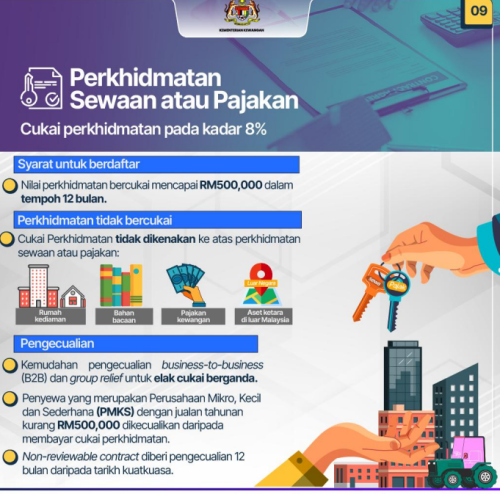

Slide 9: "Rental or Leasing Services"

This slide details the Service Tax on Rental or Leasing Services at an 8% rate.

Registration Requirement: Taxable service value must reach RM500,000 within 12 months.

Non-Taxable Services: Includes residential housing, reading materials, financial leasing, and tangible assets outside Malaysia.

Exemptions: Business-to-business (B2B) exemption and group relief to avoid double taxation. Micro, Small, and Medium Enterprises (MSMEs) with annual sales under RM500,000 are exempt from service tax. Non-reviewable contracts receive a 12-month exemption from the effective date

This post has been edited by nelson969: Jun 9 2025, 09:39 PM

Apr 24 2025, 09:37 PM, updated 7 months ago

Apr 24 2025, 09:37 PM, updated 7 months ago

Quote

Quote

0.0189sec

0.0189sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled