If Malaysia's dependance on exports continues, if the mortgage market continues to provide buyers with cheap money, then this is only the beginning or re-inflation of a local bubble - it will not end well!

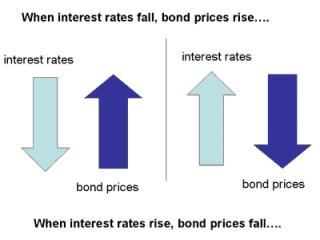

The others who are not in this camp will need to sell, especially when interest rates rise and they are unable to service their loans and/or valuations deminish downpayments.

Watch for another 18-24 months of DEFLATION! Watch for the S&P the next 6-8 weeks for all the downward indicators. Watch for a GREAT UNWIND with very little place to hide in 2010 except the USD Index.

Theme for 2010 - The beginning of second great depression! USD Index 0.825 - 0.88. Dont look to the Bond Market! Dont look to T-Bills or GOLD.

Trades for 2010, stay on the sidelines, buy USD, watch for a dip in GOLD under 1000, sell off property, domestically I can only think of gov bonds and any strong bank and utility "divendend paying" stocks!

[/quote]

such interesting pessimism

the properties which i am watching so far, has only gone up

my pbb epf unit trust advisor, has told me, to wait for the market correction market 6 months ago, but it did not appear

also waiting

in meantime, continuing to rock & roll, go long or short

don't despair! put your money to work in USA

seek & u will find

Dec. 7, 2009, 4:19 p.m.

Inflation will not get out of control, Bernanke promises

U.S. economy on the mend, but has some distance yet to go

By Rex Nutting, MarketWatch

WASHINGTON (MarketWatch) -- When the time comes, the Federal Reserve will raise interest rates to keep inflation under control, Fed Chairman Ben Bernanke said Monday, adding that that time could be far away.

With the U.S. economy still very fragile and unemployment so high, inflation isn't a pressing problem right now, Bernanke said in a talk to a group of economists in Washington.

For now, getting the economy back on its feet is the top priority. "We have come a long way from the darkest period of the crisis, but we have some distance yet to go," Bernanke said, according to the text of his remarks released in Washington. Read Bernanke's speech.

"Significant headwinds remain, including tight credit and a weak job market," he said.

Riding the Rate Roller Coaster

With bonds fully priced, it may be time to swap into preferred shares, utility stocks and other investment that offer protection if interest rates rise, according to Barron's Associate Editor Andrew Bary.

Bernanke's talk was titled "Frequently Asked Questions." The most frequently asked question of the Fed right now is: Will the Fed let inflation get out of hand?

"The answer is no," Bernanke said. "The Fed is committed to keeping inflation low and will be able to do so." However, inflation "appears likely to remain subdued for some time."

Economists said there were few surprises in Bernanke's remarks. "His speech does not change our expectations that the Fed will stay on hold until early 2011," wrote Michael Hanson, an economist for Bank of America's Merrill Lynch.

While there's more chatter among financial market participants about the Fed's first rate hike, most members of the policy-setting Federal Open Market Committee have said it's too early in the recovery to consider higher interest rates.

However, Philadelphia Fed President Charles Plosser said last week that he believed the Fed should raise rates sooner rather than later, citing the danger that inflation would become entrenched before the Fed can withdraw the stimulus. Plosser has no vote on the FOMC until 2011. See full story on Plosser's speech.

Bernanke's remarks broke no new ground; he repeated the message he's been giving for months:

* The economy is recovering, but is not growing fast enough to create many new jobs. Financial conditions have improved, but small businesses and households are still having a hard time getting credit. With jobs growing only slowly, consumer spending won't accelerate, and neither will consumer inflation.

* To prevent a recurrence of the financial crisis, the Congress needs to approve new powers that would make sure Wall Street -- not the taxpayer -- pays for the next failure of a "too-big-to-fail" financial institution. And, by the way, the Fed needs new authorities as well to monitor the stability of the economy.

* The Fed, in conjunction with other central banks and U.S. agencies, averted "a global financial meltdown that could have plunged the world into a second Great Depression." Because of Fed support for the financial system, businesses and consumers have greater access to credit than they would have had, and that support is helping the economy to recover.

* Proposals to "audit" the Fed are a thinly disguised attempt to let Congress second-guess monetary policy decisions, and have nothing to do with the Fed's books or accounts.

Bernanke's remarks come just over a week before the Federal Open Market Committee gathers in Washington for a two-day meeting.

No one expects any major changes in policies at the Dec. 15 and 16 meeting, but observers will be watching for subtle and not-so-subtle shifts in wording that might provide hints about when the Fed will begin to reverse some of the extraordinary actions it's taken, including driving short-term rates to near zero.

Bernanke gave no hints about the timing of the Fed's "exit strategy." He repeated the judgment of the FOMC that inflation is likely to remain subdued and warned that inflation rates could even move lower.

"However, as the recovery strengthens, the time will come when it is appropriate to begin withdrawing the unprecedented monetary stimulus that is helping to support economic activity," Bernanke said. "We are confident that we have all the tools necessary to withdraw monetary stimulus in a timely and effective way."

Bernanke said the Fed will be able to tighten monetary policy by raising interest rates even before its balance sheet shrinks back to a normal size.

One important tool will be the ability of the Fed to pay interest on the reserves that banks hold at the Fed. If necessary to prevent the economy from overheating, the Fed could raise the rate it pays to banks in order to entice them to deposit excess funds at the Fed, rather than lending them out.

Reserves held at the Fed are effectively quarantined from the economy, and can't contribute to growth in the money supply or inflation.

Right now, the Fed's problem is not too much money in the economy, but too little. Banks are keeping those extra reserves at the Fed (and not working in the economy) because they aren't lending much and because they want to maintain high capital ratios.

According to the latest Fed data, commercial and industrial loans have declined by 17% in the past year, evidence that small businesses are still being denied credit.

Rex Nutting is Washington bureau chief of MarketWatch.

http://www.marketwatch.com/story/inflation...09-12-07-124100

» Click to show Spoiler - click again to hide... «

Dec 28 2009, 11:44 AM

Dec 28 2009, 11:44 AM

Quote

Quote

0.0347sec

0.0347sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled