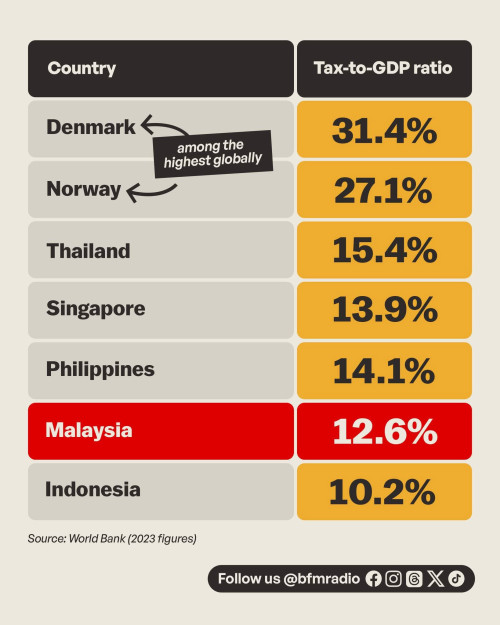

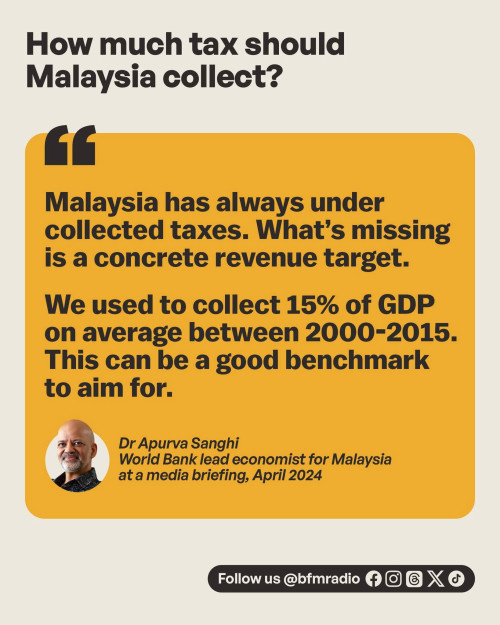

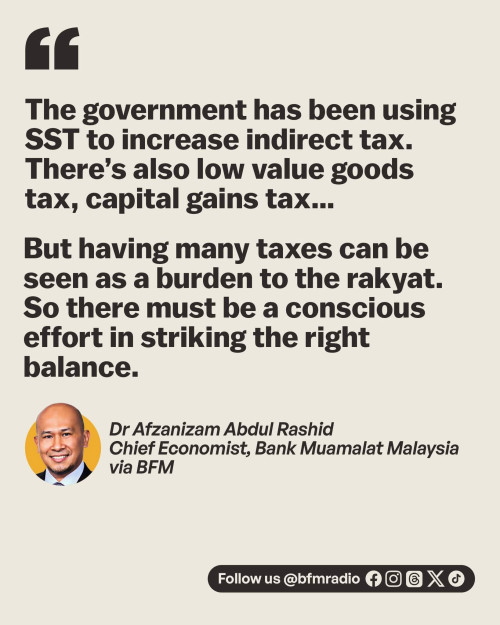

Malaysia not collecting enough tax, second lowest in our region

|

|

Nov 30 2025, 01:02 PM, updated 4w ago Nov 30 2025, 01:02 PM, updated 4w ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

269 posts Joined: Oct 2021 |

gobiomani liked this post

|

|

|

|

|

|

Nov 30 2025, 01:04 PM Nov 30 2025, 01:04 PM

Show posts by this member only | Post

#2

|

Junior Member

570 posts Joined: Jan 2003 From: /k/ isle |

then why subsidized petrol

This post has been edited by Avex: Nov 30 2025, 01:09 PM |

|

|

Nov 30 2025, 01:04 PM Nov 30 2025, 01:04 PM

Show posts by this member only | IPv6 | Post

#3

|

Senior Member

1,222 posts Joined: Jan 2003 From: Melaka |

naikan je lah cukai. walanon suka cukai nanti dapat brim

|

|

|

Nov 30 2025, 01:06 PM Nov 30 2025, 01:06 PM

Show posts by this member only | IPv6 | Post

#4

|

Junior Member

96 posts Joined: Feb 2017 |

U abolish all subsidy, increase taxes all around from personal to corporate. Then u introduce new taxes. Fastest way to reduce population in Malaysia. smokey, karwaidotnet, and 14 others liked this post

|

|

|

Nov 30 2025, 01:06 PM Nov 30 2025, 01:06 PM

Show posts by this member only | Post

#5

|

Senior Member

1,974 posts Joined: Dec 2011 |

not enough? we now already bising2

|

|

|

Nov 30 2025, 01:07 PM Nov 30 2025, 01:07 PM

Show posts by this member only | Post

#6

|

Junior Member

409 posts Joined: Nov 2009 From: Internet |

Still waiting on that bankruptcy proceedings against Jibgor after he lost his appeal. langstrasse, Optizorb, and 2 others liked this post

|

|

|

|

|

|

Nov 30 2025, 01:08 PM Nov 30 2025, 01:08 PM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

124 posts Joined: Feb 2007 From: Pahang |

Pls collect more tax from rich people

|

|

|

Nov 30 2025, 01:09 PM Nov 30 2025, 01:09 PM

Show posts by this member only | IPv6 | Post

#8

|

Junior Member

200 posts Joined: Oct 2009 From: Kuala Lumpur, Selangor |

Cukur another justification to tax the "Rich" or "T20" aka urban family earning barely rm12k gobiomani liked this post

|

|

|

Nov 30 2025, 01:10 PM Nov 30 2025, 01:10 PM

Show posts by this member only | IPv6 | Post

#9

|

Junior Member

422 posts Joined: Jan 2011 |

Collected and corrupted? No thx

|

|

|

Nov 30 2025, 01:12 PM Nov 30 2025, 01:12 PM

Show posts by this member only | IPv6 | Post

#10

|

Junior Member

549 posts Joined: Mar 2007 |

Dont give new idea to pmx.

|

|

|

Nov 30 2025, 01:13 PM Nov 30 2025, 01:13 PM

|

Junior Member

487 posts Joined: May 2005 From: KL |

even rafizi is saying it that is why he start his shops Fleximart, kesum he saying be brave and start your own business plouffle0789 liked this post

|

|

|

Nov 30 2025, 01:15 PM Nov 30 2025, 01:15 PM

|

Senior Member

4,241 posts Joined: Jan 2003 From: Selangor |

easier to reduce GDP so the ratio is better LDP liked this post

|

|

|

Nov 30 2025, 01:17 PM Nov 30 2025, 01:17 PM

Show posts by this member only | IPv6 | Post

#13

|

Junior Member

325 posts Joined: Aug 2007 |

Isn't not enough, it's banyak lari tax .....too many leakages.

|

|

|

|

|

|

Nov 30 2025, 01:17 PM Nov 30 2025, 01:17 PM

|

Junior Member

575 posts Joined: Feb 2013 |

tak habis2 mau float the ideas of charging more income tax for the general populace. go collect more tax from the biz/corps la. why the fark gov charge next to zero tax to those tycoons example: the recent Freeport Malaysia Energy Hub Tied to King Eyes $35 Billion in Investments Maharani Freeport Megaproject QUOTE Located within the Muar port limits, the private-sector initiative spans across three purpose-built reclaimed islands and a mainland plot housing an energy hub, deep seaport, industrial park and financial hub, said developer Maharani Energy Gateway Sdn Bhd (MEG). The freeport is envisioned to offer tax exemptions on energy and maritime businesses, import-duty exemptions on most raw materials and equipment for manufacturing, unrestricted capital and profit repatriation, and allows 100% foreign ownership subject to conditions, according to the project's fact sheet. fongsk liked this post

|

|

|

Nov 30 2025, 01:17 PM Nov 30 2025, 01:17 PM

|

Senior Member

3,702 posts Joined: Apr 2019 |

very simple... set the lowest tax bracket for salary from 0 to 5K at 2% tax rate...

problem solved. |

|

|

Nov 30 2025, 01:17 PM Nov 30 2025, 01:17 PM

Show posts by this member only | IPv6 | Post

#16

|

Junior Member

269 posts Joined: Oct 2021 |

march4th liked this post

|

|

|

Nov 30 2025, 01:19 PM Nov 30 2025, 01:19 PM

Show posts by this member only | IPv6 | Post

#17

|

Junior Member

71 posts Joined: Sep 2018 |

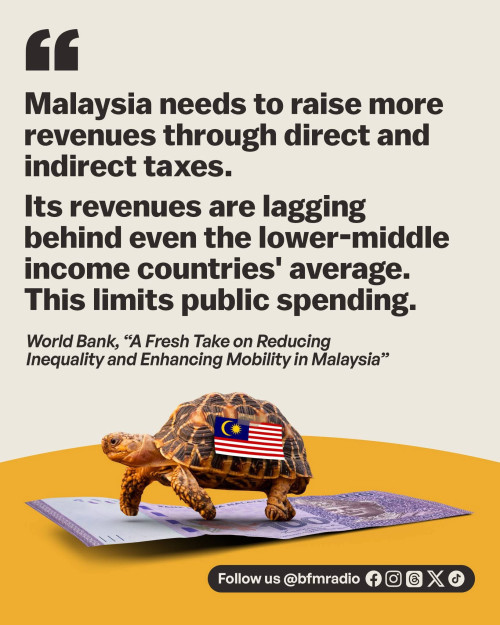

A lot commenters here don’t understand "Raising more revenue through direct and indirect tax" is a broad term and doesn’t necessarily means increasing tax rate. It could also be achieved via

1. increasing tax base - making more types of income, assets and transactions subject to tax 2. improving tax compliance and enforcement - making sure ppl and businesses pay tax. |

|

|

Nov 30 2025, 01:20 PM Nov 30 2025, 01:20 PM

Show posts by this member only | IPv6 | Post

#18

|

Senior Member

2,263 posts Joined: Dec 2006 From: In your head... |

remove subsidies. smokey and max_cavalera liked this post

|

|

|

Nov 30 2025, 01:20 PM Nov 30 2025, 01:20 PM

Show posts by this member only | IPv6 | Post

#19

|

Junior Member

460 posts Joined: Oct 2008 |

BUDI already everyone meroyan. Naik tax you will see more protest. max_cavalera liked this post

|

|

|

Nov 30 2025, 01:20 PM Nov 30 2025, 01:20 PM

Show posts by this member only | IPv6 | Post

#20

|

Junior Member

200 posts Joined: Feb 2009 |

|

|

|

Nov 30 2025, 01:25 PM Nov 30 2025, 01:25 PM

|

Junior Member

14 posts Joined: Nov 2021 |

Ok, bump it up to SG level then.

By that fuker logic if we are at SG level tax then we will have SG level service and infrastructure right? Or that fuker going to come up with another "itu tak buleh, apple orange lychee strawberry" argument? |

|

|

Nov 30 2025, 01:28 PM Nov 30 2025, 01:28 PM

|

Junior Member

13 posts Joined: Aug 2019 |

now do debt-to-gee dee pee

|

|

|

Nov 30 2025, 01:33 PM Nov 30 2025, 01:33 PM

|

Senior Member

3,702 posts Joined: Apr 2019 |

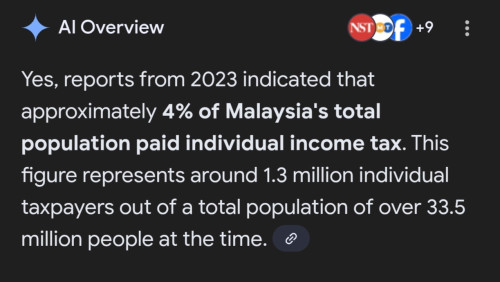

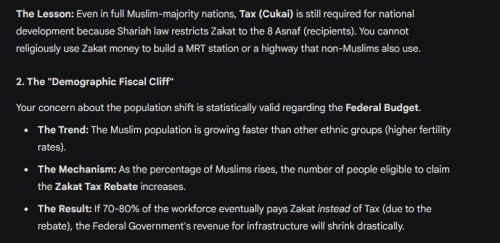

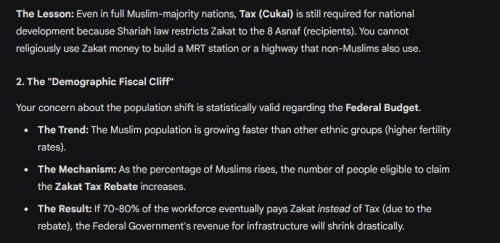

QUOTE(Satan Fallen One @ Nov 30 2025, 01:25 PM) Ok, bump it up to SG level then. they should include zakat into the calculation also for taxation.... cos ours here can knock off tax with zakat... By that fuker logic if we are at SG level tax then we will have SG level service and infrastructure right? Or that fuker going to come up with another "itu tak buleh, apple orange lychee strawberry" argument? from google: Zakat Collection Collection Figures: Zakat collection is managed by individual states, and a national aggregate figure for 2023/2024 was not found in the search results. However, data from key states indicates collections are in the millions to low billions of ringgit per state. The Selangor Zakat Board collected a record RM1.22 billion in 2024. Federal Territories (FT) collected RM937.03 million in 2022. (this is just 1 state and 1 FT) Personal Income Tax Collection Total Collection (2023): The Inland Revenue Board of Malaysia (LHDN) collected approximately RM40.96 billion in individual income tax revenue. |

|

|

Nov 30 2025, 01:34 PM Nov 30 2025, 01:34 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(30624770 @ Nov 30 2025, 02:32 PM) He havnt paid a single cent AND TAKE YOUR TAX PAYER MONEY IN PRISON.  |

|

|

Nov 30 2025, 01:35 PM Nov 30 2025, 01:35 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(Satan Fallen One @ Nov 30 2025, 02:55 PM) Ok, bump it up to SG level then. Cannot. Small Country EASY to manage. By that fuker logic if we are at SG level tax then we will have SG level service and infrastructure right? Or that fuker going to come up with another "itu tak buleh, apple orange lychee strawberry" argument? Soalan Susah Dont ASK stupid people |

|

|

Nov 30 2025, 01:42 PM Nov 30 2025, 01:42 PM

Show posts by this member only | IPv6 | Post

#26

|

Junior Member

157 posts Joined: Sep 2010 |

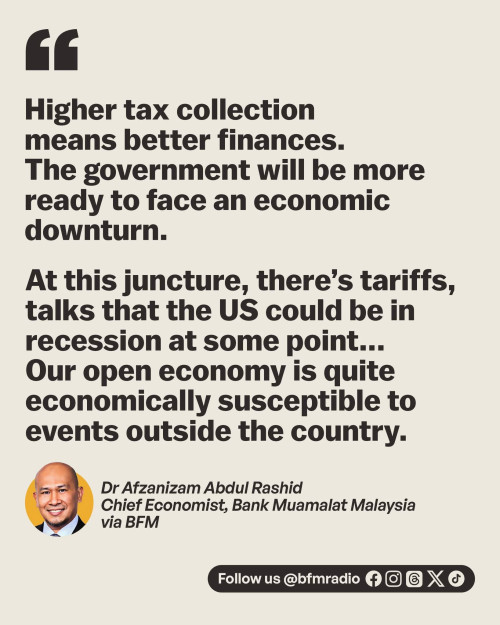

Tax low but debt to gdp ratio high not address? Talk kok punya bankers.

|

|

|

Nov 30 2025, 01:49 PM Nov 30 2025, 01:49 PM

|

Senior Member

4,895 posts Joined: May 2008 |

|

|

|

Nov 30 2025, 01:58 PM Nov 30 2025, 01:58 PM

Show posts by this member only | IPv6 | Post

#28

|

Senior Member

5,975 posts Joined: Jan 2003 From: KL, Malaysia |

|

|

|

Nov 30 2025, 02:07 PM Nov 30 2025, 02:07 PM

Show posts by this member only | IPv6 | Post

#29

|

Junior Member

101 posts Joined: Oct 2022 |

Due to the bad weather resulting in reduced/bad harvests, your chap fan tax gonna increase soon too..

|

|

|

Nov 30 2025, 02:14 PM Nov 30 2025, 02:14 PM

|

Junior Member

259 posts Joined: Apr 2022 |

U collect 50% tax also no use if most of it goes to those feudal lords and their families. U know, meow2 and helang. JonSpark liked this post

|

|

|

Nov 30 2025, 02:16 PM Nov 30 2025, 02:16 PM

|

Junior Member

166 posts Joined: Jul 2006 |

collect from all the menteri or politician, sure become number 1 Freshmeat21 liked this post

|

|

|

Nov 30 2025, 02:17 PM Nov 30 2025, 02:17 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(ZerOne01 @ Nov 30 2025, 01:08 PM) Shallow logic.The kind of self entitled mentality of the B40 who paid practically zero income tax, enjoyed the most govt assistance while wrong blaming their own frustration in life against ppl who achieved success and foot most of the nation’s bills. |

|

|

Nov 30 2025, 02:18 PM Nov 30 2025, 02:18 PM

Show posts by this member only | IPv6 | Post

#33

|

Junior Member

128 posts Joined: Mar 2020 |

Zxxxt is the solution?

This post has been edited by HasukiiXrd: Nov 30 2025, 02:19 PM |

|

|

Nov 30 2025, 02:18 PM Nov 30 2025, 02:18 PM

Show posts by this member only | IPv6 | Post

#34

|

Junior Member

24 posts Joined: Nov 2019 |

made infographic so long, yet embarrased to include the most prominent advice from the World Bank: reintro the GST. Najib jugak yang betul. fongsk liked this post

|

|

|

Nov 30 2025, 02:19 PM Nov 30 2025, 02:19 PM

Show posts by this member only | IPv6 | Post

#35

|

Junior Member

124 posts Joined: Feb 2007 From: Pahang |

QUOTE(iGamer @ Nov 30 2025, 02:17 PM) Shallow logic. OK mr smartass The kind of self entitled mentality of the B40 who paid practically zero income tax, enjoyed the most govt assistance while wrong blaming their own frustration in life against ppl who achieved success and foot most of the nation’s bills. |

|

|

Nov 30 2025, 02:20 PM Nov 30 2025, 02:20 PM

Show posts by this member only | IPv6 | Post

#36

|

Senior Member

5,274 posts Joined: Jun 2008 |

DID THEY CALCULATE CAR TAX INTO THIS OR NOT??

because our cars are taxed heavily. Lanciau |

|

|

Nov 30 2025, 02:21 PM Nov 30 2025, 02:21 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(Wedchar2912 @ Nov 30 2025, 01:33 PM) they should include zakat into the calculation also for taxation.... cos ours here can knock off tax with zakat... Zakat collected not used on overall citizens, only tax is allowed to be used for every citizen.from google: Zakat Collection Collection Figures: Zakat collection is managed by individual states, and a national aggregate figure for 2023/2024 was not found in the search results. However, data from key states indicates collections are in the millions to low billions of ringgit per state. The Selangor Zakat Board collected a record RM1.22 billion in 2024. Federal Territories (FT) collected RM937.03 million in 2022. (this is just 1 state and 1 FT) Personal Income Tax Collection Total Collection (2023): The Inland Revenue Board of Malaysia (LHDN) collected approximately RM40.96 billion in individual income tax revenue. |

|

|

Nov 30 2025, 02:22 PM Nov 30 2025, 02:22 PM

|

Junior Member

495 posts Joined: Dec 2017 |

QUOTE(iGamer @ Nov 30 2025, 02:17 PM) Shallow logic. what to do.those employer all greedy one. pay peanut to worker. increment also peanut. so the worker salary not in tax bracket.The kind of self entitled mentality of the B40 who paid practically zero income tax, enjoyed the most govt assistance while wrong blaming their own frustration in life against ppl who achieved success and foot most of the nation’s bills. |

|

|

Nov 30 2025, 02:23 PM Nov 30 2025, 02:23 PM

Show posts by this member only | IPv6 | Post

#39

|

Junior Member

128 posts Joined: Mar 2020 |

|

|

|

Nov 30 2025, 02:25 PM Nov 30 2025, 02:25 PM

Show posts by this member only | IPv6 | Post

#40

|

Newbie

16 posts Joined: Jun 2009 |

|

|

|

Nov 30 2025, 02:26 PM Nov 30 2025, 02:26 PM

Show posts by this member only | IPv6 | Post

#41

|

Junior Member

34 posts Joined: Apr 2007 |

|

|

|

Nov 30 2025, 02:27 PM Nov 30 2025, 02:27 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

|

|

|

Nov 30 2025, 02:27 PM Nov 30 2025, 02:27 PM

Show posts by this member only | IPv6 | Post

#43

|

Junior Member

128 posts Joined: Mar 2020 |

|

|

|

Nov 30 2025, 02:27 PM Nov 30 2025, 02:27 PM

Show posts by this member only | IPv6 | Post

#44

|

Senior Member

1,053 posts Joined: Jan 2008 |

IQ78?

|

|

|

Nov 30 2025, 02:29 PM Nov 30 2025, 02:29 PM

Show posts by this member only | IPv6 | Post

#45

|

Junior Member

124 posts Joined: Feb 2007 From: Pahang |

QUOTE(iGamer @ Nov 30 2025, 02:27 PM) It’s easy to echo the popular narrative adored by the general dumb down public, in defiance of logic and real world economy. I appreciate your effort to reply to my (clearly a) shitpost lolzYou don't have to worry, my worldview and perspective towards people are much larger than you. This post has been edited by ZerOne01: Nov 30 2025, 02:34 PM |

|

|

Nov 30 2025, 02:30 PM Nov 30 2025, 02:30 PM

Show posts by this member only | IPv6 | Post

#46

|

Senior Member

3,666 posts Joined: Oct 2010 |

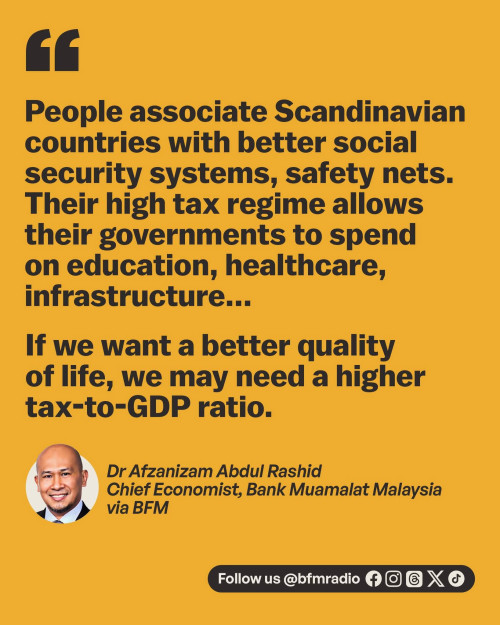

All these so called experts with their doctorates conveniently left out that Denmark and Norway are the top 5 in the least corruption.

These experts think with our high corruption index if tax more will channel back to the public? And here i thought ktards are the best at tokok. Lmao! |

|

|

Nov 30 2025, 02:32 PM Nov 30 2025, 02:32 PM

Show posts by this member only | IPv6 | Post

#47

|

Junior Member

323 posts Joined: May 2020 |

isnt they say after life more important ? hmmmmmm ? maybe ?

|

|

|

Nov 30 2025, 02:35 PM Nov 30 2025, 02:35 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(DS51 @ Nov 30 2025, 02:22 PM) what to do.those employer all greedy one. pay peanut to worker. increment also peanut. so the worker salary not in tax bracket. Overtaxed the top bracket and they will move outside the tax jurisdiction. Soon the country will be left with only self entitled parasites leeching on every social support they took for granted while the nation coffers eventually run dried. fongsk liked this post

|

|

|

Nov 30 2025, 02:36 PM Nov 30 2025, 02:36 PM

|

Senior Member

2,019 posts Joined: Jan 2003 From: Pumpkinland |

|

|

|

Nov 30 2025, 02:36 PM Nov 30 2025, 02:36 PM

Show posts by this member only | IPv6 | Post

#50

|

Junior Member

195 posts Joined: Oct 2020 |

|

|

|

Nov 30 2025, 02:41 PM Nov 30 2025, 02:41 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

Umno and BMX only wanted to tax businesses and avoid general public.

|

|

|

Nov 30 2025, 02:41 PM Nov 30 2025, 02:41 PM

Show posts by this member only | IPv6 | Post

#52

|

Junior Member

325 posts Joined: Aug 2007 |

|

|

|

Nov 30 2025, 02:45 PM Nov 30 2025, 02:45 PM

Show posts by this member only | IPv6 | Post

#53

|

Junior Member

216 posts Joined: Aug 2007 |

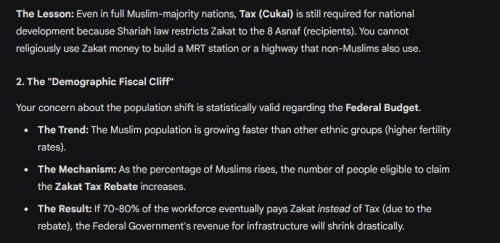

QUOTE(Freshmeat21 @ Nov 30 2025, 02:25 PM)  Hak kito. By the way, should list out how much tax our politicians paid. And how much tax monies did MOF wasted to make these? As tax collection decreases due in part to the shrinking non-Bumiputera population and the declining number of taxable corporations Malaysia may eventually reach a point where there is not enough revenue to support development.  |

|

|

Nov 30 2025, 02:48 PM Nov 30 2025, 02:48 PM

Show posts by this member only | IPv6 | Post

#54

|

Junior Member

34 posts Joined: Apr 2007 |

|

|

|

Nov 30 2025, 02:55 PM Nov 30 2025, 02:55 PM

|

Junior Member

190 posts Joined: Feb 2021 |

Zaman Madani zaman ketimbang mencanak

they say in tik tok and fb |

|

|

Nov 30 2025, 03:01 PM Nov 30 2025, 03:01 PM

Show posts by this member only | IPv6 | Post

#56

|

Junior Member

195 posts Joined: Oct 2020 |

|

|

|

Nov 30 2025, 03:05 PM Nov 30 2025, 03:05 PM

|

Senior Member

3,391 posts Joined: Mar 2007 From: KL |

QUOTE(iGamer @ Nov 30 2025, 02:17 PM) Shallow logic. Agree.. should have headcount tax. Those that buat anak like nobody's business should pay higher taxes .The kind of self entitled mentality of the B40 who paid practically zero income tax, enjoyed the most govt assistance while wrong blaming their own frustration in life against ppl who achieved success and foot most of the nation’s bills. |

|

|

Nov 30 2025, 03:17 PM Nov 30 2025, 03:17 PM

Show posts by this member only | IPv6 | Post

#58

|

Junior Member

325 posts Joined: Aug 2007 |

QUOTE(KenM @ Nov 30 2025, 03:01 PM) for those who do business less than rm500k/yr... but if the person buys a car, or from a company over that limit, they will require your details... Who would be on a right mind to buy cash for a over limit business sales revenue. You don't understand the reason for the below 500k annual sales thing meh... you see all those roadside stalls & warong warong ...got it?the government may revert to every businesses, bo one knows.. |

|

|

Nov 30 2025, 03:28 PM Nov 30 2025, 03:28 PM

Show posts by this member only | IPv6 | Post

#59

|

Junior Member

195 posts Joined: Oct 2020 |

QUOTE(etan26 @ Nov 30 2025, 02:17 PM) Who would be on a right mind to buy cash for a over limit business sales revenue. You don't understand the reason for the below 500k annual sales thing meh... you see all those roadside stalls & warong warong ...got it? those who buy from the warong, would eventually need to but a big ticket item... or even the warong seller may need to buy a big ticket item..so their details will be captured...so eventually everyone will be contributing to taxes and it will add to the total collection... only tax n death are certain.. |

|

|

Nov 30 2025, 03:30 PM Nov 30 2025, 03:30 PM

Show posts by this member only | IPv6 | Post

#60

|

Junior Member

303 posts Joined: Aug 2005 |

want me pay more tax ? then let me choose which sector the tax I contributed to goes to.

TBH I doesn't want it goes to tangkap basah team , Jakim. |

|

|

Nov 30 2025, 03:43 PM Nov 30 2025, 03:43 PM

Show posts by this member only | IPv6 | Post

#61

|

Junior Member

115 posts Joined: Aug 2020 |

so many b40 here no need pay tax, how?

gov also don't want enforce strictly to collect tax from org kito those bazaar stall owner got 7-10k sales a day Ada bayar tax tak? 20% of tax payer contributing 80% of tax If not second bottom in the region memang ada hantu |

|

|

Nov 30 2025, 03:55 PM Nov 30 2025, 03:55 PM

|

Junior Member

97 posts Joined: Sep 2010 |

increase more tax is just direct kill middle class while middle class is what drive the workforce of malaysia also.

should cut more subsidies, tax b40. future b40 will think more before they breed |

|

|

Nov 30 2025, 03:55 PM Nov 30 2025, 03:55 PM

Show posts by this member only | IPv6 | Post

#63

|

Junior Member

25 posts Joined: Dec 2015 |

QUOTE(30624770 @ Nov 30 2025, 01:02 PM) QUOTE(ja836kyau @ Nov 28 2025, 12:38 PM) Thats why dont understand Malaysia mindset. Spent billions to build TRX etc when office vacancy is already high. Should just build 100 lane customs 24x7 in JB to suck dry Singapore domestic consumption worth hundreds of billions of Singapore dollars every year. After all, Singapore accounted for 60% of Malaysia tourists every year. But Malaysia no balls to do this |

|

|

Nov 30 2025, 04:01 PM Nov 30 2025, 04:01 PM

Show posts by this member only | IPv6 | Post

#64

|

Junior Member

595 posts Joined: Oct 2011 |

gaji 3k pun tak cukup makan lagi nak tax ? nak makan ini ..

|

|

|

Nov 30 2025, 04:04 PM Nov 30 2025, 04:04 PM

Show posts by this member only | IPv6 | Post

#65

|

Junior Member

158 posts Joined: Sep 2017 |

AI Overview

Malaysia's tax position in ASEAN is complex; it is not definitively lower or higher across the board but varies by the type of tax . Overall Tax Burden (Tax-to-GDP Ratio): Malaysia's tax-to-GDP ratio (13.1% in 2023) is actually lower than the average for the Asia-Pacific region and below several ASEAN peers, including Singapore, Thailand, Vietnam, and the Philippines. This suggests a lower overall tax collection relative to the size of its economy. Corporate Income Tax (CIT): Malaysia's standard corporate tax rate of 24% (for large companies) is among the highest in ASEAN, significantly higher than Singapore's flat 17% rate, but lower than the Philippines' 30%. However, for SMEs, Malaysia offers competitive, lower rates (e.g., 15% on the first MYR 150,000). Personal Income Tax (PIT): Malaysia's highest marginal personal income tax rate (up to 30%) is lower than the top rates in Indonesia, the Philippines, Vietnam, and Thailand (which can reach 35%). It is, however, higher than Singapore's top rate of 24%. |

|

|

Nov 30 2025, 04:06 PM Nov 30 2025, 04:06 PM

Show posts by this member only | IPv6 | Post

#66

|

Junior Member

24 posts Joined: Nov 2019 |

QUOTE(Kelefeh @ Nov 30 2025, 03:43 PM) so many b40 here no need pay tax, how? world bank already advised: reinstate GST!gov also don't want enforce strictly to collect tax from org kito those bazaar stall owner got 7-10k sales a day Ada bayar tax tak? 20% of tax payer contributing 80% of tax If not second bottom in the region memang ada hantu yes, even pasar malam also can kena GST as long as gov facilitate the system accordingly. with GST. regardless of your ethnicity, income bracket, immigrants, citizens and even tourists, from legitimate or shadow economy, ALL kena tax fairly. you spend more, you kena more, simple and straightforward. blame LGE for removing GST. |

|

|

Nov 30 2025, 04:19 PM Nov 30 2025, 04:19 PM

|

Junior Member

91 posts Joined: May 2022 |

QUOTE(letitsnow @ Nov 30 2025, 04:06 PM) world bank already advised: reinstate GST! A lot of people do not realize now SST structure is charging multiple taxes along the same revenue stream. It means producer 1 is being charged SST, then producer 1 sells to producer 2 and producer 2 is also being charged SST, etc. At this point, SST could be collecting even more money than GST. Reinstating GST is no longer the sure fire way to get more taxes, it might even get less.yes, even pasar malam also can kena GST as long as gov facilitate the system accordingly. with GST. regardless of your ethnicity, income bracket, immigrants, citizens and even tourists, from legitimate or shadow economy, ALL kena tax fairly. you spend more, you kena more, simple and straightforward. blame LGE for removing GST. Many goods/services used to be exempted under GST is being charged SST now too. This post has been edited by vhs: Nov 30 2025, 04:21 PM |

|

|

Nov 30 2025, 04:23 PM Nov 30 2025, 04:23 PM

Show posts by this member only | IPv6 | Post

#68

|

Junior Member

24 posts Joined: Nov 2019 |

QUOTE(vhs @ Nov 30 2025, 04:19 PM) A lot of people do not realize now SST structure is charging multiple taxes along the same revenue stream. It means producer 1 is being charged SST, then producer 1 sells to producer 2 and producer 2 is also being charged SST, etc. At this point, SST could be collecting even more money than GST. Reinstating GST is no longer the sure fire way to get more taxes, it might even get less. the whole point of argument for the past 2-3 pages is about fairness in tax. not about revenue.and even if SST indeed collected more, the unfairness still persists. This post has been edited by letitsnow: Nov 30 2025, 04:23 PM |

|

|

Nov 30 2025, 04:30 PM Nov 30 2025, 04:30 PM

|

Junior Member

91 posts Joined: May 2022 |

QUOTE(letitsnow @ Nov 30 2025, 04:23 PM) the whole point of argument for the past 2-3 pages is about fairness in tax. not about revenue. But this article is about collecting more taxes, not about fairness. and even if SST indeed collected more, the unfairness still persists. Yes, there are a lot of unfairness in current SST structure. But it is also said to be "targeted" tax collection so that those more well off will pay more. Looks at the recent private sector dividend tax and capital gain tax in asset disposal. |

|

|

Nov 30 2025, 04:32 PM Nov 30 2025, 04:32 PM

Show posts by this member only | IPv6 | Post

#70

|

Junior Member

436 posts Joined: Mar 2005 |

Its a bird

Its a plane Its pmtax |

|

|

Nov 30 2025, 04:41 PM Nov 30 2025, 04:41 PM

Show posts by this member only | IPv6 | Post

#71

|

Junior Member

64 posts Joined: Mar 2022 |

Thread starter confirm no pay tax

|

|

|

Nov 30 2025, 04:42 PM Nov 30 2025, 04:42 PM

Show posts by this member only | IPv6 | Post

#72

|

Junior Member

115 posts Joined: Aug 2020 |

QUOTE(letitsnow @ Nov 30 2025, 04:06 PM) world bank already advised: reinstate GST! Only gst matter?yes, even pasar malam also can kena GST as long as gov facilitate the system accordingly. with GST. regardless of your ethnicity, income bracket, immigrants, citizens and even tourists, from legitimate or shadow economy, ALL kena tax fairly. you spend more, you kena more, simple and straightforward. blame LGE for removing GST. Those roadside nasi lemak ramly burger stall earn big during bazaar, earned way more than m40 annually with just 1 bazaar sales macam mana? Those baru la the reason why low tax collected |

|

|

Nov 30 2025, 04:44 PM Nov 30 2025, 04:44 PM

|

Junior Member

944 posts Joined: Jul 2005 |

|

|

|

Nov 30 2025, 04:44 PM Nov 30 2025, 04:44 PM

Show posts by this member only | IPv6 | Post

#74

|

Newbie

19 posts Joined: Oct 2014 |

Look at our corruption and wastage.

Nah no thanks. Taxation is theft. |

|

|

Nov 30 2025, 05:09 PM Nov 30 2025, 05:09 PM

Show posts by this member only | IPv6 | Post

#75

|

Senior Member

1,645 posts Joined: Aug 2005 From: Vault 13 |

QUOTE(nash_ph_41 @ Nov 30 2025, 02:45 PM) When I saw this image, I tried asking Gemini for an explanation, and it responded that Malaysia will face a “fiscal dilemma.” even right now. Interesting take. This basically says a portion of the demographic is sinking the shipAs tax collection decreases due in part to the shrinking non-Bumiputera population and the declining number of taxable corporations Malaysia may eventually reach a point where there is not enough revenue to support development.  KenM liked this post

|

|

|

Nov 30 2025, 05:44 PM Nov 30 2025, 05:44 PM

|

Newbie

14 posts Joined: Apr 2016 |

I knew a businessman pays million in Z instead of income tax, because he say why want pay tax, if pay tax also gov simply use the money.

if all type M have this mentality really gg malaysia |

|

|

Nov 30 2025, 05:48 PM Nov 30 2025, 05:48 PM

Show posts by this member only | IPv6 | Post

#77

|

Junior Member

565 posts Joined: Mar 2011 |

Economists must write shit as year end is approaching..must meet KPI..Economists are scammers

|

|

|

Nov 30 2025, 05:51 PM Nov 30 2025, 05:51 PM

Show posts by this member only | IPv6 | Post

#78

|

Junior Member

395 posts Joined: Dec 2017 |

To steal more?

|

|

|

Nov 30 2025, 05:57 PM Nov 30 2025, 05:57 PM

Show posts by this member only | IPv6 | Post

#79

|

Junior Member

500 posts Joined: Dec 2019 |

I wonder if zakat is included in that 12.6%

|

|

|

Nov 30 2025, 06:05 PM Nov 30 2025, 06:05 PM

|

Senior Member

4,693 posts Joined: Jan 2003 |

QUOTE(Kelefeh @ Nov 30 2025, 04:42 PM) Only gst matter? The problem is not that enough taxes collected 🤦♀️ but the way tax is collected and being spentThose roadside nasi lemak ramly burger stall earn big during bazaar, earned way more than m40 annually with just 1 bazaar sales macam mana? Those baru la the reason why low tax collected With BMX in place no matter how much taxes being collected 🤦♀️ the way he spent is the actual problem GST need to be in place then followed fiscal discipline and cut spending and cut the govt size with less ministers in place |

|

|

Nov 30 2025, 06:06 PM Nov 30 2025, 06:06 PM

Show posts by this member only | IPv6 | Post

#81

|

Junior Member

18 posts Joined: Aug 2016 |

Collect dari keluarga Bijan dulu.. langstrasse, Phoenix_KL, and 2 others liked this post

|

|

|

Nov 30 2025, 06:07 PM Nov 30 2025, 06:07 PM

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

must implement GST on the gerai jual pisang goreng, most of them drive alphard to pick up the banana

|

|

|

Nov 30 2025, 06:11 PM Nov 30 2025, 06:11 PM

|

Senior Member

3,702 posts Joined: Apr 2019 |

QUOTE(nash_ph_41 @ Nov 30 2025, 02:45 PM) When I saw this image, I tried asking Gemini for an explanation, and it responded that Malaysia will face a “fiscal dilemma.” even right now. then maybe it is time to change the tax law.... As tax collection decreases due in part to the shrinking non-Bumiputera population and the declining number of taxable corporations Malaysia may eventually reach a point where there is not enough revenue to support development.  |

|

|

Nov 30 2025, 06:14 PM Nov 30 2025, 06:14 PM

Show posts by this member only | IPv6 | Post

#84

|

Junior Member

27 posts Joined: Jul 2016 |

Rokek SST Suka Suka Tax |

|

|

Nov 30 2025, 07:18 PM Nov 30 2025, 07:18 PM

Show posts by this member only | IPv6 | Post

#85

|

Junior Member

19 posts Joined: Jul 2010 From: Batcave |

|

|

|

Nov 30 2025, 07:26 PM Nov 30 2025, 07:26 PM

Show posts by this member only | IPv6 | Post

#86

|

Junior Member

213 posts Joined: Dec 2008 |

ABCGST.....

owai |

|

|

Nov 30 2025, 07:36 PM Nov 30 2025, 07:36 PM

Show posts by this member only | IPv6 | Post

#87

|

Junior Member

418 posts Joined: Jun 2022 |

Braindead country tha5 decided below 3k salary no tax.

Although minimal we still.must tax. So the rakyat understand a bit about tax system. Also the main reason why vandalism so damn high in low socio area. Lesedaram civik literally zero. They think everything goverent provided fall from the sky |

|

|

Nov 30 2025, 07:40 PM Nov 30 2025, 07:40 PM

Show posts by this member only | IPv6 | Post

#88

|

Junior Member

461 posts Joined: Mar 2005 From: home |

GST is tax or not?

|

|

|

Nov 30 2025, 07:41 PM Nov 30 2025, 07:41 PM

Show posts by this member only | IPv6 | Post

#89

|

Senior Member

1,330 posts Joined: Jun 2019 |

More tax for gov to songlap?

|

|

|

Nov 30 2025, 07:59 PM Nov 30 2025, 07:59 PM

Show posts by this member only | IPv6 | Post

#90

|

Junior Member

395 posts Joined: Dec 2017 |

I agree to pay more tax if those in authority who are caught for corruption, misappropriating funds, and stealing from govt coffers are executed. fongsk liked this post

|

|

|

Nov 30 2025, 08:30 PM Nov 30 2025, 08:30 PM

Show posts by this member only | IPv6 | Post

#91

|

Junior Member

966 posts Joined: Nov 2009 |

Gov do better please

Pull in high investor foreign company do business here then hire locals You do think many times when people get good salary then can talk about high tax |

|

|

Nov 30 2025, 08:34 PM Nov 30 2025, 08:34 PM

|

Senior Member

2,120 posts Joined: Apr 2013 |

that's why need e-invoice or gst :X

|

|

|

Nov 30 2025, 08:39 PM Nov 30 2025, 08:39 PM

Show posts by this member only | IPv6 | Post

#93

|

Senior Member

5,500 posts Joined: Feb 2009 |

GST! Every bloody Tom, Dick and Harry also need to pay. T20 spend more will need to pay more, thank you very much. Those fake B40s who evade tax and those B40 who refused to improve themselves or make rational decision still need to pay their fucking dues.

|

|

|

Nov 30 2025, 08:56 PM Nov 30 2025, 08:56 PM

Show posts by this member only | IPv6 | Post

#94

|

Junior Member

844 posts Joined: Sep 2011 |

No tq. Those who want to pay more feel free do donasi. Don't simply call other to pay.

Company not enough revenue cover also look to cut wastage and expense. Only public sector keep on seek to expand bureaucracy even when know it is wastage. |

|

|

Nov 30 2025, 08:56 PM Nov 30 2025, 08:56 PM

|

Senior Member

5,831 posts Joined: Jun 2017 |

This is the very reason why Najib has to implement GST. Malaysia needed such reform but Pakatan want to go back to cave era

|

|

|

Nov 30 2025, 08:57 PM Nov 30 2025, 08:57 PM

|

Senior Member

5,831 posts Joined: Jun 2017 |

QUOTE(Mattrock @ Nov 30 2025, 12:59 PM) I agree to pay more tax if those in authority who are caught for corruption, misappropriating funds, and stealing from govt coffers are executed. I remember Pakatan saying, if there are no corruption, there is no need for GSTFunny thing is, after they became the government, they start to introducing more and more taxes. Digital tax. Sugar Tax etc. |

|

|

Nov 30 2025, 09:19 PM Nov 30 2025, 09:19 PM

|

Junior Member

269 posts Joined: Feb 2011 |

|

|

|

Nov 30 2025, 09:19 PM Nov 30 2025, 09:19 PM

Show posts by this member only | IPv6 | Post

#98

|

Junior Member

486 posts Joined: Dec 2013 |

GST easily collect 40-50b

|

|

|

Nov 30 2025, 09:22 PM Nov 30 2025, 09:22 PM

Show posts by this member only | IPv6 | Post

#99

|

Junior Member

549 posts Joined: Mar 2007 |

|

|

|

Nov 30 2025, 09:30 PM Nov 30 2025, 09:30 PM

|

Senior Member

2,210 posts Joined: Jan 2003 |

Gst is the fair tax collection.

M40 already overburdened |

|

|

Nov 30 2025, 09:32 PM Nov 30 2025, 09:32 PM

Show posts by this member only | IPv6 | Post

#101

|

Junior Member

695 posts Joined: Nov 2010 |

Try to raise tax. See what happen this coming GE

|

|

|

Nov 30 2025, 09:36 PM Nov 30 2025, 09:36 PM

Show posts by this member only | IPv6 | Post

#102

|

Senior Member

5,614 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

QUOTE(Satan Fallen One @ Nov 30 2025, 02:25 PM) Ok, bump it up to SG level then. Singkie where got petrol subsidy?By that fuker logic if we are at SG level tax then we will have SG level service and infrastructure right? Or that fuker going to come up with another "itu tak buleh, apple orange lychee strawberry" argument? Our gomen gip how much? 30-40billion rm in petrol and diesel subsidy? Yet kturds everydey buakke tered why mesia not high income country like singkie??? |

|

|

Nov 30 2025, 10:11 PM Nov 30 2025, 10:11 PM

Show posts by this member only | IPv6 | Post

#103

|

Senior Member

3,336 posts Joined: Nov 2007 From: Pluto |

1. tax those earning from forex/crypto

2. tax those roadsite nasi lemak, pasar malam, businessmen, who always either never declare tax or under-declaring the amount. 3. reduce unnecessary spending (for example, we should not have contributed so much funds to palestine or other countries). 4. implement back GST |

|

|

Nov 30 2025, 11:05 PM Nov 30 2025, 11:05 PM

|

Junior Member

115 posts Joined: Aug 2020 |

QUOTE(xander2k8 @ Nov 30 2025, 06:05 PM) The problem is not that enough taxes collected 🤦♀️ but the way tax is collected and being spent next year Jakim budget 5bilWith BMX in place no matter how much taxes being collected 🤦♀️ the way he spent is the actual problem GST need to be in place then followed fiscal discipline and cut spending and cut the govt size with less ministers in place Donation to Palestine 3bil |

|

|

Nov 30 2025, 11:10 PM Nov 30 2025, 11:10 PM

Show posts by this member only | IPv6 | Post

#105

|

Senior Member

2,510 posts Joined: Jan 2003 |

Our government and bureaucracy do not have a good record with using our tax revenue.

|

|

|

Nov 30 2025, 11:19 PM Nov 30 2025, 11:19 PM

Show posts by this member only | IPv6 | Post

#106

|

Senior Member

1,683 posts Joined: Oct 2004 From: let there be rain |

maybe TS is blind. Indo below MY.

|

|

|

Nov 30 2025, 11:21 PM Nov 30 2025, 11:21 PM

|

Senior Member

1,590 posts Joined: Sep 2011 |

just reduce the 95 to 100 liter

|

|

|

Nov 30 2025, 11:26 PM Nov 30 2025, 11:26 PM

|

Junior Member

409 posts Joined: Nov 2009 From: Internet |

|

|

|

Nov 30 2025, 11:31 PM Nov 30 2025, 11:31 PM

Show posts by this member only | IPv6 | Post

#109

|

Senior Member

816 posts Joined: May 2013 |

QUOTE(hirano @ Nov 30 2025, 10:11 PM) 1. tax those earning from forex/crypto they would never implement back GST. they refuse to admit BN is right all along.2. tax those roadsite nasi lemak, pasar malam, businessmen, who always either never declare tax or under-declaring the amount. 3. reduce unnecessary spending (for example, we should not have contributed so much funds to palestine or other countries). 4. implement back GST They rather implement tax, oxygen tax, birth tax, inheritance tax, m40 tax, luxry tax, vape tax, alcohol more tax, cig more tax, roti canai tax, vege tax rather than re-introduce GST or a better taxation system. |

|

|

Nov 30 2025, 11:49 PM Nov 30 2025, 11:49 PM

|

Senior Member

2,079 posts Joined: Aug 2005 |

world bank?

We don't trust the bank supported by yahoodie. Instead of how much tax is collected, I'd rather ask WHERE HAVE ALL THE TAXES GONE. |

|

|

Dec 1 2025, 12:24 AM Dec 1 2025, 12:24 AM

|

Junior Member

786 posts Joined: Jun 2005 |

QUOTE(hirano @ Nov 30 2025, 10:11 PM) 1. tax those earning from forex/crypto Unfortunately doing this also will kena boikote2. tax those roadsite nasi lemak, pasar malam, businessmen, who always either never declare tax or under-declaring the amount. 3. reduce unnecessary spending (for example, we should not have contributed so much funds to palestine or other countries). 4. implement back GST Either way also will be shit for our country |

|

|

Dec 1 2025, 07:02 AM Dec 1 2025, 07:02 AM

|

Senior Member

4,693 posts Joined: Jan 2003 |

QUOTE(Kelefeh @ Nov 30 2025, 11:05 PM) Cut jakim budget instead if they want to donate to Palestine 🤦♀️ at least 4 bil Jv8888 liked this post

|

|

|

Dec 1 2025, 10:35 AM Dec 1 2025, 10:35 AM

Show posts by this member only | IPv6 | Post

#113

|

Junior Member

115 posts Joined: Aug 2020 |

|

|

|

Dec 1 2025, 10:38 AM Dec 1 2025, 10:38 AM

|

Junior Member

433 posts Joined: Jul 2010 |

12%? i tot more

|

|

|

Dec 1 2025, 10:41 AM Dec 1 2025, 10:41 AM

|

Junior Member

485 posts Joined: Jan 2010 |

QUOTE(party @ Nov 30 2025, 11:31 PM) they would never implement back GST. they refuse to admit BN is right all along. after roll back, susah want to re-implement again....They rather implement tax, oxygen tax, birth tax, inheritance tax, m40 tax, luxry tax, vape tax, alcohol more tax, cig more tax, roti canai tax, vege tax rather than re-introduce GST or a better taxation system. I rugi so much money during the GST time |

|

|

Dec 1 2025, 10:43 AM Dec 1 2025, 10:43 AM

|

Senior Member

7,938 posts Joined: Mar 2014 |

QUOTE(Avex @ Nov 30 2025, 01:04 PM) If no subsidy, whether related or not, everything goes up in cost. Just like govt increases salary then suddenly groceries and other daily cost also rises for no reason If living cost goes up significantly, economy slows down. Govt will collect less tax also. Govt get the subsidy money back from booming businesses through tax money. Lower household spending on petrol means people spend more money on something else. People more likely to spend extra money than saving it |

|

|

Dec 1 2025, 10:44 AM Dec 1 2025, 10:44 AM

|

Junior Member

196 posts Joined: Sep 2010 |

Based on the heavy fuel subsidies and healthcare subsidies, we are really under collecting taxes. So either increase the tax or reduce the subsidies.

|

|

|

Dec 1 2025, 10:46 AM Dec 1 2025, 10:46 AM

|

Junior Member

429 posts Joined: May 2009 |

Habis lar. Now more M40 can join me in B40.

|

|

|

Dec 1 2025, 10:51 AM Dec 1 2025, 10:51 AM

|

All Stars

21,458 posts Joined: Jul 2012 |

In oecd countries, high tax revenue returns perpetual pensions, health care, etc to the people. but tax collected in this country spent largely on gomen opex and pensions, largely for the benefit of gomen servants. |

|

|

Dec 1 2025, 10:53 AM Dec 1 2025, 10:53 AM

Show posts by this member only | IPv6 | Post

#120

|

Junior Member

555 posts Joined: Apr 2006 |

The answer lies in the tax relief provisions

|

|

|

Dec 1 2025, 11:36 AM Dec 1 2025, 11:36 AM

Show posts by this member only | IPv6 | Post

#121

|

Senior Member

816 posts Joined: May 2013 |

QUOTE(Virlution @ Dec 1 2025, 10:41 AM) Re-implement is much better than SST and tons of x20 new taxes no? At tis rate of progress msia will be no.1 in quantity of apps and taxes if bmx still in power. |

|

|

Dec 1 2025, 12:57 PM Dec 1 2025, 12:57 PM

|

Junior Member

51 posts Joined: Jan 2007 |

no problem, can tax like Norway and Denmark

i dun mind. but everything need to be same quality la |

|

|

Dec 1 2025, 12:58 PM Dec 1 2025, 12:58 PM

|

Junior Member

51 posts Joined: Jan 2007 |

|

|

|

Dec 1 2025, 02:55 PM Dec 1 2025, 02:55 PM

|

Senior Member

4,693 posts Joined: Jan 2003 |

QUOTE(Kelefeh @ Dec 1 2025, 10:35 AM) Not that easy 🤦♀️ and how much can you tax when the non populations is small less 10million now and already is at the limit now hence why BMX now losing votes QUOTE(party @ Dec 1 2025, 11:36 AM) Re-implement is much better than SST and tons of x20 new taxes no? At tis rate of progress msia will be no.1 in quantity of apps and taxes if bmx still in power. Malaysians don’t mind paying taxes but they angry on how the taxes are being spent unnecessary as you look at how BMX is spending now 🤦♀️ instead of now every year expansionary budget only |

|

|

Dec 1 2025, 02:58 PM Dec 1 2025, 02:58 PM

Show posts by this member only | IPv6 | Post

#125

|

Junior Member

115 posts Joined: Aug 2020 |

QUOTE(xander2k8 @ Dec 1 2025, 02:55 PM) Not that easy 🤦♀️ and how much can you tax when the non populations is small less 10million now and already is at the limit now hence why BMX now losing votes sure they know about this especially LHDN since only they got the data by races and income levelMalaysians don’t mind paying taxes but they angry on how the taxes are being spent unnecessary as you look at how BMX is spending now 🤦♀️ instead of now every year expansionary budget only but instead they looking for ways to tax more from non, lately they so hardworking on catching those rental income without declaring tax tax more from non, spend less on non still can sustain them for many years to come |

|

|

Dec 1 2025, 03:40 PM Dec 1 2025, 03:40 PM

|

Junior Member

325 posts Joined: Aug 2007 |

QUOTE(Kelefeh @ Nov 30 2025, 03:43 PM) so many b40 here no need pay tax, how? Don't say so loud some people here never understand leakages...when I mention warong & road side stall.gov also don't want enforce strictly to collect tax from org kito those bazaar stall owner got 7-10k sales a day Ada bayar tax tak? 20% of tax payer contributing 80% of tax If not second bottom in the region memang ada hantu JonSpark liked this post

|

|

|

Dec 1 2025, 03:43 PM Dec 1 2025, 03:43 PM

Show posts by this member only | IPv6 | Post

#127

|

Junior Member

115 posts Joined: Aug 2020 |

|

|

|

Dec 1 2025, 03:49 PM Dec 1 2025, 03:49 PM

|

Senior Member

1,863 posts Joined: Aug 2014 From: Soviet Sarawak - Dum Spiro Spero |

1. remove subsidy

2. collect from ptptn so you dont keep filling the blackhole. ppl dont pay, you black list them from flight, borrowings, travel, government related work |

|

|

Dec 1 2025, 05:24 PM Dec 1 2025, 05:24 PM

Show posts by this member only | IPv6 | Post

#129

|

Senior Member

4,693 posts Joined: Jan 2003 |

QUOTE(Kelefeh @ Dec 1 2025, 02:58 PM) sure they know about this especially LHDN since only they got the data by races and income level 1stly non is already paying above board taxes 🤦♀️ and in return getting less so do you think govt spend less on them as it is already happened but instead they looking for ways to tax more from non, lately they so hardworking on catching those rental income without declaring tax tax more from non, spend less on non still can sustain them for many years to come The problem now is not about collection of taxes as ir is already shown is above board but the key problem is BMX is spending his way to just to keep in power You already can tell from the way he is speaking and defending shown that he is not capable barring Thanos warning just to stay in power no matter what that is why he is still hogging MOF for that reason |

| Change to: |  0.0314sec 0.0314sec

0.68 0.68

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 06:43 AM |