1. Having ASB-financing as part of a retirement portfolio is sound financial strategy. There are detractors who claim to get better returns or reach their financial goals earlier

and they can be right; however honest investors would disclose the pros and cons of these other investment vehicles/intruments

2. Take property property investment for example. Plenty of people made a lot of money through properties, especially when they bought theirs before and during the property-boom that took place from 2008 through a few years following that. When you compare the two, buying properties

with a mortgage is very similar to subscribing to ASB units

with ASB-financing. They both:

a. have their financing backed with

collaterals (property vs. ASB units)

b. use

reducing balance interest calculation (as opposed to upfront interest calculation)

c. have annual and

floating interest rates (as opposed to fixed/flat rates)

3. The con, and in-turn the difference between property investment to ASB/ASB-financing would be that the

value of the asset (the property) is not fixed. While this is a huge advantage due to the fact that properties may increase in value over time (capital gain), they can also, in-turn

lose value over time (capital loss).

4. Do yourself a favor and read on arguments from investment-pragmatic individuals like

icemanx and

askarperang who are looking at the property-investment situation with a realistic approach. If I got them right, their consensus would be that there were bubbles in the past few years which have started to pop and would get worse over time. Property

prices have decreased in some areas, rental yields (rental per annum over MV) have dropped, and lelong units are popping up everywhere with low probability of being sold. High property overhang being reported by developers, agents facing difficulty to dispose their listings, owners having to top up the shortfall between their installments and rental income, etc.

Multiple Signs of Malaysia Property Bubble V205. Following point (3), losing value of your property is a huge financial concern. Properties are big-ticket items, unlikely to be bought using cold-hard cash.

Mortgages are taken to complete the purchase and in turn would have interest charges on the outstanding each day (daily rest). This is similar to ASB-financing, but while

ASB units do not lose value, properties could and have proven to do so:

» Click to show Spoiler - click again to hide... «

6. Following point (6), when the market-value or realistic-selling-price of your property has dropped lower than the loan balance, you would have to

top-up to repay the bank to dispose the property. For example, if the realistic-selling-price of your property is RM400k, and your loan balance with the bank is currently RM500k, you would have to pay RM100k (excluding other costs, like redemption fee, etc) to the bank for them to release the unit to be transferred to the purchaser

7. Some bid their time before disposing their properties - after assessing that they are able to continue paying their installments while topping up the difference between the installment (plus other costs like maintenance) and rental. Some purchasers are not so lucky, and are unable to do so due to cash-flow issues. When they exhaust their cash due to negative cash-flow, unable to repay their installments, and having no cash to top-up (refer to point 6) to dispose the property,

the property would be auctioned off8. But that is not the end of it. Just because the bank has started the process to auction the property, there are no guarantees they would be successful. If the property fails to be sold in the first round it would go for further rounds of auctions, each time the reserve price would be reduced by about 10%. If the winning price is lower than your loan balance with the bank (plus other fees),

you would still end up being liable to pay this balance; if you fail to do so within a stipulated time you will be sued in court for bankruptcy

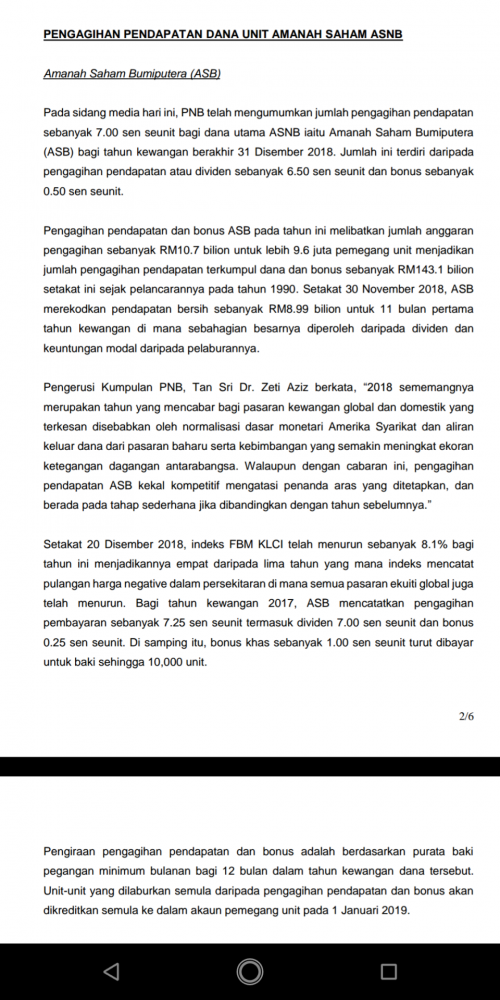

9. No such thing would happen with ASB-financing due to the fact that the ASB-units do not change value. At any time you fail to pay the installments and the bank force-sell the units, the loan balance would ALWAYS be lower than the RM200k certificate value. As any investment vehicles/instruments,

there are cons to ASB-financing, but I am not covering that in this post.

As a practitioner in the financial industry, doing both mortgages as well as ASB-financing among other things, these points are a form of summary on investments in property and ASB through my lens.

As always, thanks for sharing these information ! I've looked around and I never sen any better investment tool than asbf for investment.

Just some minor question: would asb continue to be fixed price fund or will it someday be variable price fund (like what happened to ASN)?

Dec 4 2018, 09:26 PM

Dec 4 2018, 09:26 PM

Quote

Quote

0.0256sec

0.0256sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled