OCBC shareholders looking at more earnings here lol

Nice one! I am gonna open OCBC SG account soon too.

This post has been edited by TOS: Jul 26 2023, 11:23 AM

Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Jul 26 2023, 11:23 AM Jul 26 2023, 11:23 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

OCBC shareholders looking at more earnings here lol

Nice one! I am gonna open OCBC SG account soon too. This post has been edited by TOS: Jul 26 2023, 11:23 AM |

|

|

|

|

|

Jul 26 2023, 12:43 PM Jul 26 2023, 12:43 PM

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(markedestiny @ Jul 26 2023, 10:21 AM) I read from its website that for Statement Savings Account, the min is Sgd1k, not 20k, min fee is sgd2 if below. There's discrepancy between the T&C and some pages on ocbc website.There is no min below fee for Global Savings Account tho, but you don't get interest if fall below min deposit sums for foreign currencies you keep there. Btw can we choose which accounts to apply or the two accounts above are the only ones eligible for Msian applying online? Edited for clarity and to add: What are the verifying docs you submitted besides your ID IC/passport? Statement Savings Account minimum balance and minimum deposit for non-resident based on T&C is 20k, but the app only requires 1k. Is the 20k minimum balance imposed only after one year, and waive before that? Looks like it. If ocbc treat Malaysians as non resident. But what if ocbc treats Malaysians as residents and therefore only 1k required? I have no idea. Ocbc would know best. To be safe, just apply for other accounts where the minimum balance is a lot less, and there's no different category for non-residents. Only IC and Passport is required. They only give the 2 accounts at first, you are free to apply any other accounts once application approved and u have access to online banking. This post has been edited by Mr Gray: Jul 26 2023, 12:46 PM |

|

|

Jul 26 2023, 02:37 PM Jul 26 2023, 02:37 PM

|

Junior Member

764 posts Joined: May 2018 |

QUOTE(Mr Gray @ Jul 26 2023, 12:43 PM) There's discrepancy between the T&C and some pages on ocbc website. The links below are quite clear on the requirements.Statement Savings Account minimum balance and minimum deposit for non-resident based on T&C is 20k, but the app only requires 1k. Is the 20k minimum balance imposed only after one year, and waive before that? Looks like it. If ocbc treat Malaysians as non resident. But what if ocbc treats Malaysians as residents and therefore only 1k required? I have no idea. Ocbc would know best. To be safe, just apply for other accounts where the minimum balance is a lot less, and there's no different category for non-residents. Only IC and Passport is required. They only give the 2 accounts at first, you are free to apply any other accounts once application approved and u have access to online banking. See this link for the Statement Savings Account: https://www.ocbc.com/personal-banking/depos...savings-account See below for Global Savings Account: https://www.ocbc.com/personal-banking/depos...nt?qualtric=faq Why do you think there is discrepancies in the above vs T&C on the mobile application? The bank explicitly told you so in your application? For eg, need to maintain SGD20K after one year? Whether if OCBC have made the waivers to waive off the requirements for valid Employment/Student Pass (for foreigners) and also waive off submission of the following Additional document: Include any one of the following documents that shows your residential address Phone bill Half-yearly CPF statement Any bank statement Btw your intention of closing the accounts and then apply for others are subjected to the bank's T&C, they can refuse as per their terms. |

|

|

Jul 26 2023, 02:40 PM Jul 26 2023, 02:40 PM

Show posts by this member only | IPv6 | Post

#4764

|

Senior Member

2,318 posts Joined: Dec 2012 |

I had opened OCBC SG MBB SG CIMB SG as well. Nice!

|

|

|

Jul 26 2023, 02:46 PM Jul 26 2023, 02:46 PM

|

Junior Member

764 posts Joined: May 2018 |

|

|

|

Jul 26 2023, 03:40 PM Jul 26 2023, 03:40 PM

Show posts by this member only | IPv6 | Post

#4766

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(markedestiny @ Jul 26 2023, 02:37 PM) The links below are quite clear on the requirements. Fees & Charges document here https://www.ocbc.com/iwov-resources/sg/ocbc...icing-guide.pdfSee this link for the Statement Savings Account: https://www.ocbc.com/personal-banking/depos...savings-account See below for Global Savings Account: https://www.ocbc.com/personal-banking/depos...nt?qualtric=faq Why do you think there is discrepancies in the above vs T&C on the mobile application? The bank explicitly told you so in your application? For eg, need to maintain SGD20K after one year? Whether if OCBC have made the waivers to waive off the requirements for valid Employment/Student Pass (for foreigners) and also waive off submission of the following Additional document: Include any one of the following documents that shows your residential address Phone bill Half-yearly CPF statement Any bank statement Btw your intention of closing the accounts and then apply for others are subjected to the bank's T&C, they can refuse as per their terms. It clearly stated SGD20k initial deposit. No mention of waiver of this SGD20k deposit. And it stated SGD20k minimum balance, this is waived for the first year. But after signing up via the app, the app only ask to deposit SGD1k. Understand where I'm coming from?  ceo684 liked this post

|

|

|

|

|

|

Jul 26 2023, 04:16 PM Jul 26 2023, 04:16 PM

|

Junior Member

764 posts Joined: May 2018 |

QUOTE(Mr Gray @ Jul 26 2023, 03:40 PM) Fees & Charges document here https://www.ocbc.com/iwov-resources/sg/ocbc...icing-guide.pdf Appreciate your response, this is much clearer. Thanks.It clearly stated SGD20k initial deposit. No mention of waiver of this SGD20k deposit. And it stated SGD20k minimum balance, this is waived for the first year. But after signing up via the app, the app only ask to deposit SGD1k. Understand where I'm coming from?  |

|

|

Jul 26 2023, 04:18 PM Jul 26 2023, 04:18 PM

|

Senior Member

3,022 posts Joined: Oct 2005 |

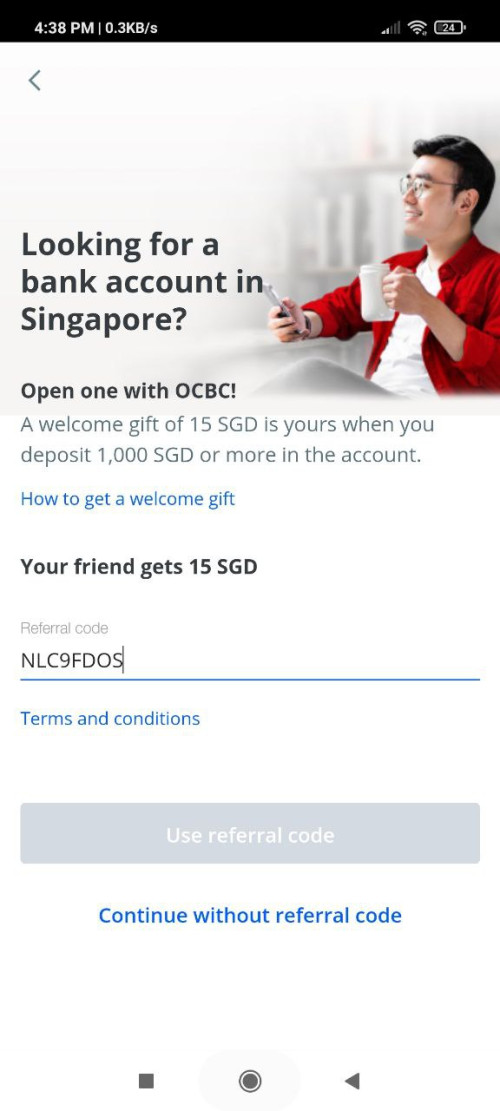

» Click to show Spoiler - click again to hide... « thanks, i will give it a try and i will definitely will use your referral code. hopefully this will work for me EDIT: EDIT2: the referral code work, but it must be all caps, and then you must press "Terms and Conditions" and read tnc, then it work This post has been edited by john123x: Jul 26 2023, 05:04 PM |

|

|

Jul 26 2023, 05:00 PM Jul 26 2023, 05:00 PM

Show posts by this member only | IPv6 | Post

#4769

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(john123x @ Jul 26 2023, 04:18 PM) » Click to show Spoiler - click again to hide... « thanks, i will give it a try and i will definitely will use your referral code. hopefully this will work for me EDIT:  i just want to let you know, the use referral button is grayed out i try all lower case also same |

|

|

Jul 26 2023, 05:11 PM Jul 26 2023, 05:11 PM

|

Senior Member

3,022 posts Joined: Oct 2005 |

del

This post has been edited by john123x: Aug 29 2023, 06:54 PM |

|

|

Jul 26 2023, 05:14 PM Jul 26 2023, 05:14 PM

Show posts by this member only | IPv6 | Post

#4771

|

Senior Member

926 posts Joined: Aug 2013 |

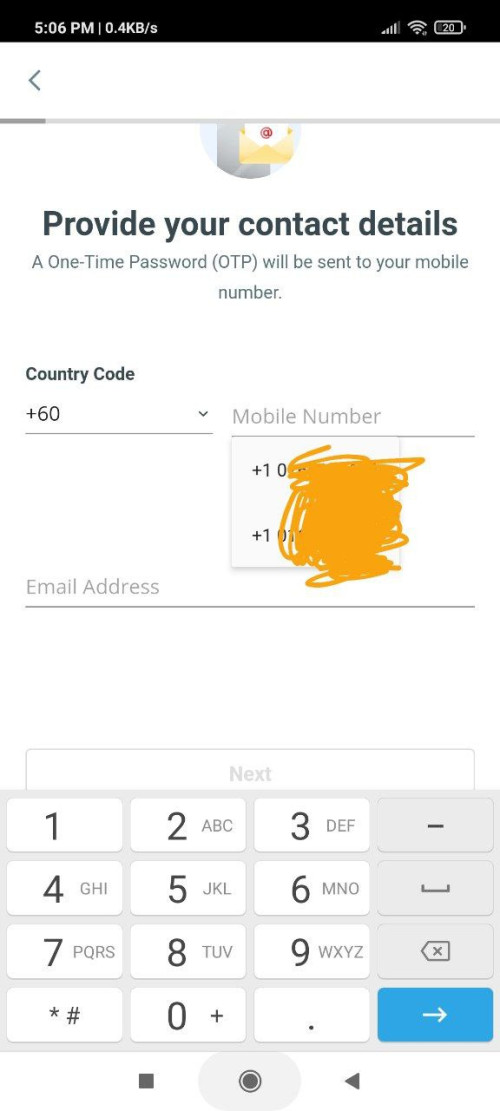

QUOTE(john123x @ Jul 26 2023, 05:11 PM) the referral code work, but it must be all caps, and then you must press "Terms and Conditions" and read tnc, then it work It's probably your phone. I have no such problem with Sony Xperia. Maybe try uninstall and reinstall app?next problem is this part.  keypad doesnt work, and if i select also it does nothing. my life is hard mode. everything i do in my life seems more harder than normal folks. my phone is poco x3 nfc, and i already restarted my phone, still the same This post has been edited by Mr Gray: Jul 26 2023, 05:15 PM |

|

|

Jul 26 2023, 05:24 PM Jul 26 2023, 05:24 PM

|

Senior Member

3,022 posts Joined: Oct 2005 |

QUOTE(Mr Gray @ Jul 26 2023, 05:14 PM) It's probably your phone. I have no such problem with Sony Xperia. Maybe try uninstall and reinstall app? your right. i also would like to advise everyone to stay away from xiaomi phone. the phone may be cheap, but it could ruin your life when you need to use a mission critical app. xiaomi is cheap because the user is the product... |

|

|

Jul 26 2023, 08:07 PM Jul 26 2023, 08:07 PM

|

Junior Member

102 posts Joined: Oct 2017 |

QUOTE(Mr Gray @ Jul 26 2023, 12:43 PM) There's discrepancy between the T&C and some pages on ocbc website. So when we apply at the app, we maximum only can apply 2 account includes statement saving account and another one account we choose ourself? Then after 6 month we close the statement saving account right?? Statement Savings Account minimum balance and minimum deposit for non-resident based on T&C is 20k, but the app only requires 1k. Is the 20k minimum balance imposed only after one year, and waive before that? Looks like it. If ocbc treat Malaysians as non resident. But what if ocbc treats Malaysians as residents and therefore only 1k required? I have no idea. Ocbc would know best. To be safe, just apply for other accounts where the minimum balance is a lot less, and there's no different category for non-residents. Only IC and Passport is required. They only give the 2 accounts at first, you are free to apply any other accounts once application approved and u have access to online banking. |

|

|

|

|

|

Jul 26 2023, 08:08 PM Jul 26 2023, 08:08 PM

|

Junior Member

102 posts Joined: Oct 2017 |

|

|

|

Jul 26 2023, 08:14 PM Jul 26 2023, 08:14 PM

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(lyyera96 @ Jul 26 2023, 08:07 PM) So when we apply at the app, we maximum only can apply 2 account includes statement saving account and another one account we choose ourself? Then after 6 month we close the statement saving account right?? :thumbsup: During application, ocbc will give 2 accounts. You cannot choose. These 2 are Statement Savings Account SSA and the Global Savings Account GSA. Immediately after that, you will have access to ocbc online banking. Then u can add any other ocbc accounts that u want. Yes can close SSA after 6 month without charge. This post has been edited by Mr Gray: Jul 26 2023, 08:15 PM |

|

|

Jul 26 2023, 09:13 PM Jul 26 2023, 09:13 PM

Show posts by this member only | IPv6 | Post

#4776

|

Junior Member

313 posts Joined: Mar 2010 From: Kuala Lumpur |

QUOTE(joeblow @ Jul 22 2023, 06:28 PM) Thanks for the info. So the audit is done by Sunway and CIMB SG, not BNM or LHDN right? Actually I don't know what Sunway can do since a bank statement doesn't tell anything much. I fear more from BNM or LHDN, though I have been audited by LHDN twice. Just want to avoid the trouble. According to foreign exchange act, as a resident individual with ringgit borrowing you are allowed to transfer uo to RM1m in aggregate to overseas, anything above requires BNM approval. Ringgit borrowing is defined having more than 1 housing loan, 1 hire purchase loan and 1 credit card each.Yes ringgit is on downtrend. But so is vietnam dong, thai baht, indo rupiah 10 or 20 years ago. All recovered to perform better than Malaysia. Let's keep the faith eventually Ringgit will go back up... But my plan eventually is to move fund out from 75% Malaysia 25% to overseas to more 50% 50%. |

|

|

Jul 26 2023, 09:51 PM Jul 26 2023, 09:51 PM

Show posts by this member only | IPv6 | Post

#4777

|

|

Staff

5,568 posts Joined: Jan 2003 From: the lack of sleep |

QUOTE(ky33li @ Jul 26 2023, 09:13 PM) According to foreign exchange act, as a resident individual with ringgit borrowing you are allowed to transfer uo to RM1m in aggregate to overseas, anything above requires BNM approval. Ringgit borrowing is defined having more than 1 housing loan, 1 hire purchase loan and 1 credit card each. Slight correction there on the credit card. It is not just 1 credit card. It is any credit card facilities for retail purchasing. So the amount of credit cards you have does not matter as they all fall under credit card facilities.Domestic ringgit borrowing refers to any ringgit advance, loan, trade financing, hire purchase, factoring, leasing facilities, redeemable preference shares or similar facility in whatever name or form, except: •Trade credit terms extended by a supplier for all types of goods and services; •Forward exchange contracts entered into with licensed onshore banks; •One personal housing loan and one vehicle loan obtained from residents; •Credit card and charge card facilities; and •Inter-company borrowing within a corporate group in Malaysia. TOS liked this post

|

|

|

Jul 28 2023, 10:09 AM Jul 28 2023, 10:09 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(TOS @ Jun 5 2023, 11:11 PM) Just to inform Maybank SG users to check if there are any fraudulent/unauthorized transactions with your debit cards. Called Maybank SG today. Luckily all "stolen" money has been refunded! I noticed someone stole hundreds of SGD from my account via unauthorized debit card transactions with merchant names like MyPerfectResume.com and BLS*MYHeritageLtd. Have to call Maybank SG Customer Rep. to deactivate my debit card and now need to submit a dispute resolution form to claim back my money... If the "stolen" amount is small (e.g. 5 SGD), no email notification will be sent, but if the amount is large, e.g. hundreds of SGDs in one go, then that will trigger an email to your account. So, it's best to login and check your account often. You can close your Maybank SG account from any branch within SG, no need to go to the HQ in Marina Bay. Just bring along passport, Malaysia IC, and the debit card issued by Maybank. |

|

|

Jul 28 2023, 10:13 AM Jul 28 2023, 10:13 AM

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(TOS @ Jul 28 2023, 10:09 AM) Called Maybank SG today. Luckily all "stolen" money has been refunded! Good, also, are you planning to travel to Singapore just for the purpose of closing the account? If yes, it'll be the same as taking the recovered funds and spending it again, this time for yourselfYou can close your Maybank SG account from any branch within SG, no need to go to the HQ in Marina Bay. Just bring along passport, Malaysia IC, and the debit card issued by Maybank. |

|

|

Jul 28 2023, 10:15 AM Jul 28 2023, 10:15 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(moonsatelite @ Jul 28 2023, 10:13 AM) Good, also, are you planning to travel to Singapore just for the purpose of closing the account? If yes, it'll be the same as taking the recovered funds and spending it again, this time for yourself I am coming to SG to study... Once I obtain my student pass, will open OCBC monthly savings account, dollardex (for Fullerton SGD cash fund), and ICBC SG (3-month FD always looks attractive compared to others). |

| Change to: |  0.0447sec 0.0447sec

0.99 0.99

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 07:35 PM |