QUOTE(alworks @ Aug 24 2020, 04:26 PM)

keep accumulating since 7.6 n thought the price i bought was the lowest.....now left last few bullet shots...need to aim well this time, cant simply shoot again....

👍😬😬MayBank shareholder Group

|

|

Aug 24 2020, 09:52 PM Aug 24 2020, 09:52 PM

Return to original view | Post

#1

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

|

|

|

Sep 5 2020, 04:05 PM Sep 5 2020, 04:05 PM

Return to original view | Post

#2

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

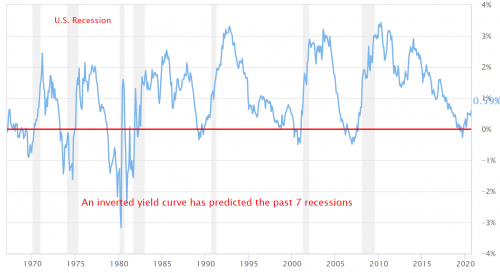

QUOTE(machonacho @ Sep 5 2020, 10:16 AM) The only factor that will discount MBB's price futher is only systematic risk, since r-rf=a+b(r-rf)+e according to single index model, alpha and standard error already priced in after the dividend cut, futher opr cut won't affect the price significantly as we've seen previously. Only a global recession will break the bull's back. I'm confident the market will crash eventually. Here are my justifications  CAPE/Shiller's PE is @ 32. Only two times in history has cape ever exceed 32, and that was the dotcom crash and the great depression.  A cap to GDP ratio of 1.6 means we are vastly overpaying 1.6 dollars for 1 dollars of product. This should be enough of a justification alone.  Back in 2018 there was a panic because Trump was just elected as president, there was a brief period of inverted yield curve but the recession didn't happen, so I'm confident a much more dire depression is due to happen. 3 alone should be enough elaboration on why I'm extremely bearish right now. Oh and, the chart is mostly fundemental indicators, telling you the CURRENT state of the company, it can't predict the future. Technical indicator such as MACD 12 26, RSI, MFI may be able to tell the very short term movement of the common price, but that's about it. |

|

|

Sep 5 2020, 04:07 PM Sep 5 2020, 04:07 PM

Return to original view | Post

#3

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

[quote=SunBear1999,Sep 5 2020, 04:05 PM]

[/quot Banks set for more profits https://www.thestar.com.my/business/busines...or-more-profits |

|

|

Sep 8 2020, 05:18 PM Sep 8 2020, 05:18 PM

Return to original view | Post

#4

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

Maybank 💪💪💪😘

|

|

|

Oct 8 2020, 05:57 PM Oct 8 2020, 05:57 PM

Return to original view | Post

#5

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

Maybank at last minute shot up 💪 RM7.30😃

|

|

|

Oct 9 2020, 04:52 PM Oct 9 2020, 04:52 PM

Return to original view | Post

#6

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

Maybank today RM7.40 💪💪💪😃😃😃

|

|

|

|

|

|

Oct 11 2020, 08:08 PM Oct 11 2020, 08:08 PM

Return to original view | Post

#7

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

Oct 22 2020, 09:09 PM Oct 22 2020, 09:09 PM

Return to original view | Post

#8

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

Nov 21 2020, 02:52 PM Nov 21 2020, 02:52 PM

Return to original view | Post

#9

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

If budget failed, Maybank share will drop further below 8?

|

|

|

Nov 21 2020, 03:01 PM Nov 21 2020, 03:01 PM

Return to original view | Post

#10

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

Is any one here know when is Maybank annual report out? It’s next week?

This post has been edited by SunBear1999: Nov 21 2020, 03:04 PM |

|

|

Nov 23 2020, 08:51 PM Nov 23 2020, 08:51 PM

Return to original view | Post

#11

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

Nov 27 2020, 07:32 PM Nov 27 2020, 07:32 PM

Return to original view | Post

#12

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

Better than no give dividend as compared to Public, Hong Leong, CIMB & Alliance Bank this time no give dividend.

This post has been edited by SunBear1999: Nov 27 2020, 07:50 PM |

|

|

Nov 28 2020, 06:41 AM Nov 28 2020, 06:41 AM

Return to original view | Post

#13

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

|

|

|

Nov 28 2020, 06:42 AM Nov 28 2020, 06:42 AM

Return to original view | Post

#14

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

Nov 28 2020, 06:48 AM Nov 28 2020, 06:48 AM

Return to original view | Post

#15

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

TNB 4thQR dividend 0.22 per share

Very good dividend stock to hold for long term |

|

|

Nov 29 2020, 08:07 PM Nov 29 2020, 08:07 PM

Return to original view | Post

#16

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

Dec 5 2020, 12:08 PM Dec 5 2020, 12:08 PM

Return to original view | Post

#17

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

Dec 5 2020, 02:36 PM Dec 5 2020, 02:36 PM

Return to original view | Post

#18

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

QUOTE(HereToLearn @ Dec 5 2020, 02:15 PM) Maybe? Sovereign rating = bond rating IF I AM NOT MISTAKEN. FF for sure will sell bonds, stocks I unsure Thanks 🙏 for your precious info 😊 HereToLearn liked this post

|

|

|

Dec 11 2020, 09:51 AM Dec 11 2020, 09:51 AM

Return to original view | Post

#19

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

|

|

|

Dec 12 2020, 10:47 PM Dec 12 2020, 10:47 PM

Return to original view | IPv6 | Post

#20

|

Junior Member

202 posts Joined: Jul 2017 From: Malaysia |

got this from The Star online newspapers.

FYI FOR the past 21 years, whether there is an economic crisis or not, Malaysia’s debt levels have been rising. One only needs to look at the debt service charges (DSC), which has been on the uptrend since the 1998 Asian Financial Crisis. That year Malaysia imposed capital controls to stop the manipulation of the ringgit. The controls were effective and saved the economy then. But at the same time it gave leeway for the government to borrow to fuel their spending without being penalised by international rating agencies. Following capital controls, the ringgit was no longer being traded in the international market. There is an offshore market for the trading of the ringgit but it is settled in US dollars. The government’s external borrowing was reduced to a tiny fraction of its total borrowings. Whenever the government needed to tap the debt market, it had ready takers in the form of the Employees Provident Fund (EPF), Kumpulan Wang Amanah Pencen and the National Trust Company or also known as Kumpulan Wang Amanah Negara (KWAN). KWAN was set up to conserve the wealth that the nation gets from natural resources such as oil and minerals. Since 1998, Malaysia went through several slowdowns in its economy. There was one year of recession in 2008 due to the Global Financial Crisis. It started and ended in the US and we had minimal impact. There were many good years after 2008. Between 2009 and 2014, the government’s revenue received tremendous boost from oil money. The price per barrel hit US$100. From 2016 onwards, money was flowing in from the collection of the Goods and Services Tax (GST). But despite the extra income, the Federal Government’s DSC in absolute amounts have always been on the uptrend. It is because there was no attempt to reduce the total debt. For 2019, the DSC stood at RM32.9bil or 12.5% of the operating expenditure. This year it is expected to be RM34.95bil and next year the DSC is RM39bil or 16.5% of the operating expenditure. As a percentage of the gross domestic product (GDP), the DSC has been hovering between 10% and 13.5% since 2000, which is an acceptable ratio in the eyes of the rating agencies. However, the absolute amount that the country pays to service the debts has been rising and it is beginning to attract attention. The rating review by Fitch is an example. Fitch citied political instability and lack of governance as among the reasons for the downgrade. But in reality, if Malaysia were more disciplined in managing its public finances and had ample reserves, the rating agencies would not have issued a downgrade. Neighbouring Thailand is more instable when it comes to politics compared to Malaysia. It has not had a stable government for a few years and now the people are against the monarch. But there is no downgrade. Indonesia has a multitude of problems from weak governance to rebellion from the people for the slightest of things. But the ratings of both countries are not downgraded. Indonesia has tighter public finance regulations relative to Malaysia. The government does not have a debt to GDP ratio of 60% as in Malaysia. It has relaxed on the ratio for three years until 2023 due to the pandemic. Even with that relaxation, the debt to GDP ratio is expected to rise marginally from the current levels of about 32%. But the downside to Indonesia is that government revenue is low as a large section of the population do not pay taxes. On that score, Malaysia is fortunate as the system captures a large section of the population’s earnings. In the world of public finance, governments always borrow to fund their expenditure when there is a shortfall in revenue. Governments with good credit ratings get cheap financing. Such governments usually borrow less in good times to reduce the total amount of debts and the DSC. But in Malaysia’s case, the DSC has been on an uptrend since the 1998 Asian Currency Crisis. The most significant rise in the DSC is from 2009 onwards, which coincidentally is the time when former Prime Minister Datuk Seri Najib Razak took over the leadership in Putrajaya. Najib’s bold economic policy of introducing the highly unpopular GST raised Federal Government revenue. But at the same time, his mantra of `cash is king’ also led to excessive spending by the Federal Government. Not to mention, the 1Malaysia Development Bhd (1MDB) debacle merely exacerbated Malaysia’s debt position. Even after there was a change in government in 2018, the addiction to debt continued. For the last few years, every time there is an economic outlook speech, every Prime Minister talks about a budget surplus. In 2015, the aim was for the Federal Government to have a Budget surplus by 2020. In 2018, the target was pushed to 2023. Now, we really do not know if ever the Federal Government would achieve a budget surplus. The Fitch downgrade is merely a warning shot. No government can go on borrowing perpetually to fuel the economy. It would only be a matter of time before the other rating agencies follow suit. The addiction to debt that has led to rising DSC and less amount allocated for development is beginning to take a toll on the Malaysian economy. When the government needs to spend most, as in this year and next, it finds that the balance sheet is stretched. So what it does is to get the people to tap into their savings such as in the EPF or asking banks to give moratorium on loans so that people can get on with their lives until the pandemic subsides. This year the economy has been ravaged by the Covid 19 pandemic. Private sector consumption and investment has come down significantly. Most governments have expanded on their development expenditure. It is acceptable for public finance to burst their limits. Next year, it cannot afford the luxury. M Shanmugam is the former specialist editor of The Star. Views expressed here are his own. This post has been edited by SunBear1999: Dec 12 2020, 10:50 PM |

| Change to: |  0.1030sec 0.1030sec

0.21 0.21

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 10:15 AM |