Outline ·

[ Standard ] ·

Linear+

AKPK, debt issue, anyone got a question to ask them?

|

Sagiez

|

Dec 18 2020, 02:45 PM Dec 18 2020, 02:45 PM

|

New Member

|

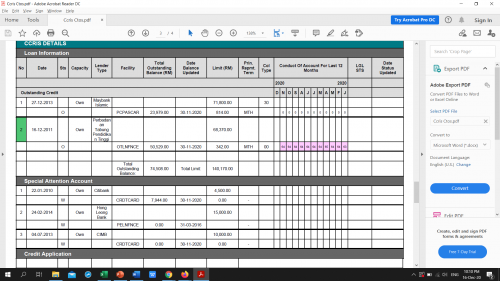

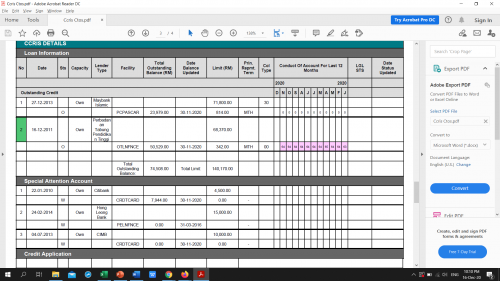

QUOTE(fumi @ Dec 16 2020, 10:12 PM)  and why only show limit on PL (HLB) CC (CIMB) but without the amount of owing them? ya from pic u c , there is no CC from maybank Any loan under special attention accounts, the outstanding balance usually will not shown in CCRIS report. Even when you want to check the balance at the bank counter, they will need to call the collector to know the details. Meaning that bank already passed your account to the collector agent. And although not directly blacklisted, these special attention accounts will be treated as blacklisted by other banks if you want to apply for loans. Banks will never approve your loans as long as those special attention accounts still there. And what worst is you can no longer pay partially to clear your record. Example you only defaulted 5/6 months for each accounts, even if you pay back those 5/6 months in lump sum those accounts will still remain in that special attention account, and will not move back to upper row (normal loan accounts). You have to pay the whole outstanding amounts left in order to clear your CCRIS record. This special attention account also will bring down your credit score to very poor, normally below 400. This post has been edited by Sagiez: Dec 18 2020, 02:46 PM |

|

|

|

|

|

Sagiez

|

Apr 15 2021, 02:05 PM Apr 15 2021, 02:05 PM

|

New Member

|

QUOTE(a_peace1101 @ Apr 15 2021, 12:30 PM) Guys, Sorry want to ask. I had a long time overdue debt with a few banks, I f I start to pay again starting this month, how long will take to clear my name? Can I apply housing loan after 3 month if did not miss the payment? You need to settle all the overdue amount, and start paying without miss from now on. But only after 12 months your record will be clear. Almost impossible to get any loan approved if you have any payment arrears in the last 12 months especially if the number is >2. Have you check your credit score in CTOS? If you not yet register, can just register in the CTOS website so you can check where your credit score stand. From experience, if you have long overdue debt, plus with several banks your credit score might be categorized as poor. Even if you start paying diligently from now on, your credit score will also take times to recover from poor > low > fair > good > very good > excellent. For housing loan, usually your credit score has to be at least in 'good' category to be approved, but still depend on how high your commitments are. |

|

|

|

|

Dec 18 2020, 02:45 PM

Dec 18 2020, 02:45 PM

Quote

Quote 0.0663sec

0.0663sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled