Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

Hoshiyuu

|

Mar 23 2021, 08:51 PM Mar 23 2021, 08:51 PM

|

|

QUOTE(trapezohedron13 @ Mar 23 2021, 08:49 PM) Ya first $1,000 can be from fintech. Wa serious cimb in house so good? No hidden fees kah nope...what i saw was what i get, CIMB even have a "we'll match your rate and refund you the difference if you email us" but probably dont apply to fintech...will try it next time. |

|

|

|

|

|

Ramjade

|

Mar 23 2021, 09:07 PM Mar 23 2021, 09:07 PM

|

|

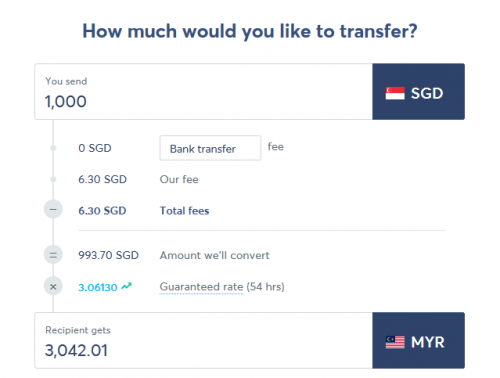

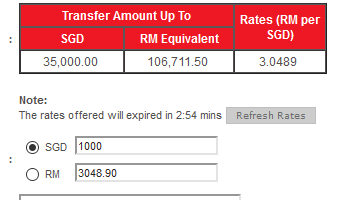

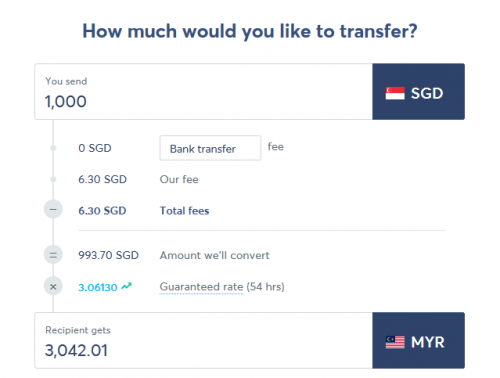

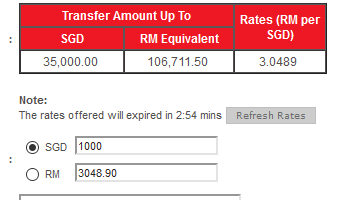

QUOTE(Hoshiyuu @ Mar 21 2021, 06:08 PM) Nope, the 1000 can use fintech for best rates - just need $1 in house for e-KYC Edit: Copy pasted from my reply in other thread- Random midnight snapshot for those curious on how to bring money back from IBKR->CIMBSG->CIMBMY TransferWise:  CIMB SG -> MY self account remit  The CIMB SG->CIMB MY transfer rate is pretty good! For MYR->SGD the usual path is still better. QUOTE(trapezohedron13 @ Mar 23 2021, 08:49 PM) Ya first $1,000 can be from fintech. Wa serious cimb in house so good? No hidden fees kah Keep in mind this is a promo from CIMB SG. Not a permanent feature. They can end it anytime. So far they never end it. They have been extending it everytime. |

|

|

|

|

|

trapezohedron13

|

Mar 23 2021, 11:34 PM Mar 23 2021, 11:34 PM

|

|

Nice.. thanks for the heads up. Indeed the most cost efficient to bring back MYR for whatever reasons

|

|

|

|

|

|

jack2

|

Mar 24 2021, 10:34 AM Mar 24 2021, 10:34 AM

|

|

Which bank is the best in Singapore? I wanna open priority or private banking account

|

|

|

|

|

|

Ramjade

|

Mar 24 2021, 10:41 AM Mar 24 2021, 10:41 AM

|

|

QUOTE(jack2 @ Mar 24 2021, 10:34 AM) Which bank is the best in Singapore? I wanna open priority or private banking account Dbs. With sgd500k you can get access to MTRL loan at 0.85%p.a interest rate. |

|

|

|

|

|

jack2

|

Mar 24 2021, 10:42 AM Mar 24 2021, 10:42 AM

|

|

QUOTE(Ramjade @ Mar 24 2021, 10:41 AM) Dbs. With sgd500k you can get access to MTRL loan at 0.85%p.a interest rate. Don't want DBS. Their CS is suck |

|

|

|

|

|

Ramjade

|

Mar 24 2021, 10:44 AM Mar 24 2021, 10:44 AM

|

|

QUOTE(jack2 @ Mar 24 2021, 10:42 AM) Don't want DBS. Their CS is suck Well they are the one with the lowest interest rate. Depending on what you want. No other banks come close. |

|

|

|

|

|

jack2

|

Mar 24 2021, 10:45 AM Mar 24 2021, 10:45 AM

|

|

QUOTE(Ramjade @ Mar 24 2021, 10:44 AM) Well they are the one with the lowest interest rate. Depending on what you want. No other banks come close. No need loan.. Need the best services... like free coffee hahahahhaha |

|

|

|

|

|

SUSTOS

|

Mar 25 2021, 03:09 PM Mar 25 2021, 03:09 PM

|

|

https://www.businesstimes.com.sg/banking-fi...chard-branch-toQUOTE Business Times Breaking News

CIMB Singapore lays off staff following restructuring exercise; Orchard branch to close

Vivien Shiao

25 March 2021

Business Times Singapore

© 2021 Singapore Press Holdings Limited

CIMB Singapore will be laying off staff and shutting its branch in Orchard Road as part of a restructuring exercise following a review of its business, according to an internal memo seen by The Business Times (BT).

This comes as the bank revises its strategy to emphasise on sustainable growth, in line with the group's vision to be a "leading focused Asean bank", wrote CIMB Singapore's chief executive officer Victor Lee in the memo sent on Tuesday morning.

"This would entail optimising our functional setup, leveraging our group's strengths through regionalisation, and closing our branch in Orchard to fully focus on our main branch in Raffles Place," he wrote in the memo. "These will make us more resilient, more productive and better positioned for growth going forward."

BT has reached out to the bank to find out the number of those affected and which departments they come from. CIMB had about 1,200 staff in the Singapore office.

Mr Lee noted that the bank's efforts to upskill staff since 2020, particularly in digital, data and design, have allowed it to redeploy over 50 colleagues in new growth areas.

"Regrettably, there will be some in our workforce who will be affected by the restructuring," he wrote in the memo. "We will ensure affected staff are informed at the earliest possible date and all efforts will be made to assist them with the transition."

It is understood that all affected staff have been notified.

Mr Lee added that the bank will do its best to support affected staff with the opportunity to apply for other roles within the organisation, on-site career counselling and outplacement services.

For those who are unable to tap the internal job opportunities, they will be offered a "separation package that is in line with the market", said the memo. One source told BT that the payout is one month's pay for every year of service, capped at 12 months.

The retrenchment list was kept secret, and many department heads on Tuesday morning were also not aware of who would be cut. Several departments are believed to have been hit, but there was no official verification by the bank.

The Orchard branch will be closed by end-June, with operations staff there to be affected, while other segments will be offshored, said the source.

In the memo, Mr Lee wrote that the bank does not "foresee any further organisation-wide changes to CIMB Singapore after this exercise" and expressed his appreciation for the contributions made by the affected staff.

"With the group's recalibrated strategy, CIMB Singapore will be positioned as an Asean banking hub for the group with a doubling down on wealth management, SME banking, regional corporates and Treasury & Markets," said the memo.

BT had earlier reported that there has been talk of restructuring within the CIMB Singapore office since the middle of last year.

The bank has seen a wave of management changes in the past few months, with the layoffs of three long-time business heads last November taking the industry by surprise. They have since been replaced by Merlyn Tsai as head of consumer banking, Singapore; Benjamin Tan Wee Chuan as head of commercial banking, Singapore; and Foo Tsiang Wei, head of corporate and investment banking, Singapore.

The group reported dismal full-year results in February, posting a 73.8 per cent drop in net profit to RM1.19 billion (S$387.3 million). This was partly attributed to a spike in oil and gas impairments in Singapore. The Republic was CIMB's only market which saw losses in all three segments of consumer, commercial and wholesale banking for FY20.

Singapore Press Holdings Limited

|

|

|

|

|

|

gunpla student

|

Mar 25 2021, 07:01 PM Mar 25 2021, 07:01 PM

|

Getting Started

|

CIMB very easy and fast.

|

|

|

|

|

|

frostfrench

|

Mar 29 2021, 03:26 PM Mar 29 2021, 03:26 PM

|

|

My CIMB SG bank account was open there around 5 years ago, and went there yearly until 2019, guess cannot go there anymore, cannot travel to SG also  their kopi quite good in their lounge |

|

|

|

|

|

Ladszy

|

Mar 30 2021, 12:04 PM Mar 30 2021, 12:04 PM

|

Getting Started

|

Hmm, received a SMS and email saying my CIMB account is activated but no PIN to access Clicks SG. From what I read in the guides it appears that the PIN would be sent alongside it.

Anyone else having this issue? Just wanted to ask here before I call them.

Edit: Problem solved after a call with them.

This post has been edited by Ladszy: Apr 12 2021, 03:40 PM

|

|

|

|

|

|

lmjoo

|

Mar 30 2021, 01:18 PM Mar 30 2021, 01:18 PM

|

New Member

|

Hi guys,if i have a joint account in CIMB Malaysia account,can use it to link with CIMB Singapore personal saving account?or must personal my-personal sg?

This post has been edited by lmjoo: Mar 30 2021, 02:23 PM

|

|

|

|

|

|

shift

|

Mar 30 2021, 01:24 PM Mar 30 2021, 01:24 PM

|

Getting Started

|

QUOTE(Ladszy @ Mar 30 2021, 12:04 PM) Hmm, received a SMS and email saying my CIMB account is activated but no PIN to access Clicks SG. From what I read in the guides it appears that the PIN would be sent alongside it. Anyone else having this issue? Just wanted to ask here before I call them. U should have received a SMS from 6939* for PIN number & activation instruction on the same day that ur account been activated. |

|

|

|

|

|

roarus

|

Apr 6 2021, 11:15 PM Apr 6 2021, 11:15 PM

|

|

QUOTE(Ladszy @ Mar 30 2021, 12:04 PM) Hmm, received a SMS and email saying my CIMB account is activated but no PIN to access Clicks SG. From what I read in the guides it appears that the PIN would be sent alongside it. Anyone else having this issue? Just wanted to ask here before I call them. The cimb clicks pin is sent in a separate SMS. You can drop CIMB SG an email on this, someone will call you and re-trigger the SMS to you during the call. *Based on experience around Aug 2018 when I opened mine |

|

|

|

|

|

taiping...

|

Apr 13 2021, 11:12 AM Apr 13 2021, 11:12 AM

|

|

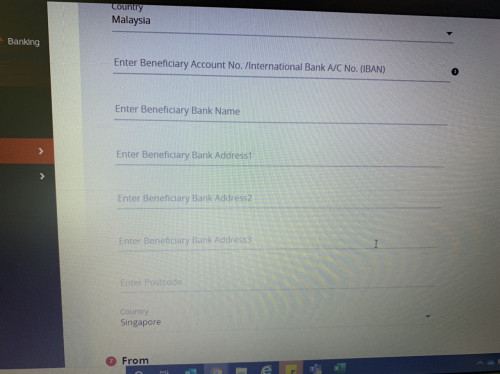

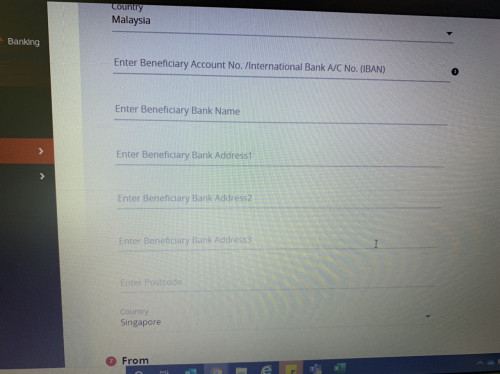

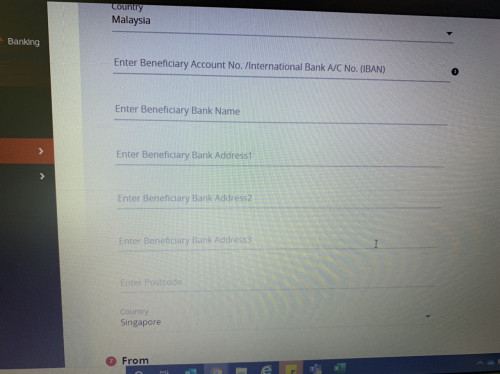

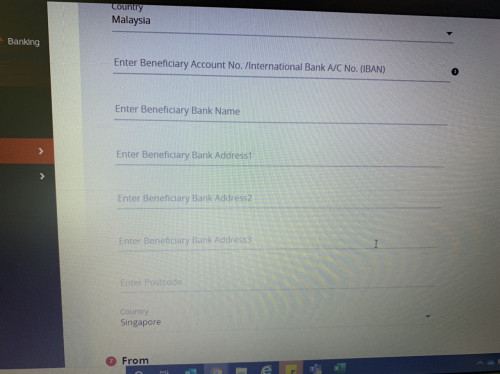

Pls excuse my noobness Am trying to transfer funds from CIMB MY to CIMB SG I went to foreign transfer I cant seem to transfer funds. 3 times already i tried  What do i put here? Bank name n address This post has been edited by taiping...: Apr 13 2021, 11:17 AM |

|

|

|

|

|

tsutsugami86

|

Apr 13 2021, 11:39 AM Apr 13 2021, 11:39 AM

|

|

QUOTE(taiping... @ Apr 13 2021, 11:12 AM) Pls excuse my noobness Am trying to transfer funds from CIMB MY to CIMB SG I went to foreign transfer I cant seem to transfer funds. 3 times already i tried  What do i put here? Bank name n address Just "Pay & Transfer" then choose "Transfer money", then you should able to see your Fastsaver account (if you had link your Sg account) |

|

|

|

|

|

taiping...

|

Apr 13 2021, 11:54 AM Apr 13 2021, 11:54 AM

|

|

QUOTE(tsutsugami86 @ Apr 13 2021, 11:39 AM) Just "Pay & Transfer" then choose "Transfer money", then you should able to see your Fastsaver account (if you had link your Sg account) Thanks so much! |

|

|

|

|

|

fun_feng

|

Apr 13 2021, 03:42 PM Apr 13 2021, 03:42 PM

|

|

QUOTE(lmjoo @ Mar 30 2021, 01:18 PM) Hi guys,if i have a joint account in CIMB Malaysia account,can use it to link with CIMB Singapore personal saving account?or must personal my-personal sg? I tried it... can |

|

|

|

|

|

Ramjade

|

Apr 13 2021, 05:59 PM Apr 13 2021, 05:59 PM

|

|

QUOTE(taiping... @ Apr 13 2021, 11:12 AM) Pls excuse my noobness Am trying to transfer funds from CIMB MY to CIMB SG I went to foreign transfer I cant seem to transfer funds. 3 times already i tried  What do i put here? Bank name n address Already tell you how many time? Do not use bank to transfer Ringgit. |

|

|

|

|

Mar 23 2021, 08:51 PM

Mar 23 2021, 08:51 PM

Quote

Quote

0.0251sec

0.0251sec

0.48

0.48

6 queries

6 queries

GZIP Disabled

GZIP Disabled