High Dividend Counters, Better than putting in FD

|

|

Sep 12 2011, 04:09 PM Sep 12 2011, 04:09 PM

|

Senior Member

4,342 posts Joined: Apr 2010 From: The place that i call home :p |

|

|

|

|

|

|

Dec 8 2011, 09:18 AM Dec 8 2011, 09:18 AM

|

Junior Member

141 posts Joined: Jun 2008 |

Anyone aware of what is happening to Uchitec? High dividend conuter, but the price kept dropping like nobody cares...

|

|

|

Dec 8 2011, 11:22 AM Dec 8 2011, 11:22 AM

|

Junior Member

656 posts Joined: Jan 2003 |

QUOTE(omgimnoob @ Dec 8 2011, 09:18 AM) Anyone aware of what is happening to Uchitec? High dividend conuter, but the price kept dropping like nobody cares... EPF has been disposing this counter since Nov like mad. Maybe need the money for GE....But thanks for highlighting this share. I've managed to pick up some. This post has been edited by tohca: Dec 8 2011, 01:37 PM |

|

|

Dec 10 2011, 10:40 AM Dec 10 2011, 10:40 AM

|

Junior Member

141 posts Joined: Jun 2008 |

Perstim is losing steam recently, March still at RM4.80 now become RM3.70....the company doing badly?

|

|

|

Dec 10 2011, 07:38 PM Dec 10 2011, 07:38 PM

|

Junior Member

476 posts Joined: Aug 2008 |

|

|

|

Dec 12 2011, 03:43 PM Dec 12 2011, 03:43 PM

|

Junior Member

132 posts Joined: Oct 2011 |

Anyone discuss about Carlsberg here? This is also high dividend stack.

http://klse.i3investor.com/quoteservlet.jsp?sa=ss&q=CARLSBG |

|

|

|

|

|

Dec 14 2011, 10:36 AM Dec 14 2011, 10:36 AM

|

Senior Member

556 posts Joined: Oct 2007 |

actually im abit blur with the dividend announcements like:

A) 4 sen per ordinary share of RM1.00 each B) 4 sen per ordinary share of RM0.50 each C) DIVIDEND OF 4% LESS TAX izzit all A,B,C are the same RM40 for total 1000 shares? |

|

|

Dec 14 2011, 11:00 AM Dec 14 2011, 11:00 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(aerobowl @ Dec 14 2011, 10:36 AM) actually im abit blur with the dividend announcements like: A) B) is same.A) 4 sen per ordinary share of RM1.00 each B) 4 sen per ordinary share of RM0.50 each C) DIVIDEND OF 4% LESS TAX izzit all A,B,C are the same RM40 for total 1000 shares? C) not enough info. If C face value is Rm1.00 each, then yes, Rm40 If C face value is RM0.50 each, then, RM20. |

|

|

Dec 19 2011, 11:43 AM Dec 19 2011, 11:43 AM

|

Junior Member

34 posts Joined: Jan 2008 |

by the way what website you guyz using to check dividend can tell me ?

|

|

|

Dec 19 2011, 12:11 PM Dec 19 2011, 12:11 PM

|

Senior Member

1,481 posts Joined: Sep 2011 |

|

|

|

Dec 19 2011, 12:57 PM Dec 19 2011, 12:57 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(aerobowl @ Dec 14 2011, 10:36 AM) actually im abit blur with the dividend announcements like: A) 4 sen per ordinary share of RM1.00 each B) 4 sen per ordinary share of RM0.50 each C) DIVIDEND OF 4% LESS TAX izzit all A,B,C are the same RM40 for total 1000 shares? QUOTE(rayng18 @ Dec 19 2011, 12:11 PM) B) Stated clear 4 cents, not 4%. |

|

|

Dec 19 2011, 01:46 PM Dec 19 2011, 01:46 PM

|

Junior Member

47 posts Joined: Oct 2008 |

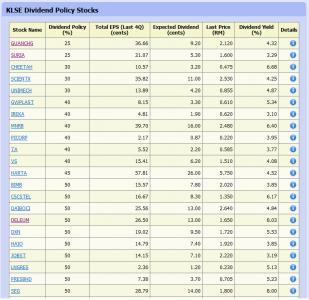

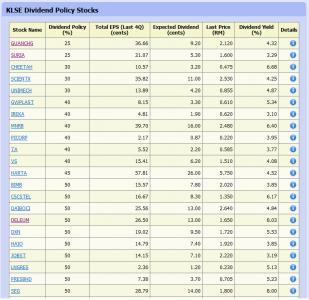

QUOTE(Derrecklim @ Dec 19 2011, 11:43 AM) Hi Derrecklim, you can find more information by using the website below:KLSE TOP DIVIDEND STOCK Continuously Improvement in Dividend for Pass 3 Years Also, you can find those KLSE stock with dividend policy from the link below: KLSE Dividend Policy

This post has been edited by my1ststep: Dec 19 2011, 01:55 PM |

|

|

Dec 19 2011, 06:20 PM Dec 19 2011, 06:20 PM

|

Senior Member

4,093 posts Joined: Jul 2011 |

QUOTE(my1ststep @ Dec 19 2011, 01:46 PM) Hi Derrecklim, you can find more information by using the website below: KLSE TOP DIVIDEND STOCK Continuously Improvement in Dividend for Pass 3 Years Also, you can find those KLSE stock with dividend policy from the link below: KLSE Dividend Policy

very informative website.. thanks for sharing ! |

|

|

|

|

|

Dec 20 2011, 07:54 PM Dec 20 2011, 07:54 PM

|

Junior Member

34 posts Joined: Jan 2008 |

Thnks so much love you =D

|

|

|

Dec 21 2011, 06:37 PM Dec 21 2011, 06:37 PM

|

Junior Member

476 posts Joined: Aug 2008 |

very nice ..thanks my1ststep

|

|

|

Dec 22 2011, 06:13 PM Dec 22 2011, 06:13 PM

|

Senior Member

629 posts Joined: Dec 2007 |

http://www.icapital.biz/english/dividenddisplay2.asp

I usually check this site for divvy before ex date. Also can get historical divvy, esp by each company and predict which counter going to announce their divvy in respective month |

|

|

Dec 23 2011, 11:13 PM Dec 23 2011, 11:13 PM

|

Junior Member

47 posts Joined: Oct 2008 |

I hope this topic can benefit to all the lowyat members here. To invest in high dividend counter in KLSE, one of the most important key is to consider the dividend policy. We should also make sure the company's business is growing in term of the revenue & profit. Without these 2 components, the dividend policy is meaningless. But, it is really hard to find such a stock in malaysia.

Some of the counters as below: 1) TECNIC 2) WELLCAL 3) PIE 4) BSTEAD 5) HARTA If you are holding these stocks for pas few years, you will notice that you are getting more and more dividend when their business is growing. You can find more info about KLSE stock with dividend policy from the website below: MalaysiaStock.Biz - Dividend-Policy

Hope you guys enjoy it and share all your information about dividend policy here. This post has been edited by my1ststep: Dec 23 2011, 11:26 PM |

|

|

Dec 23 2011, 11:48 PM Dec 23 2011, 11:48 PM

|

Junior Member

9 posts Joined: Dec 2011 |

You guys can also checked at http://bursa-dividend.blogspot.com.

|

|

|

Dec 24 2011, 10:07 AM Dec 24 2011, 10:07 AM

|

Junior Member

656 posts Joined: Jan 2003 |

QUOTE(my1ststep @ Dec 23 2011, 11:13 PM) I hope this topic can benefit to all the lowyat members here. To invest in high dividend counter in KLSE, one of the most important key is to consider the dividend policy. We should also make sure the company's business is growing in term of the revenue & profit. Without these 2 components, the dividend policy is meaningless. But, it is really hard to find such a stock in malaysia. Thanks for sharing. Yes it is a very useful list. But Panajie has an awesome list of div cum growth stocks in her portfolio, however most are very highly priced stocks. Not within reach of humble investors like me.Some of the counters as below: 1) TECNIC 2) WELLCAL 3) PIE 4) BSTEAD 5) HARTA If you are holding these stocks for pas few years, you will notice that you are getting more and more dividend when their business is growing. You can find more info about KLSE stock with dividend policy from the website below: MalaysiaStock.Biz - Dividend-Policy

Hope you guys enjoy it and share all your information about dividend policy here. |

|

|

Dec 24 2011, 10:59 AM Dec 24 2011, 10:59 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(tohca @ Dec 24 2011, 10:07 AM) Thanks for sharing. Yes it is a very useful list. But Panajie has an awesome list of div cum growth stocks in her portfolio, however most are very highly priced stocks. Not within reach of humble investors like me. Nowadays per unit is 100 shares already.There is no such thing of high priced stock that are not affordable. Nestle is Rm50, you bought 100 shares = RM5k Another dividend stock is Rm5.00, you bought 1000 share = RM5k. If both have dividend yield of 5%. You get the same amount of dividend from your 5k invested, aka Rm250. Don't be influenced by the stock price, Rm0.50, RM5.00 or RM50.00. If they have the same dividend yield, they are the same. |

| Change to: |  0.0194sec 0.0194sec

0.29 0.29

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 05:35 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote