 @ Sep 26 2021, 10:06 PM) hi , just wondering the CIMB/maybank singapore account is for withdrawal fund to your bank account in singapore rather than to your malaysia bank account ? i know now we can use wise /instaram /big pay for remittance , ie Rm -> Sin dollar Use CIMB sg. Forget about Maybank sg. Alternative is use TransferWise. The rates between CIMB sg and TransferWise are interchangeable. Sometimes one is cheaper than the other. |

|

|

Sep 27 2021, 12:50 PM Sep 27 2021, 12:50 PM

Return to original view | IPv6 | Post

#737

|

All Stars

24,429 posts Joined: Feb 2011 |

|

|

|

Sep 27 2021, 01:39 PM Sep 27 2021, 01:39 PM

Return to original view | IPv6 | Post

#738

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(jack2 @ Sep 27 2021, 01:01 PM) Care to share the deals you made with them? Or step by step which you take to open account with UOB?QUOTE(SkyHermit @ Sep 27 2021, 01:16 PM) Yes but he said need to made deals with them. So don't know deals he made. Wish he can share more.This post has been edited by Ramjade: Sep 27 2021, 01:39 PM |

|

|

Oct 6 2021, 12:18 AM Oct 6 2021, 12:18 AM

Return to original view | IPv6 | Post

#739

|

All Stars

24,429 posts Joined: Feb 2011 |

|

|

|

Oct 6 2021, 09:30 AM Oct 6 2021, 09:30 AM

Return to original view | IPv6 | Post

#740

|

All Stars

24,429 posts Joined: Feb 2011 |

QUOTE(cryzord @ Oct 6 2021, 08:28 AM) For now bigpay. Coming soon mymy card/youtrip card. Don't know when launched. I don't think merchant trade is good.QUOTE(TOS @ Oct 6 2021, 09:23 AM) Sunway Money not good? I just opened an account with them. Can transfer MYR to other currencies too like HKD. Rates very close to Instarem and Wise. He/she wants to buy stuff. Not send money to sg. Sunway money is way better than instarem or wise in terms of rates and final foreign currency. I don't bother about inatarem anymore. They are now expensive. I dont know which one have best rates for hkd as I don't bother sending hkd.This post has been edited by Ramjade: Oct 6 2021, 12:17 PM TOS liked this post

|

| Change to: |  0.1831sec 0.1831sec

1.21 1.21

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 07:35 PM |