Congrats those who bought at its support level yesterday, it seems to be the turning point together with klci

didn't those who bought at 1.7 followed the ci down too

they did enjoy the front row seat shows, didn't they

y would govt wan to privatize bimb? just bcos many co in klse follow trend to create rumor for insiders to exit, at the end, they rarely do it

there is so much to be made off the retailers & ikan bilis, no point killing the goose

anyway, ever wonder y buy high, sell higher doesn't work tat well in bolehland vis a vis usa shares

all those acronym asb, abc & etc being mentioned, r they all foreign owned izit? of coz not!

how high can those acronym & retailers or ikan bilis push the share price? $50 $100

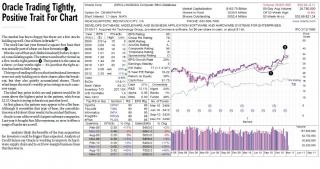

some below article r outdated, but the points r still valid, in case u wondering y not many shares in klse above $50 coz ff prefer elsewhere

http://www.alantanblog.com/epf/employees-p...sia-volume.html'Ideally, any Stock Exchange must be able to provide ample free float and liquidity in the market. All these are important in order to to attract a diverse set of local and foreigner investors into our market for sustainable growth'

http://www.bernama.com/bernama/v5/pdf/Inve...ech-Final91.pdfr this wishy washy rules again? one minute, got rpgt, the next cancel. one minute super high tax on those cpo co, the next cancel & etc. also got so many ways to calculate bumi owned, some say 18%, some say not yet 30%, some say more, tis is called politics & do ff like it?

http://www.btimes.com.my/Current_News/BTIM...icle/print_html

http://www.btimes.com.my/Current_News/BTIM...icle/print_htmlsizeable portion of stocks of blue chip companies on the exchange were held by government-linked entities. The quantum left as free float was not enough to excite international fund managers.

http://www.worldbank.org/ifa/rosc_cg_malaysia.pdfSome government-linked corporations have issued a Special Share/Golden Share to the government, entitling it to exercise a veto over any tabled resolution. A review of publicly available information for the past 15 years indicates that the government (or its institutions) has not at any

instance exercised this right. Whereas, on the one hand, the presence of a golden share is a source of comfort for a small investor, on the other hand, it has the potential of being used to further public policy that may not be entirely in line with short-term commercial goals. However, the very existence of these golden shares could be perceived by the market as a poison pill, depriving investors of potential returns. Key Challenges, To further improve its corporate governance practices, Malaysia faces the following challenges: the government's level of equity ownership remains large; free float remains low

Anyway, its ur choice & I did not say it is wrong

I prefer invest usa & u guys prefer lower risk, undervalue & etc, its a free world

At the end of the day, for a share price to go VERY HIGH, there must be deep pocket institutions participation

for bimb case, its FA is good, its volume its good, the price drop with lower volume, means not much sellers either

so who the heck claim TA paint a lousy picture

unless they misinterpreted TA, aiyoyo muthusamy!

Jan 25 2011, 10:01 PM

Jan 25 2011, 10:01 PM

Quote

Quote

0.0418sec

0.0418sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled