Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Jul 31 2025, 04:45 PM Jul 31 2025, 04:45 PM

|

Senior Member

3,485 posts Joined: Jan 2003 |

|

|

|

|

|

|

Aug 4 2025, 03:08 PM Aug 4 2025, 03:08 PM

|

Senior Member

3,019 posts Joined: Oct 2005 |

Maybank SG app offline?

It shows error FEUI02 error, then show "service is not available" error its frustrating to unable to access account. This post has been edited by john123x: Aug 4 2025, 03:16 PM |

|

|

Aug 4 2025, 05:32 PM Aug 4 2025, 05:32 PM

Show posts by this member only | IPv6 | Post

#6223

|

Senior Member

5,474 posts Joined: Feb 2009 |

QUOTE(john123x @ Aug 4 2025, 03:08 PM) Maybank SG app offline? Mine is also the same.It shows error FEUI02 error, then show "service is not available" error its frustrating to unable to access account. john123x liked this post

|

|

|

Aug 6 2025, 01:28 AM Aug 6 2025, 01:28 AM

|

Senior Member

3,019 posts Joined: Oct 2005 |

|

|

|

Aug 6 2025, 08:53 AM Aug 6 2025, 08:53 AM

|

Senior Member

7,349 posts Joined: Aug 2015 |

QUOTE(john123x @ Aug 6 2025, 01:28 AM) I managed to find our why. Likely new implementation. Wasn't facing this issue before. Why would they do this though. Don't see this being implemented in any of the MY banking apps.Maybank SG app is implementing country IP block I use VPN Singapore and managed to login!!!! |

|

|

Aug 6 2025, 08:59 AM Aug 6 2025, 08:59 AM

Show posts by this member only | IPv6 | Post

#6226

|

Senior Member

5,474 posts Joined: Feb 2009 |

|

|

|

|

|

|

Aug 6 2025, 09:07 AM Aug 6 2025, 09:07 AM

Show posts by this member only | IPv6 | Post

#6227

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

|

|

|

Aug 6 2025, 09:36 AM Aug 6 2025, 09:36 AM

|

Senior Member

3,485 posts Joined: Jan 2003 |

i asked a friend who registered last month with MBB sg to login in app. he can still login from malaysia

|

|

|

Aug 6 2025, 01:13 PM Aug 6 2025, 01:13 PM

|

Senior Member

3,019 posts Joined: Oct 2005 |

QUOTE(Medufsaid @ Aug 6 2025, 09:36 AM) i asked a friend who registered last month with MBB sg to login in app. he can still login from malaysia you are right. Here is result of research, Ironically, its offtopic involves broadbandUnifi WIFI with Cloudflare 1.1.1.1 DNS = Cant Login. Need VPN SG to login DIGI Mobile Data = Can Login I suspect Unifi IP got blocked by Maybank SG I apologize if I cause any unnecessary panic This post has been edited by john123x: Aug 6 2025, 01:21 PM |

|

|

Aug 7 2025, 10:03 PM Aug 7 2025, 10:03 PM

|

Senior Member

1,550 posts Joined: Feb 2013 |

Hmmm I use this 2 for my MBB SG app.

TIME wifi. Same error can’t login. Maxis data. Successfully login. |

|

|

Aug 15 2025, 09:00 PM Aug 15 2025, 09:00 PM

Show posts by this member only | IPv6 | Post

#6231

|

Senior Member

1,401 posts Joined: Apr 2012 |

Need some helpful advice here. My plan was to open a UOB One Account in Singapore, however it seems to require my EP card, which I can only possibly have a few days after I start work (work start date + processing time). So, I would not have an SG bank for approximately my first two weeks there.

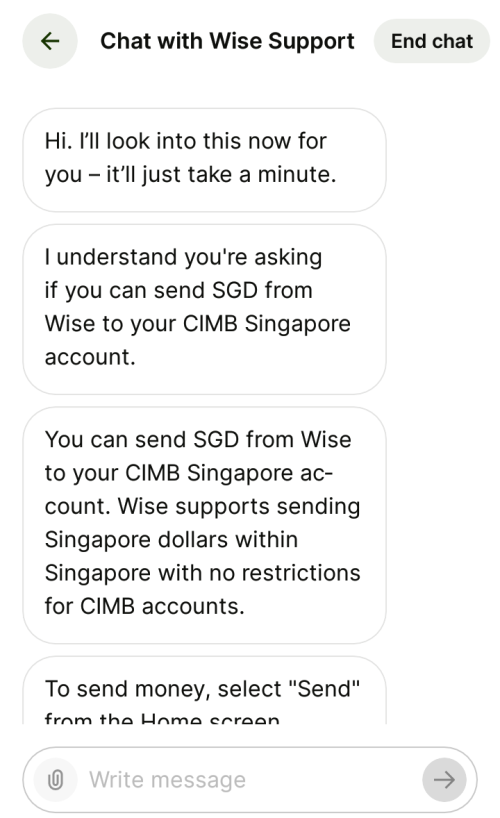

I thought about just fully bringing cash and then depositing when the UOB bank account can finally be open, but seems rather inconvenient and a bit dangerous. Another option could be just setting up WISE, bank transfer to WISE, and then transferring SGD to my bank account when it's open. Then there is also CIMB, technically I can open both CIMB MY and CIMB SG online before setting foot in SG. Conversion cost seem cheaper to compared to the others (MYR>SGD). Correct me if I'm wrong, the accounts are Malaysia (CIMB Basic Savings Account) and Singapore (CIMB FastSaver Account)? Do I open these two together at the same time, or perhaps open one first, and through the app/website I can open the other? |

|

|

Aug 15 2025, 09:54 PM Aug 15 2025, 09:54 PM

|

Senior Member

3,485 posts Joined: Jan 2003 |

SwarmTroll scroll back. you totally forgot about MBB SG and OCBC SG. which allows u to get debit cards before setting foot into sg. CIMB SG is an ATM card. not even a real debit card problem with wise is, the debit card only allows 2 free monthly withdrawals. up to RM1,000 total https://wise.com/my/pricing/card-fees?sourc...SGD&track=false SwarmTroll liked this post

|

|

|

Aug 15 2025, 10:08 PM Aug 15 2025, 10:08 PM

Show posts by this member only | IPv6 | Post

#6233

|

Senior Member

1,401 posts Joined: Apr 2012 |

QUOTE(Medufsaid @ Aug 15 2025, 09:54 PM) SwarmTroll scroll back. you totally forgot about MBB SG and OCBC SG. which allows u to get debit cards before setting foot into sg. CIMB SG is an ATM card. not even a real debit card Ah, I didn't consider MBB SG and OCBC SG because my intention was to open a UOB One Account (just pending the limitation of waiting for EP to be issued). The issue is more like when I'm there for first 2-3 weeks without a bank so I'm holding hard cash.problem with wise is, the debit card only allows 2 free monthly withdrawals. up to RM1,000 total https://wise.com/my/pricing/card-fees?sourc...SGD&track=false Ah CIMB SG is not a debit card, so that also means there is no QR payment function in their banking app to pay for stuff I reckon. Would WISE be an option? I wouldn't need to worry about withdrawals since It's more like a temporary measure until I get my UOB account open in SG. |

|

|

|

|

|

Aug 15 2025, 10:15 PM Aug 15 2025, 10:15 PM

|

Senior Member

3,485 posts Joined: Jan 2003 |

SwarmTroll u can close MBB SG 6 months after opening so just "use" them for the first 2-3 weeks CIMB SG has PayNow QR function. to open CIMB sg u need to deposit SGD1,000 from banks (wise is not considered a valid bank by CIMB). Either option below

I think wise is ok if you just use it as a card without withdrawal. take note that Wise Debit card will incur S$0.60 daily surcharge if u use for public transport as it'll be registered as a foreign card, unless u use SMRT stored value card This post has been edited by Medufsaid: Aug 15 2025, 11:04 PM SwarmTroll liked this post

|

|

|

Aug 16 2025, 02:32 AM Aug 16 2025, 02:32 AM

Show posts by this member only | IPv6 | Post

#6235

|

Senior Member

1,401 posts Joined: Apr 2012 |

QUOTE(Medufsaid @ Aug 15 2025, 10:15 PM) SwarmTroll u can close MBB SG 6 months after opening so just "use" them for the first 2-3 weeks The fees/cost to transfer from MBB MY to MBB SG also quite high cause their exchange rate is pretty bad. Initial deposit is 500 SGD which I think they require transfer direct from MBB MY.CIMB SG has PayNow QR function. to open CIMB sg u need to deposit SGD1,000 from banks (wise is not considered a valid bank by CIMB). Either option below

I think wise is ok if you just use it as a card without withdrawal. take note that Wise Debit card will incur S$0.60 daily surcharge if u use for public transport as it'll be registered as a foreign card, unless u use SMRT stored value card Perhaps I'll bring some amount in cash and the rest will be in WISE, which I can use the debit card there, and then transfer to my UOB Account once its ready. |

|

|

Aug 16 2025, 07:53 AM Aug 16 2025, 07:53 AM

Show posts by this member only | IPv6 | Post

#6236

|

Senior Member

5,474 posts Joined: Feb 2009 |

QUOTE(SwarmTroll @ Aug 16 2025, 02:32 AM) The fees/cost to transfer from MBB MY to MBB SG also quite high cause their exchange rate is pretty bad. Initial deposit is 500 SGD which I think they require transfer direct from MBB MY. I used Wise to to transfer money to MBB SG as initial deposit.Perhaps I'll bring some amount in cash and the rest will be in WISE, which I can use the debit card there, and then transfer to my UOB Account once its ready. SwarmTroll liked this post

|

|

|

Aug 16 2025, 08:20 AM Aug 16 2025, 08:20 AM

|

Senior Member

3,485 posts Joined: Jan 2003 |

QUOTE(SwarmTroll @ Aug 16 2025, 02:32 AM) The fees/cost to transfer from MBB MY to MBB SG also quite high cause their exchange rate is pretty bad. once you open MBB sg you have access to Duitnow Overseas Transfer which is cheaper than Wise MYR->SGD (during office hours). use that to send initial deposit» Click to show Spoiler - click again to hide... « This post has been edited by Medufsaid: Aug 16 2025, 09:17 AM SwarmTroll liked this post

|

|

|

Aug 16 2025, 11:23 AM Aug 16 2025, 11:23 AM

Show posts by this member only | IPv6 | Post

#6238

|

Senior Member

1,401 posts Joined: Apr 2012 |

QUOTE(Medufsaid @ Aug 16 2025, 08:20 AM) once you open MBB sg you have access to Duitnow Overseas Transfer which is cheaper than Wise MYR->SGD (during office hours). use that to send initial deposit Ooohhh I see, even sending back from MBB SG to MBB MY seems not too far off compared to CIMB method.» Click to show Spoiler - click again to hide... « I was looking at i-Savvy Savings but I noticed you shared the Ar Rihla Regular Savings. Seems to be the same, but Ar Rihla has a minimum amount of 200 SGD compared to iSavvy's 500 SGD. Interest paid is also at discretion of the bank and need to have minimum deposit of 50 SGD per month. But iSavvy's 0.05% and then 0.60% for above 10k SGD isn't much better off either lmao. Other than that am I missing something? Seems I still have access to the app in SG for PayNow and also have the debit card. Function wise it seems the same. |

|

|

Aug 16 2025, 11:44 AM Aug 16 2025, 11:44 AM

|

Senior Member

3,485 posts Joined: Jan 2003 |

QUOTE(SwarmTroll @ Aug 16 2025, 11:23 AM) Interest paid is also at discretion of the bank and need to have minimum deposit of 50 SGD per month. you might not get hibah if you close under 1 year https://www.maybank2u.com.sg/iwov-resources...lar-Savings.pdf QUOTE The bonus (if declared) is usually credited into your account on the first calendar day after the end of each 12-month cycle. QUOTE yes, been using Ar-Rihla last year until now, wasn't charged any fees at all and have maintained SGD $200 in that account This post has been edited by Medufsaid: Aug 16 2025, 11:48 AM SwarmTroll liked this post

|

|

|

Aug 16 2025, 11:56 AM Aug 16 2025, 11:56 AM

Show posts by this member only | IPv6 | Post

#6240

|

Senior Member

1,401 posts Joined: Apr 2012 |

QUOTE(Medufsaid @ Aug 16 2025, 11:44 AM) you might not get hibah if you close under 1 year https://www.maybank2u.com.sg/iwov-resources...lar-Savings.pdf I see lol. Well it's mostly to be used as a foothold before I open the UOB One Account. Maybe I'll use it to transfer money back to MBB MY if the rates are as competitive as CIMB. Minimum 200 SGD is better than iSavvy.Other functions and features seem no different to iSavvy. I think I'll just apply for this then. Thanks Medufsaid. This post has been edited by SwarmTroll: Aug 16 2025, 11:57 AM |

| Change to: |  0.0211sec 0.0211sec

0.41 0.41

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 09:29 PM |