Anyone get Moratorium? Can share the details

ASB loan, worth to get it???

ASB loan, worth to get it???

|

|

Nov 20 2020, 08:14 PM Nov 20 2020, 08:14 PM

Return to original view | Post

#121

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

Anyone get Moratorium? Can share the details

|

|

|

|

|

|

Dec 2 2020, 08:49 PM Dec 2 2020, 08:49 PM

Return to original view | Post

#122

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

QUOTE(afif737 @ Dec 2 2020, 04:57 PM) they gave me this package where i only pay the interest which is rm414 for 1 year. i didnt apply for it, i only applied for my home loans, they gave me this coz i wanted to cancel the loan i think. my loan is with maybank btw. rm180k. Its gonna be quite stressful to ask them about this though, whenever i call them no answer, email no reply. so the best is to go to the bank. after that they're not gonna follow up. if they approve, they will only change the figure in your maybank2u. if they reject, they will not call you they will not text you they will not email you :lol2: Nice package. At least they gave u something. |

|

|

Dec 8 2020, 09:21 AM Dec 8 2020, 09:21 AM

Return to original view | Post

#123

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

QUOTE(tr3xsdcc @ Dec 8 2020, 12:47 AM) Hi wanna ask is it a good idea to withdraw from epf 10k then invest in asb? after dividend announce then decideI'm referring to the approval of government to withdraw from account 1. What's do u guys think? Good idea? Tq tr3xsdcc liked this post

|

|

|

Dec 29 2020, 02:59 PM Dec 29 2020, 02:59 PM

Return to original view | Post

#124

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

|

|

|

Dec 30 2020, 09:02 PM Dec 30 2020, 09:02 PM

Return to original view | Post

#125

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

QUOTE(afif737 @ Dec 29 2020, 04:40 PM) mine is also with maybank. i think the 3.4 rate is only for existing customers and it's probably one of the lowest. But I did refinance 20k asbf from rhb which was 3.75 to ambank 3.55. the rest of my asbf i maintain with maybank 3.4 I see.How do u play with multiple cert, what is the game plan? Mind sharing the strategy, pros and cons. |

|

|

Jan 24 2021, 05:48 PM Jan 24 2021, 05:48 PM

Return to original view | Post

#126

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

QUOTE(PPZ @ Jan 24 2021, 04:26 PM) I am wondering if this scenario, which one is more beneficial to us? 2 for meScenario 1: refinance Loan 150k for 25 years and top up dividend around RM 50k. Scenario 2: refinance loan 200k for 39 years and top up dividend around RM 50k. Which one you think will get more return? The loan for the scenario 1 and 2 are nearly the same. Please share your thoughts. Thanks |

|

|

|

|

|

Jan 24 2021, 11:03 PM Jan 24 2021, 11:03 PM

Return to original view | Post

#127

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

QUOTE(bara bara api @ Jan 24 2021, 10:18 PM) Is this ASB general thread? I'd like to ask question that always bothers me. Try to submit new loan before cancelI already max out my ASB loan to RM200k. Started in 2014 if I remember correctly. Due to financial strain nowadays and jobless (long story but I digress), I'm struggling to pay the monthly loan. I've been taking the dividend money out to pay it monthly. But I don't want the dividend to deplete over time because I'm also using of the dividend to pay for other expenses. Though I do have other income sources, but not that much to cover it all. Do you guys have any advice on what other options I have? Whether to refinance it or just liquidate and do something else with the dividend balance? If refinance, is there any other sub-option in there, like longer tenure, or create another ASB account but lower loan? bara bara api liked this post

|

|

|

Feb 17 2021, 10:17 PM Feb 17 2021, 10:17 PM

Return to original view | Post

#128

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

Got tldr version?

|

|

|

Feb 21 2021, 08:26 PM Feb 21 2021, 08:26 PM

Return to original view | Post

#129

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

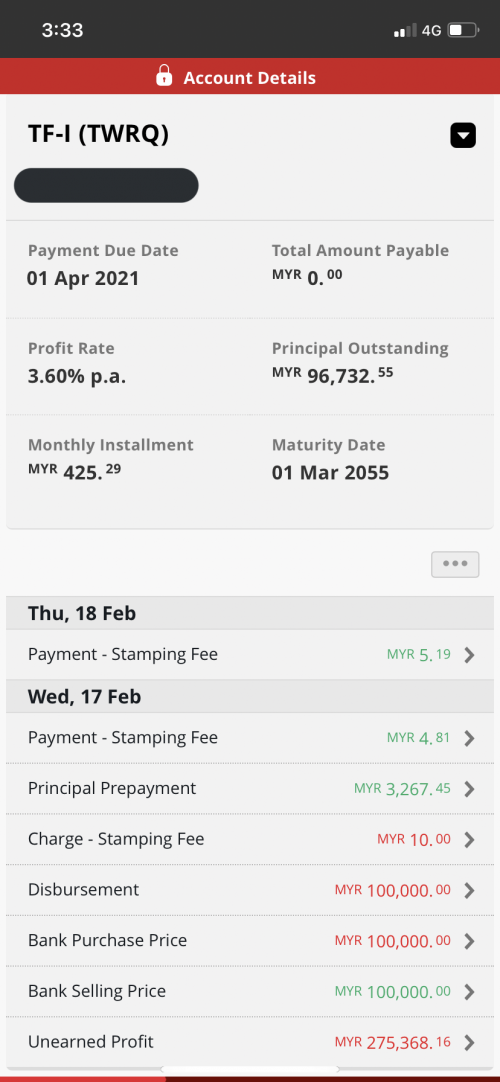

QUOTE(facktura @ Feb 21 2021, 07:06 PM)  Finally my asbf been revised to 3.6% and i check the statement came as above. Principle repayment and all are correct right? Been 4 years with cimb, i had 3 certs for 100k 50k and 50k. So for this month payment should i follow the new rate or still follow the older one? |

|

|

Feb 3 2022, 01:06 PM Feb 3 2022, 01:06 PM

Return to original view | IPv6 | Post

#130

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

if 3.3% for 1st 5y really wonderful. no T&C will terminate on early 6th

|

|

|

Feb 6 2022, 01:08 PM Feb 6 2022, 01:08 PM

Return to original view | IPv6 | Post

#131

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

correct me if im wrong.

for maybank, gameplan is 5 year to benefit low % for 1st 3y can someone check is there any T&C refrain me from doing so |

|

|

Feb 24 2022, 10:33 PM Feb 24 2022, 10:33 PM

Return to original view | IPv6 | Post

#132

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

if anyone want to take takaful hibah can PM me

|

|

|

May 22 2022, 09:22 PM May 22 2022, 09:22 PM

Return to original view | IPv6 | Post

#133

|

Senior Member

813 posts Joined: Aug 2008 From: KUALA LUMPUR |

is there any offer for asbf?

|

| Change to: |  0.2248sec 0.2248sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 02:49 PM |