QUOTE(TaiGoh @ Sep 21 2021, 08:01 PM)

Wondering you transfer 1k SGD with only CIMB Clicks or together with Wise?

Thinking whether to do it straight with CIMB Clicks or together with BigPay.

Transferring 1k via CIMB Clicks need 3148.80 but BigPay only 3113.01.

Thanks again!

1 SGD for e-KYC from CIMB MY to CIMB SG. Thinking whether to do it straight with CIMB Clicks or together with BigPay.

Transferring 1k via CIMB Clicks need 3148.80 but BigPay only 3113.01.

Thanks again!

1k SGD for minimum deposit from my Maybank SG to CIMB SG (My Maybank SG was opened last year, you can transfer this 1k SGD from CIMB MY/other local MY banks (expensive) or fintech apps/portals like Wise/Instarem/Sunway Money etc. or from an SG bank with your name)

So total for me is 1001 SGD.

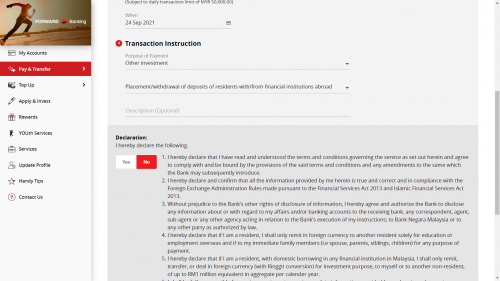

Your observation is correct, banks charge high fees and markup the forex rates. So you should use fintech like BigPay/Wise/Instarem/Sunway Money etc. to do the 1k SGD deposit. Don't use CIMB Clicks MY to transfer the 1k SGD. Gracie mentioned that in her blog too.

In any case, just don't forget about the e-KYC which must be from your CIMB MY account , that one you already did. (For e-KYC 1 SGD is enough, transfer more is also ok, say 1k SGD, but you will lose money like what you have observed above.)

This post has been edited by TOS: Sep 21 2021, 09:06 PM

Sep 21 2021, 09:03 PM

Sep 21 2021, 09:03 PM

Quote

Quote

0.1536sec

0.1536sec

0.15

0.15

7 queries

7 queries

GZIP Disabled

GZIP Disabled