we both hav been fighting since day1

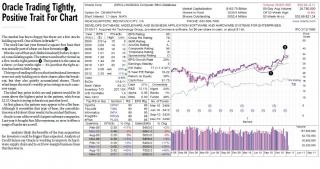

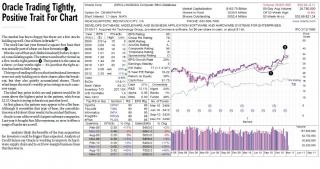

I do not use FA, TA solely by itself & to repeat nicely again... using combination of both

So how am I going to giv u one stock, which TA can do the said

since u say u got power of FA, at wat price would u rekomen to enter bimb? $1.70 and average downwards from there?

or y dun u giv one FA stock tat can do the said & we'll measure its performance in the coming weeks

all I can see from the bimb graph is anything below $1.30 is ok to buy or anything above $1.90

anything in between is a congestion & tidur time. does buy high, sell higher works in bolehland?

furthermore, I only have cincai data available to do improper analysis on bolehland shares

for usa shares, I got access to uncincai data. eg

to compare with usa, wat do u think of ownership by mgt, banks & funds? do u consider it important?

if u hav data showing u no. of funds increasing every quarter? do u consider it important?

how do u see where the previous volume support, resistance & moving averages is without a graph? do u consider it important?

well if u consider it unimportant. wat can I say?

no offense intended & constructive criticism is healthy for debate

our experience differs & its difficult for a fish to tell a bird how nice it is to live underwater

we can continue our argument in a specific thread once u decided on ur share via solely FA

QUOTE(SKY 1809 @ Jan 26 2011, 12:25 PM)

This is the power of FA. Give me one stock TA can do the said

From Zaman, Yup, I know how crazy it can be.

China Shen Zhou Mining & Resources Inc. (Public, AMEX:SHZ)

China Shen Zhou Mining & Resources, Inc. (CSZM) is engaged in the exploration, development, mining and processing of fluorite, zinc, lead, copper, and other nonferrous metals in the People’s Republic of China

March 2009 = 0.25-34cts

December 1, 2010 $2.45

December 15 $4.60

December 27 $4.55

December 29 $9.29

January 7, 2011 $8.97

January 25, 2011 $6.19

My Quote :

Time to read an interesting story:-

In Australia, there are some mining stocks which were trading at very cheap prices around 10-20 cents before they found the minerals underneath the mining land. However, their shares rocketed to the sky once they found the minerals such as gold, copper, tin, gas or rare earth.

There is a stock named Sanfire which traded at 9cts in May last year and had since sky-rocketed to more than A$7.00 now as they found big deposits of copper in its mine worth about A$5-6 billion at current market value. Another stock named Karoon Gas drilling for oil and gas off N-W part of Australia, has its share price zoomed from a few cents to more than $8 now!! In year 2005, a share called Redback Minerals Resource which has a very small market cap found gold in West Africa and saw its market cap. zoomed to $6 billion currently traded in Canada stock Exchange. In view of this, many Malaysians might not be aware of the craziness of share prices of mineral companies overseas.

*

Jan 25 2011, 10:01 PM

Jan 25 2011, 10:01 PM

Quote

Quote

0.0231sec

0.0231sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled