Outline ·

[ Standard ] ·

Linear+

High Dividend Counters, Better than putting in FD

|

my1ststep

|

Dec 19 2011, 01:46 PM Dec 19 2011, 01:46 PM

|

New Member

|

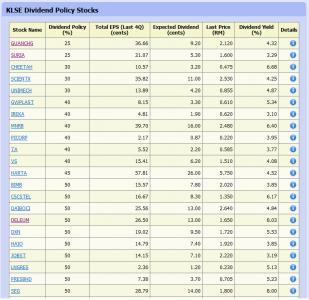

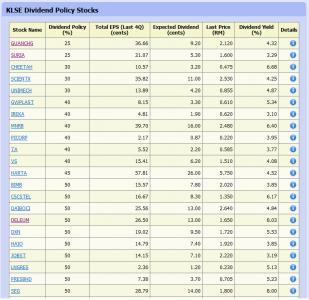

QUOTE(Derrecklim @ Dec 19 2011, 11:43 AM) by the way what website you guyz using to check dividend can tell me ? Hi Derrecklim, you can find more information by using the website below: KLSE TOP DIVIDEND STOCKContinuously Improvement in Dividend for Pass 3 YearsAlso, you can find those KLSE stock with dividend policy from the link below: KLSE Dividend Policy This post has been edited by my1ststep: Dec 19 2011, 01:55 PM

This post has been edited by my1ststep: Dec 19 2011, 01:55 PM |

|

|

|

|

|

my1ststep

|

Dec 23 2011, 11:13 PM Dec 23 2011, 11:13 PM

|

New Member

|

I hope this topic can benefit to all the lowyat members here. To invest in high dividend counter in KLSE, one of the most important key is to consider the dividend policy. We should also make sure the company's business is growing in term of the revenue & profit. Without these 2 components, the dividend policy is meaningless. But, it is really hard to find such a stock in malaysia. Some of the counters as below: 1) TECNIC2) WELLCAL3) PIE4) BSTEAD5) HARTAIf you are holding these stocks for pas few years, you will notice that you are getting more and more dividend when their business is growing. You can find more info about KLSE stock with dividend policy from the website below: MalaysiaStock.Biz - Dividend-Policy

Hope you guys enjoy it and share all your information about dividend policy here. This post has been edited by my1ststep: Dec 23 2011, 11:26 PM |

|

|

|

|

|

my1ststep

|

Jan 1 2012, 04:19 PM Jan 1 2012, 04:19 PM

|

New Member

|

QUOTE(LYR @ Dec 24 2011, 01:31 PM) i reckon most people are thinking it's gone up so much. would it go up again? then they will say, i'll wait for it come down first" but the fact is it never retreats or its correction is insignificant compared to its price. the cycle continues and they never had bought it. Totally agreed with you. Those really good share hardly come down. Have a look on nestle, gab, tecnic, wellcal, pie, panamy and etc. They never come down even when market crash. People are just waiting there to collect it. |

|

|

|

|

|

my1ststep

|

Jan 3 2012, 12:45 PM Jan 3 2012, 12:45 PM

|

New Member

|

If you can get those high dividend stock at low price then you can have a very steady income for years. Example, if you can get panamy at RM10 at 2010. Not only your capital double now, but you also able to receive more than 10% dividend yield every year. PANASONIC MANUFACTURING MSIA

It give RM1.45 for FY2011. So, you are getting around 14-15% dividend yield if your entry price is RM10 without worry much about its share price. So, i think high dividend is good if you can get it at low price. This post has been edited by my1ststep: Jan 3 2012, 12:47 PM |

|

|

|

|

|

my1ststep

|

Jan 3 2012, 02:13 PM Jan 3 2012, 02:13 PM

|

New Member

|

QUOTE(CP88 @ Jan 3 2012, 12:50 PM) So how about those late comers? Any advice to grab such high dividend stocks?  You can take a look on wellcal, tecnic, bstead, pie also. They are growing company and high dividend stocks also. This post has been edited by my1ststep: Jan 3 2012, 02:13 PM |

|

|

|

|

|

my1ststep

|

Jan 4 2012, 07:38 PM Jan 4 2012, 07:38 PM

|

New Member

|

QUOTE(tohca @ Jan 4 2012, 07:01 AM) Absolutely. Timing is everything in trading. That's why I use the RSI model to help me find good entry and exit points. It does not work all the time (as pointed out by dinamika) but is simple and effective enough to work in the long run (anywhere from 3 to 5 years). You may lose out some opportunities during a bull run and sell a little too late during a crash if you only use the RSI. But for fundamentally sound high dividend yielding companies, the risk is much lower. But seriously, how often does one see a super bull run or a market crash? I think many of us are anxiously waiting for the next market crash in a while now. I used to do that, wait them for correction and buy at low price. But at the same time, i have miss out a lot of good counters like paramon, harison, bstead as they never come down and all the way up. If you take a look at Harison, Panamy, Tecnic's chart, you probably cannot tell when is the correction period and best time to buy it. Their business are getting better and better and at the same time, they are giving us more and more dividend, so i think it is best to buy consistently just as what you did. This post has been edited by my1ststep: Jan 4 2012, 07:39 PM |

|

|

|

|

|

my1ststep

|

Jan 5 2012, 09:40 AM Jan 5 2012, 09:40 AM

|

New Member

|

QUOTE(tohca @ Jan 4 2012, 10:45 PM) You can always use charts to help you to time your purchases and sales to help you with these shares. If you are more conservative, then rely more on RSI, and if you are more aggressive then you may want to try StochRSI. I've appended below the charts for these 3 counters which you mentioned. If you use RSI then there will be just a couple of times a year which you can buy and sell these shares. But if you use StochRSI then the window opens wider (of course so does errors). Have a look at them and see if you can apply them to help you make more money. Hi Tohca, Thanks for sharing the chart. I think it is the best if we can combine both fundamental + technical analysis before we buy / sell the stock. Good luck for 2012 and hope we can make more money... |

|

|

|

|

Dec 19 2011, 01:46 PM

Dec 19 2011, 01:46 PM

Quote

Quote

0.0186sec

0.0186sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled