QUOTE(Jebonmacho @ Oct 13 2010, 10:53 PM)

Hai guys, I jus need your help. I jus purchased a new apartment (140K) n my loan can only go until 70% (cos of other commitment)

I have paid de 10% upon signing de s&p. My question is when do I have to pay de remaining 20% to de developer, isit before bank make their first release to de developer or after they have released all de money then i pay de 20%.

10Q a lot for ur helps.

The bank will disburse the loan based on the progress claim from developer for new property. Prior to that, you need to settle the 30% down payment to developer after signed the SPA,

Have you signed the loan agreement? If not, do you have any supplement income like part-time income? You can appeal to the bank to increase your financing margin with supplement income.

Meanwhile, my banker can offer BLR -2.0% without MRTA based on client's profile. With MRTA/MLTA, you can get BLR -2.1% to -2.2%.

Btw, I'm a mortgage broker with various banks as panel. Pls email me at khhong88@gmail.com if you have any query.

Added on October 14, 2010, 7:01 amQUOTE(animegod @ Oct 13 2010, 10:42 PM)

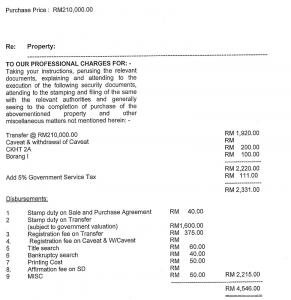

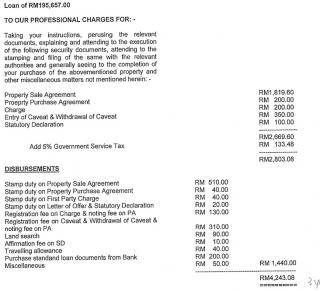

I've been quoted 8.4k for all fees to acquire the 210k property. faint...

Anyway, is there MOT charge payable upon approving the loan? I thought MOT is issued only after we fully paid the loan amount. Or did the lawyer charged MOT fee due to it's a 3rd hand property?

thanks for all input.

The fee is on SPA or loan agreement? Think MOT is charged when your property's strata title is not issued. Which bank you took the loan & what's the rate they offer you? Need to reconfirm with the lawyer on MOT.

Btw, I'm a mortgage broker with various banks as panel that provide free advice to our clients. Pls email me your contact no. at khhong88@gmail.com for more effective communication. Thanks.

Added on October 14, 2010, 7:04 amQUOTE(mr_civicfd1 @ Oct 7 2010, 12:14 AM)

hii, i'm looking for a housing loan

details are as below:

1. Sub-sales

2. around RM 120K-130K

3. Age: 26

4. address: pandan perdana (near the pandan lake area), cheras

5. Property detail: condominium

6. MOF: <90%

7. looking for BLR - 2.0+ range

appreciate if anyone can advise/suggest what is current best offer out there.

thanks.

Hi, i can help you on the loan. I'm a mortgage broker with various banks as panel. We offer free advice to our clients.

Pls email me your contact no. & property details at khhong88@gmail.com so that i can help you. Thanks.

Added on October 14, 2010, 7:23 amQUOTE(animegod @ Oct 12 2010, 08:23 PM)

Hi all,

I have 1 question. I'm about to put my signature on a 189k loan (property value 210k)

with Legal fee financed by the bank at approximately RM5k.

I'm about to be the 3rd owner of the property.

So, my question is how much approximately do I have to top up on the 5k legal fee financed by the bank? Does the 5k includes stamping fee, lawyer fee, etc?

Are there any other charges that I should be aware of, that might cost beyond the 5k amount?

And what if the legal fees are less than 5k? Where would the extra $$$ goes?

thanks.

Hi, i can help you on the loan. I'm a mortgage broker with various banks as panel. We offer free advice to our clients.

Are you first time house buyer? If yes, property below 250K can appeal for 50% rebate on stamp duty. RM5k is more than enough for loan agreement. Does your bank charge valuation fee? Which bank you apply the loan?

Pls email me your contact no. & property details at khhong88@gmail.com. Thanks.

Added on October 14, 2010, 7:37 amQUOTE(beast_doadore @ Oct 8 2010, 02:05 PM)

Any Pro please help!

1. Sub-sales

2. around 270-280k

3. Age: 25

4. Manjalara, Kepong, Jln Ipoh or Segambut

5. Property detail: condominium

6. MOF: more or less 90%

7. looking for BLR - 2.2

How much for the intial payment?

how the lawyer, duty stamp and other charges calculation?

thank

Added on October 8, 2010, 2:11 pmohh..btw, should I ask for the mortage loan before to buy a house or get a house 1st then just survey for mortage loan?

if let say I get a house 1st, how should I know how the mortage package I can get for example, how much per month I have to pay for bank?

First thing, if you plan to buy a property, pls find out whether your income capability is enough to get a loan (eg: monthly salary + side income)? What's your commitment level (eg: car loan, personal loan...etc)? Most of the bank can allow to 50% commitment. From there, you set your budget. When you have confidence with the loan, you can pay the deposit 2-3%.

On ther other hand, you can indicate in the booking form the transaction will be cancelled & the deposit is fully refunded if you can't secure the loan. This you protect your earnest deposit from for-feited.

Btw, I'm a mortgage broker with vaious banks as panel. We offer free advice to our client. Pls email me your contact no. & email address at khhong88@gmail.com so that I can help you further. Thanks.

Added on October 14, 2010, 7:48 amQUOTE(jeff_v2 @ Oct 7 2010, 03:26 PM)

any good mortgage package to offer me?

1. Sub-sales

2. around RM 250-280k

3. Age: 25

4. bandar baru bangi area

5. Property detail: 2 storey terrace

6. MOF: <90%

7. looking for BLR - 2.0 (fixed or islamic)

8. can get flexi?

thanks

Hi, I'm a mortgage broker with various banks as our panel. We offer free advice to our client.

We offer fixed rate loan & flexi loan as well. Our panel bank can offer higher than BLR -2.0.

Pls email me your contact no. & property details at khhong88@gmail.com. Thanks.

This post has been edited by khhong88: Oct 14 2010, 07:48 AM

Oct 13 2010, 10:42 PM

Oct 13 2010, 10:42 PM

Quote

Quote

0.0230sec

0.0230sec

0.50

0.50

6 queries

6 queries

GZIP Disabled

GZIP Disabled