QUOTE(river.sand @ Apr 26 2013, 04:07 PM)

Thanks.I used RM509 million as the 2012's FCF. No of shares = 1979 million.

Hope that you get a value close to mine, then mine should be about right. Ha.

Cheerio.

Q&A, General question on stock market

|

|

Apr 26 2013, 04:15 PM Apr 26 2013, 04:15 PM

Return to original view | Post

#41

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

|

|

|

|

|

|

Apr 26 2013, 06:18 PM Apr 26 2013, 06:18 PM

Return to original view | Post

#42

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(river.sand @ Apr 26 2013, 05:00 PM) I got... Noted and thanks.Total discounted FCF for first 10 years - 3976 mil Discounted perpetuity value = 4703 mil Total equity value = 8679 mil Per share value = RM4.39 Close enough for me. Surprised that the curent price ia about 4 times higher than the intrinsic value for PG! Cheerio. |

|

|

May 12 2013, 08:33 PM May 12 2013, 08:33 PM

Return to original view | Post

#43

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

Need help again.

Can't remember where I saw the daily KLCI P/E ratios & DY. I have checked a few of my favourite shares related web sites and can't find them there. Like to know where I can get the historical KLCI P/E & DY values. Many thanks. This post has been edited by plumberly: May 12 2013, 08:48 PM |

|

|

May 21 2013, 12:45 PM May 21 2013, 12:45 PM

Return to original view | Post

#44

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

Help please.

Using Yahoo to get the daily historical prices of some KLSE companies. But the prices are about a week or 2 behind. a. How can I get the up to date prices from Yahoo? Pay for it? b. Any other web sites I can get up to date daily prices? Have tried Bloomberg but find it very difficult to find the things I am looking for. Many thanks. |

|

|

May 21 2013, 08:43 PM May 21 2013, 08:43 PM

Return to original view | Post

#45

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(hyzam1212 @ May 21 2013, 07:52 PM) I tried b4 to get the data from the net but it seems tht its not quite straight forward and insufficient for analysis...now I checked the historical price using free nexuschart but it only has up to three years of data, u want more u have to pay more...its good for me to analyse the entry price Many thanks!Downloaded the program. Realised that what I need are the raw numeric data (not graphs) which I need for my Coppock analysis. I will try and see if I can extract the data from CN into Excel. Thanks. |

|

|

May 21 2013, 08:51 PM May 21 2013, 08:51 PM

Return to original view | Post

#46

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

|

|

|

|

|

|

May 24 2013, 11:48 AM May 24 2013, 11:48 AM

Return to original view | Post

#47

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

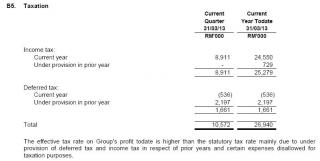

Looking at FIMA's latest report. Saw that the profit after tax is half of the corresponding previous quarter though revenue this quarter was higher. Found out that this was beacuse of higher tax they paid (more than the normal company's tax rate) due to deferred tax and disallowed tax deductions. a. What is provision of deferred tax and how does that result in more tax being paid? b. Is disallowed tax deduction a common thing practised in M'sian companies to maximise profit and thus nicer report card? I will watch out for companies with too many of this type of disallowed tax deduction corrections. c. Is there a tax penalty if a company makes too many/repeated disallowed tax deductions? Thanks. |

|

|

May 28 2013, 09:28 AM May 28 2013, 09:28 AM

Return to original view | Post

#48

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(siew14 @ May 28 2013, 08:54 AM) a) try wsj journal? i did my fundamental analysis from the website. pulled the closing price for each day to calculate beta and returns. Thanks siew14.b) do you mean by closing price for each day? if yes, then wsj will be a good source. a. not sure about malaysia company, but what i learned was because of there is different in accounting method for reporting financial statement & income tax financial statement ,and also there will be difference tax rate for 2 type of financial statement.... then the amount of tax difference from both method will determine the provision i think.. try google about deferred tax asset & deferred tax liability, i think is that one.. need further advice from the pros. Went to WSJ to have a look. Don't know where to go to download the daily data. Too much infor there. Please give me the page link. Thanks. Yes, I am after the daily closing price. Had a look in the web on deferred tax liability the other night. The one in Wilkipedia is written by a PhD guy for PhD readers. Can't make any sense out of it. Saw another web site in simple English. Still rather confusing for me, about timing difference, even out the tax paid, etc. Thanks again for your help. P/S Had another go and found how to get the data. Thanks. http://quotes.wsj.com/XX/ADOW/index-historical-prices This post has been edited by plumberly: May 28 2013, 09:32 AM |

|

|

Jun 14 2013, 04:30 PM Jun 14 2013, 04:30 PM

Return to original view | Post

#49

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

Need advice/input from you all.

I want to have a filter to eliminate or reduce the number of "risky" companies. Yes, risk means different things to different people. My attempt is as below. Risky elements: * govt link * less than 5 years of proven profitable business operation * volatile monopoly/economic moat Looking for 2 more elements (to help me from my tunnel vision). Many thanks. |

|

|

Jun 14 2013, 05:02 PM Jun 14 2013, 05:02 PM

Return to original view | Post

#50

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(river.sand @ Jun 14 2013, 04:46 PM) Let me try... Thanks.* earning flat or down * high gearing (but what's the percentage?) * supplier and customers have strong bargain power I forgot to add that what I have described is the first filter, looking at the wider picture. Details like earnings, cashflow etc will be considered later. Cheerio. P/S One more element comes to mind. Volatility (beta) relative to KLCI. Others? |

|

|

Jun 14 2013, 05:10 PM Jun 14 2013, 05:10 PM

Return to original view | Post

#51

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

|

|

|

Jun 15 2013, 11:50 AM Jun 15 2013, 11:50 AM

Return to original view | Post

#52

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(gark @ Jun 15 2013, 10:01 AM) IMHO govt link and monopoly reduces risk.... unless change government but that's 5 years down the road. Noted and many thanks!Risk elements include 1. company size - small cap more risky than big cap 2. Earnings voltality - consistent earning is less risky 3. debt/equity ratio - lower the better 4. interest cover - higher the better 5. foreign forex rate exposure - especially in loans/debt - lower is better 6. commodity related - cannot dictate price 7. non minority friendly company - screw minority by private placement, rights issue, takeover at low price, pay less dividend etc. 8. bad management who pays themselves shitload compared to earnings. - Need your help with the following: 6 - do I take it that since one cannot dictate the price, then it is considered a risk? Example? 7 - meaning the company can offer shares at lower price to certain people/companies? Isn't there Bursa rule on the amount and duration like ESOS? Like to learn more on this potential risk. 2 examples of such companies? My concern on govt link /monopoly as risk is like what YTL Power is going through now. Some politicians can pull the plug when they need to for their own benefits. Yes, some companies with govt link/monopoly can do well but I prefer to take that risk out with some opportunity cost to my potential earning. Cheerio. |

|

|

Jun 15 2013, 03:46 PM Jun 15 2013, 03:46 PM

Return to original view | Post

#53

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(gark @ Jun 15 2013, 12:08 PM) 6 - like palm oil/gold... depends on world pricing, so they have no pricing power ie. sell at higher price than competitor/branding/moat etc. If drop.. profit drop BUT if up then profit up.. so consider a risk. The risk is that the management strength can not affect profitability. Thanks once again.7 - most private placement are sold at 5%-10% discount to market fixing price, allowable in bursa rules. Esos also have discounts vs market price. Some rights issue also raise at PREMIUM to market price, hence forcing you to fork out more money or risk dilution, which is also not good. Examples arr.. lots but recent i know is MAS (rights issue) and SpSetia (private placement) Very good and valid point on #7. I need to cover this in my selection. Had a look in SP Guide, stated as shares split, bonus and warrant. How do I know when it is a private placement? Do they name that differently? I assume private placement could be to friends/partners/family at a lower price, right? Will learn more about this on the web. Cheerio. |

|

|

|

|

|

Jun 16 2013, 12:21 PM Jun 16 2013, 12:21 PM

Return to original view | Post

#54

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

|

|

|

Jun 17 2013, 10:17 AM Jun 17 2013, 10:17 AM

Return to original view | Post

#55

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

Dayang is one of the companies I am analysing with my first cut risk filter I mentioned earlier.

Saw an article this morning on Dayang. "Naim may divest part of Dayang stake to unlock value" http://biz.thestar.com.my/news/story.asp?f...82&sec=business I take it that the major shareholder now wants to cash out on its paper profit. Nice words to put it as " unlock value"! Your view on this major change on Dayang's future? Better cash out now while the price is high? Too much politics in this. Cheerio. |

|

|

Jun 17 2013, 11:18 AM Jun 17 2013, 11:18 AM

Return to original view | Post

#56

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(hyzam1212 @ Jun 17 2013, 11:04 AM) IMO both prices are high already and it all depend on your entry price to be frank...if u buy around the latest support level, u may consider on selling...if ur price is well below, i think no harm in keeping them...they are both gomen-related stocks somemore Noted and thanks.Regarding on your project, how do u classify PN17 companies? These stocks are varies in terms of attractiveness and level of risk depending on their latest status though or it is wise to avoid it altogether? On your question, saw this last night .. "What he wondered was whether it was possible to weed out the poor performers and identify the winners in advance. He therefore sought to develop a simple accounting-based stock selection strategy for evaluating a stock’s financial strength. Piotroski's F-Score involves nine variables from a company’s financial statements. One point is awarded for each test that a stock passes. Piotroski regards any stocks that scored eight or nine points as being the strongest. " http://www.stockopedia.co.uk/content/the-p...e-stocks-55711/ Cheerio |

|

|

Jul 3 2013, 07:24 PM Jul 3 2013, 07:24 PM

Return to original view | Post

#57

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

I have some shares in the UK and the dividend is taxed. As a M'sian living in M'sia, can I claim for the tax? If so, how?

Thanks. |

|

|

Jul 4 2013, 09:45 AM Jul 4 2013, 09:45 AM

Return to original view | Post

#58

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

Another question came to mind last night after reading that JobStreet will be having a 1 for 2 share split.

Why share split? To reduce the share price so that it is easier/cheaper for people to buy, I guess. Digi did that a few years ago and I don't think Digi is doing as well now as before the split. I may be wrong here as I am not following Digi now though I was thinking of getting some Digi earlier. My concern on split like this is, the share price increases will be more driven by market sentiment (partly due to its lower price) and not by its fundamental (e.g., EPS growth etc). Was thinking of getting into JS but now the split is holding me back. Is the company management more interested in the price increases than the company real performance and fundmental? Appreciate your views on splits in the past. How they turned out, the good and the bad. Thanks. |

|

|

Jul 5 2013, 12:11 PM Jul 5 2013, 12:11 PM

Return to original view | Post

#59

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(gark @ Jul 5 2013, 10:04 AM) Shares split is usually used to improve liquidity as more shares are available for trade. More liquidity can attract more traders. If the counter is already liquid prior to share split, the share split will achieve nothing. Noted and thanks for the tip, Wise Man!Always consider the fundamentals before buying, BI & Split is all technically does not bring shareholder value. Cheerio. |

|

|

Jul 5 2013, 12:14 PM Jul 5 2013, 12:14 PM

Return to original view | Post

#60

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(hyzam1212 @ Jul 4 2013, 10:28 AM) Yeah IMO the split is obviously to attract interest ATM...but its hard to see tht Jobstreet has any potential to grow if they have not indicated any plans to increase their profit, can u think any possible expansion plan for the industry there are in? I can only think of adding more clients and advertising revenue Yes, growth there is rather uncertain.JS recently broke the RM 1 billion market mark. Even the CEO Mark said they need to re-engineer JS to stay ahead of the group. Cheerio. |

|

Topic ClosedOptions

|

| Change to: |  0.0641sec 0.0641sec

0.65 0.65

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 05:34 PM |