QUOTE(aniza228 @ Feb 22 2021, 11:52 AM)

Hi All..

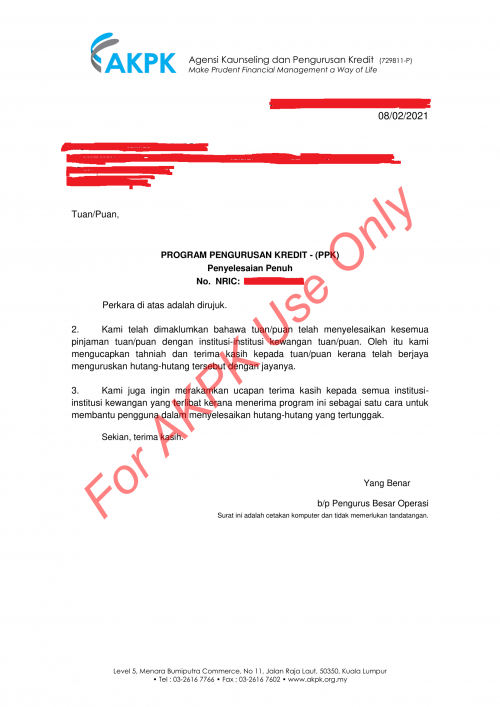

I've just submitted my application to withdraw from AKPK. Being a member since june 2014.

Reason I have some intention to pay one of the biggest loan amount while the rest I shall continue with banks. My expectation the rest hutang will gradually become lesser in shortest time since I keep paying as normal tenure.

Been paying Rm2800 under akpk since 2014. Pre AKPK amount was close to RM5,000

Will need to wait 7 days until AKPK approves my application.

Question :

1. I even called each pf the bank they wont able to reveal the amount owed under this program all subjects to AKPK consent

2. How do I make my "normal" payment pre-akpk again? I have almost couldn remember what was the outstanding amount since some of the bank didn't send me statement anymore

3. What will be the arrangement and rate upon exiting AKPK. Afraid the banks will still imposing me late charges la penalty you know la they have so many reasons to inply anthing when u are not backed up by AKPK.

Anyone has the experience dealing with this

Question :

1. I even called each pf the bank they wont able to reveal the amount owed under this program all subjects to AKPK consent

ANSWER : Call Collection Dept every bank except Standard Chartered (Redemption Dept) ask for actual amount to do earlier settlement.

2. How do I make my "normal" payment pre-akpk again? I have almost couldn remember what was the outstanding amount since some of the bank didn't send me statement anymore

ANSWER : Have you skipped from AKPK ?

3. What will be the arrangement and rate upon exiting AKPK. Afraid the banks will still imposing me late charges la penalty you know la they have so many reasons to inply anthing when u are not backed up by AKPK.

Exit from AKPK once you have make full settlement every banks , they would update automatically and would remove from your akpk dashboard

My experience (most banks sent me release letter within 24 hours except SC took 2 weeks)

1. Call Collection Dept every bank except Standard Chartered (Redemption Dept) ask for actual amount to do earlier settlement.

2. Pay over counter or pay online (depend on their procedure)

3. Inform them once payment has been made

4. Ask for them for release letter via email and original would be posted to your current address.

Normally once full settlement has been paid they would inform AKPK and would remove from your AKPK dashboard

This post has been edited by jiwaman: Feb 22 2021, 01:25 PM

Feb 9 2021, 12:48 AM

Feb 9 2021, 12:48 AM

Quote

Quote

0.1040sec

0.1040sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled