hi, after reading from 1st post til 521st post, I decide to to post and ask for your opinion on my situation.

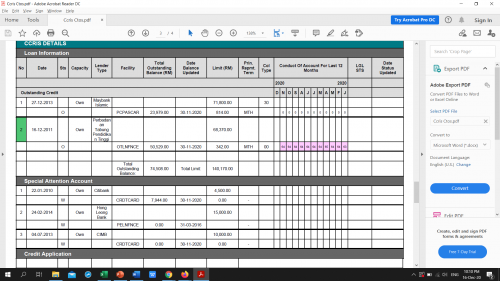

I owe banks on PL and CC about 50k and didn't pay for the last 6 years, didnt bother how much the interest accumulated

and I know there is nothing bad or wrong if go AKPK (most of you concern about getting new loan or CC canceled) , because I am used to live without CC just debit card now so it is fine with me.

However I wont go to AKPK yet which most of the Sifus always say is the last option to go. The reason is I have a house but loan under wife name (but i m the one pay for it on time).

The question is

1) should I refinance the house loan of course under my wife name? since the interest rate is lower.

2) the house bank value is RM100k than when we bought. So shall I take take the avantages to refinance 50k more of the previous loan amount. then I have the extra money then go into the bank direct meet the officer and nego for the discounted amount to settle once and for all. The bank that I owed is HLB, CIMB, MBB and Citibank. Are these banks friendly to give us discount to pay in one lumsum?

after all the sifus reading my situation, does the idea of refinancing can solve the problem?

thanks

This post has been edited by fumi: Dec 14 2020, 10:47 PM

AKPK, debt issue, anyone got a question to ask them?

Dec 14 2020, 10:41 PM

Dec 14 2020, 10:41 PM

Quote

Quote

0.0922sec

0.0922sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled