QUOTE(buggie @ Jan 17 2017, 11:31 AM)

Bro, you might need to check back on this. Cause it sounds too good to be true. If this is the case, I will double my money instantly. Just imagine, having 245k cash in my account and apply loan immediately bumped to 445k! and my dividend bumped from 16k to 29k! That is just awesome... but unfortunately sounds a little too easy. Technically, i could dump 200k in there as per limit, then wait 3 years for 45k dividend. Then apply 200k loan and immediately after 3 years i'm earning dividend on 445k

If I have 245k in there, my limit is therefore pegged 245k. I can't exceed this amount until my dividend expands it further.

Doesn't matter if I take out 200k and leave 45k in there, or take out 245k and later put back the 45k. The end result is still the same. I will end up with the same 245k in my account after the terminate/reapply process.

ok buggie...im correcting my statementIf I have 245k in there, my limit is therefore pegged 245k. I can't exceed this amount until my dividend expands it further.

Doesn't matter if I take out 200k and leave 45k in there, or take out 245k and later put back the 45k. The end result is still the same. I will end up with the same 245k in my account after the terminate/reapply process.

yes u are right about that...

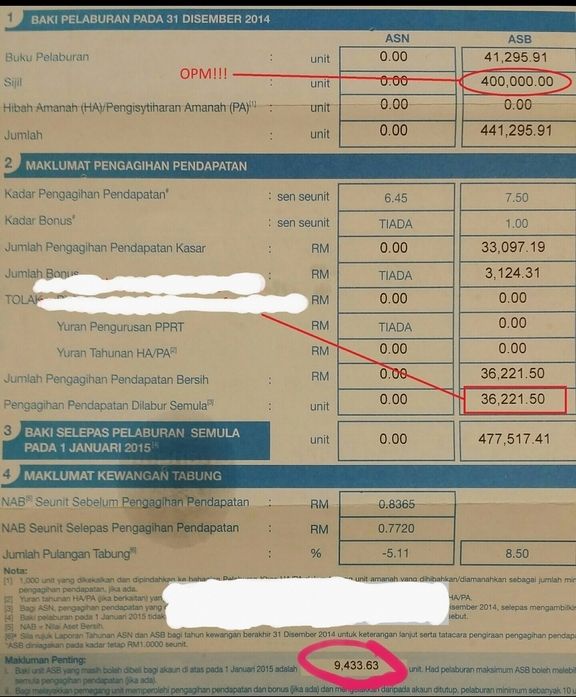

in ASB account it have credit limit. This credit limit will be increasing follow to your total fund in ASB + dividend...

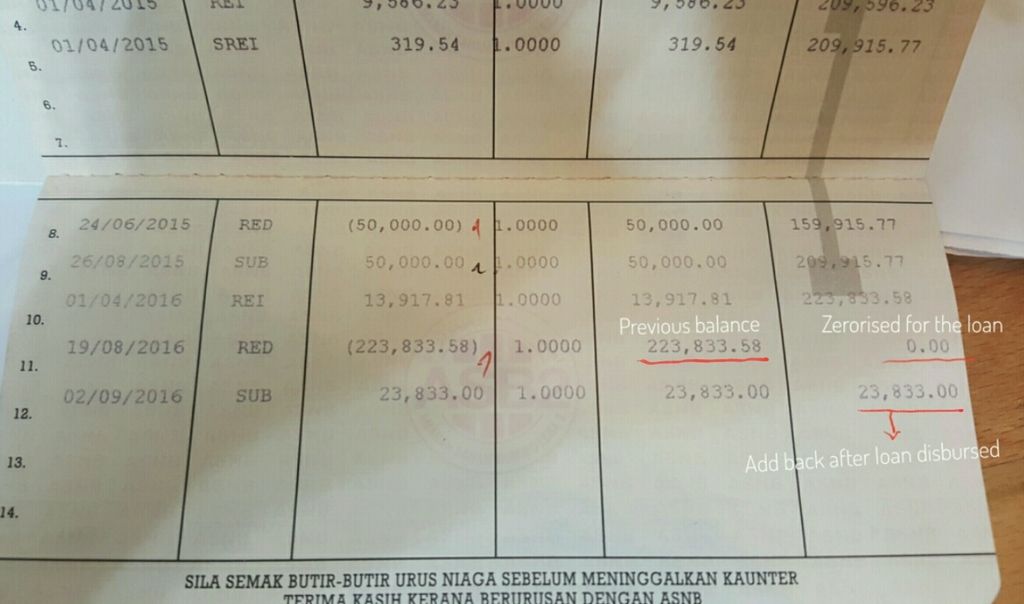

For example if u have 200k and next year u get 14k of dividend then your credit limit will be increase to 214k...but this credit will move on along together (your fund/loan + dividend)...so if you take out your fund in ASB then your credit limit will be reset to 200k...thats why u cant apply for 200k loan when u have 45k in your asb account because of this credit limit.

so if u have 245k in your ASB the best way is to separate the money to 2 portion, 200k into ASB2 and 45k into TH or your wife/family ASB account.

When u take this fund out from your ASB then u can apply for 200k loan. You cant put back the 245k into your ASB1.

i try my best to explain in english... Hope u can understand

sorry for my previous statement... i just clarify it with my upper. It a bit complex to understand about this credit limit. Thanks buggie for asking me to double check

BUT

You can always confirm with the bank how much of unit / loan u can apply. Only give ur IC no and full name to check. Much easier to do so.

This post has been edited by haziqnet: Jan 17 2017, 03:28 PM

Jan 17 2017, 02:21 PM

Jan 17 2017, 02:21 PM

Quote

Quote

0.0287sec

0.0287sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled