Let's me do some calculations:

Scenario 1: You borrow 400k. BLR is raised for 2%.

Initial monthly instalment: RM 2000

After that: RM2700

Scenario 2: You borrow 200k, BLR is raised for 2%

Initial Instalment: RM1000

After that: RM1350

For scenario 1, those who borrow 400k will have to pay more RM700.

And the problem now is even those with RM3k-5k dare to do this.

Do you think they can give more RM700 permonth? When they leverage to the most?

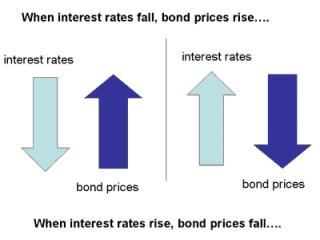

And if BLR is higher, house price will drop, so the rental should also drop.

Now: You have more to pay (RM700) per month and you receive less rental due to more competition to rent out. Then also the house price will drop, means your loan is higher than the asset value.

That's what I worry. do advise on this.

i think, that make sense..especially for those who buy and rent a lot of houses..

Jan 15 2010, 04:47 PM

Jan 15 2010, 04:47 PM Quote

Quote

0.0257sec

0.0257sec

0.35

0.35

6 queries

6 queries

GZIP Disabled

GZIP Disabled