Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

ccschua

|

Jul 8 2023, 11:14 AM Jul 8 2023, 11:14 AM

|

|

Finally I completed the singappore CIMB account, took me 2 weeks.

cimb bank request quite some documents from me. I transfer to new cimb sg acc via ocbc sg account, wise is not accepted.

now need to link sg acc with msia via via their sg cimb clicks.

|

|

|

|

|

|

Mr Gray

|

Jul 8 2023, 01:17 PM Jul 8 2023, 01:17 PM

|

|

QUOTE(ccschua @ Jul 8 2023, 11:14 AM) Finally I completed the singappore CIMB account, took me 2 weeks. cimb bank request quite some documents from me. I transfer to new cimb sg acc via ocbc sg account, wise is not accepted. now need to link sg acc with msia via via their sg cimb clicks. How did u open OCBC SG account? |

|

|

|

|

|

ccschua

|

Jul 8 2023, 01:23 PM Jul 8 2023, 01:23 PM

|

|

just read a few threads before this. you will find it.

|

|

|

|

|

|

Mr Gray

|

Jul 9 2023, 07:07 AM Jul 9 2023, 07:07 AM

|

|

QUOTE(ccschua @ Jul 8 2023, 01:23 PM) just read a few threads before this. you will find it. Sorry. I 've searched both your posts and this thread. Couldn't find it U mentioned that u are not SG PR or working/studying in SG, yet u have OCBC SG, so I wonder how did u do that. Because as far as I know, ocbc sg needs work permit. I already have maybank SG and cimb sg This post has been edited by Mr Gray: Jul 9 2023, 07:11 AM |

|

|

|

|

|

Ramjade

|

Jul 9 2023, 11:06 AM Jul 9 2023, 11:06 AM

|

|

QUOTE(Mr Gray @ Jul 9 2023, 07:07 AM) Sorry. I 've searched both your posts and this thread. Couldn't find it U mentioned that u are not SG PR or working/studying in SG, yet u have OCBC SG, so I wonder how did u do that. Because as far as I know, ocbc sg needs work permit. I already have maybank SG and cimb sg If you got huge money, no issue. They will turn you away. If you are peasant like me, yes no hope. |

|

|

|

|

|

ccschua

|

Jul 9 2023, 11:10 AM Jul 9 2023, 11:10 AM

|

|

QUOTE(Mr Gray @ Jul 9 2023, 07:07 AM) Sorry. I 've searched both your posts and this thread. Couldn't find it U mentioned that u are not SG PR or working/studying in SG, yet u have OCBC SG, so I wonder how did u do that. Because as far as I know, ocbc sg needs work permit. I already have maybank SG and cimb sg I thot u refer to CIMB sg acc. so its OCBC Sg account. I opened my ocsbc sg long ago while i am still in singapore. This post has been edited by ccschua: Jul 9 2023, 11:11 AM |

|

|

|

|

|

Mr Gray

|

Jul 9 2023, 03:18 PM Jul 9 2023, 03:18 PM

|

|

QUOTE(Ramjade @ Jul 9 2023, 11:06 AM) If you got huge money, no issue. They will turn you away. If you are peasant like me, yes no hope. Seems like we can. My passport has less than 6 month maturity though, got an error message when trying to do that. The apps says need passport more than 6 month validity. You may try. It should work I think. Need to renew my passport then try again This post has been edited by Mr Gray: Jul 9 2023, 03:19 PM |

|

|

|

|

|

elea88

|

Jul 9 2023, 03:23 PM Jul 9 2023, 03:23 PM

|

|

QUOTE(Mr Gray @ Jul 9 2023, 03:18 PM) https://www.ocbc.com/group/media/release/20...foreigners.pageSeems like we can. My passport has less than 6 month maturity though, got an error message when trying to do that. The apps says need passport more than 6 month validity. You may try. It should work I think. Need to renew my passport then try again for those relocating to sg |

|

|

|

|

|

Mr Gray

|

Jul 9 2023, 03:52 PM Jul 9 2023, 03:52 PM

|

|

QUOTE(elea88 @ Jul 9 2023, 03:23 PM) for those relocating to sg They don't really ask for any proof for that. Just require passport and IC |

|

|

|

|

|

!@#$%^

|

Jul 9 2023, 05:47 PM Jul 9 2023, 05:47 PM

|

|

QUOTE(Mr Gray @ Jul 9 2023, 03:18 PM) https://www.ocbc.com/group/media/release/20...foreigners.pageSeems like we can. My passport has less than 6 month maturity though, got an error message when trying to do that. The apps says need passport more than 6 month validity. You may try. It should work I think. Need to renew my passport then try again QUOTE(Mr Gray @ Jul 9 2023, 03:52 PM) They don't really ask for any proof for that. Just require passport and IC keep us posted on ur journey |

|

|

|

|

|

Ramjade

|

Jul 9 2023, 05:49 PM Jul 9 2023, 05:49 PM

|

|

QUOTE(Mr Gray @ Jul 9 2023, 03:18 PM) https://www.ocbc.com/group/media/release/20...foreigners.pageSeems like we can. My passport has less than 6 month maturity though, got an error message when trying to do that. The apps says need passport more than 6 month validity. You may try. It should work I think. Need to renew my passport then try again DBS > OCBC. OCBC got no good multicurrency acocunt. If got also need to lock up sgd3k. |

|

|

|

|

|

alex_00787

|

Jul 10 2023, 03:15 PM Jul 10 2023, 03:15 PM

|

New Member

|

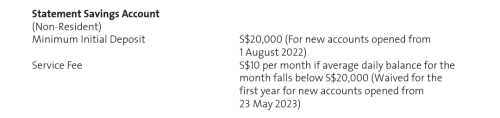

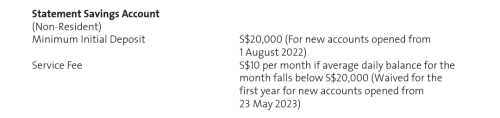

QUOTE(Mr Gray @ Jul 9 2023, 03:18 PM) https://www.ocbc.com/group/media/release/20...foreigners.pageSeems like we can. My passport has less than 6 month maturity though, got an error message when trying to do that. The apps says need passport more than 6 month validity. You may try. It should work I think. Need to renew my passport then try again https://www.ocbc.com/personal-banking/digit...nk-account.pageNeed minimum balance SGD 20k |

|

|

|

|

|

Mr Gray

|

Jul 10 2023, 09:16 PM Jul 10 2023, 09:16 PM

|

|

QUOTE(alex_00787 @ Jul 10 2023, 03:15 PM) You're absolutely right. Hmm, only for the rich then.  |

|

|

|

|

|

clon12

|

Jul 11 2023, 09:05 PM Jul 11 2023, 09:05 PM

|

|

Hi all,

I am interested to open a SG bank account and after reading the recent posts, I am leaning towards opening the CIMB SG account despite the lengthy process. However, I still have some questions before proceeding.

1. Is the rate (SGD to MYR) really better on CIMB than Maybank? I couldn't find the forex rate on Maybank SG site to compare, though I read on this forum that most suggests CIMB SG has better rate.

2. What is the max amount per transaction for CIMB SG to CIMB MY and Maybank SG to Maybank MY?

3. Can I use the CIMB SG account to pay bills (e.g. insurance) via CIMB Clicks?

Thanks in advance.

|

|

|

|

|

|

Ramjade

|

Jul 11 2023, 11:36 PM Jul 11 2023, 11:36 PM

|

|

QUOTE(clon12 @ Jul 11 2023, 09:05 PM) Hi all, I am interested to open a SG bank account and after reading the recent posts, I am leaning towards opening the CIMB SG account despite the lengthy process. However, I still have some questions before proceeding. 1. Is the rate (SGD to MYR) really better on CIMB than Maybank? I couldn't find the forex rate on Maybank SG site to compare, though I read on this forum that most suggests CIMB SG has better rate. 2. What is the max amount per transaction for CIMB SG to CIMB MY and Maybank SG to Maybank MY? 3. Can I use the CIMB SG account to pay bills (e.g. insurance) via CIMB Clicks? Thanks in advance. 1. CIMB SG offer the best rate Vs other banks unless you can get access to fintech like singx. 2. Don't know. 3. Please do not use your sg money to pay your Malaysian bills. Kindly do not put money into Singapore if you keep wanting to bring back money or use the money every month. Money in Singapore is meant to be long term/one way ticket which you can only assess say after 5-10 years. By you keep bringing the money back, the only person to benefit is cimb. |

|

|

|

|

|

clon12

|

Jul 12 2023, 12:12 AM Jul 12 2023, 12:12 AM

|

|

QUOTE(Ramjade @ Jul 11 2023, 11:36 PM) 1. CIMB SG offer the best rate Vs other banks unless you can get access to fintech like singx. 2. Don't know. 3. Please do not use your sg money to pay your Malaysian bills. Kindly do not put money into Singapore if you keep wanting to bring back money or use the money every month. Money in Singapore is meant to be long term/one way ticket which you can only assess say after 5-10 years. By you keep bringing the money back, the only person to benefit is cimb. Thanks for your reply, for my question #3 actually I meant paying for bills in SG. The reason I am opening a SG account is to pay the Singlife insurance as they do not accept Wise payment directly. |

|

|

|

|

|

Ramjade

|

Jul 12 2023, 12:15 AM Jul 12 2023, 12:15 AM

|

|

QUOTE(clon12 @ Jul 12 2023, 12:12 AM) Thanks for your reply, for my question #3 actually I meant paying for bills in SG. The reason I am opening a SG account is to pay the Singlife insurance as they do not accept Wise payment directly. Of course. Just use FAST transfer. Singlife accept FAST transfer. I have asked them. |

|

|

|

|

|

MasBoleh!

|

Jul 17 2023, 05:37 AM Jul 17 2023, 05:37 AM

|

|

QUOTE(Ramjade @ Jun 6 2023, 08:36 AM) I never activate any of my sg cards.  I remember HSBC requires me to activate my debit card before I can login to the dashboard |

|

|

|

|

|

hksgmy

|

Jul 17 2023, 06:22 AM Jul 17 2023, 06:22 AM

|

|

After reading through most of the comments here, I'm now quite keen to open an CIMB SG account (I'm based in Singapore) - and after that, try to open up one in Malaysia.

|

|

|

|

|

|

ccschua

|

Jul 17 2023, 11:17 AM Jul 17 2023, 11:17 AM

|

|

QUOTE(clon12 @ Jul 11 2023, 09:05 PM) Hi all, I am interested to open a SG bank account and after reading the recent posts, I am leaning towards opening the CIMB SG account despite the lengthy process. However, I still have some questions before proceeding. 1. Is the rate (SGD to MYR) really better on CIMB than Maybank? I couldn't find the forex rate on Maybank SG site to compare, though I read on this forum that most suggests CIMB SG has better rate. 2. What is the max amount per transaction for CIMB SG to CIMB MY and Maybank SG to Maybank MY? 3. Can I use the CIMB SG account to pay bills (e.g. insurance) via CIMB Clicks? Thanks in advance. for Item 2, based on the cimb sg screen, the limit is RM 3000 per day. I am not sure if this can be increase. just for info, the rate offer today is 3.4366 while the rate online from google is 3.44. so it seems the rate is quite competitive. the cimb screen is 3.4366, I am not sure if this exc rate is net of all costs or there will be another chanrges/commission. |

|

|

|

|

Jul 8 2023, 11:14 AM

Jul 8 2023, 11:14 AM

Quote

Quote

0.0283sec

0.0283sec

1.39

1.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled