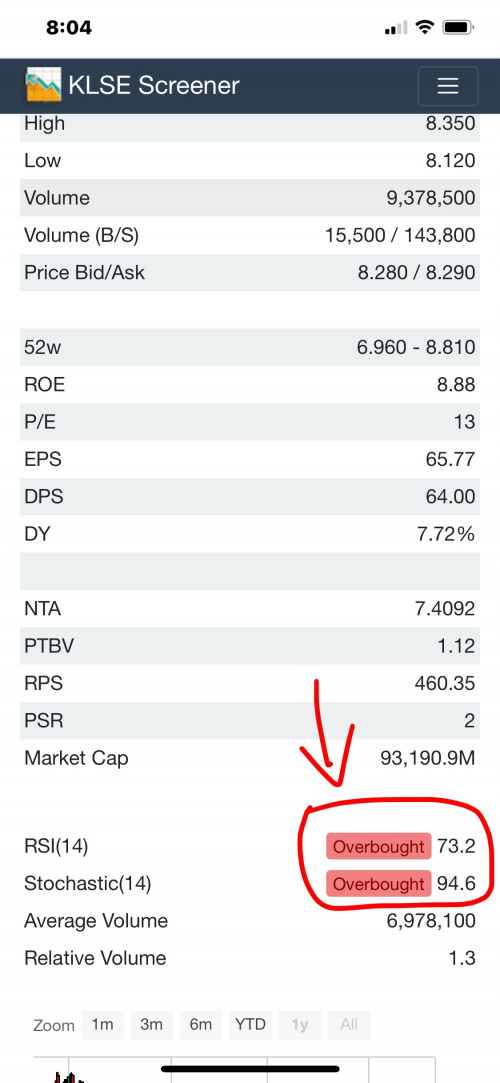

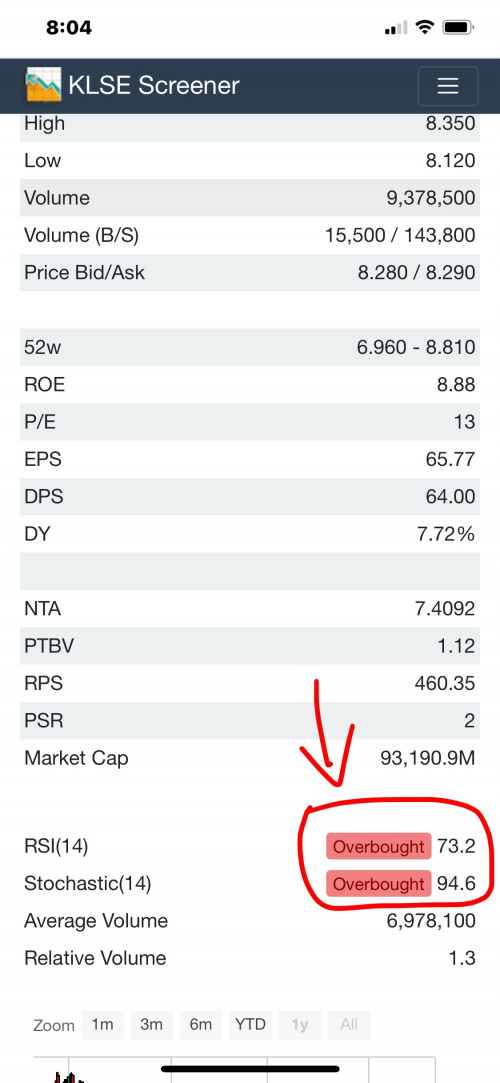

Hi, any sifu here can tell me this “overbought” in red? Does this indicate the price may drop anytime soon? TIA 🙏

MayBank shareholder Group

|

|

Nov 29 2020, 08:07 PM Nov 29 2020, 08:07 PM

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

|

|

|

Nov 29 2020, 09:01 PM Nov 29 2020, 09:01 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(SunBear1999 @ Nov 29 2020, 08:07 PM)  Hi, any sifu here can tell me this “overbought” in red? Does this indicate the price may drop anytime soon? TIA 🙏 Answer: When something becomes really overbought. So can an RSI overbought condition ever be a good thing? Absolutely. When the RSI is “extremely overbought” with a value above 80, the upside momentum has become so great that the price will likely continue in the direction of the primary trend, following a brief corrective pattern. Source: https://stockcharts.com/articles/mindfulinv...overbought.html XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX Also, according to my technical analysis, you can see these few things below  1. The short term EMAs are crossing the long term EMAs: golden cross (Bullish) 2. Smart money just rotated into the finance sector with increasing interest: latest red bar is >50% and it is still increasing (Bullish) 3. Bull Flag breakout - verified with pro trader BOon3 from thread "Traders' corner - Gone Fishing" (Bullish) 4. The trend reversal is supported with huge volume From sentiment point of view, now the institutional investors are selling gloves and buying recoveries. So, sentiment is also bullish. Yes, you can expect corrective brief corrective pattern any time soon in the finance sector (already corrected once). However, since the upside momentum has become so great, the uptrend is likely to stay. So, you should make use of the dips as your entries. Although the uptrend is most likely there to stay, I personally think that there are better finance counters out there, e.g. BIMB. Reasons? 1. Lower PE, Similar ROE, lower PB 2. Still have a lot of room to reach pre-covid price, while MBB has almost reached pre-covid price. *I also want to clarify that pre-covid price is not the maximum price that MBB could reach. It might break it and move higher. francis226, AthrunIJ, and 3 others liked this post

|

|

|

Nov 30 2020, 12:58 PM Nov 30 2020, 12:58 PM

|

All Stars

12,413 posts Joined: Jan 2008 From: KL - Cardiff - Subang - Sydney |

Anyone of you starting to sell off your holdings considering the price now and anticipating a further drop in coming months?

I've been collecting when its 7.xx |

|

|

Nov 30 2020, 05:06 PM Nov 30 2020, 05:06 PM

Show posts by this member only | IPv6 | Post

#3324

|

Senior Member

2,992 posts Joined: Feb 2015 |

Top up chance incoming?!?? 👀👀👀👀

|

|

|

Nov 30 2020, 05:10 PM Nov 30 2020, 05:10 PM

|

Junior Member

501 posts Joined: Apr 2020 |

QUOTE(HumbleBF @ Nov 26 2020, 10:57 AM) Didn't I predict correctly?😆 SunBear1999 and HereToLearn liked this post

|

|

|

Nov 30 2020, 05:55 PM Nov 30 2020, 05:55 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

|

|

|

Nov 30 2020, 05:57 PM Nov 30 2020, 05:57 PM

Show posts by this member only | IPv6 | Post

#3327

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

Nov 30 2020, 06:13 PM Nov 30 2020, 06:13 PM

|

All Stars

17,021 posts Joined: Jan 2005 |

|

|

|

Nov 30 2020, 06:22 PM Nov 30 2020, 06:22 PM

Show posts by this member only | IPv6 | Post

#3329

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

Nov 30 2020, 06:24 PM Nov 30 2020, 06:24 PM

|

All Stars

17,021 posts Joined: Jan 2005 |

|

|

|

Nov 30 2020, 06:24 PM Nov 30 2020, 06:24 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

fall a little bit only, not free fall la ....

if fall to ~RM7.20 then we talk. |

|

|

Nov 30 2020, 06:26 PM Nov 30 2020, 06:26 PM

|

All Stars

17,021 posts Joined: Jan 2005 |

|

|

|

Nov 30 2020, 08:20 PM Nov 30 2020, 08:20 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(HereToLearn @ Nov 29 2020, 09:01 PM) Question: When can “overbought” be a good thing? Answer: When something becomes really overbought. So can an RSI overbought condition ever be a good thing? Absolutely. When the RSI is “extremely overbought” with a value above 80, the upside momentum has become so great that the price will likely continue in the direction of the primary trend, following a brief corrective pattern. Source: https://stockcharts.com/articles/mindfulinv...overbought.html XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX Also, according to my technical analysis, you can see these few things below  1. The short term EMAs are crossing the long term EMAs: golden cross (Bullish) 2. Smart money just rotated into the finance sector with increasing interest: latest red bar is >50% and it is still increasing (Bullish) 3. Bull Flag breakout - verified with pro trader BOon3 from thread "Traders' corner - Gone Fishing" (Bullish) 4. The trend reversal is supported with huge volume From sentiment point of view, now the institutional investors are selling gloves and buying recoveries. So, sentiment is also bullish. Yes, you can expect corrective brief corrective pattern any time soon in the finance sector (already corrected once). However, since the upside momentum has become so great, the uptrend is likely to stay. So, you should make use of the dips as your entries. Although the uptrend is most likely there to stay, I personally think that there are better finance counters out there, e.g. BIMB. Reasons? 1. Lower PE, Similar ROE, lower PB 2. Still have a lot of room to reach pre-covid price, while MBB has almost reached pre-covid price. *I also want to clarify that pre-covid price is not the maximum price that MBB could reach. It might break it and move higher. QUOTE(AthrunIJ @ Nov 30 2020, 05:57 PM) QUOTE(ozak @ Nov 30 2020, 06:24 PM) Buy BIMB only, see BIMB green today |

|

|

|

|

|

Nov 30 2020, 08:26 PM Nov 30 2020, 08:26 PM

|

Junior Member

349 posts Joined: May 2017 |

QUOTE(HereToLearn @ Nov 30 2020, 08:20 PM) Stop promoting your bimb that you bought at high price. This is Maybank tered HumbleBF and HereToLearn liked this post

|

|

|

Nov 30 2020, 08:33 PM Nov 30 2020, 08:33 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(hc7840 @ Nov 30 2020, 08:26 PM) Not at high price. I am positive Just sharing better similar counters ma. MBB share price of RM7.9 Analysts FY2021 NP FY2022 NP 2021 PE 2022 PE PBB 7050.8 8008.2 12.60 11.09 HLG 7223.7 8009 12.29 11.09 MIDF 7642 8615 11.62 10.31 Affin 6173.8 7216.6 14.38 12.31 PM me if you want the compiled data for other banks |

|

|

Nov 30 2020, 08:37 PM Nov 30 2020, 08:37 PM

|

Junior Member

349 posts Joined: May 2017 |

QUOTE(HereToLearn @ Nov 30 2020, 08:33 PM) Not at high price. I am positive Bugger off. No body want your amateur analysis. Go open a bimb shareholder thread to promote.Just sharing better similar counters ma. MBB share price of RM7.9 Analysts FY2021 NP FY2022 NP 2021 PE 2022 PE PBB 7050.8 8008.2 12.60 11.09 HLG 7223.7 8009 12.29 11.09 MIDF 7642 8615 11.62 10.31 Affin 6173.8 7216.6 14.38 12.31 PM me if you want the compiled data for other banks |

|

|

Nov 30 2020, 08:44 PM Nov 30 2020, 08:44 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Nov 30 2020, 08:50 PM Nov 30 2020, 08:50 PM

|

Senior Member

4,497 posts Joined: Mar 2014 |

QUOTE(AthrunIJ @ Nov 30 2020, 05:57 PM) If EPF selling why RHB didn't drop? My take is today is last day of Nov. Meaning it's Msci rebalancing day. Chances are some large ETFs are selling the large cap banks, PBB. Maybank, Cimb because of change to EM index. In other years, domestic insti will sapu, but maybe the recent strong price run up makes them reluctant to sapu. Also absence of short sell perhaps make the drop worse this year. N This is short term effect only. This post has been edited by Cubalagi: Nov 30 2020, 08:50 PM AthrunIJ, HereToLearn, and 1 other liked this post

|

|

|

Nov 30 2020, 09:17 PM Nov 30 2020, 09:17 PM

Show posts by this member only | IPv6 | Post

#3339

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Cubalagi @ Nov 30 2020, 08:50 PM) If EPF selling why RHB didn't drop? Ah, true. Another point of view. My take is today is last day of Nov. Meaning it's Msci rebalancing day. Chances are some large ETFs are selling the large cap banks, PBB. Maybank, Cimb because of change to EM index. In other years, domestic insti will sapu, but maybe the recent strong price run up makes them reluctant to sapu. Also absence of short sell perhaps make the drop worse this year. N This is short term effect only. Thanks for info |

|

|

Nov 30 2020, 09:20 PM Nov 30 2020, 09:20 PM

|

Junior Member

349 posts Joined: May 2017 |

|

| Change to: |  0.0319sec 0.0319sec

0.71 0.71

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 09:56 PM |